In a stunning revelation, Burrillville Town Council legal counsel Oleg Nikolyszyn confirmed under questioning from Burrillville resident Jeremy Bailey that the council has been secretly negotiating a tax agreement with Invenergy for the proposed gas and oil burning power plant. Before this revelation, the existence of such negotiations may have been suspected, but were not confirmed. Shortly after Nikolyszyn’s revelation, Councillor Kimberly Brissette Brown questioned whether the item was properly before the Council. Council President John Pacheco III said that the item was not properly before the council, and said that if Bailey wanted to discuss the issue of the Council’s tax agreement deliberations with Invenergy, he would have to put that item on the agenda.

How Bailey would know to put previously unknown secret meetings with Invenergy on the agenda was not discussed.

Nikolyszyn’s admission capped a stressful and difficult Burrillville Town Council meeting, in which council members, aided by legal counsel Nikolyszyn, once again said that they have no power to stand against Invenergy. President Pacheco said that if the Town Council doesn’t remain absolutely neutral about the plant, it may seem that they are unfairly influencing various boards, the members of which the Town Council has nominated. Why this level of neutrality is necessary from the Burrillville Town Council in relation to boards they nominate but such neutrality is not necessary for Governor Gina Raimondo, who nominates the members of the Energy Facilities Siting Board and has taken a position in strong support of the power plant, is unknown.

Burrillville resident Jonathan Dyson later followed up with the Town Council about the tax negotiations with Invenergy, asking if there was any board, regulation or law that forced the tax agreement meetings. Despite saying earlier that the item wasn’t properly before the board, Pacheco answered Dyson and maintained that entering into such discussions was a fiduciary duty of the Town Council. Then Pachco added that these negotiations also include the “potential abutters to the power plant,” that is, people who own property next to Invenergy’s land.

Pacheco didn’t explain exactly what this means, but it seems to indicate that Invenergy is actively negotiating what payments, if any, abutters to the project might receive in the event that the power plant is built.

When Dyson then asked the Town Council “under what conditions would the Town Council say no to Invenergy,” Town manager Michael Wood angrily said, “That is not an agenda item.” But in fact, it was an agenda item 16-106 (b). Wood then said that the item was too vague and would not be discussed, never mind that earlier, Council President Pacheco had complimented Gary Patterson, who requested that item be placed on the the agenda, saying, “Your item on the agenda was properly phrased. I appreciate that.”

Throughout the meeting the Town Council took great pains to tell the people attending that the fix wasn’t in and this wasn’t a done deal. However, to the consternation of most of those present, the Town Council has admitted to secretly negotiating tax agreements and issues of abutment with Invenergy. Worse, theses discussion have been going on for some time, as the earliest discussions seem to precede Oleg Nikolyszyn becoming town solicitor.

By the end of the meeting the public was more angry and distrustful of the Town Council than when the meeting began.

I’ll be writing much more about this meeting in a future piece, but right now, questions remain: How long has the Town Council been in negotiation with Invenergy? Who has been party to these negotiations? The Town Council says that this isn’t a done deal, that the “fix isn’t in” but what other unknown meetings and negotiations are happening without the public’s knowledge?

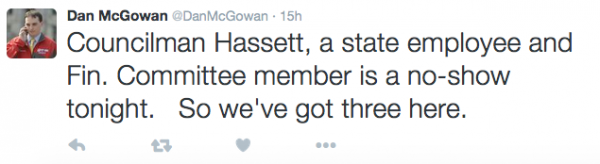

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation (

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation ( As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

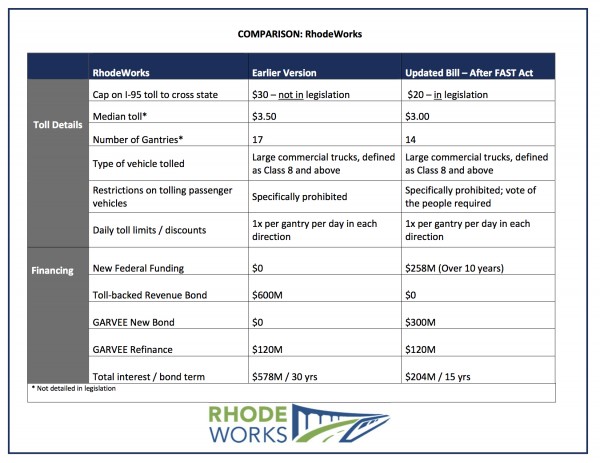

Ahead of yesterday’s finance committee votes in both houses of the General Assembly approving RhodeWorks, the truck toll plan, a press conference was held at the Greater Providence Chamber of Commerce (GPCC) featuring some of Rhode Island’s most powerful political, business and labor leaders. They were there to present a unified message in support of the tolls, despite vocal opposition.

Ahead of yesterday’s finance committee votes in both houses of the General Assembly approving RhodeWorks, the truck toll plan, a press conference was held at the Greater Providence Chamber of Commerce (GPCC) featuring some of Rhode Island’s most powerful political, business and labor leaders. They were there to present a unified message in support of the tolls, despite vocal opposition. As I said before,

As I said before,

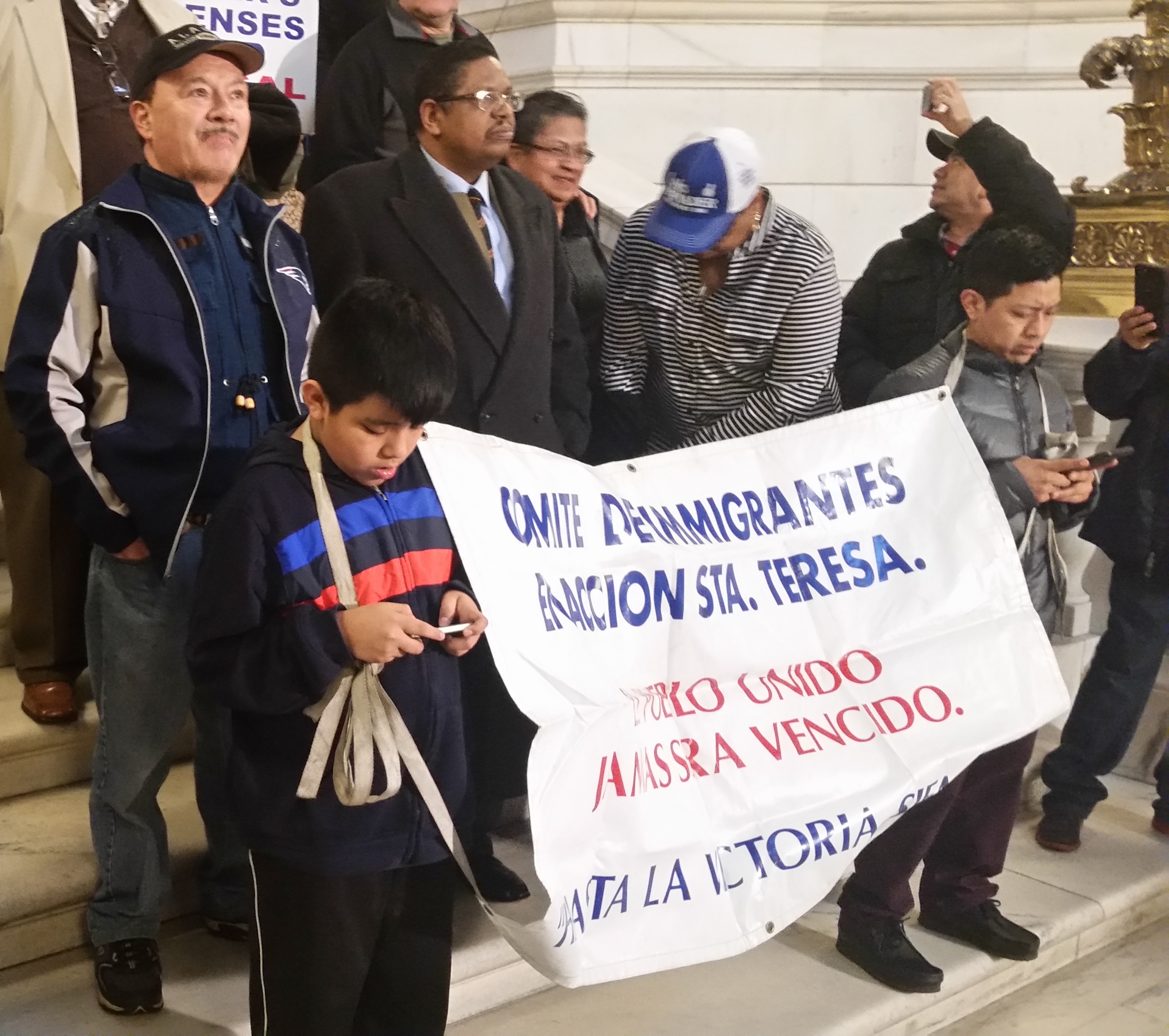

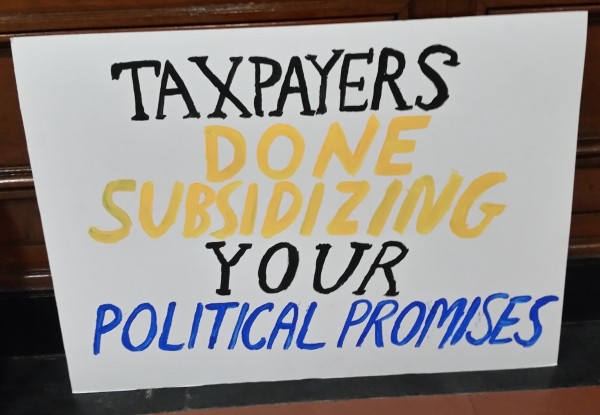

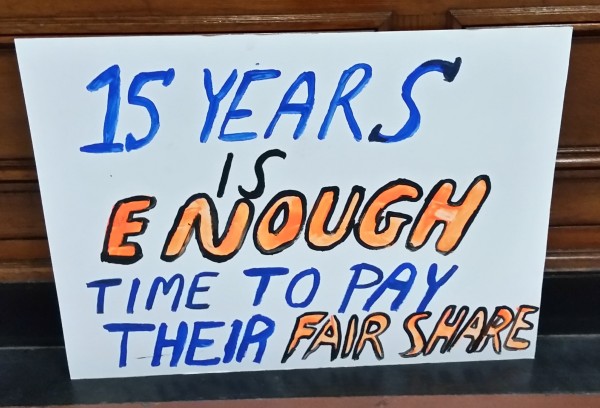

The Providence City Council Finance Committee unanimously rejected the proposed extension of the tax stabilization agreement (TSA) for the property at

The Providence City Council Finance Committee unanimously rejected the proposed extension of the tax stabilization agreement (TSA) for the property at

Though the big news was that Governor Gina Raimondo announced that she would be calling of an increase in the Earned Income Tax Credit (EITC) and the minimum wage when she presents her budget during the State of the State address Tuesday evening, the press conference where this was announced was to call attention to VITA, a program to help low and modest-income Rhode Islanders file their taxes and apply for tax credits like the EITC. Raimondo said that if the budget permits, she will push that rate higher.

Though the big news was that Governor Gina Raimondo announced that she would be calling of an increase in the Earned Income Tax Credit (EITC) and the minimum wage when she presents her budget during the State of the State address Tuesday evening, the press conference where this was announced was to call attention to VITA, a program to help low and modest-income Rhode Islanders file their taxes and apply for tax credits like the EITC. Raimondo said that if the budget permits, she will push that rate higher.

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.” So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As

A

A

“A 14.3 percent poverty rate is the story for this year,” said Richman, “but it need not be the story for next year.”

“A 14.3 percent poverty rate is the story for this year,” said Richman, “but it need not be the story for next year.” Also, as they have asked nearly every year and to no avail, the Coalition would like the General Assembly to take action to reform PayDay loans. This is unlikely as long as Speaker Mattiello continues to

Also, as they have asked nearly every year and to no avail, the Coalition would like the General Assembly to take action to reform PayDay loans. This is unlikely as long as Speaker Mattiello continues to

As a candidate, Jorge Elorza promised that tax deals would not be given out unless Providence could profit from the deal in some way. Mayor Elorza, however, seems intent on perpetuating the kinds of bad practices that lead inevitably to higher tax rates for home owners.

As a candidate, Jorge Elorza promised that tax deals would not be given out unless Providence could profit from the deal in some way. Mayor Elorza, however, seems intent on perpetuating the kinds of bad practices that lead inevitably to higher tax rates for home owners.

Some of the business suits worn in the Providence City Council Finance Committee meeting last night were worth more than a hotel worker’s monthly salary.

Some of the business suits worn in the Providence City Council Finance Committee meeting last night were worth more than a hotel worker’s monthly salary.