From the headlines, you would think that CNBC is the gold standard economic authority. After the cable news network released its 10th annual “America’s Top States for Business 2016” listing, in which Rhode Island was ranked dead last, local corporate media raced to bring the bad news to readers and viewers. CNBC ranks R.I. worst state for business, CNBC: Rhode Island ranked ‘Bottom State for Business‘, and RI back to dead last in new CNBC rankings are typical examples from the Projo, Channel 10 and Channel 12 respectively.

From the headlines, you would think that CNBC is the gold standard economic authority. After the cable news network released its 10th annual “America’s Top States for Business 2016” listing, in which Rhode Island was ranked dead last, local corporate media raced to bring the bad news to readers and viewers. CNBC ranks R.I. worst state for business, CNBC: Rhode Island ranked ‘Bottom State for Business‘, and RI back to dead last in new CNBC rankings are typical examples from the Projo, Channel 10 and Channel 12 respectively.

Missing from the Cassandra-like coverage is any hint that the rankings are meaningless and based on metrics that rate our state on how well our policies kowtow to the whims of business, not on how well they benefit the poor and middle class. Only Ted Nesi even approaches this angle in his coverage, but he did so through the lens of competing political discourse. But what about the economics of the report? Does it hold up under scrutiny? I’ve tackled the subject of economic rankings before, here and here, trying to bring some sort of real economic analysis to bear.

I asked Doctor of Economics Douglas Hall, Director of Economic and Fiscal Policy at the Economic Progress Institute, for some insights. Hall said that many of CNBC’s economic indicators “have a lot of merit and point to the need to address matters via public policy, such as repairing the state’s crumbling infrastructure and the need to help Rhode Islanders improve their educational attainment. But when you deconstruct their aggregate groupings,” said Hall, “many of the categories are deeply flawed and point to policies that would severely undermine the well-being and quality of life of working families in Rhode Island.”

One indicator the report uses is “union membership and the states’ right to work laws.” Low union membership and strong anti-union right to work laws contribute to a higher economic ranking for a state in CNBC’s report, yet Hall says that “research clearly shows that as unionization rates have gone down, the well-being of the American middle class has gone down.” In Hall’s view, this metric “taints the entire aggregate measure.”

Another metric, the CNBC aggregate category for the cost of doing business, considers the cost of paying wages and presumably, says Hall, “a state in which every employee worked for sub-poverty wages would get a very high grade in this category, while those paying living wages that can sustain a family and support a viable business community through demand for goods and services, would get a low grade in this category.”

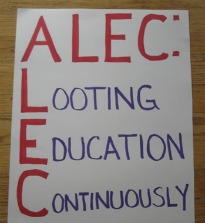

It seems clear that these rankings of states by various business interests, including corporate entities such as CNBC, puppet organizations such as ALEC and members of the State Policy Network (which includes the RI Center for Freedom and Prosperity) and various Chambers of Commerce are are not objective measures of a state’s economic well-being, but are tools crafted to shape public policy to the advantage of large business interests and to the detriment of the poor and middle class.

The most sensible tactic in dealing with such garbage is to file it accordingly.

]]> At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

“That’s something I’ve got my eye on,” said Mattiello, offering to collaborate with the business community to do something about it.

The idea of reforming the estate tax came out of a previous Summit, said Wiley, and the important thing, he continued, looking towards Raimondo and Mattiello, is that, “you guys are listening.”

“Rhode Island ends up at the bottom of a lot of the ratings of taxes and business climate,” said Wiley, and though he did not specify to what ratings he was referring, two annual business climate rankings, the SBEC (Small Business and Entrepreneurship Council)’s Small Business Policy Index and ALEC (American Legislative Exchange Council)’s Rich States, Poor States, include the mere existence of a state level estate tax as a negative in their questionable formulas for determining a state’s ranking.

The problem, says economist Peter Fisher, is that “the estate tax – which is paid only by the ultra-wealthy – doesn’t affect economic growth.”

Fisher says that Rich States, Poor States author Arthur Laffer, “and his co-authors devote an entire chapter to estate and inheritance taxes, incorrectly tagging them as ‘job killers’ that ‘strangle economic growth.’”

Laffer and company assert that states with an estate tax are losing ‘enormous amounts of accumulated wealth,’ and that this wealth would have created jobs, alleviated poverty, and increased tax revenue, but they fail to explain how this would happen. The wealth held by retirees typically is not the kind of capital normally used in job creation. The wealth that drives prosperity consists of real assets: natural resources, plant and equipment, public infrastructure, human capital, technological knowledge. By contrast, large estates typically consist of real estate, stocks and bonds, mutual funds, and other financial assets which could be located anywhere in the world. The future use of those assets is unaffected by where the person who owned them died.”

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As Bob Plain showed, the last time RI messed with the estate tax, the burden of public services and infrastructure was shifted onto poor and middle class Rhode Islanders, allowing the rich and the mega rich to become richer still. These policies contribute to our ever increasing wealth inequality and pervert our democracy, tilting us ever faster towards an oligarchy represented by the likes of “Cap” Wiley, if we aren’t there already.

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As Bob Plain showed, the last time RI messed with the estate tax, the burden of public services and infrastructure was shifted onto poor and middle class Rhode Islanders, allowing the rich and the mega rich to become richer still. These policies contribute to our ever increasing wealth inequality and pervert our democracy, tilting us ever faster towards an oligarchy represented by the likes of “Cap” Wiley, if we aren’t there already.

Citing an Economic Progress Institute (EPI) fact sheet, Plain wrote, “The clear winners are a small number of wealthy taxpayers whose estates will pay less in taxes and in many cases, nothing at all starting next year. The clear losers are tens of thousands of low- and modest-income Rhode Islanders who will pay more in taxes next year. Unemployed homeowners and renters are among the biggest losers, because they will no longer qualify for property tax assistance and are not eligible for the earned income tax credit (EITC). Many of the lowest-wage workers will also be negatively impacted by the loss of the property tax refund, even with an eventual boost in the EITC.”

“SBEC’s stated mission, says Fisher, “is to ‘encourage entrepreneurship and small business growth,'” but “its lobbying activities reveal a very conservative, anti-government agenda.” ALEC, “is a mechanism by which corporations pay substantial sums of money to draft legislation benefiting them.” Neither group has the interests of state economies or average citizens in mind when they advance their agendas under the guise of “economic research.” These groups are made up entirely of the oligarchic prosperous and their servile, deluded sycophants.

Our gullible state leaders are not searching for real economic solutions to our state’s budgeting issues, they are instead looking for the excuses they need to pass the legislation their corporate masters demand.

To truly help our economy and budget, instead of eliminating the estate tax we should be increasing it.

Also, do yourself a favor and familiarize yourself with Peter Fisher’s website:

]]> Something stinks in Rhode Island, and according to StinkTanks.org, that smell is the Ocean State Center for Freedom and Prosperity.

Something stinks in Rhode Island, and according to StinkTanks.org, that smell is the Ocean State Center for Freedom and Prosperity.

A new report which follows Koch brother and other corporate spending through the State Policy Network to its state-based advocacy groups says the Center for Freedom and Prosperity, “claims to be focused on issues important to the people of Rhode Island, it actually pushes an agenda dictated by its national right-wing funders and partners.”

The Center for Freedom and Prosperity, like all SPN-affiliated groups, says it’s a non-partisan group. The group and its staff advocate on behalf of out-of-state corporate interests and often against the working class people of Rhode Island.

Justin Katz, the group’s research director, told me, “This shows that our work is having an effect, but it’s pretty clear that it was produced by outside organizations with no real understanding of what’s going on in Rhode Island.”

RI Future contributor Russ Conway gets a shout out in the report, who debunks the group’s biased research on education in this post. He wrote, “What I found though was nothing but a rehash of the standard right -wing talking points framed as “so sensible and obvious” that they needed no explanation.”

The report indicates the Center received $122,000 from the SPN in 2011 and $25,000 from the JM Foundation in 2012.

You can check out the full report here:

RI – Who Is Behind The Rhode Island Center for Freedom

]]>

Rhode Island may be down to just five card-carrying ALEC members left in the legislature, but the Ocean State is still doing an exemplary job of implementing ALEC’s agenda.

Rhode Island may be down to just five card-carrying ALEC members left in the legislature, but the Ocean State is still doing an exemplary job of implementing ALEC’s agenda.

A new report that links the American Legislative Exchange Council with the State Policy Network (which funds the RI Center for the Freedom and Prosperity) cites five examples of how the “SPN Pushes ALEC’s Corporate-Sponsored Legislation.”(page 7 here)

Rhode Island is a national leader in three of the five policy proposals cited by the report, specifically: “Privatizing Public Education”, “Privatizing Public Pension Systems” and “Disenfranchising People of Color, the Elderly, and Students” (aka voter ID).

Here’s the full list from the report:

Attacking Workers’ Rights: ALEC’s “Right to Work Act ” seeks to limit the rights of workers to unionize in the private sector and undermine the power of unions to negotiate and protect workers. SPN member state think tanks have published articles and reports supporting “right to work” legislation in at least Alabama, Kentucky, Ohio, Delaware, Oregon, Minnesota, Indiana, Michigan, Maine, New Mexico, and Pennsylvania. Michigan’s operation, the Mackinac Center, was recently singled out by SPN for its efforts to push “Right to Work” into law in Michigan despite its long state record of support for workers’ rights to organize and collectively bargain. Who was there to tout this legislative victory that came over the objections of thousands and thousands of Michigan workers? Betsy and Dick DeVos, the extreme right-wing millionaires pushing an array of divisive and destructive legislative issues to suit their narrow personal views.SPN think tanks join ALEC in pushing a broad agenda to undermine other worker protection, including tearing down collective bargaining, prohibiting paid union activity in the form of “release time,” and ending the ability to deduct union dues from paychecks for private and public employees (so-called “paycheck protection”).

Privatizing Public Education: SPN think tanks join ALEC in pushing a broad education agenda to privatize public schools, including pushing for-profit online schools, for-profit and other charter schools, using taxpayer dollars for vouchers to for-profit schools, and even so-called “parent triggers” to allow a group of parents to close a public school for current and future students, andturn the school into a charter school or require a voucher system that takes away from traditional public schools.Privatizing Public Pension Systems: SPN think tanks join ALEC in pushing to privatize public employee pension systems that workers have negotiated for, making them 401(k)-style defined contribution type accounts rather than defined benefit plans. Such changes provide less retirement security for workers who have devoted their lives to public service and negotiated for such benefits to protect themselves and their families from poverty as they age. Additionally, 401(k) systems tend to include the diminution of benefits through corporations taking fees out of the pensioners’ funds, creating a lengthy revenue stream for the corporations that administer those plans, which often involves substantial income for the corporation relative to the work involved.Rolling Back Environmental Initiatives: ALEC’s “State Withdrawal from Regional Climate Initiatives“ would allow states to pull out of the Regional Greenhouse Gas Initiative or the Western Climate Initiative, cap-and-trade programs to cut greenhouse gases and carbon-dioxide emissions. It also uses language that denies the documented climate changes that are underway. SPN state think tanks have published articles and reports supporting states’ withdrawals from these regional initiatives in at least Alabama, Arkansas, Tennessee, Delaware, Oregon, New Jersey, Montana, Virginia, and Connecticut.Disenfranchising People of Color, the Elderly, and Students: ALEC’s restrictive “Voter ID Act ” makes it more difficult for American citizens to vote. It would change identification rules so that citizens who have been registered to vote for decades must show only specific kinds of ID in order to vote. This bill disenfranchises college students and many low-income, minority, and elderly Americans who do not have driver’s licenses but have typically used other forms of ID and proof of residency in the district. SPN state think tanks have published articles and reports supporting voter ID bills in several states, including Arkansas, Washington state, North Carolina, and Wisconsin.

And here’s the full report: