The budget as proposed benefits wealthy heirs at the expense of low-income Rhode Islanders, according to an Economic Progress Institute analysis of the House Finance Committee’s revenue and spending plan released late last week.

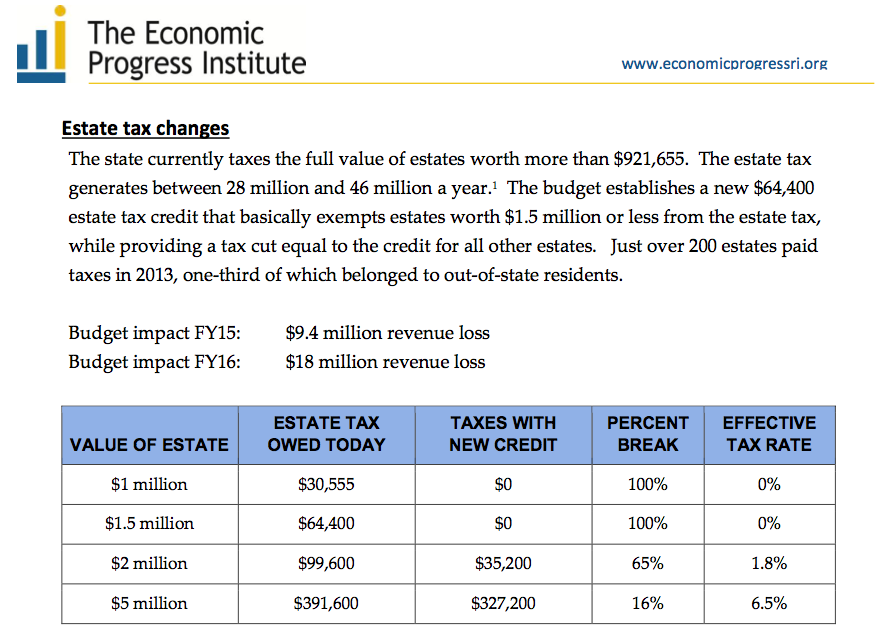

The proposed budget would increase the exemption on the estate tax from $921,655 to $1.5 million while eliminating $3.9 million in tax breaks to low and moderate income Rhode Islanders. The budget lowers the Earned Income Tax Credit and eliminates a property tax refund.

“The clear winners are a small number of wealthy taxpayers whose estates will pay less in taxes and in many cases, nothing at all starting next year,” according to this factsheet put together by EPI. “The clear losers are tens of thousands of low- and modest-income Rhode Islanders who will pay more in taxes next year. Unemployed homeowners and renters are among the biggest losers, because they will no longer qualify for property tax assistance and are not eligible for the earned income tax credit. Many of the lowest-wage workers will also be negatively impacted by the loss of the property tax refund, even with an eventual boost in the EITC.”

According to EPI, if you are a Rhode Island taxpayer who dies with a million dollars, your heirs will owe $30,555 of their inheritance to the state. The proposed budget would eliminate the estate tax for everyone who dies with less than $2 million. Those heirs would owe $35,200.

On the other hand, the proposed budget would reduce the Earned Income Tax Credit overall. According to EPI: “Lawmakers are reforming the credit by reducing it to equal 10 percent of the federal EITC and making it fully refundable. This change is likely to result in larger refunds for some of the lowest-wage workers in our state, and some workers who did not receive a refund will now get to keep more of what they earn come tax time. Still, many modest-income EITC filers with relatively higher income tax liability will pay more in taxes as the credit is reduced.”

The budget plan also eliminates what is known as the “property tax circuit breaker.” This tax refund is for Rhode Islanders who earn less than $30,000 a year whose property tax rate is more than 3 percent of their household income. 40,000 renters and homeowners took advantage of this deduction last year for an average refund of $272, according to EPI.

“The $4 million being taken directly out of the pockets of low- income taxpayers is money that would have been spent right here in the Ocean State at local businesses,” said EPI Executive Director Kate Brewster. “On the other hand, high-income households don’t need to spend every dollar they have to meet their basic needs and are more likely to save their tax cut.”

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387