Here’s a link to Governor Raimondo’s budget website and below is the text, as prepared, of her budget address to the House and Senate tonight:

Speaker Mattiello, Senate President Paiva Weed, Members of the General Assembly, the Judiciary, the Cabinet, City and Town Leaders, and my fellow Rhode Islanders.

Speaker Mattiello, Senate President Paiva Weed, Members of the General Assembly, the Judiciary, the Cabinet, City and Town Leaders, and my fellow Rhode Islanders.

Good Evening. It is an honor to stand before you to address how we can work together to expand opportunities for all Rhode Islanders and create jobs.

The budget I present to you tonight is rooted in the core belief that every hardworking family deserves the chance to make it in Rhode Island. Despite starting with a nearly $200M deficit, this budget is balanced, makes significant progress towards eliminating our structural deficit, involves no broad based tax increases, and calls for significant investments in economic growth and education.

From my first conversation with Speaker Mattiello and Senate President Paiva Weed, we agreed that priority one was jumpstarting our economy and creating jobs. I couldn’t ask for better partners in this effort and I’d like to thank you both for the time and support you’ve given me these past few months.

Our biggest problem is that our state’s economic engine is out of gas – we’ve lost 80K manufacturing jobs in the last few decades and we haven’t positioned ourselves for job-creation in advanced industries with higher growth and higher wage jobs. The jobs we are creating are low wage and, as a result, our per capita income is about $47K a year compared to $57K in Massachusetts and $60K in Connecticut. We remain among the last states in the nation in employment and in job growth, and we are one of the oldest states in America because our young people are fleeing to find work elsewhere.

All most people want is the chance to earn a decent living that lets them provide for their family. Parents want the chance to give their children a better life than they themselves led.

That’s what my parents wanted. My mom is here tonight – she and my dad worked so hard to provide stability for our family.

But now, not enough Rhode Islanders have the opportunity to do the same for their children because we aren’t creating enough good jobs, and too many of the jobs we are creating don’t pay a sufficient wage.

Our weak economy contributes to our budget deficit, forcing us into the same crunch every year: not enough jobs means lower state revenue, so we make painful cuts to balance the budget. But some of those cuts have been to economic development or infrastructure, which hurt our economy more. It is time to break this downward spiral and set in motion a virtuous cycle of progress and momentum driven by economic growth.

We need to cut in areas where we are inefficient or spend too much, and then invest in economic growth. Over time, our growth will lead to even more revenue, which will allow for further investments in education, infrastructure, and an adequate safety net.

Our turnaround won’t happen overnight but we have to start immediately because Rhode Islanders are struggling right now.

A couple of weeks ago, I was at the Warwick Mall reading to kids, and a young mom told me about how she was barely scraping by.

I took my mom shopping and a man who has worked the same full time retail job for more than a decade told me that he can barely sleep because he’s worried about the fact that there’s no money in his checking account.

We need to give a boost to Rhode Islanders who are working hard and trying to provide a decent living for their family. No one who works full-time should be forced to raise their family in poverty.

That’s why I’d like to work with you to raise the minimum wage to $10.10 an hour.

We need to do more to make work pay.

This budget expands the Earned Income Tax Credit from 10% to 15% over the next two years, putting more money directly in the pockets of working Rhode Islanders. If the revenue forecasts in May improve, I’d love to see us go to 15% this year.

It also eliminates state taxes on Social Security benefits for low and middle income seniors. Social Security is a crucial source of income for these seniors, and we should help them make ends meet. Speaker Mattiello is a leader in this effort and I am pleased to work with him to make it happen.

These steps will help families live a little more comfortably. But they will also stimulate our economy, because we know these folks will spend this money in our local economy.

And as this immediate action takes hold, we must together turn our attention to taking bold steps to create opportunities for Rhode Island.

I propose a bold comprehensive jobs plan that operates in waves with the first wave being the most robust to kick start our effort. We can’t sit back and expect jobs to appear.

This budget sets us on the path to Rhode Island’s comeback by focusing on three things:

First, building the skills our students and workers need to compete in the 21st century.

Second, attracting entrepreneurs and investment.

And third, fostering innovation, including in our state government, to enhance accountability and deliver value to taxpayers.

These principles — and an unwavering focus on creating jobs and expanding opportunity — guided every decision we made in assembling this budget.

Helping people build the skills they need to succeed is one of the best investments we can make.

Since being elected, I have dedicated time every week to talk with businesses, asking them what it will take to add jobs in Rhode Island. The thing I hear most often is that they want a skilled workforce, ready to work. We need to provide people with the training so Rhode Island is a more desirable place for 21st century businesses to invest.

This budget invests in each rung of the ladder – our schools, college affordability, and skills training for adults.

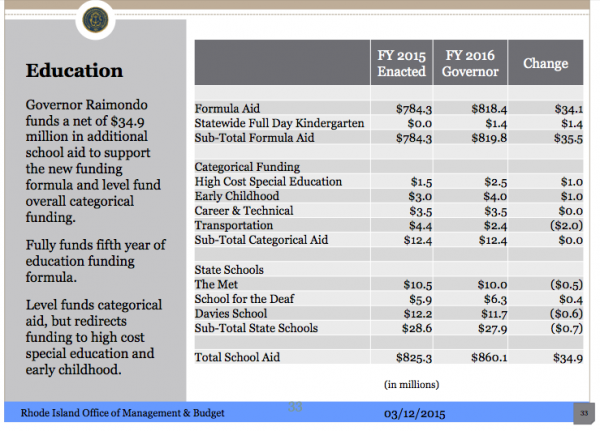

This budget invests record amounts in our K-12 public schools.

This budget also commits the necessary matching funds that allow us to more than triple the number of state sponsored pre-k classrooms in Rhode Island. It’s never too early to put our youngest learners on a path to opportunity.

And we still have almost 2,000 kindergarten students who don’t have access to full-day K. My husband and I know firsthand how much our kids flourished because of all day K and every Rhode Island kid deserves the same opportunity.

Senate President Paiva Weed is passionate about this too and I’m eager to work with her and others to bring universal full day Kindergarten to every school by September 2016. This budget makes it possible.

Teachers want it. Parents want it. And our kids need it. Let’s get it done. But how are students supposed to learn if they’re in crumbling school buildings?

Too many of our children go to school each day in buildings that have outdated heating systems; that lack modern security or technology for 21st century learning; or suffer from general disrepair.

And so, the time has come to lift the current moratorium on school construction.

My budget proposes creating a new School Building Authority to partner with cities and towns to address critical renovation needs. We are seeding it with $20 million this year, and to keep it going, starting next year, we’ll create a long-term and stable source of funds for this purpose.

We’ll put our kids in better schools. And we’ll put construction crews to work, many of whom haven’t seen steady work in years.

Building skills also means making education more relevant and effective. I propose an initiative called “Prepare RI” to empower every high school student across the state who qualifies to take college courses while they’re in high school at no cost to the student. Whether you want to go to college, or start a career right after high school, we want to make your path to a degree or industry certification more affordable and more attainable.

My dad took advantage of the GI Bill and became the first person in our family to go to college. That enabled him to get a good job. One person going to college changed all of our lives. Now more than ever, higher education can be the ladder to the middle class because in today’s economy high wage jobs go to people with high skills.

But for too many a college degree is out of reach because of the cost.

So I propose restructuring our higher education grant programs to create a last-dollar scholarship that begins to tackle the unmet financial need of Rhode Island students. In its first year, this program will invest $10M in students with proven academic performance but for whom the costs of higher education might too high and prevent them from going.

I propose we do this by restructuring and consolidating redundant bureaucracies, specifically moving the Rhode Island Higher Education Assistance Authority to the Office of the Post Secondary Commissioner. These moves will enable the state to save money and fund these scholarships for Rhode Islanders. This is the right thing to do – let’s do it together.

Even with these scholarships, we know that college costs are a lot to bear. So we’re establishing a competitive student loan forgiveness program for college graduates who pursue careers in technology, engineering and design. This program will fully cover four years’ worth of student debt for over 100 high achieving graduates per year. We want to stop the brain drain and keep these talented Rhode Islanders in Rhode Island after they graduate, especially in these fields.

Everyone knows that the global economy is changing and to compete we have to provide people access to opportunities to build the skills they need to get a job now.

Soon, I will announce a new approach to workforce training where we partner with businesses to make sure we’re training people for the jobs that actually exist now. This new system won’t require additional money in the budget, but will use existing funds to help Rhode Islanders get jobs, and help businesses get the well-trained workers they need. The difference is that we will put the employer at the center so we’re training people for jobs that are in demand now.

While we are building skills we also have to cultivate conditions to make Rhode Island an attractive place to do business and add jobs.

We’ve already begun addressing our regulatory climate. We are modernizing the way we issue regulations to make sure we’re as business-friendly as possible while still protecting our quality of life, air, water, and public safety. And we’re reviewing old regulations to see what we can eliminate.

We’re clearing away burdensome underbrush in other areas, too. After examining the over 300 licensed occupations in Rhode Island, we have identified about 30 that we can eliminate immediately. Wherever possible we should remove burdensome layers of bureaucracy to promote more economic activity.

The General Assembly to its great credit, recently cut the corporate tax rate to make us more competitive. But it’s no secret that Rhode Island’s taxes remain uncompetitive in some areas. Tonight I propose building on your good work.

To reduce business’s energy costs, I am proposing that we phase-out the sales tax on energy that the state imposes on commercial users. This will provide $5.1 million in tax relief to businesses next fiscal year, and help reduce the burden of rising energy costs.

We also have some taxes that are just a nuisance on businesses and don’t raise much revenue for the state. For instance, we are one of the only states that places special taxes on imaging centers and outpatient health services. To help contain health care costs and promote job creation in the healthcare industry, I am recommending phasing out both of these surcharges over four years.

Despite all this, let’s face it, Rhode Island has developed a reputation as a tough place to do business.

So to get companies to invest and create jobs here, we need to be proactive. This is especially true because so many other states offer incentives and have much more robust economic development efforts. If we want to compete…if we want companies to add jobs here, we can’t put ourselves at such a disadvantage relative to our neighbors.

It is time for our economic development strategy to turn heads, change perceptions, and put Rhode Island back in the game. Now I know we’ve made mistakes in economic development in the past. We must learn from them and never repeat them. We must move forward.

This budget proposes investing to attract high-quality companies, and encouraging the growth of businesses already here.

We are working with the legislature to introduce competitive tax packages that encourage businesses to create well-paying jobs, particularly well-paying jobs in promising industries.

We will implement these credits with rigorous accountability provisions, and won’t spend a dollar of state money until long after the jobs have been created.

There’s so much construction booming in Boston that they say the state bird of Massachusetts is the crane. I want job-producing construction here, so we propose creating a new initiative to encourage more real estate projects. These benefits will only be provided after the buildings are built, and are modeled after similar successful programs in other states.

Small businesses are the backbone of our state, and our comeback cannot occur without ensuring they are healthy and growing. Unlike our neighboring states, Rhode Island lacks a state-backed small business loan fund. So we will create a Small Business Program and an Innovation Initiative to expand access to capital for small businesses enabling them to thrive and expand.

Also, to leverage the businesses we already have, we will implement an Anchor Tax Credit that incentivizes our large employers to attract their suppliers to Rhode Island. These employers will benefit from having more of their suppliers close by, and the state will gain new businesses and jobs. If we are going to turn our economy around, everyone has a role to play, including our largest employers.

I am also proposing a series of steps to grow our innovation economy. Since 2010, over 1 million jobs have been created in America in advanced industries marked by technology and innovation – these industries pay more and are growing faster than most. It’s time Rhode Island got its fair share of these jobs for our families.

It is not the time to be passive or timid. We’re falling behind other states, and unemployed or underemployed Rhode Island families are bearing the brunt. If we succeed in sparking a recovery and creating jobs, everything is possible. If we don’t, nothing else will matter.

Finally, we must reinvigorate state government with fresh ideas and new ways of doing things in order to get better results. This starts with an honest and ethical government that the public deserves.

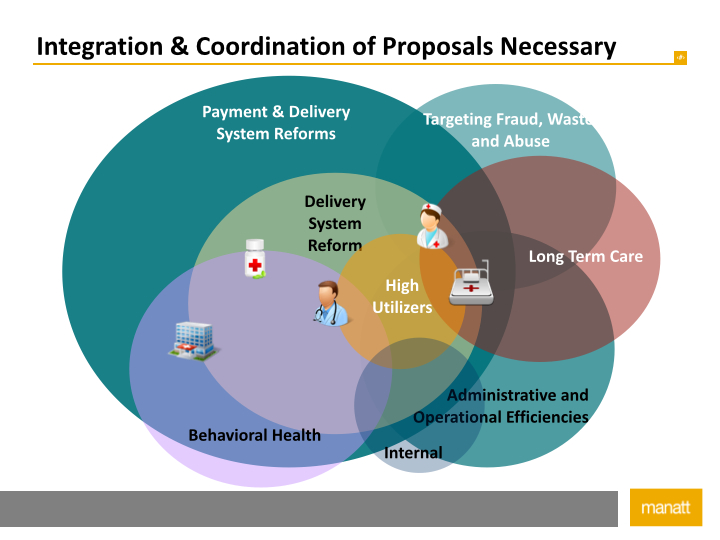

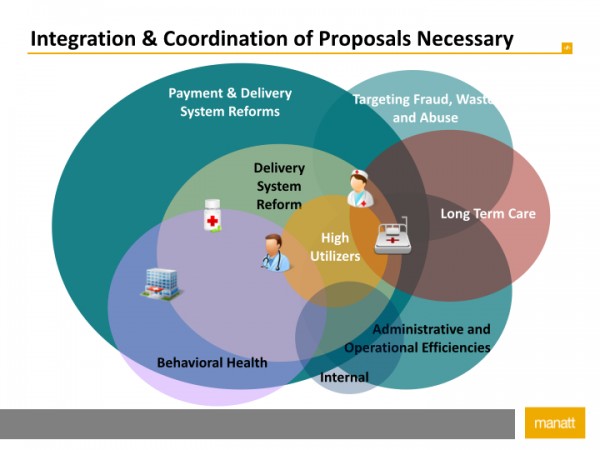

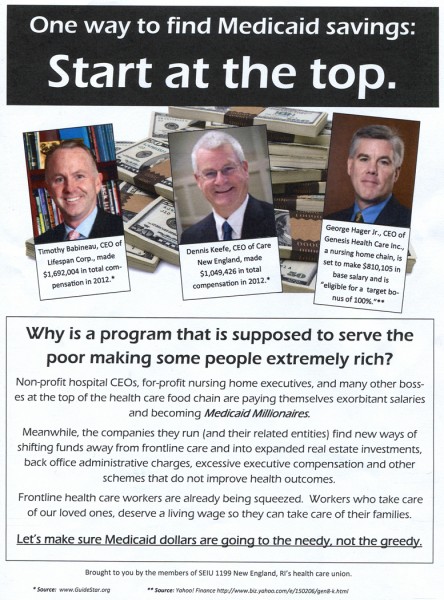

A key innovation priority this year is reinventing Medicaid.

It isn’t sustainable to have a system that has the second highest cost per enrollee of any state in the nation — a cost that is 60% higher than the national average and where a small percent of the enrollees account for the vast majority of the spending.

We have an opportunity to deliver better health care services to Rhode Islanders, and to make our system more affordable at the same time. To do so, we will have to crack down on fraud and waste; improve quality and coordination of care; and make Rhode Island a leader in health innovation by paying for value not volume.

I recently learned of a story from one of our health centers of a homeless man who was in the ER once a week with substance abuse issues. The health center would treat him, but until the root cause was addressed his cost of care continued to mount.

This is why our work to address Medicaid’s structural problems will continue beyond this evening with our working group.

I realize this working group is different than the way we’ve addressed medicaid in the past, but I believe the magnitude and complexity of the challenges we face requires it. And I am grateful to the General Assembly leadership for their flexibility as we work in partnership to find solutions. We have an opportunity with all the stakeholders at the table to put in place changes that will yield savings for years to come. This budget proposes a 9 percent cut in Medicaid expansion this year.

I intend to deliver a budget amendment to more specifically identify the cost savings that the working group generates. The working group is similar to a successful effort in New York.

Our redesigned system will focus on providing a coordinated system of care that delivers better outcomes, and delivers better value for taxpayers.

It’s also long past time to modernize our antiquated personnel rules in state government.We want to recruit and reward the best people, and ensure that there are incentives in place to encourage employees to be their best.

So this budget includes a proposal to provide state government with greater flexibility in hiring and managing personnel. In addition to a more efficient government, our goal is to achieve savings this year. If the revenue estimates in May are stronger, I would ask the General Assembly to reduce this saving target. We will work collaboratively with state employees to reduce personnel costs in a way that causes the least amount of disruption, avoids significant layoffs and honors the pay increases of the most recent contract. For my part, I am going to start by cutting my own pay by 5% this year.

The General Treasurer and I are working on another innovation — the Rhode Island Infrastructure Bank — to put Rhode Islanders back to work, improve our infrastructure, and reduce our demand for energy.

The bank will create a dependable source of capital to complete energy efficiency projects. We will integrate private capital into the mix of existing state funds to ramp up the deployment of clean energy technologies, while at the same time helping to create jobs.

This infrastructure bank — along with the school building authority and full funding for the municipal road and bridge revolving fund – will put people back to work and help our localities keep property taxes stable.

Despite all of our challenges, there’s a lot to love about Rhode Island. We love our neighborhoods, places to eat and shop. We love our beaches and our bay. For my family, a weekend in the summer is never complete without a visit to Sand Hill Cove.

We need more people to experience the things we all love. For too many years, though, we haven’t maximized the effectiveness in our state-funded tourism efforts. Rather than spending the resources in one concentrated way to maximize the bang for our buck, we’ve been sprinkling state-funded tourism dollars among various tourism bureaus around the state.

The time has come to redesign how we market our wonderful state to prospective visitors.

My proposal will restructure our tourism marketing efforts by concentrating resources behind a unified statewide tourism message. I realize that this proposal will cause some initial concern among the local bureaus, and that it is a change from the way we’ve always done it, but let’s work together over the coming months to find a solution. If we do this right, we can supercharge our tourism industry and create thousands of jobs just like other states have and that our families deserve.

The fiscally responsible budget I submit tonight takes a balanced approach to solving our challenges. We started with a nearly $200 million deficit, and we closed it by focusing mainly on spending cuts.

But, we also looked for ways to generate new revenue without imposing broad-based tax increases.

I propose closing a tax loophole on certain real estate transactions. This budget also asks those among us who are most able, to pay a little more. I propose asking those who have second homes worth more than $1 million to pay a modest assessment on those homes. This new revenue source, together with certain other revenue enhancements, is enabling us to invest in creating jobs.

We also have an opportunity now to take advantage of historically low interest rates to restructure some of our outstanding debt. By more actively managing our debt, something other states have done, we will be able to make important investments in job growth to jumpstart our economy.

The funds we will generate through refinancing will not be used to plug a budget hole, but will be part of a long-term plan to jumpstart economic growth and invest in specific economic development programs outlined in the budget.

I look forward to productive discussions and working together in the weeks to come. The truth is the people of Rhode Island are counting on us to because they are struggling and are losing faith in government. They want us to work together and make the right decisions to put Rhode Island on a better path.

I know all of us here tonight are aware of these challenges and want to rise to the occasion. I am asking you to.

Be a part of the team that sparks Rhode Island’s economic comeback. Be a part of the team that restores people’s faith in government by showing that we can get things done. Be a part of the team that restores optimism and confidence in our future. This budget sets forth a path to a Rhode Island full of opportunity, where everyone who works hard has a chance. Now, I know we have a high hill to climb, but let’s start now, and climb it together.

Thank you.

The 7th Annual Budget Policy Conference, a fundraiser for the

The 7th Annual Budget Policy Conference, a fundraiser for the

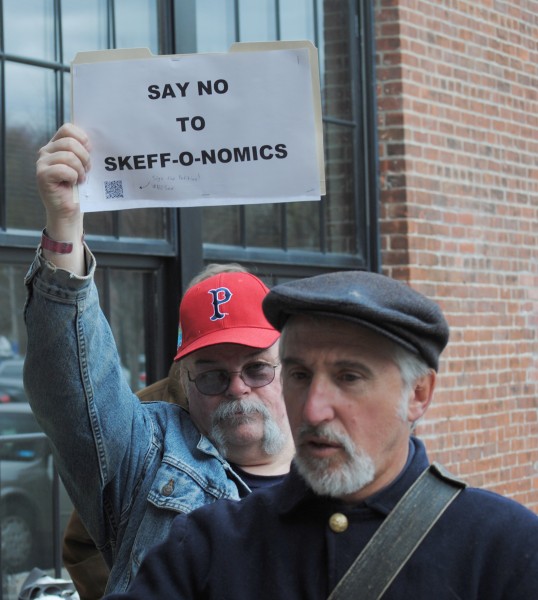

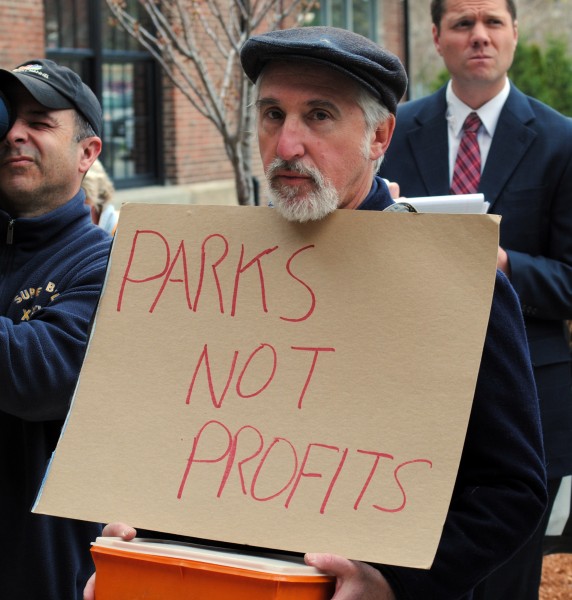

An unlikely coalition of opponents to the proposed downtown Providence stadium deal greeted new PawSox owner Jim Skeffington as he exited his chauffeured ride and quickly entered the Rhode Island Commerce Corporation (RICC) offices at 315 Iron Horse Way.

An unlikely coalition of opponents to the proposed downtown Providence stadium deal greeted new PawSox owner Jim Skeffington as he exited his chauffeured ride and quickly entered the Rhode Island Commerce Corporation (RICC) offices at 315 Iron Horse Way.

Since two-thirds of minimum wage earners are women, Governor Gina Raimondo says that

Since two-thirds of minimum wage earners are women, Governor Gina Raimondo says that

As they have for the past six years, about four dozen clergy representing a wide variety of faith traditions gathered at

As they have for the past six years, about four dozen clergy representing a wide variety of faith traditions gathered at

Earlier this year,

Earlier this year,  Ironically, just before the hotel workers took to the State House rotunda to talk about their planned hunger strike, there was an event in the Bell Room on the first floor of the State House to celebrate the release of a new cookbook, Extraordinary Recipes from Providence & Rhode Island Chef’s Table by Linda Beaulieu, complete with expertly prepared foods from some of the area’s best chefs. This juxtaposition of fancy food for the entitled political class and a hunger strike by poorly paid workers is a jarring reminder that things are not going right in Rhode Island.

Ironically, just before the hotel workers took to the State House rotunda to talk about their planned hunger strike, there was an event in the Bell Room on the first floor of the State House to celebrate the release of a new cookbook, Extraordinary Recipes from Providence & Rhode Island Chef’s Table by Linda Beaulieu, complete with expertly prepared foods from some of the area’s best chefs. This juxtaposition of fancy food for the entitled political class and a hunger strike by poorly paid workers is a jarring reminder that things are not going right in Rhode Island.