“Today is about you putting your issues on the table and [about] how you can influence the decision making process that we have in this great state,” Mark Hayward, District Director of the Rhode Island Small Business Association (SBA) told an eager gathering of business owners, lobbyists and politicians, “Your participation at this Summit will essentially decide… the direction of [economic and business] issues that are going to be critical to you over the next year.”

The 2016 Rhode Island Small Business Economic Summit (Summit) is held at Bryant University and sponsored by the SBA and the Center for Women and Enterprise. A long list of state senators, representatives and gubernatorial staff come out to this event every year. Big names include Speaker Nicholas Mattiello, General Treasurer Seth Magaziner and Governor Gina Raimondo. It took Hayward two minutes to list the the government reps appearing, and he didn’t get them all. It’s the kind of political access social justice groups cannot imagine.

The point, says Hayward, “is to provide an opportunity for members of the small business community to have a discussion with members of the General Assembly and the [Governor’s] administration and,” he says, “over the years, we have succeeded because many of the issues that are being taken up today, derive from the Summit.”

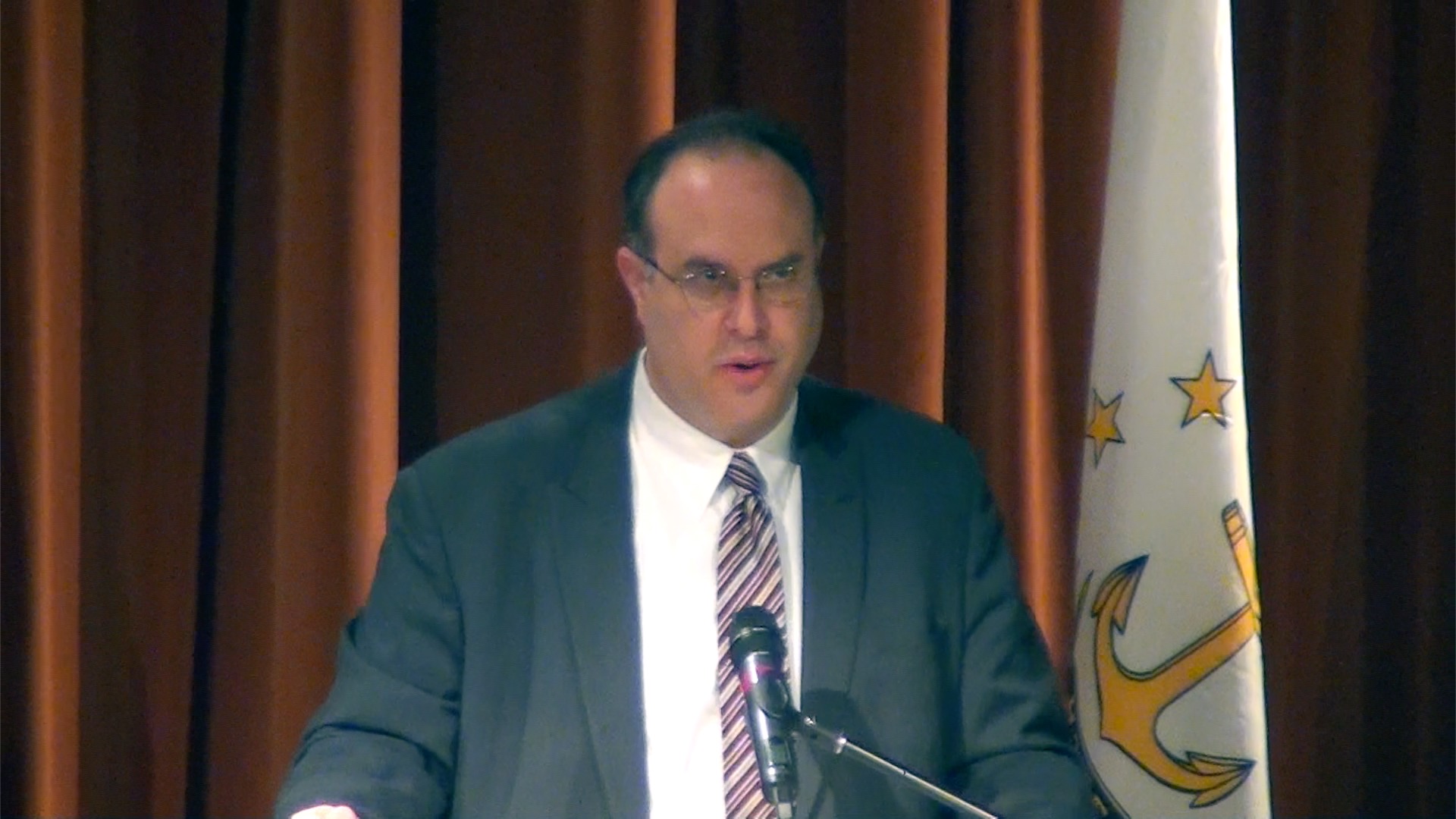

Hayward introduced speaker Stefan Pryor, Rhode Island’s Secretary of Commerce. Pryor painted a rosy picture of Rhode Island’s economic future, saying, “We’re beginning to see the optimism lift, we’re beginning to see the unemployment drop, we are starting to see the new projects start, and we are starting to see the pessimism dissipate.”

Pryor did not mention the cruel poverty that affects nearly 1 in 5 children in our state, but he did mention that the state is “still suffering from unemployment. We still compete for the worst unemployment rate in New England.”

Pryor did not draw a connection between the high unemployment, high poverty and what he called a “favorable tax climate” for business. “We have the lowest corporate tax rate in the northeast, a hard-earned distinction at 7 percent. In the recent session we completely eliminated the sales tax on energy, the Business Energy Tax. It’s not an easy tax to eliminate a tax entirely but it’s gone. Gone forever.”

Pryor assured those in attendance that Rhode Island will not be raising taxes on business owners. “We have not raised a major tax, corporate, income or sales, in twenty years,” said the Secretary with pride, “Think about that relative to tax stability and at the same time we’re axing taxes.

“Why do we think we can maintain that kind of stability going forward? In this past session we put the final touches on and solidified pension reform that then General Treasurer Raimondo had begun. With all your help, Medicaid reform, in a substantial way, was undertaken.

“These structural reforms will save Rhode Islanders over $4 billion dollars over the next 20 years” and “this will ensure future retirement security and future budgetary stability, said Pryor, “That’s the platform we’re building. The hybrid of generations of discipline and not raising taxes, even when times were tough.

“These are the signs of responsible budgeting and sensible fiscal stewardship.”

You can watch all of Pryor’s remark Here: