The Providence City Council extended a tax break for the developers of a mixed use project on Valley Street because an anchor tenant relocated to Johnston.

The Providence City Council extended a tax break for the developers of a mixed use project on Valley Street because an anchor tenant relocated to Johnston.

“Do we really need another vacant or foreclosed property in our city,” said Council President Luis Aponte, who voted for the so-called tax stabilization agreement, after the meeting. He said the developers could have attained an administrative TSA for a smaller redevelopment had the council not awarded the tax break and that the city negotiated a good deal for residents by working with the developers.

Councilor Carmen Castillo was the only member of the elected board to vote against the TSA.

“We’re not a bank,” she said. “The neighborhood I represent never gets a tax break. We pay a lot in property taxes too.”

Councilor Sabina Matos said she supported the TSA because the council approved TSAs for downtown businesses so it was only fair that it do so for businesses in her district too. “We set a precedent,” she said. “We can’t give them to some developers and not others.”

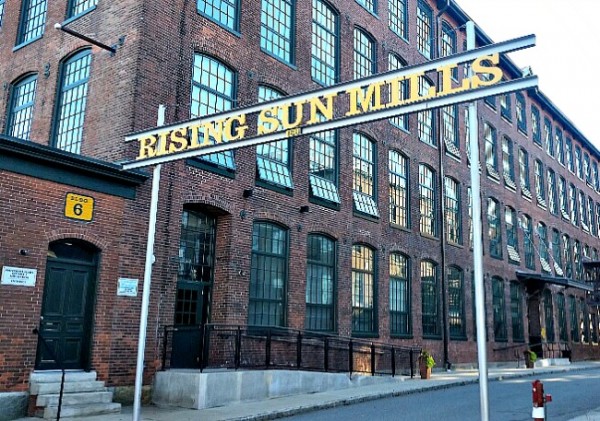

Abacus Technology paid $1.8 million annually to rent 100,000 square feet of space in the Rising Sun Mills development on Valley Street but the company has decided to move to Johnston, said the developers.

“There’s no benefit to having Rising Sun Mills go dark,” said BJ Dupre, one of the developers, after the favorable decision from the Council. When asked if that would have happened if they didn’t get the tax break, another of the developers, Mark Van Noppen said it was a “distinct possibility.”

Aponte said the developers plan to reconfigure the commercial space into smaller offices. He said the TSA is void if they don’t pull all the requisite permits in 180 days.

“It’s hard to tell,” Aponte said when asked how much money the city budget would lose by extending the TSA to the Rising Sun Mills project. But, he added, “They are paying more than if they would have got a 5 year extension” as a result of the negotiations with city officials.

]]>

The Providence City Council has called a special meeting for Tuesday night and among the agenda items is tax stabilization agreements (TSAs) for 60 Valley Street, LLC and 166 Valley Street, LLC on behalf of the Rising Sun Mills Project. The ordinance is sponsored by Council President Luis Aponte. The details of the TSA can be found here.

The City Council unanimously rejected a similar TSA, for 100 Fountain St, in February, under intense public pressure. Aponte then said, given the city’s precarious economic situation, “It’s the right signal that the [Finance] Committee is sending to the public and to the [City] Council.”

The TSA being considered by the council notes that the “projects been suffered serious financial setbacks and hardships as a result of the collapse of the real estate and financial markets over the past several years” and hence a five year extension of TSAs granted in 2003 and 2006 is needed. In return, “the Project Owners of 166 Valley Street will make an additional investment of approximately $5 million which shall be used to convert approximately 85,000 square feet of the building from a single tenant space to multiple commercial spaces. This will assist in the Project Owners in attracting new tenants to the Project and will create new construction and potential permanent jobs at the Project Site.”

The amount of revenue Providence will lose in this deal is unclear.

Stop Tax Evasion in Providence (STEP) released a press release Monday claiming that that the Providence City Council leadership is failing taxpayers.

“You would think that the Council would be in no rush to go handing out more of these questionable extensions to projects that have already been paying very little taxes for 15 years, but you would be wrong,” says the STEP press release. “While the… promise of new spending and jobs from Rising Sun Mill owners would seem welcome, there are absolutely no safeguards to ensure they will invest what they say. Thus the city can be certain of neither jobs nor permitting revenue.”

The special city council meeting was announced on Friday, July 29, as big news stories broke, such as Representative John Carnevale deciding not to appeal the Providence Board of Canvassers decision that ended his re-election campaign and Attorney General Peter Kilmartin announcing the non-results of his 38 Studios investigation. Technically, the City Council went on break for August and was not due to reconvene until September 1.

As a result, this important meeting was almost missed.

The city council will also be awarding hundreds of thousands of dollars in contracts at this meeting, according to the agenda.

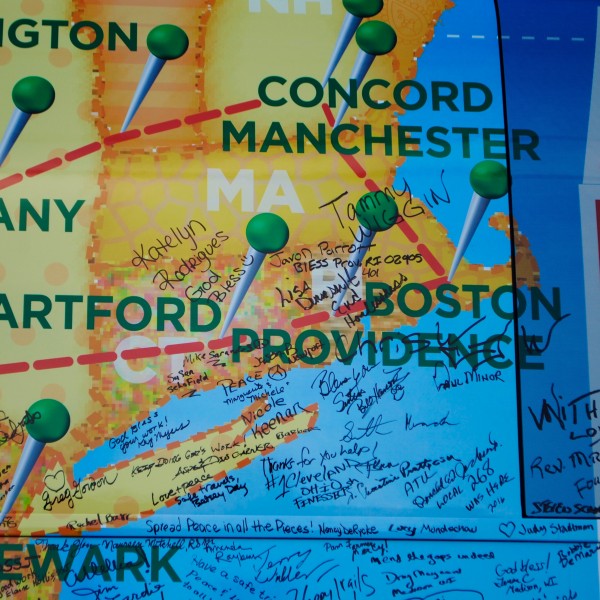

]]> The Nuns on the Bus came to Providence Saturday night as part of a 13 state tour that ended at the Democratic National Convention in Philadelphia. At each stop, the Nuns held meetings where concerned residents could share their concerns about a range of topics – including tax justice, living wages, family-friendly workplaces, access to democracy, healthcare, citizenship and housing. These meetings were held under the general title of “Mending the Gaps” and the discussion points and concerns from each meeting are to be delivered in Philadelphia.

The Nuns on the Bus came to Providence Saturday night as part of a 13 state tour that ended at the Democratic National Convention in Philadelphia. At each stop, the Nuns held meetings where concerned residents could share their concerns about a range of topics – including tax justice, living wages, family-friendly workplaces, access to democracy, healthcare, citizenship and housing. These meetings were held under the general title of “Mending the Gaps” and the discussion points and concerns from each meeting are to be delivered in Philadelphia.

The Nuns arrived at St. Michael’s Church in South Providence to the music of the Extraordinary Rendition Band and St. Michael’s own drummers.

During the discussions the Nuns learned about the obscene child poverty rates in Rhode Island, the criminality and disconnect of many of our elected leaders and our state’s support for the fossil fuel industry and the environmental racism such support entails. The meeting filled the basement of St. Michael’s.

From Providence the Nuns headed to Hartford, Scranton and Newark before arriving in Philly on July 26. You can follow their progress here.

The Executive Board of the Rhode Island Progressive Democrats wishes to express extreme displeasure that Hillary Clinton would name Governor Gina Raimondo as a co-chair of the Democratic convention. While this role is purely ceremonial, it indicates that some of Clinton’s advisors may consider Raimondo an acceptable figure within the national Democratic party, a sentiment that would be deeply chilling. Raimondo’s politics represent a brand of conservatism well to the right of basically anyone of prominence in the national Democratic party. Deeply unpopular in Rhode Island, Raimondo is known for her aggressive push to restrict women’s access to abortion coverage through plans sold on Rhode Island’s exchange. She is also one of the most aggressive proponents of pension cuts, which Democrats just voted to oppose in our party platform. She has been a feisty advocate of expanding fossil fuel infrastructure, and she even opposes repealing Rhode Island’s tax cuts for the rich. A former private equity executive, Raimondo epitomizes an extreme type of Wall Street politician. After the withdrawal of banker Antonio Weiss, the national party has had an informal rule against Wall Street appointees for top posts. Raimondo appears to violate that rule.

The Executive Board of the Rhode Island Progressive Democrats wishes to express extreme displeasure that Hillary Clinton would name Governor Gina Raimondo as a co-chair of the Democratic convention. While this role is purely ceremonial, it indicates that some of Clinton’s advisors may consider Raimondo an acceptable figure within the national Democratic party, a sentiment that would be deeply chilling. Raimondo’s politics represent a brand of conservatism well to the right of basically anyone of prominence in the national Democratic party. Deeply unpopular in Rhode Island, Raimondo is known for her aggressive push to restrict women’s access to abortion coverage through plans sold on Rhode Island’s exchange. She is also one of the most aggressive proponents of pension cuts, which Democrats just voted to oppose in our party platform. She has been a feisty advocate of expanding fossil fuel infrastructure, and she even opposes repealing Rhode Island’s tax cuts for the rich. A former private equity executive, Raimondo epitomizes an extreme type of Wall Street politician. After the withdrawal of banker Antonio Weiss, the national party has had an informal rule against Wall Street appointees for top posts. Raimondo appears to violate that rule.

We ask that the Hillary Clinton campaign withdraw this appointment. We believe it is crucial for the Hillary campaign to send a signal that they will not be considering Raimondo for any posts in a Hillary administration, an event that would place the even more right wing Dan McKee in power. McKee is such a far right Democrat that we took the completely unprecedented step of urging voters to support his Republican opponent Catherine Taylor, and the AFL-CIO went further and openly endorsed Taylor.

Moreover, we urge Hillary to make it clear that she, the national Democratic party, and the DSCC will oppose Raimondo in the primary should she attempt to take a US Senate seat in the future. Raimondo is so unpopular in Rhode Islanders that she could easily lose to a Republican. In fact, she only won by four points against a weak GOP opponent in a state that Obama won by 27 points. A Raimondo nomination is the GOP’s only path to a US Senate seat from Rhode Island, and it is of utmost importance that the national party prevent such a debacle. The national party has often intervened in primaries to stop weak nominees from jeopardizing a Democratic US Senate seat, most recently in Pennsylvania. We urge Hillary Clinton to make clear she will do the same in Rhode Island to prevent a Raimondo nomination and a GOP victory, should Raimondo attempt to take a US Senate seat.

]]> Despite much wringing of hands and awarding of tax breaks to various upper income and business folks, we Rhode Islanders are told our business climate IS still at the bottom. Thus I propose these seven modest suggestions for addressing this problem.

Despite much wringing of hands and awarding of tax breaks to various upper income and business folks, we Rhode Islanders are told our business climate IS still at the bottom. Thus I propose these seven modest suggestions for addressing this problem.

1. Ban any pro-union advocacy opinions in the state’s media. While talk radio mostly does this already, some pro-union opinions occasionally do slip into the Providence Journal, RI Future, and maybe other local papers. I’m sure business will appreciate it if we close this loophole.

2. Cut pay of public workers by 50%. Though public workers have already made concessions on pay, health care and pensions, some of them can still afford to drive. Halving their pay would not only lower the tax burden, but make more room on the roads for the important people.

3. Stop enforcing clean water laws. Not only will this too lower the tax burden, but as public water supply gets more polluted, investors will see opportunities here to sell more bottled water and also to make money in the health care system treating the people who persist in drinking public water and thus get sick.

4. Stop funding bike, pedestrian and transit programs. This will make the state more attractive to oil and auto companies. Also, by discouraging physical activity, this will also increase obesity, making Rhode Islanders less fit and thus less able to challenge pro-business programs. Those who persist in biking or walking can perhaps be made subject to a gasoline-avoidance fee that can generate revenue to subsidize business jets. But as there are proposals in the US House of Representatives to do something like this on a national level, we better do this quickly before we lose a competitive advantage over other states.

5. Sell all public beaches. Not only will this provide more shoreline for the rich to buy, but their view of the shore from their yachts will be improved if the hordes of riffraff on the public beaches are forced off.

6. End the sales tax on high-end cars. Though we already eliminated sales taxes on boats and private airplanes, the rich still have to pay sales taxes on BMWs, Cadillacs, Lexuses etc. It is not fair that their cars are not treated tax-wise the same way as their yachts and planes.

7. Require all low income folks to be servants to the business class for 3 days a year. After all, we know how hard it is to find good servants these days. The low income folks serving the rich could polish their cars or silver, cut the grass, mop the floors and such. Giving up only 3 days would not be too much of a burden, but think how much it could improve our business climate rankings as no other state does this. Indeed we can market this initiative by emphasizing the “Plantations” part of our official state name that we voted to keep. not that long ago.

Will these suggestions be seriously considered? Maybe.

Every night in downtown Providence, we see the darkened windows of our state’s tallest building. It’s a sad sign of failed development policies. Recently, the developers announced that they are going to hold the building empty for yet another year, waiting for a massive payout from the taxpayers. What a better way to bully Rhode Island into giving them subsidies than to insist on keeping the largest and most recognizable building in Rhode Island completely empty?

Every night in downtown Providence, we see the darkened windows of our state’s tallest building. It’s a sad sign of failed development policies. Recently, the developers announced that they are going to hold the building empty for yet another year, waiting for a massive payout from the taxpayers. What a better way to bully Rhode Island into giving them subsidies than to insist on keeping the largest and most recognizable building in Rhode Island completely empty?

In 2008, the building was bought by David Sweetser and High Rock Development LLC for $33 million dollars. In a bid to lower their taxes, the developers are now arguing that the building has “no value.” In 2013, Sweetser asked for $75 million in state assistance and tax breaks, and each year, he comes back to ask again.

Rhode Islanders should not be held responsible for bad business decisions. And we should subsidize affordable housing, not luxury apartments that further segregate the rich from the poor. With the massive expansion of the agency that did 38 Studios, more and more Rhode Island corporations are coming to expect big checks from the state for any developments they do. And more and more developers are holding development hostage to bargain for public bailouts. It’s time to take action.

That’s why, continuing our strong stance against corporate welfare, we call on our political leaders to reject any subsidies for the Superman Building. We need to send a clear message that holding the building empty to extort money won’t work. Until the developer gets the message, the building will remain vacant.

We ask Sweetser to either develop the building or sell it to someone who can. The people of Rhode Island will not be bullied into giving absurd amounts of money to bail out a corporation’s mistakes. We can’t let this Massachusetts developer take advantage of us by using enormous tax subsidies to build unaffordable luxury apartments. Spending $75 million on corporate welfare for luxury apartments is unethical. Less than 5 years ago, the state of Rhode Island gave $75 million dollars to 38 Studios. We ask that we not make that mistake again.

]]>

The Conservation Law Fund (CLF) supports S-3037, by Senators Fogarty, Nesselbush, and Kettle, and respectfully urges passage of this bill. This bill addresses an important issue pertaining to the proposal by Invenergy to build a new 900 MW fossil-fuel power plant in Burrillville, RI.

CLF has considerable first-hand knowledge of the Invenergy proposal. CLF is the only environmental organization that has been admitted as a full party before the Energy Facility Siting Board (EFSB) in Docket SB 20 15-06, which is the Invenergy permitting proceeding. CLF is the only environmental organization that has been admitted as a full party in the Public Utilities Commission Docket # 4606 that is considering issues pertaining to Invenergy (including whether the proposed plant is even needed and what the ratepayer impacts might be).

In connection with these legal proceedings, CLF has received and reviewed thousands of pages of evidence, including significant quantities of confidential information pertaining to the Invenergy proposal. CLF urges passage of Senator Fogarty’s bill because it addresses a crucially important issue that is not being addressed anywhere else — and, indeed, cannot be addressed anywhere else: the matter of voter approval for tax treaties.

I respectfully direct your attention to the portion of this bill beginning on page 3, line 34, and running through page 4.

Under long-existing law, R.I. General Laws § 44-3-30, the Town Council of Burrillville has the legal ability to enter into tax agreements, called “tax treaties,” with the proponent or owner of electricity-generating plants within the Town. Senator Fogarty’s bill would make one crucially important change to this law. The bill would retain the long-existing power of the Burrillville Town Council to enter into these tax treaties — but would require voter approval of such treaties.

This bill is good for democratic process.

The only argument that I have personally heard from Invenergy’s lawyers against this provision in the Fogarty Bill is that, by requiring such voter approval for tax treaties, the Bill would stymie any and all infrastructure projects in the state. I was even told that passage of the Fogarty Bill would prevent small projects from going forward at the Johnston Land Fill.

This is untrue. The underlying, existing statute that the Fogarty Bill modifies pertains only to Burrillville, and only to electricity generators in Burrillville. The Bill would have no application and no effect anywhere else in the state.

Moreover, if enacted, the Fogarty Bill would not stop the Invenergy plant from being built — nor even prevent the Burrillville Town Council from entering into a tax treaty with Invenergy. The only thing the Fogarty Bill would do is require that any such tax treaty be voted on by the people of Burrillville.

And, in the event that such a tax treaty were turned down by Burrilliville voters, even that would not necessarily stop the Invenergy plant from being built. The tax treaty that was voted down would not take effect, but Invenergy could seek to negotiate a different tax treaty, or could even build the plant without a tax treaty.

In short, the scare tactics used by Invenergy and its allies to oppose this provision of the Fogarty Bill are just not true.

I want to address one other provision in this bill: the section on page 1, lines 7 to 14, that would enlarge the membership of the EFSB. When this bill was heard in the House Environment Committee on Thursday, May 26, National Grid expressed reservations about expanding the membership of the EFSB, and said that so expanding the EFSB could potentially jeopardize tens (or even hundreds) of millions of dollars of pending infrastructure projects.

CLF has long had reservations about the way the current EFSB is constituted; thus, CLF well understands the impulse to change how the EFSB is constituted. Nevertheless, CLF believes that the most critically important portion of Senator Fogarty’s bill is the portion on page 4 requiring voter approval of tax treaties. For that reason, if there is significant opposition to the provision on page 1 of the bill (changing the membership of the EFSB). CLF respectfully urges that you strip out that latter provision and pass the rest of the bill.

[This post was created with an advanced copy of Jerry Elmer’s testimony for tomorrow’s Senate Judiciary hearing.]

]]>

A bill under consideration at the Statehouse, sponsored by Representative Edith Ajello and Senator Louis DiPalma, would repeal the sales tax on tampons, menstrual products, and single-use medical supplies. If Rhode Island passes it (and we should) we would join growing ranks of states that have repealed the so-called “tampon tax”—and we would distinguish ourselves by including other medically necessary items in that repeal.

Tax policy is complicated, and many injustices (intentional or not) are hidden within it. Sales tax in general is considered a “regressive” tax, meaning that it represents a higher portion of poor people’s income than it does of wealthy people’s income. Specifically, taxes on menstrual products and single-use medical supplies penalize people for conditions that they can’t help.

Most states in the US, including Rhode Island, tax “tangible personal property” but make exemptions for select “necessities”. These necessities include groceries, food stamp purchases, medical purchases (prescriptions, prosthetics, some over-the-counter drugs), clothing, and agriculture supplies.

In Rhode Island, as elsewhere, menstrual products (including tampons, sanitary pads, menstrual cups, and panty liners), as well as single-use medical supplies (such as diabetes strips) fall under the category of “hygiene products,” and are considered “luxury items.”

They are therefore taxable.

As almost any woman could tell you, periods are not luxurious. Menstrual products are a basic necessity for reproductive-aged women; the tax is particularly unjust since it targets people already at the wrong end of the wage gap. On average, a woman will, in her lifetime, use more than 11,000 tampons or pads, and is expected to spend approximately $5,600 on these items. Of that, nearly $500 is sales tax.

The same is true for people with illnesses that require regular single-use medical supplies. People suffering from diabetes cannot “opt out” of their daily insulin checks, and those needing regular injections would hardly classify them as “luxuries”.

Of the fifty US states, forty currently tax menstrual products. In the past several years, five states (Maryland, Massachusetts, New Jersey, Minnesota, and Pennsylvania) have repealed the “tampon tax”. In Delaware, Alaska, Montana, Oregon, and New Hampshire there is no sales tax at all.

Other states have been engaging this question, and there is movement across the country to reconsider, reshape, and/or repeal the tax on sanitary products. Five states (California, Utah, Virginia, Ohio, and New York) either have active coalitions working on this issue, or have introduced bills. Several weeks ago, Chicago repealed the “tampon tax”.

Even President Obama agrees that taxing medically necessary supplies is unjust.

“I have no idea why states would tax [menstrual products] as luxury items,” President Obama said in a YouTube interview to blogger Ingrid Nilsen: “I suspect it’s because men were making the laws when those taxes were passed.”

We support this bill in Rhode Island that would re-classify menstrual products and single-use medical supplies as “necessities,” thus eliminating the sales tax on such items, and we are proud of the fine efforts of our state legislators.

Meghan Elizabeth Kallman, Robin Dionne, and Christina Morra are fellows at the Women’s Policy Institute.

]]>Below is all the testimony, in order, separated by speaker.

01 Representative Cale Keable, who represents Burrillville, introduced the bill.

02 Jeremy Bailey, Burrillville resident

03 Lenette F. Boisselle, representing the Northern RI Chamber of Commerce, opposes the bill. Earlier in the day, Loiselle was at the Kirkbrae Country Club for the Northern RI Chamber of Commerce breakfest. At that event, all the questions for guest speaker John Niland, director of development for Invenergy, the company that wants to build the power plant in Burrillville, were submitted in writing. It was Boiselle who carefully sorted the questions, allowing Niland to only answer softball questions.

Boiselle took some tough questions regarding her opposition to the bill. The Chamber of Commerce, says Boiselle, “has a history of opposing any type of referendum… as a fundamental principle, the Chamber of Commerce believes that these types of issues are extremely complicated, that’s why we elect people to be in a position to be able to take the time to study the pros and the cons and determine whats in the best interest of whether it be the town or whether it be the state.”

Boiselle said that the Chamber has “no position on the power plant one way or another” and that if this bill is passed, whoever spends the most amount of money to advertise their positions will likely win.

The legislation, said Boiselle, in response to a question from Representative Michael Marcello, “could kill [a project] just by making it wait” until the next general election for the voters to decide.

Representative John Lombardi asked “what would be wrong with the town and the council having the last say in this. Is there a problem with that? You say you oppose that?”

Boiselle said that the time it takes to understand the pros and cons of complex issues is too great for voters. That’s why we elect representatives.

“I think its always good to engage the people,” said Lombardi.”It’s supposed to be a representative government, but sometimes it doesn’t end up that way. They don’t seak on the behalf of the people. I think this is a good process.”

“I’m just curious,” asked Representative Aaron Regunberg, “Money plays a big role in pretty much every election, do you think we shouldn’t have any elections?”

04 Jerry Elmer, senior attorney at the Conservation Law Foundation is strongly in favor of the bill.

05 Mike Ryan of National Grid opposes the bill, at least in part. They have no position on the part of the bill concerning voter approval of negotiated tax treaties.

06 Meg Kerr, of the Audubon Society, is for the bill.

07 Elizabeth Suever representing the Greater Providence Chamber of Commerce opposes the bill. She seems to think that granting more democracy to Burrillville might make other municipalities want more democracy as well, which may slow down growth. Of course, Suever never uses the word democracy, because that would make her argument sound anti-American.

08 Paul Bolduc is a Burrillville resident.

09 Greg Mancini – Build RI

10 Paul Beaudette – Environmental Council of RI

11 Michael Sabitoni -Building Trades Council

12 Lynn Clark

13 Scott Duhamel – Building Trades

14 Peter Nightingale – Fossil Free RI

15 Roy Coulombe – Building Trades

16 Adam Lupino – Laborers of NE

17 Catherine

18 Paul McDonald – Providence Central Labor Council

19 Paul Lefebvre

20 George Nee AFL-CIO

21 Jan Luby

22 Richard Sinapi – NE Mechanical Contractors Association

23

24 Doug Gablinske Tech RI, The Energy Council

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

The bill Representative Cale Keable introduced to the RI House that seeks to overhaul Rhode Island General Law 44-4-30 by giving the residents of Burrillville more power over whether or not Invenergy‘s proposed fracked gas and diesel oil burning power plant gets built in their town has been reviewed by Conservation Law Foundation (CLF) Senior Attorney Jerry Elmer, and his verdict is clear: “Despite its imperfections,” says Elmer, “the Keable Bill is an excellent bill that ought to be supported by enviros, because – for the two separate reasons outlined above — it makes it much less likely that the Invenergy plant will be built.”

The bill Representative Cale Keable introduced to the RI House that seeks to overhaul Rhode Island General Law 44-4-30 by giving the residents of Burrillville more power over whether or not Invenergy‘s proposed fracked gas and diesel oil burning power plant gets built in their town has been reviewed by Conservation Law Foundation (CLF) Senior Attorney Jerry Elmer, and his verdict is clear: “Despite its imperfections,” says Elmer, “the Keable Bill is an excellent bill that ought to be supported by enviros, because – for the two separate reasons outlined above — it makes it much less likely that the Invenergy plant will be built.”

You can read House Bill 8240 here.

Elmer’s analysis is worth reading in its entirety:

]]>Main Point of the Bill – The main point of the bill appears on page 4. Under existing law (RIGL 44-4-30) the Burrillville Town Council has the power to set the property tax rate for Invenergy at any level it wants. Thus, under existing law, the Town Council could give Invenergy a sweetheart deal by charging one dollar per decade; or the Town Council could drive Invenergy out of Burrillville by charging a million dollars per nano-second. The Keable bill changes this by adding the requirement that, whatever the Town Council does, that arrangement must be approved by the voters of Burrillville in a voter referendum. This is a very, very good thing because it makes it much less likely that the plant will be built. In fact, this is true for two separate reasons:

First, many people have been worried that the Burrillville Town Council will make a secret sweetheart deal with Invenergy, and that the people of Burrillville will be cut out of the process. People have been very worried about this, because the people of Burrillville are overwhelmingly opposed to the Invenergy proposal, but the Town Council seems (much) more favorably inclined toward Invenergy. If passed, this law would make it impossible for the Town Council to cut the people of Burrillville out of the process. Any deal the Town Council makes with Invenergy would have to be approved by the voters; and the voters could vote down any tax treaty with Invenergy that does not ensure, with 100% certainty, that the plant is not built.

Second, even the presence of this law on the books creates uncertainty for Invenergy – at least until a tax treaty is negotiated and approved by public referendum. This uncertainty will probably make it more difficult (and maybe impossible) for Invenergy to obtain the necessary funding (loans) to start construction. After all, what lender would put up hundreds of millions of dollars knowing that the Town could tax Invenergy out of existence? Importantly, in a situation like this, delay (“mere delay”) can actually kill the project. As CLF argued at the [Energy Facilities Siting Board] EFSB, Invenergy made the election to obtain a Capacity Supply Obligation (CSO) in the ISO’s Forward Capacity Auction (FCA) on February 8, 2016, before Invenergy had the necessary state permits. That CSO begins on June 1, 2019, and it comes with huge financial penalties if Invenergy is not up and running by that time. If Invenergy is delayed in starting construction by even 12 months, Invenergy may be forced to sell out of its CSO (in an effort to avoid penalties) and abandon this project.

Note, importantly, that what I say in that last paragraph is true even if the EFSB grants Invenergy a permit! In other words, if passed, the Keable bill provides a separate and independent way of stopping Invenergy, a way that works even if CLF’s litigation against Invenergy in the EFSB fails.

In this sense, the Keable bill is clearly good for democracy. Up until now, many people have feared that the Town Council would secretly cut a sweetheart deal with Invenergy, despite overwhelming citizen opposition within the Town. If passed, the Keable bill would make that impossible.

Changing the Make-Up of the EFSB – The Keable bill would also change the make-up of the EFSB by expanding the EFSB from three to nine members. (Bill, page 1, lines 7 to 14) Currently two of the three members of the EFSB sit at the pleasure of the Governor (and this provision in the Keable Bill is probably intended to change that status quo). I am skeptical about how useful this provision would be, even leaving aside the unwieldiness of a nine-member EFSB. Note that two EFSB members now sit at the pleasure of the Governor. One of the proposed new members under the Keable Bill is the chairperson of the Commerce Corporation, who also sits at the pleasure of the Governor. Of the three “public members” to be added, the union representative will reliably support all new power plant construction, and the person “experienced in energy issues” may very well also reliably support new power plants. That would be five members of a nine-member EFSB that would reliably support new power plants. While well-intentioned, this provision is probably not a good way to stop the Invenergy proposal, or to constitute a better EFSB.

Considering a Town Council Resolution – The Keable bill contains this sentence (page 3, lines 18-19): “Prior to making a decision, the board [EFSB] shall take into consideration any town or city council resolution regarding the application.” This is toothless – for two reasons. First, “take into consideration” means “think about” but not necessarily respect or act upon. Second, as we know in this case, the Town Council is much more favorable toward Invenergy than the people of the Town.

Nevertheless, I want to be clear: Despite its imperfections, the Keable Bill is an excellent bill that ought to be supported by enviros, because – for the two separate reasons outlined above — it makes it much less likely that the Invenergy plant will be built.

What are the chances of passage? – Of course, the honest answer is, “I don’t know.” On the one hand, in order to have been introduced this late in the General Assembly session (three months after the filing deadline for new bills), the bill must have some support from leadership. On the other hand, if passed, this bill would go a long way to un-doing the whole purpose, the raison d’etre, of the state’s Energy Facility Siting Act that created the EFSB. That statute was designed to take the power to stop a proposal like Invenergy’s out of the hands of the local people (who could be motivated by base NIMBYism) and put it into the hands of the EFSB. This bill (not so much the change in EFSB membership, but the tax treaty referendum requirement) goes a long way to un-doing that purpose. Also, there is, as of yet, no Senate-side analogue of the Keable Bill in the House. Also, remember this: Governor Raimondo is a huge supporter of the Invenergy proposal going forward (because of the job-creation aspects). Even if the bill passes the General Assembly, Gov. Raimondo could still veto the bill – especially if her analysis of the bill’s real-world effects jibes with my own. My analysis is that, if passed, the bill would make it much less likely that the Invenergy plant will ever be built. If Gov. Raimondo agrees with me, she might veto the bill for that very reason.

Hearing on Thursday – Although not yet posted on the General Assembly website, Rep. Keable believes that his bill will be heard this Thursday in the House Environment Committee, at the Rise of the House (some time after 4 PM).