Quietly in America, but with a deafening roar of anger in the U.K., the U.S. Department of Justice and the U.K. Financial Services Authority unleashed a record-breaking fine on June 27 of a combined £290 million ($453 million) on Barclays PLC, the world’s fourth-largest bank, as part of a non-prosecution agreement. In exchange for the bank to avoid prosecution over its fraud, it has agreed to help the two governments with their inquiries into other banks. The deal also does not cover current and former employees from facing prosection. The City of Baltimore has already initiated a lawsuit against Barclays and its fellow banks. The US government is expected to investigate a further 16 banks, now assisted by Barclays. Investigations are also taking place around the world in countries such as Canada and Singapore.

Barclays had admitted to manipulating Libor (London Interbank Offered Rate), which is the average cost of borrowing at which Britain’s banks lend each other money. British banks daily submit to a trade association the interest rates they’re borrowing money at, which are then averaged and used worldwide to calculate interest rates on loans. The whole process is overseen by the British Bankers’ Association, a non-profit company made up of the banks themselves, with little regulation.

After the Global Financial Crisis of 2008, Libor became a way of measuring a banks health. But according to an anonymous source inside a different bank, Libor rates were routinely under-reported, in a banking culture that had normalized illegal activity. The account was published in the Telegraph. Emails show the traders responsible for submitting these rates completely manipulating them, with such phrases like “done… for you big boy” tossed in without any regard for posterity.

How does this affect you? Libor is used to calculate the interest rates on loans ranging from mortgages, student loans, small business loans, and insurance; to the tune of $10 trillion of loans. Chances are, you owe payment on one of those loans. The U.S. Commodity Futures Trading Commission (CFTC) estimated that Libor effects futures contracts with a notional $564 trillion value in 2011. The Wall Street Journal believes the total in contracts is $800 trillion.

But former chairman of the Securities and Exchange Commission Hervey Pitt has said “this may be the tip of the proverbial iceberg.” Indeed, Barclays’ decision to cooperate with authorities signals that they’re prepared to give up their colleagues to Washington. Swiss banking behemoth UBS has announced it’s approached the Swiss authorities with information regarding rate abuses.

The result of the “global fraud” won’t do any wonders for the banking sector’s reputation around the world. Seen by 72% of Americans as “only car[ing] about making money for itself” according to a Pew Research poll released on June 4th, pluralities of Americans also blame Wall Street bankers for the bad economy; according to an Economist poll.

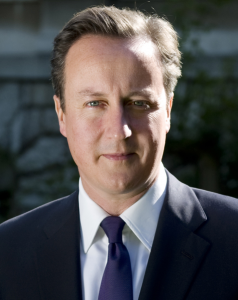

Already, British politicians are rounding on the banking sector, with British Prime Minister David Cameron (Conservative Party) telling Parliament that:

“We need to take action right across the board, introducing the toughest and most transparent rules on pay and bonuses of any major financial center in the world, increasing the taxes banks must pay, insuring tough civil and criminal penalties for those who break the law, and above all, clearing up the regulatory failure left by the last Labour government.”

Despite the remarks, Mr. Cameron’s government is being criticized by its Labour Party opponents as attempting to stave off demands for a public inquiry and criminal proceedings by scoring political points by blaming the former Labour government for the deregulation of the banking sector with a parliamentary inquiry.

But though American politicians and media remain largely silent on the scandal, David Meister, the U.S. CFTC’s director of enforcement, told Britain’s Guardian newspaper that the Commission’s investigation was “to protect the markets and public from such illegal conduct… [June 27th’s] action demonstrates that we will bring the full force of our authority to bear as we carry out that mission.”

__________________________________________

This might be the trial that the banks never got, especially if Barclays spills its guts. However, it should be noted that observers like NakedCapitalism.com’s Yves Smith have pointed out that one of the major obstacles to this is that both parties in the United States are beholden to Wall Street. Whether this translates into a full-on crackdown on the rampant illegality in the high-flying financial remains to be seen.