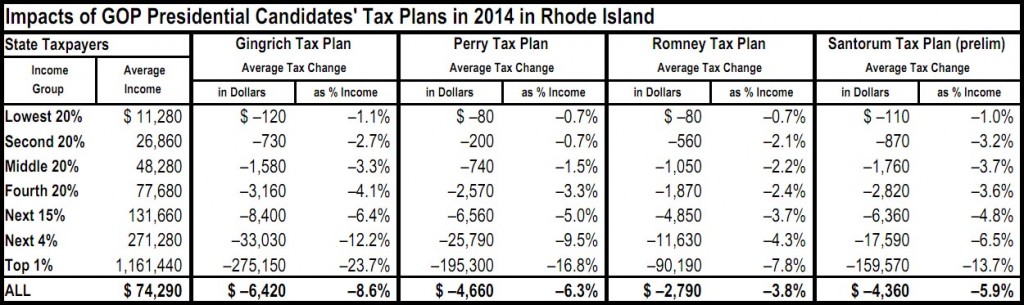

There’s nothing quite like a political campaign to demonstrate just how extreme the national Republican Party and its primary voters are. The Center for Tax Justice has an analysis of the GOP Presidential Candidates’ Tax Plans which shows just how much they favor the wealthiest 1% of Americans. Some high(low)lights:

- Former House Speaker Newt Gingrich’s $18.1 trillion tax plan would give the richest one percent of Americans an average tax cut of $391,330.

- Texas Governor Rick Perry’s $10.5 trillion tax plan would give the richest one percent of Americans an average tax cut of $272,730.

- Former Senator Rick Santorum’s $9.4 trillion tax plan would give the richest one percent of Americans an average tax cut of $217,500.

- Former Massachusetts Governor Mitt Romney’s $6.6 trillion tax plan would give the richest one percent of Americans an average tax cut of $126,450.

To put these numbers into better perspective, let’s compare them to the 2010 median wgae of $26,363, as reported by the Social Security Administration (note: median wage means that 50% of workers earned less and 50% or workers earned more. This is a much better calculation to use since “average” income skews higher because of the outrageous sums of wealth that some people generate).

- Under Newt Gingrich’s plan, the median worker would need to work almost 15 years to earn as much as the average tax cut received by the richest 1%.

- Under Rick Perry’s plan, the median worker would need to work about 10 years and 4 months to earn as much as the average tax cut received by the richest 1%.

- Under Rick Santorum’s plan, the median worker would need to work about 8 years and 3 months to earn as much as the average tax cut received by the richest 1%.

- Under Rick Perry’s plan, the median worker would need to work about 4 years and 8 months to earn as much as the average tax cut received by the richest 1%.

And these calculations don’t include the millions of people who are either “officially” unemployed, or have stopped looking for work, just those that are fortunate enough to find jobs. Why these proposals are even being seriously considered is beyond me.

It’s important to remember that not all taxes (or tax cuts) are equal. For instance, a payroll tax is more regressive than an income tax, a sales tax is more regressive than a payroll tax, and a capital gains tax is the most progressive of all since the wealthy benefit the most from capital gains (hence why capital gains taxes were sharply cut under George W. Bush). It’s also important to remember that the US tax burden is at its lowest level since 1958 and also federal income taxes are at historically low levels. The LAST thing this country needs right now are additional transfers of wealth to the already rich.

Each of the GOP candidates’ tax plans would further starve the federal government of much needed revenue, increase borrowing to provide for all the important things the federal government does for us, further increase the national debt and the interest we pay on that debt, and exacerbate the growth of income inequality, albeit in varying degrees. What they wouldn’t do is deal with the real economic problem facing the country: not enough money is going into the hands of people who will spend it.

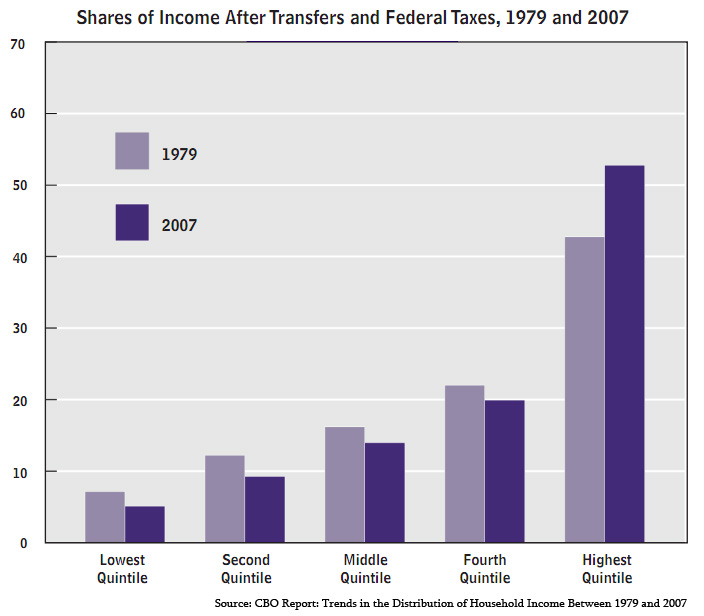

Since the 1970s, U.S. wages have largely remained stagnant. At the same time, the vast majority of all the wealth created in the country over the last 30 years has been flowing upward.

Because the super wealthy don’t actually work to generate their income, wages as a share of national income has been declining for just as long. What that means is less and less money is being earned by workers, and that’s bad for the economy because workers spending money is what fuels economic growth. Consumers earning more money means that they can buy more goods and services, increasing the effective demand in an economy. Seems pretty simple, right? Well, yes, it is.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387