Rhode Island’s House Committee on Labor is today considering H7633, An Act Relating To Labor And Labor Relations— Healthy And Safe Families And Workplaces Act, legislation that if passed would provide Rhode Island workers with earned paid sick days.

Among the basic provisions of this legislation are the following:

- Annual accrual of 56 hours (equivalent to seven 8-hour work days) of earned sick leave.

- Ability to make use of paid leave after 90 days.

- Rollover of unused sick leave into new calendar year, with option to instead pay employees for unused time.

- Protection of earned sick leave time in the event an employee is transferred to a different division of the same company, and in the event that “an employer succeeds or takes the place of an existing employer”.

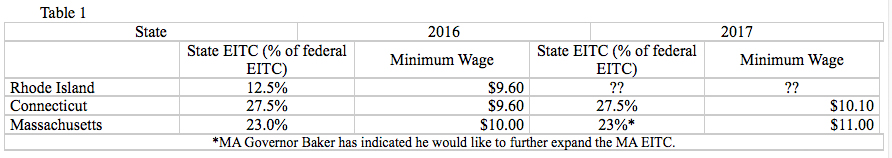

Until national legislation is passed providing earned paid sick time, state and local provisions can provide this important family-friendly employment standard. As of March 2016, five states have passed earned paid sick time legislation, including three of our New England neighbors, Connecticut, Massachusetts, and Vermont. As well, at least fifteen cities and counties have passed legislation providing earned paid sick leave, including San Francisco, Washington, DC, New York, Philadelphia, Portland (OR), and San Diego.

The experience of those jurisdictions that have been leaders in enacting family-supporting earned paid sick leave is instructive. In San Francisco, the first jurisdiction to introduce earned paid sick leave, employment in the five years after implementation of their earned paid sick leave provisions grew twice as fast in the city than in neighboring counties lacking earned paid sick leave, and grew even faster in the food service and hospitality industries with significant concentrations of workers benefiting from the new provisions.

A report by the Center on Economic and Policy Research found that in neighboring Connecticut, the policy was implemented at little to no cost for business (consistent with findings from an Economic Policy Institute study prior to passage), and that two years after initial implementation, more than three-quarters of employers were supportive of the law.

Provision of earned paid sick days results in significant savings for both employers and government:

Employer savings are considerable, and include savings due to:

- increased worker productivity,

- Lower turnover rates

- Reduced workplace contagion from reduced presenteeism (attending work while sick)

- Fewer workplace injuries

Government saves through savings to public health insurance programs, through reduced reliance on emergency rooms for treatment of illnesses. With availability of paid sick time, an employee is able to schedule an appointment with his/her primary care provider for diagnosis and treatment. One recent study shows that extending earned paid sick leave to all currently uncovered would save over $1.1 billion annually, including savings of $517 million to public health insurance programs such as Medicaid. Other savings result from reduced reliance on public assistance, as nearly one in four employees report losing a job or being threatened with job loss for taking time off due to personal or family illness. Earned paid sick leave gives employees much needed economic security, which is critical to family stability.

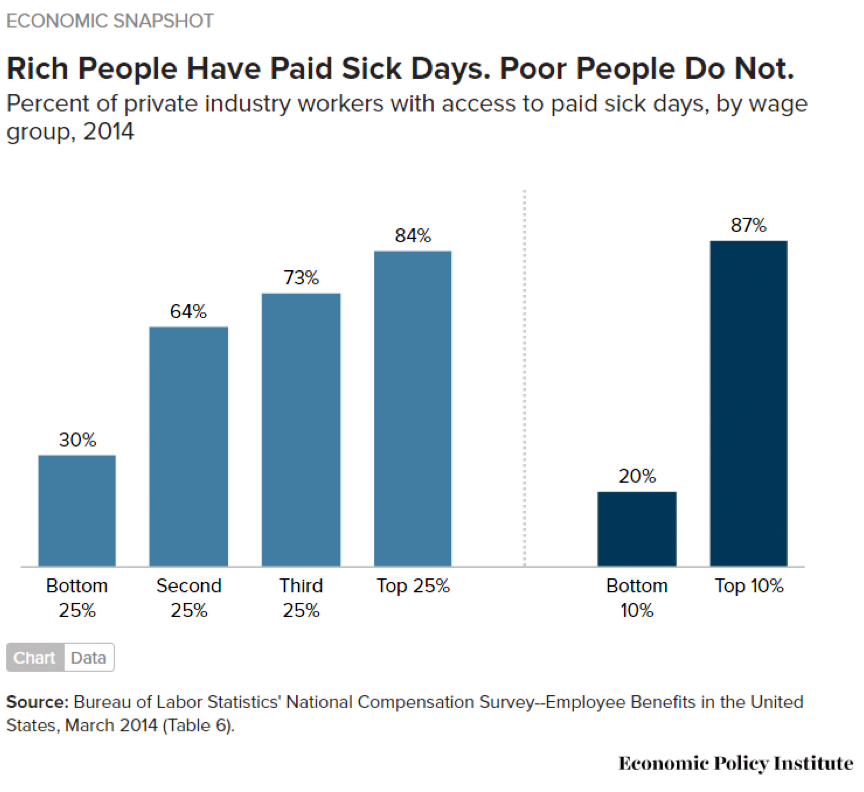

One significant reason to pass paid sick leave legislation is that failing to do so further exacerbates disparities based on income. The Economic Policy Institute shows in stark terms that “rich people have paid sick days [while] poor people do not.” While only one in five (20 percent) of private sector workers in the bottom 10 percent of wage earners has earned paid sick time, nearly nine in ten (87 percent) of top-five wage earners have earned paid sick time.

One significant reason to pass paid sick leave legislation is that failing to do so further exacerbates disparities based on income. The Economic Policy Institute shows in stark terms that “rich people have paid sick days [while] poor people do not.” While only one in five (20 percent) of private sector workers in the bottom 10 percent of wage earners has earned paid sick time, nearly nine in ten (87 percent) of top-five wage earners have earned paid sick time.

The case for providing earned paid sick leave to workers in Rhode Island is strong. It’s good for businesses and workers, making Rhode Island a more family-friendly place to live and work.

A new paper released yesterday by the Center on Budget and Policy Priorities (CBPP) is the latest study making the case that infrastructure investment is one of the best investments for state government, creating jobs today, and laying foundation for future prosperity. While this is not news (a 2010 paper from the Political Economy Research Institute at the University of Massachusetts showed that infrastructure spending and investments in education and training were the best tools in the tool boxes of New England states to ensure current and future prosperity) it comes at an opportune moment for Rhode Island, just a couple of weeks after the legislature passed an extensive package of infrastructure investments aimed at overhauling our deteriorating roads and bridges.

A new paper released yesterday by the Center on Budget and Policy Priorities (CBPP) is the latest study making the case that infrastructure investment is one of the best investments for state government, creating jobs today, and laying foundation for future prosperity. While this is not news (a 2010 paper from the Political Economy Research Institute at the University of Massachusetts showed that infrastructure spending and investments in education and training were the best tools in the tool boxes of New England states to ensure current and future prosperity) it comes at an opportune moment for Rhode Island, just a couple of weeks after the legislature passed an extensive package of infrastructure investments aimed at overhauling our deteriorating roads and bridges.