Rhode Island spends more per capita and more per dollar of state budget in tax incentives and expenditures than most nearby states, according to an investigation by the New York Times that examines the value of such corporate giveaways in an era of government austerity.

The series is called, “Unites States of Subsidies” and the first piece is called “How Taxpayers Bankroll Business.”

“Despite their scale, state and local incentives have barely been part of the national debate on the economic crisis,” according to the first piece of the Times series. “The budget negotiations under way in Washington have not addressed whether the incentives are worth the cost, even though 20 percent of state and local budgets come from federal spending.”

Rhode Island, according to the investigation, gives away $356 million in tax subsidies annually according to the Times study. That’s about the same as the state saved by reforming pensions. You can check out the data on RI here and compare it to other states.

UPDATE: According to a Providence Journal story, “Paul L. Dion, head of the state Office of Revenue Analysis, says that the $156 million, which the Times cites as coming from a ‘Food and Food Ingredients Exemption,’ represents the state’s lost revenue from not subjecting groceries to the state’s 7 percent sales tax.”

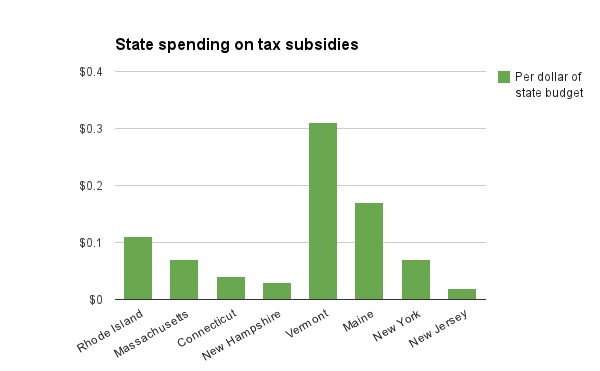

While both Massachusetts and New York giveaway billions of dollars each year, they each have much larger state budgets than Rhode Island. Only Vermont and Maine spend more per dollar of state budget on tax giveaways.

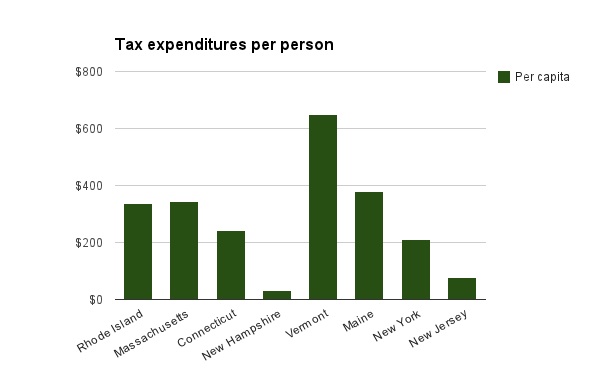

As far as revenue lost to tax expenditures per capita, or per person, Rhode Island is the third highest in the region. Again, Vermont and Maine are much higher. Massachusetts ($345 per capita) spends $7 more than Rhode Island ($338) on tax expenditures per person.

Rhode Island, according to the study, loses $272 million annually in sales tax deductions, discounts and exemptions. We give away $59.9 million annually in corporate tax credits, and $15.5 million in personal income tax credits.

GoLocalProv puts together this list of the biggest beneficiaries of tax breaks in Rhode Island:

- 38 Studios – $75 million

- CVS – $70 million

- Fidelity – $17 million

- Brotherhood (Showtime TV show) – $15.6 million

- Bank of America – $7.88 million

- Bridesmaid (movie) $4.14 million

- Corporate Marketplace – $4 million

- Hachiko Productions – $3.8 million

- Page Productions – $3.46 million

- Twin River – $2.67 million

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387