From the headlines, you would think that CNBC is the gold standard economic authority. After the cable news network released its 10th annual “America’s Top States for Business 2016” listing, in which Rhode Island was ranked dead last, local corporate media raced to bring the bad news to readers and viewers. CNBC ranks R.I. worst state for business, CNBC: Rhode Island ranked ‘Bottom State for Business‘, and RI back to dead last in new CNBC rankings are typical examples from the Projo, Channel 10 and Channel 12 respectively.

From the headlines, you would think that CNBC is the gold standard economic authority. After the cable news network released its 10th annual “America’s Top States for Business 2016” listing, in which Rhode Island was ranked dead last, local corporate media raced to bring the bad news to readers and viewers. CNBC ranks R.I. worst state for business, CNBC: Rhode Island ranked ‘Bottom State for Business‘, and RI back to dead last in new CNBC rankings are typical examples from the Projo, Channel 10 and Channel 12 respectively.

Missing from the Cassandra-like coverage is any hint that the rankings are meaningless and based on metrics that rate our state on how well our policies kowtow to the whims of business, not on how well they benefit the poor and middle class. Only Ted Nesi even approaches this angle in his coverage, but he did so through the lens of competing political discourse. But what about the economics of the report? Does it hold up under scrutiny? I’ve tackled the subject of economic rankings before, here and here, trying to bring some sort of real economic analysis to bear.

I asked Doctor of Economics Douglas Hall, Director of Economic and Fiscal Policy at the Economic Progress Institute, for some insights. Hall said that many of CNBC’s economic indicators “have a lot of merit and point to the need to address matters via public policy, such as repairing the state’s crumbling infrastructure and the need to help Rhode Islanders improve their educational attainment. But when you deconstruct their aggregate groupings,” said Hall, “many of the categories are deeply flawed and point to policies that would severely undermine the well-being and quality of life of working families in Rhode Island.”

One indicator the report uses is “union membership and the states’ right to work laws.” Low union membership and strong anti-union right to work laws contribute to a higher economic ranking for a state in CNBC’s report, yet Hall says that “research clearly shows that as unionization rates have gone down, the well-being of the American middle class has gone down.” In Hall’s view, this metric “taints the entire aggregate measure.”

Another metric, the CNBC aggregate category for the cost of doing business, considers the cost of paying wages and presumably, says Hall, “a state in which every employee worked for sub-poverty wages would get a very high grade in this category, while those paying living wages that can sustain a family and support a viable business community through demand for goods and services, would get a low grade in this category.”

It seems clear that these rankings of states by various business interests, including corporate entities such as CNBC, puppet organizations such as ALEC and members of the State Policy Network (which includes the RI Center for Freedom and Prosperity) and various Chambers of Commerce are are not objective measures of a state’s economic well-being, but are tools crafted to shape public policy to the advantage of large business interests and to the detriment of the poor and middle class.

The most sensible tactic in dealing with such garbage is to file it accordingly.

Speaker Nicholas Mattiello said that though he “is very supportive of raising the minimum wage,” and that Rhode Island “needs to be competitive” with our neighboring states, he has, “heard from the business community” that they need time to absorb the current wage before increasing it again. Mattiello said that the minimum wage has gone up four years in a row and, “I’ve indicated that we’re going to look at it next year.”

Speaker Nicholas Mattiello said that though he “is very supportive of raising the minimum wage,” and that Rhode Island “needs to be competitive” with our neighboring states, he has, “heard from the business community” that they need time to absorb the current wage before increasing it again. Mattiello said that the minimum wage has gone up four years in a row and, “I’ve indicated that we’re going to look at it next year.”

On Friday

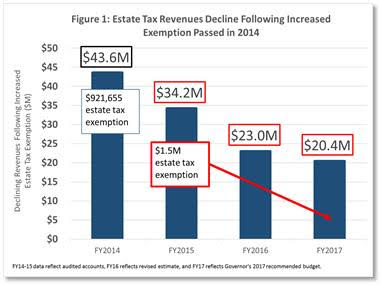

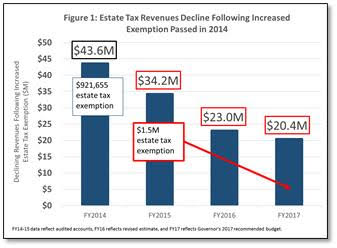

On Friday The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

New carbon pricing legislation, backed by the

New carbon pricing legislation, backed by the