“Competition” is the word on seemingly every policy-maker’s lips. The Governor tells us that we must improve it. Our Senate Policy Office and the Rhode Island Public Expenditures Council have suggestions for how to do that. “Competition” is the stated reason for doing away with programs such as temporary disability insurance, the worker-funded program that allows for things like maternity leave. That Rhode Island must become more competitive is accepted wisdom.

“Competition” is the word on seemingly every policy-maker’s lips. The Governor tells us that we must improve it. Our Senate Policy Office and the Rhode Island Public Expenditures Council have suggestions for how to do that. “Competition” is the stated reason for doing away with programs such as temporary disability insurance, the worker-funded program that allows for things like maternity leave. That Rhode Island must become more competitive is accepted wisdom.

Once again, the accepted wisdom is wrong. We say “increase Rhode Island’s competitiveness, make us more attractive to business.” But Rhode Island already can be attractive to business. If an ill-conceived business idea can receive $75 million with no questions asked, then Rhode Island has a way to attract businesses here: throw guaranteed millions at them. That is certainly competitive. That is certainly attractive.

Competition is the wrong philosophy for Rhode Island. First, it seeks to make Rhode Island something it is not. Does Massachusetts have this? Then we must have it. Does Texas have this other policy? Then we must have it! We cease to favor originality, instead seeking the square pegs of the world to fit into our round hole. Our collection of useless pegs is immense. And they have not grown more useful. We must not think about Rhode Island as being a new Massachusetts or a second Singapore or some other such nonsense. These other places already are the best at being themselves. We cannot always replicate what they have done. We must seek to be the best Rhode Island we can be. Our state’s policy should not be dictated by those who insult our state and its people at every turn. Rather we need to listen to those who adore it.

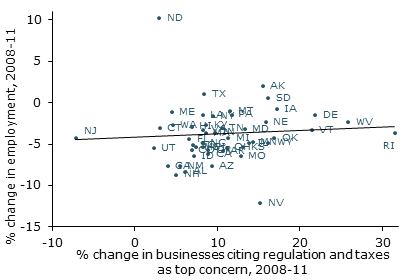

Second, the philosophy of competition distracts from our real goal for our economy: growth. When we talk about making Rhode Island more attractive or increasing competition, we are not talking about making it more attractive for our own people. We are talking about attracting businesses from elsewhere. This is not growth, it is trade diversion; snatching away the wealth of others. We impoverish one area of America to slightly enrich another. This kind of competition benefits not the people of this country, but aristocracy of this country.

This policy led to the disaster of 38 Studios. This policy gives away millions to outside businesses who deal only in hypotheticals while giving nothing to our own people who deal with realities every day. Instead of focusing our resources on attracting a hypothetical outsider, we should focus on the very real Rhode Islander who needs to be fostered, whose economic situation needs to be bolstered. This is a strategy of growth, of building our economy from the ground up. This strategy benefits us all.

Rhode Island was the birthplace of the Industrial Revolution in America. Once we fostered our own industry. Once we utilized what we had already, what made us unique and special, and we built factories and roads and our state grew and grew. And in the name of competition and attractiveness, in worship of these twin false idols, we destroyed it all.

We suffered through a blizzard the past few days, as tons of snow were dumped on us by sheer chance. A blizzard can be a demonstrative experience. In such conditions we do not favor competition, but collaboration. Neighbors work to clear each other’s walkways, they assist when we’ve lost power, in some cases they clear the streets when the plows have been unable to. Those who compete at such times are rightfully reviled and disdained.

For the past four years plus Rhode Island has been struggling through an economic blizzard and its aftermath. We should revile those who call for competition as utterly as we revile those who dump snow into their neighbors’ yards. We are not here to fight against our neighbors and battle over what little we have. We need to reach out, to help those who need it, and ask what help they require. And we should not ask those who have sacrificed too much already to sacrifice more. But that is exactly what we appear likely to see.

If this blizzard has proved one thing, it is that we will never be Florida. We need to be the best Rhode Island we can be. And that means being better Rhode Islanders.

Matthew Lannon is 12-year-old. He’s a boy scout, he goes to church, he plays video games and sometimes fights with his sister. In many ways, he’s just like all the other kids his age … except that Rhode Island won’t let his parents get married.

Matthew Lannon is 12-year-old. He’s a boy scout, he goes to church, he plays video games and sometimes fights with his sister. In many ways, he’s just like all the other kids his age … except that Rhode Island won’t let his parents get married.