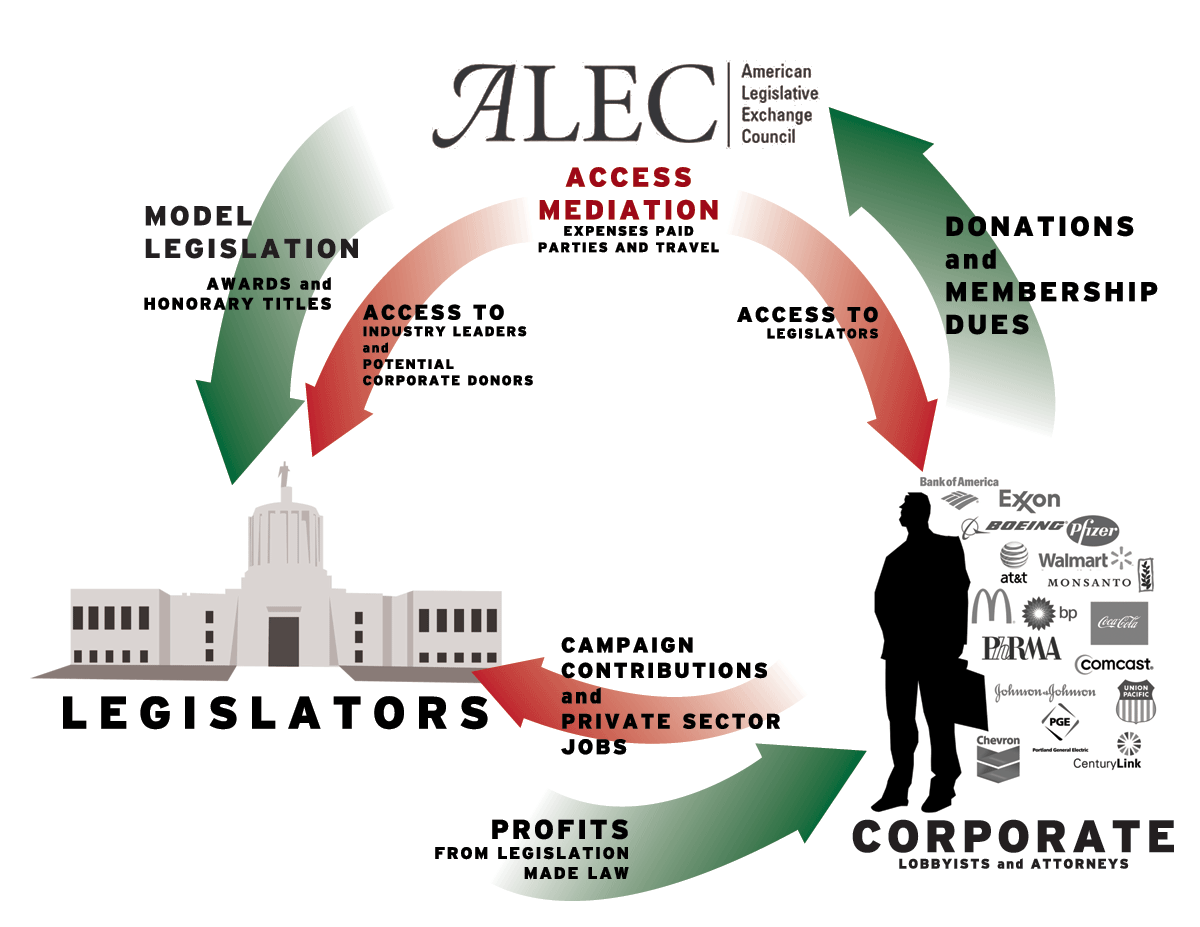

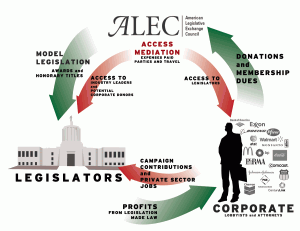

More than 20 percent of Rhode Island’s General Assembly is affiliated with ALEC, the right-wing group sponsored by corporate America that drafts model legislation for use at state houses across the country, according to a list provided by Rep. Jon Brien, the state chairman and a member of the group’s board of directors.

More than 20 percent of Rhode Island’s General Assembly is affiliated with ALEC, the right-wing group sponsored by corporate America that drafts model legislation for use at state houses across the country, according to a list provided by Rep. Jon Brien, the state chairman and a member of the group’s board of directors.

There are 24 legislators, half of whom are Democrats, associated with the conservative group that has come under fire as of late for sponsoring the Stand Your Ground law in Florida, voter ID efforts and other conservative initiatives. 11 of the members are from the Senate

Additionally, according to Brien, there are 14 former members of ALEC in the General Assembly, all of whom are Democrats, including some of the state’s most liberal legislators, such as Harold Metts, Josh Miller and Rhoda Perry. All of the former members are Senate Democrats

Here’s the list:

Current members

- Sen. Dennis Algiere, R – Westerly (12/31/12)

- Rep. Samuel Azzinaro, D – Westerly (12/31/13)

- Rep. Lisa Baldelli-Hunt, D – Woonsocket (12/31/13)

- Rep. Jon Brien, D – Woonsocket (12/31/12)

- Rep. Doreen Costa, R – North Kingstown (12/31/13)

- Rep. John Edwards, D – Tiverton (12/31/13)

- Rep. Laurence Ehrhardt, R – North Kingstown (12/31/10)

- Rep. Michael Marcello, D – Scituate (12/31/13)

- Rep. Peter Martin, D – Newport (12/31/13)

- Rep. Brian Newberry, R – North Smithfield (12/31/12)

- Rep. Daniel Reilly, R – Portsmouth (12/31/13)

- Rep. John Savage, R – East Providence (12/31/12)

- Rep. Lisa Tomasso, D – Coventry (12/31/13)

- Rep. Robert Watson, R – East Greenwich (12/31/12)

- Sen. David Bates, R – Barrington (12/31/12)

- Sen. Marc Cote, D – Woonsocket (12/31/12)

- Sen. Walter Felag, D – Bristol (12/31/12)

- Sen. Dawson Hodgson, R – North Kingstown (12/31/12)

- Sen. Frank Lombardo, D – Johnston (12/31/12)

- Sen. Francis Maher, R – Exeter (12/31/12)

- Sen. Christopher Ottiano, R – Portsmouth (12/31/12)

- Sen. Glenford Shibley, R – Coventry (12/31/12)

- Sen. John Tassoni, D – Smithfield (12/31/12)

- Sen. William Walaska, D – Warwick (12/31/12)

Past members

- Sen. Daniel DaPonte, D – East Providence (12/31/10)

- Sen. Louis DiPalma, D – Newport (12/31/10)

- Sen. James Doyle, D – Pawtucket (12/31/10)

- Sen. Paul Fogarty, D – Burrillville ( 12/31/10)

- Sen. Hanna Gallo, D – Cranston (12/31/10)

- Sen. Maryellen Goodwin, D – Providence (12/31/10)

- Sen. Paul Jabour, D – Providence (12/31/10)

- Sen. Beatrice Lanzi, D – Cranston (12/31/10)

- Sen. Michael McCaffrey, D – Warwick (12/31/10)

- Sen. Harold Metts, D – Providence (12/31/10)

- Sen. Joshua Miller, D – Cranston (12/31/10)

- Sen. Rhoda Perry, D – Providence (12/31/10)

- Sen. Roger Picard, D – Woonsocket (12/31/10)

- Sen. V. Susan Sosnowski, D – South Kingstown (12/31/10)