Janet Lee Dupree took out a $ 3,000 student loan to help finance her undergraduate degree when she was in her late twenties. While acknowledging that she did not pay off the student loan when she should have, even paying thousands of dollars on this debt, today the 72-year-old, still owes a whopping $15,000 because of compound interest and penalties.

Janet Lee Dupree took out a $ 3,000 student loan to help finance her undergraduate degree when she was in her late twenties. While acknowledging that she did not pay off the student loan when she should have, even paying thousands of dollars on this debt, today the 72-year-old, still owes a whopping $15,000 because of compound interest and penalties.

The Ocala, Florida resident, in poor health, will never pay off this student loan especially because all she can afford to pay is the $50 the federal government takes out of her Social Security check each month. Citing Dupree’s financial problems in her golden years in his opening remarks, Chairman Bill Nelson (D-FL), of the Senate Special Committee on Aging, used his legislative bully pulpit to dispel the myth that student loan debt only happens to young students.

“Well, as it turns out, that’s increasingly not the case,” he said.

Student Loan Debt Impacts Seniors, Too

Last week’s Senate Aging panel hearing also put the spot light on 57-year-old Rosemary Anderson, a witness who traveled from Watsonville, California, to inside Washington’s Beltway, detailing her student loan debt. Anderson remarked how she had accumulated a $126,000 loan debt (initially $64,000) to pay for her bachelor’s and master’s degree. A divorce, health problems combined with an underwater home mortgage kept her from paying anything on her student loan for eight years.

Anderson told Senate Aging panel members that with new terms to paying off her student loan debt, she expects to pay $526 a month for 24 years to settle the defaulted loan, setting her debt at age 81. The aging baby boomer will ultimately pay $87,487 more than her original student loan amount.

Like Anderson, a small but growing percentage of older Americans who are delinquent in paying off their student debts worry about their Social Security benefits garnished, drastically cutting their expected retirement income.

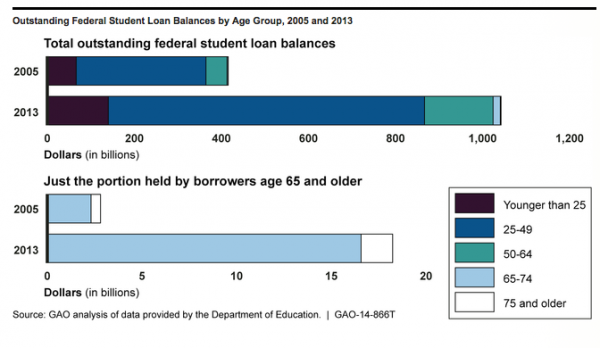

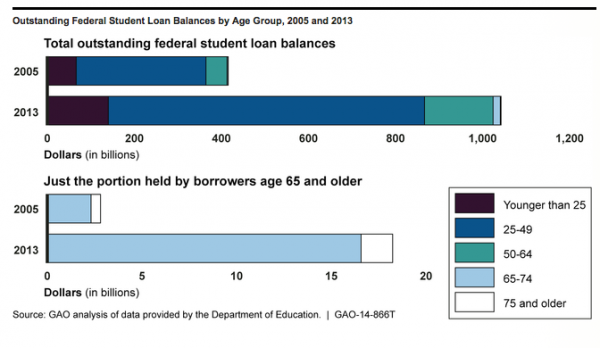

According to a 22 page Government Accountability Office (GAO) report, “Inability to Repay Student Loans May Affect Financial Security of a Small Percentage of Retirees,” released at the Sept. 10 Senate panel hearing, the amount that older Americans owe in outstanding federal student loans has increased six-fold, from $2.8 billion in 2005 to more than $18 billion last year. Student loan debt for all ages totals $ 1 trillion.

The GAO report noted that student loan debt reduces net worth and income, eroding the older person’s retirement security.

Nelson observed, “Large amounts of any kind of debt can put a person’s finances at risk, but I think that Ms. Dupree’s story shows that student debt has real consequences for those in or near retirement. And, the need to juggle debt on a fixed income may increase the likelihood of student loan default.”

Although the newly released GAO report acknowledged that seniors account for a small fraction of student loan debt holders, it noted that the numbers of seniors facing student loan debt between 2004 and 2010 had quadrupled to 706,000 households. Roughly 80 percent of the student loan debt held by retirement-aged Americans was for their own education, while only 20 percent of loans were taken out went to help finance a child or dependent’s education, the report said.

Senator Sheldon Whitehouse (D-RI), who sits on the Senate Special Committee on Aging, says student loan debt is a burden for thousands of Rhode Islanders, including a growing number of retirement-age borrowers who either took out student loans as young adults, or when they changed careers, or helped pay off a child’s education.

“Student debt presents unique challenges to these older borrowers, who risk garnishment of Social Security benefits, accrual of interest, and additional penalties if they are forced to default,” said Whitehouse, stressing that pursuing an education should not result in a lifetime of debt.

He sees the Bank on Students Emergency Loan Refinancing Act, which would allow approximately 88,000 Rhode Islanders to refinance existing student loans at the low rates that were available in 2013-2014, as a legislative fix to help those who have defaulted on paying off their student loans. “By putting money back in the pockets of Rhode Islanders we can help individual borrowers make important long-term financial decisions that will ultimately benefit the economy as a whole,” he says.

Garnishing Social Security

The GAO reports finds that student loan debt has real consequences for those in or near retirement. The need to juggle debt on a fixed income may increase the likelihood of student loan default. In 2013, the U.S. Department of the Treasury garnished the Social Security retirement and survivor benefits of 33,000 people to recoup federal student loan debt. When the government garnishes a Social Security check, multiple agencies can levy fees in addition to the amount collected for the debt, making it even more challenging for seniors to pay off their loan.

Susan M. Collins (R-ME) warned [because of a 1998 law] seniors with defaulted student loans may even see their Social Security checks slashed to see their Social Security check to $750 a month, a floor set by Congress in 1998. “This floor was not indexed for inflation, and is now far below the poverty line, adds Collins, who says she plans to introduce legislation shortly to adjust this floor for inflation and index it going forward, to make sure garnishment does not force seniors into poverty.

According to an analysis of government data detailed on the CNNMoney website, “More than 150,000 older Americans had their Social Security checks docked last year for delinquent student loans.”

Unlike other types of consumer debt, student loans can’t be discharged in bankruptcy. Besides docking Social Security, the federal government can use a variety of ways to collect delinquent student loans, specifically docking wages or taking tax refund dollars. These strategies also cutting the income of the older person.

Some Final Thoughts…

“It’s very important that we focus on the big picture and the implications in play,” said AARP Rhode Island State Director Kathleen Connell, noting that “Education debt is becoming a significant factor for younger workers in preparing for retirement, delaying the ability of people to retire and threatening a middle-class standard of living, both before and after they retire.

Connell says, “Its serious concern for some older Americans as approximately 6.9 million carry student loan debt – some dating back to their youth. But others took on new debt when they returned to school later in life and many others have co-signed for loans with their children or grandchildren to help them deal with today’s skyrocketing college costs.”

“It’s not just a matter of Federal student loan debt being garnished from Social Security payments if it has not been repaid, “ Connell added. “Outstanding federal debt also will disqualify an older borrower from eligibility for a federally- insured reverse mortgage.

“Families need to know the costs and understand the long-term burden of having to repay large amounts of student loan debt,” Connell concluded. “They also need information regarding the value of education, hiring rates for program graduates and the likely earnings they may expect.”

Finally, Sandy Baum, senior fellow with the Urban Institute, warns people to think before they borrow. “They should borrow federal loans, not private loans, she says, recommending that if their payments are more than they can afford, they should enroll in income-based repayment.

Addressing student loan debt issues identified by the GAO report, Baum suggests that Congress might ease the restrictions on discharging student loans in bankruptcy, and end garnishment of Social Security payment for student debt. Lawmakers could also strengthen income-based repayment, making sure that they don’t give huge benefits to people with graduate student debt and relatively high incomes.