“My guiding principles in life

are to be honest, genuine,

thoughtful and caring.”

Prince William

When you look in a mirror, what do you see?

No, you don’t see yourself. You inhabit a body—not a mirror. No, you see a projection of yourself. Similarly, we often project ourselves upon others.

Are you diligent and honest? Then you tend to trust others easily: You project on them the traits of diligence and honesty which come naturally to you. If you are a private person, you likely believe others also keep secrets. Or if you often tell small lies, you may readily conclude others are deceiving you.

Name the trait or motivation. We tend to project these on others. This is familiar and natural. The opposite attributes are foreign to us, so we find these more difficult to believe.

The consequences of these beliefs can be disastrous, for ourselves and others. As a landlord, for example, I lost several thousand dollars when I rented to a few tenants despite signs they were untrustworthy. We all need to widen our vision—to see reality—or our mistakes will multiply.

How can we apply this wisdom? How can we challenge our mistaken projections?

Shortly after graduating college in 1977, I discussed farm subsidies with Mark, a church friend. I had just completed a study of economist Milton Freedman, agreeing with his tenet that the free market alone should determine a person’s income. So I opposed farm subsidies.

Mark was shocked. Why would an otherwise caring Christian approve of farmers going bankrupt when farm prices crash? My friend thought I was heartless, having lost both compassion and common sense.

Mark was right.

Why did I fail to care? Despite my business degree, I was ignorant. I knew nothing about farming. Even more pertinent: I had adopted an ideology which shut out the experiences of others.

I also projected on to bankrupted farmers my history of obtaining work easily. I did not consider the hardship of bankruptcy, the trauma of families losing their homes, nor farmers’ ordeals when seeking another profession.

I needed to widen my world. I needed to listen to others’ experiences. I needed to be thoughtful.

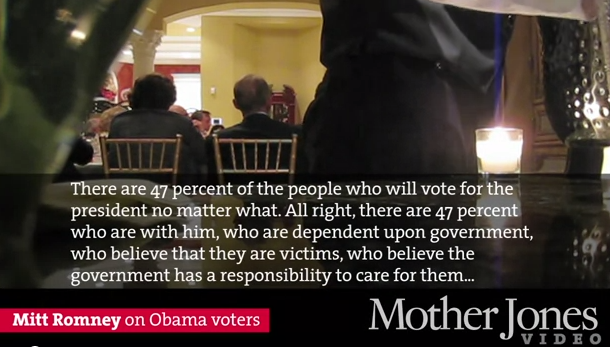

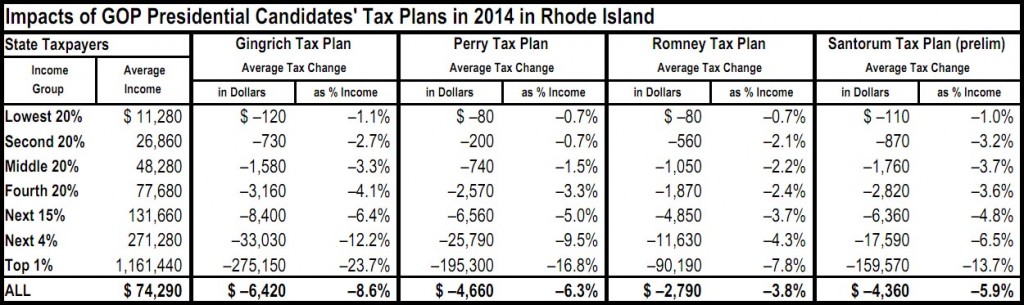

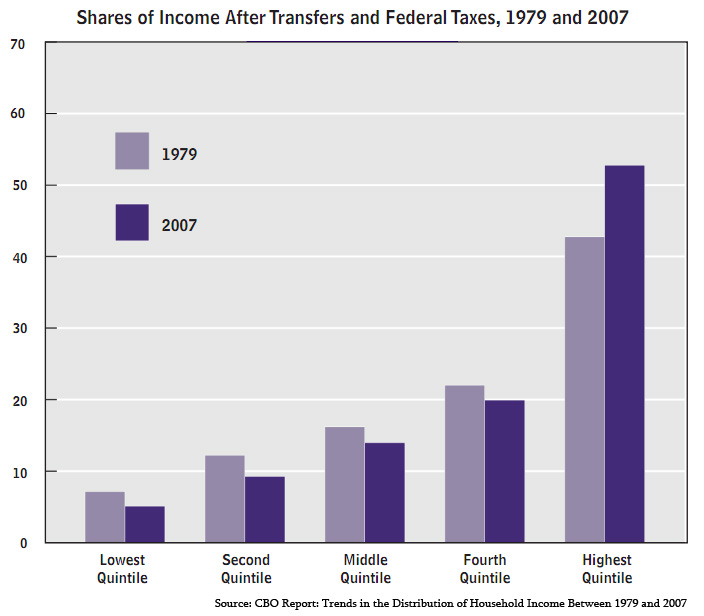

Similarly, many leaders project their limited experiences upon others. One politician, “Edward,” laments that so many receive food stamps. Why not? His family never needed food stamps. Why should anyone else?

Instead of projecting his economic abilities upon others, however, Edward could consider their experiences. What about the millions who earn a living yet, due to low wages, experience the continuing agony of poverty? What about the many millions of seniors dependent upon social security and food stamps for survival? What about the many children who, due to food stamp cuts, have some days each month with little or no food?

Edward projects his economic strengths on others. He concludes the US needs to spend more on the military, so our nation should spend less on food stamps. This is a false choice. One does not exclude the other.

Those in need should not be denigrated or starved. Moreover, the US military currently spends as much as China and Russia—as well as the next ten countries combined.

“Supporting our troops” instead of supporting those needing food stamps is ironic: The pay of low-ranking service people requires $100 million in food stamps and $1 billion in subsidies at military grocery stores in 2014. Severe reduction of commissary subsidies brings hardship to many military families. For many, food stamps remain a necessity.

Edward is not alone in projecting his food prosperity on others: A plethora of political leaders hold a variety of heartless viewpoints.

Sometimes, due to our own projections, we too have uncaring positions. What is true for these heartless politicians is also true for you and me: We need to widen our world; we need to listen to others’ experiences; we need to be thoughtful.

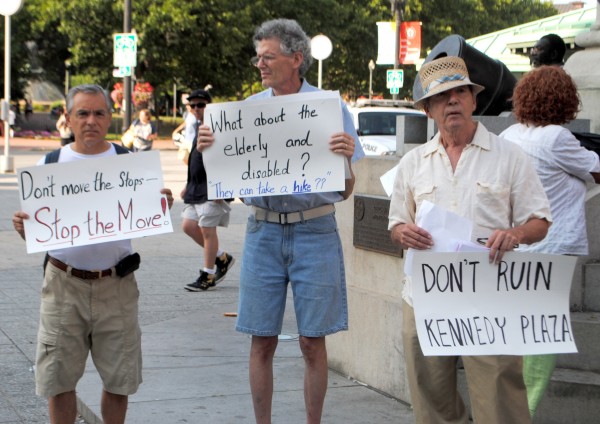

In the minds of some Rhode Island politicians and business leaders, the empty and unsellable “Superman” building hangs like a millstone around the neck of the City of Providence. Rather than come to grips with the fact that the building is rundown and overpriced and that new economic thinking is needed to reinvigorate the Capital City, Providence Mayor Angel Taveras and Warwick Mayor Scott Avidesian (who currently heads RIPTA, the Rhode Island Public Transportation Administration), have pushed through a plan that scapegoats the poor, disabled, elderly, homeless and people of color.

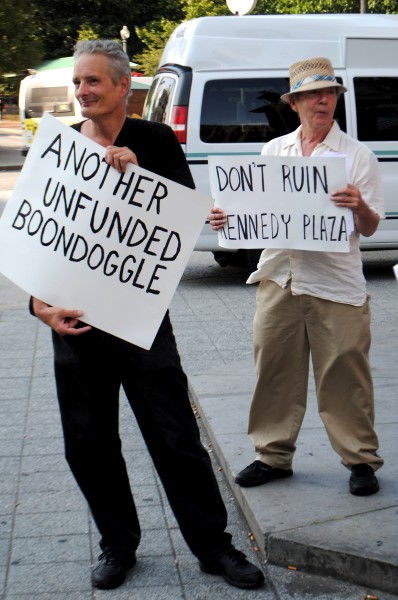

In the minds of some Rhode Island politicians and business leaders, the empty and unsellable “Superman” building hangs like a millstone around the neck of the City of Providence. Rather than come to grips with the fact that the building is rundown and overpriced and that new economic thinking is needed to reinvigorate the Capital City, Providence Mayor Angel Taveras and Warwick Mayor Scott Avidesian (who currently heads RIPTA, the Rhode Island Public Transportation Administration), have pushed through a plan that scapegoats the poor, disabled, elderly, homeless and people of color. The new vision for a modern and vibrant downtown does not include a busing hub. So Kennedy Plaza has been fenced off and is being destroyed as quickly as possible, before an outraged public can mount any kind of coordinated defense. Already the shelters have been taken down and trucked away, and the expensive heating system that automatically melts the snow is being dug up and scrapped. This work is leaving a giant pit in the center of downtown, even though there is no money allocated to completing the project. The plan seems akin to digging a hole in the hopes that someone will come along and build a house there.

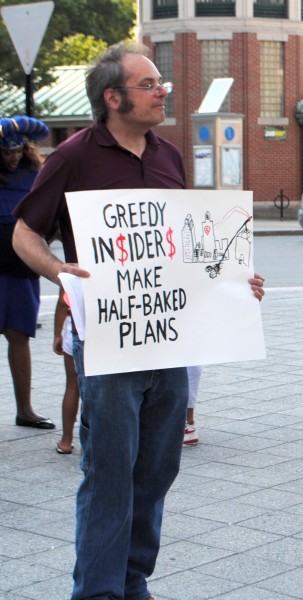

The new vision for a modern and vibrant downtown does not include a busing hub. So Kennedy Plaza has been fenced off and is being destroyed as quickly as possible, before an outraged public can mount any kind of coordinated defense. Already the shelters have been taken down and trucked away, and the expensive heating system that automatically melts the snow is being dug up and scrapped. This work is leaving a giant pit in the center of downtown, even though there is no money allocated to completing the project. The plan seems akin to digging a hole in the hopes that someone will come along and build a house there. Simply stated, this is class warfare being waged against the most vulnerable populations in our state, and it is being done with taxpayer money. Instead of walking across a plaza replete with convenient shelters to transfer from one bus to another, bus riders are now required to walk several blocks from one bus to another. In the winter, when Burnside Park is effectively one giant sheet of ice, the walk will become more treacherous or even impossible, especially for the handicapped and the elderly.

Simply stated, this is class warfare being waged against the most vulnerable populations in our state, and it is being done with taxpayer money. Instead of walking across a plaza replete with convenient shelters to transfer from one bus to another, bus riders are now required to walk several blocks from one bus to another. In the winter, when Burnside Park is effectively one giant sheet of ice, the walk will become more treacherous or even impossible, especially for the handicapped and the elderly.