From the headlines, you would think that CNBC is the gold standard economic authority. After the cable news network released its 10th annual “America’s Top States for Business 2016” listing, in which Rhode Island was ranked dead last, local corporate media raced to bring the bad news to readers and viewers. CNBC ranks R.I. worst state for business, CNBC: Rhode Island ranked ‘Bottom State for Business‘, and RI back to dead last in new CNBC rankings are typical examples from the Projo, Channel 10 and Channel 12 respectively.

From the headlines, you would think that CNBC is the gold standard economic authority. After the cable news network released its 10th annual “America’s Top States for Business 2016” listing, in which Rhode Island was ranked dead last, local corporate media raced to bring the bad news to readers and viewers. CNBC ranks R.I. worst state for business, CNBC: Rhode Island ranked ‘Bottom State for Business‘, and RI back to dead last in new CNBC rankings are typical examples from the Projo, Channel 10 and Channel 12 respectively.

Missing from the Cassandra-like coverage is any hint that the rankings are meaningless and based on metrics that rate our state on how well our policies kowtow to the whims of business, not on how well they benefit the poor and middle class. Only Ted Nesi even approaches this angle in his coverage, but he did so through the lens of competing political discourse. But what about the economics of the report? Does it hold up under scrutiny? I’ve tackled the subject of economic rankings before, here and here, trying to bring some sort of real economic analysis to bear.

I asked Doctor of Economics Douglas Hall, Director of Economic and Fiscal Policy at the Economic Progress Institute, for some insights. Hall said that many of CNBC’s economic indicators “have a lot of merit and point to the need to address matters via public policy, such as repairing the state’s crumbling infrastructure and the need to help Rhode Islanders improve their educational attainment. But when you deconstruct their aggregate groupings,” said Hall, “many of the categories are deeply flawed and point to policies that would severely undermine the well-being and quality of life of working families in Rhode Island.”

One indicator the report uses is “union membership and the states’ right to work laws.” Low union membership and strong anti-union right to work laws contribute to a higher economic ranking for a state in CNBC’s report, yet Hall says that “research clearly shows that as unionization rates have gone down, the well-being of the American middle class has gone down.” In Hall’s view, this metric “taints the entire aggregate measure.”

Another metric, the CNBC aggregate category for the cost of doing business, considers the cost of paying wages and presumably, says Hall, “a state in which every employee worked for sub-poverty wages would get a very high grade in this category, while those paying living wages that can sustain a family and support a viable business community through demand for goods and services, would get a low grade in this category.”

It seems clear that these rankings of states by various business interests, including corporate entities such as CNBC, puppet organizations such as ALEC and members of the State Policy Network (which includes the RI Center for Freedom and Prosperity) and various Chambers of Commerce are are not objective measures of a state’s economic well-being, but are tools crafted to shape public policy to the advantage of large business interests and to the detriment of the poor and middle class.

The most sensible tactic in dealing with such garbage is to file it accordingly.

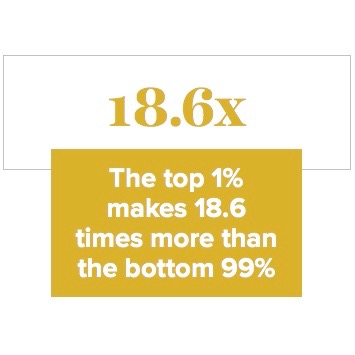

]]> Between 2009 and 2013, the top one percent captured 85.1 percent of total income growth in the United States. To be included in the top one percent in Rhode Island your annual income would have to be $336,625. The average income of a Rhode Island one-percenter is $884,609. Since the bottom 99 percent makes $47,545 on average, the top one percent makes 18.6 times more than the bottom 99 in this state.

Between 2009 and 2013, the top one percent captured 85.1 percent of total income growth in the United States. To be included in the top one percent in Rhode Island your annual income would have to be $336,625. The average income of a Rhode Island one-percenter is $884,609. Since the bottom 99 percent makes $47,545 on average, the top one percent makes 18.6 times more than the bottom 99 in this state.

This info is gleaned from Income inequality in the US by state, metropolitan area, and county, a new paper published by the Economic Policy Institute (EPI) for the Economic Analysis and Research Network (EARN). The paper, by Mark Price, an economist at the Keystone Research Center in Harrisburg, Penn. and Estelle Sommeiller, a socio-economist at the Institute for Research in Economic and Social Sciences in Greater Paris, France, shows that the top one percent of income earners captured the majority of income growth since the Great Recession in 24 states—with the top one percent taking home all income growth in 15 states.

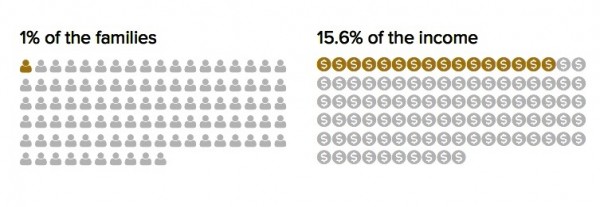

Rhode Island ranks 28 out of the states in income inequality, based on the ratio of top one percent to bottom 99 percent income. The situation in Massachusetts (ranked 6) and Connecticut (ranked 2) is far worse for inequality.

The top one percent in Rhode Island takes 15.6 percent of all income in Rhode Island. This number approaches or surpasses historical highs, tracked from 1917-2013.

“Rising inequality is not a new phenomenon, and it’s not confined to large urban areas or financial centers,” said Price. “It’s a persistent problem throughout the country—in big cities and small towns, in all 50 states. In the face of this national problem, we need national policy solutions to jump start wage growth for the vast majority.”

“Rising inequality is not a new phenomenon, and it’s not confined to large urban areas or financial centers,” said Price. “It’s a persistent problem throughout the country—in big cities and small towns, in all 50 states. In the face of this national problem, we need national policy solutions to jump start wage growth for the vast majority.”

“The degree of income inequality differs from one city to another, but the underlying forces are clear. Inequality isn’t a regional issue. It’s the result of intentional policy decisions to shift bargaining power away from working people and towards the top 1 percent,” said Sommeiller. “To reverse this, we should enact policies that boost worker’s ability to bargain for higher wages, rein in the salaries of CEOs and the financial sector, and prioritize full employment.”

]]>

Last year, the General Assembly and the governor took an important first step to help thousands of working families make ends meet by increasing the state’s Earned Income Tax Credit (EITC) — a tax benefit for workers earning $50,000 or less — to 12.5 percent of the federal credit.

As the Ocean State strives to become a place where all families can enjoy our natural beauty while maintaining affordable housing, nutritious food, and a quality education, a further increase to the state’s Earned Income Tax Credit is a common-sense tax policy we should all rally behind. An increased state EITC means 83,000 Rhode Island taxpayers are rewarded for working hard to keep their families afloat.

That is why, for the second consecutive year, we have introduced legislation in the House and Senate to further increase the state EITC to 20 percent of the federal credit. With our legislation, a family qualifying for the maximum EITC will receive a tax credit worth up to $1,248—a significant amount for our struggling working families.

Massachusetts and Connecticut have adopted the refundable state EITC as smart policy to support working families, with refundable credits of 23 percent and 27.5 percent, respectively.

The paychecks of too many Rhode Island workers have fallen behind and our current tax structure does not provide adequate relief. Of the 50 occupations expected to produce the most job openings by 2022, nearly one in four jobs will pay less than $11 an hour, the amount the Economic Progress Institute (EPI) finds a single adult needs to earn to meet his or her most basic needs and less than half of what a single parent of two children requires.

We all benefit from living in a state where hard work is rewarded. An increased EITC helps our workforce but it also helps our local economies. More money in the pockets of working Rhode Islanders means more money in the cash registers of supermarkets, retailers, and other local businesses. The return on investment is large. The Economic Progress Institute estimates that increasing the EITC to 20 percent would not only put $12 million in pockets of working families, but add approximately $15 million to the economy through the multiplier effect. Raising the EITC to 15 percent, as proposed by the governor, would put $4 million in the pockets of working families, and add around $5 million to the economy through the multiplier effect.

With last year’s EITC increase, the General Assembly and the governor took an important step to reduce income inequality in the Ocean State and reward our workers who are doing their best to make it in Rhode Island.

We strongly believe that if you are working, you should not be poor. Raising the minimum wage and expanding EITC is helping those who work for lower wages to get ahead. The very least we can do is increase a common-sense tax credit that helps our hardest workers make ends meet. If we do not, it saps the belief that our state is a place where hard work and persistence can lead to a better life. A state EITC increased to 20 percent of the federal credit is the smartest investment we can make. We can all profit from living in a state where hard work is rewarded, taxes are fairer, and our local businesses thrive.

]]> Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation (2016-S 2333 / 2016-H 7610) that would allow the Rhode Island Department of Motor Vehicles to issue driving privilege licenses and permits to applicants unable to establish a lawful presence in the United States. The licenses and permit would not be valid for identification purposes as per the Real ID Act, but would be usable only for the purposes of operating a motor vehicle in Rhode Island.

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation (2016-S 2333 / 2016-H 7610) that would allow the Rhode Island Department of Motor Vehicles to issue driving privilege licenses and permits to applicants unable to establish a lawful presence in the United States. The licenses and permit would not be valid for identification purposes as per the Real ID Act, but would be usable only for the purposes of operating a motor vehicle in Rhode Island.

“We need to ensure that all drivers, regardless of their immigration status, are trained, tested and insured when driving on our roads,” said Ciccone at the press conference to highlight this legislation, “This is a safety issue as well as an economic issue. If the worst was to happen and an accident occurs involving an undocumented person driving, our residents and businesses are protected far better if this legislation is enacted as opposed to the current status quo.” (See the full video of the press conference below.)

Under the rules proposed by Ciccone and Williams, those wanting these licenses and permits would have to have no felony convictions, have lived in Rhode Island for two years and provide proof that they have paid taxes.

As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

From the EPI press release:

“The study, Undocumented Immigrants’ State and Local Tax Contributions, also estimates that Rhode Island stands to gain $2.5 million in increased revenue under full implementation of the Obama administration’s 2012 and 2014 executive actions and by more than $7.0 million under comprehensive immigration reform.

“EPI’s Executive Director, Rachel Flum notes that “This report shows that undocumented immigrants are contributing to Rhode Island’s economy through sales, property and income taxes. State law makers should take this into account and approve policies that help these residents live safely in our state until comprehensive immigration reform at the federal level provides a pathway to legal status. Providing driver’s licenses for undocumented residents is one such policy”

“The report found that undocumented immigrants contribute $4.1 million in personal income taxes, $11.1 million in property taxes, and $18.3 million in sales and excise taxes to Rhode Island’s. These tax contributions would be larger if all undocumented immigrants were granted legal status under a comprehensive immigration reform and if President Obama’s 2014 executive action were upheld.

“‘Regardless of the politically contentious nature of immigration reform, the data show undocumented immigrants greatly contribute to our nation’s economy, not just in labor but also with tax dollars,’ said Meg Wiehe, ITEP State Tax Policy Director. ‘With immigration policy playing a key role in state and national debates and President Obama’s 2014 executive action facing review by the Supreme Court accurate information about the tax contributions of undocumented immigrants is needed now more than ever.'”

To view the full report or to find state-specific data, go to www.itep.org/immigration/.

]]>

As corporations achieve extraordinarily high profit levels and executive pay reaches new heights, wages in certain sectors are so low that even those who work full time must rely on government assistance to make ends meet. A new report from EPI economic analyst David Cooper finds that raising wages for low-wage workers will significantly reduce government spending on public assistance, making billions of dollars a year available for improvements to other anti-poverty programs.

As corporations achieve extraordinarily high profit levels and executive pay reaches new heights, wages in certain sectors are so low that even those who work full time must rely on government assistance to make ends meet. A new report from EPI economic analyst David Cooper finds that raising wages for low-wage workers will significantly reduce government spending on public assistance, making billions of dollars a year available for improvements to other anti-poverty programs.

“When employers pay wages so low that working people have to turn to public assistance to make ends meet, they’re effectively receiving a subsidy from taxpayers,” said Cooper. “Policies that raise wages would free up resources that could then be used to strengthen anti-poverty programs or make investments in any number of other policy priorities. The simplest way we can do this is by raising the federal minimum wage.”

The majority (66.6 percent) of individuals and families who receive public assistance work or are in a family in which at least one adult works. This number grows to 71.6 percent when focusing on recipients under the age of 65. More than two-thirds (69.2 percent) of all public assistance benefits that go to non-elderly families go to families in which at least one adult works.

If the bottom 30 percent of wage earners received a $1.17 per hour pay raise, more than 1 million working people would no longer need to rely on public assistance. For every $1 that wages rise among these low-wage workers, spending on government assistance programs falls by roughly $5.2 billion. Because this estimate is conservative and does not include the value of Medicaid benefits, it has the potential to be even higher.

Other findings from the paper include:

- Raising the minimum wage to $12 by 2020 would reduce public assistance spending by $17 billion. These savings could be used to make improvements other anti-poverty programs, such the President Barack Obama’s proposal to expand the national school lunch program to provide food for children during the summer months.

- Workers in the arts, entertainment, recreation, accommodation, food services, and retail trade industries are disproportionately represented among public assistance recipients.

- Roughly 60 percent of all workers making less than $7.42 per hour receive some form of government-provided assistance, either directly or through a family member.

- More than half (52.6 percent) of workers paid between $7.42 and $9.91 per hour receive public assistance, either directly or through a family member.

- Nearly half (46.9 percent) of all working recipients of public assistance work full time.

[From a press release]

]]> New data released today by CFED (the Corporation for Enterprise Development), a national partner of Rhode Island’s Economic Progress Institute, shows that too many Rhode Island families remain economically vulnerable. Smart public policies that create opportunities for families to save and make investments in their future prosperity pay huge dividends for all of us. The Assets and Opportunity Scorecard, now published annually, shows Rhode Island ranked 35th overall in Outcomes, despite ranking 8th overall in the Scorecard’s Policy measures.

New data released today by CFED (the Corporation for Enterprise Development), a national partner of Rhode Island’s Economic Progress Institute, shows that too many Rhode Island families remain economically vulnerable. Smart public policies that create opportunities for families to save and make investments in their future prosperity pay huge dividends for all of us. The Assets and Opportunity Scorecard, now published annually, shows Rhode Island ranked 35th overall in Outcomes, despite ranking 8th overall in the Scorecard’s Policy measures.

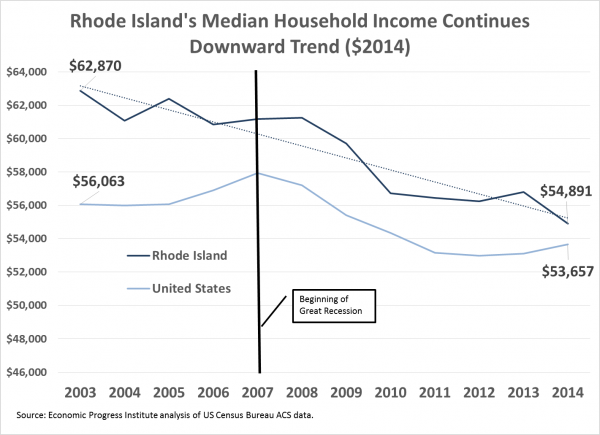

Doug Hall, Director of Economic and Fiscal Policy at the Economic Progress Institute isn’t surprised by these findings: “We see the economic vulnerability of Rhode Island families in wage and income data (as shown in our recent State of Working Rhode Island: Workers of Color report). Until Rhode Islanders have good jobs that pay economy-boosting wages, they won’t be able to set aside savings or invest in homes or businesses.”

Across five main issue areas, Rhode Island fares in the middle of the pack in four issue areas (Financial Assets and Income, Businesses and Jobs, Education, and Health Care) but nearly dead last for Housing and Homeownership.

Rhode Island’s outcome indicators point to a number of areas where improvements need to be made to improve the financial security of Ocean State families. Rhode Island scores very poorly (40th or worse) in 14 areas, including 8 indicators for housing/homeownership:

- Income inequality (46th out of 50 states and the District of Columbia)

- Business value by race (44th)

- Underemployment Rate (40th)

- Homeownership rate (46th)

- Homeownership by race (50th)

- Homeownership by income (51st)

- Homeownership by family structure (50th)

- Delinquent mortgage loans (49th)

- Affordability of homes (43rd)

- Housing cost burden – homeowners (46th)

- Housing cost burden – renters (45th)

- Uninsured by race (45th)

- Uninsured by gender (49th)

- Average college student debt (46th)

While Rhode Island’s poor performance on housing/homeownership outcomes in the Assets and Opportunities Scorecard is not new, it is striking. Jim Ryczek, Executive Director of the Rhode Island Coalition for the Homeless responds:

“While Rhode Island clearly has much work to do to meet the state’s housing needs, we have significantly increased funding of programs to solve homelessness. We need to match that progress with investments that provide housing options for all Rhode Islanders.”

It is also noteworthy that Rhode Island falls in the bottom 11 rankings in three of the six outcome measures that look at disparities by race/ethnicity. National data show stark disparities in wealth based on race and ethnicity. We know that here in Rhode Island, racial disparities in wages and income are significant. The lack of good state-based data on wealth prevents us from fully understanding these disparities, which in turn prevents us from addressing the challenges with the necessary urgency. Another new report released last week by the Annie E Casey Foundation addresses the need for better data:

“To properly gauge the effects of policies and practices on families’ ability to build assets, we must have the right tools. Data on family assets are meager and difficult to access, particularly for various racial and ethnic groups. The federal government should explore better mechanisms to track that information, such as representative surveys for national and state use with questions on savings behavior and asset holdings or additional questions in the U.S. Census Bureau’s American Community Survey.” Annie E Casey Foundation, Investing in Tomorrow: Helping Families Build Savings and Assets

CFED has been publishing the Asset and Opportunities Scorecard since 2002. It remains a key benchmark in tracking important policy and outcome measures, and highlighting best practices in state policies addressing these areas.

Key policies that Rhode Islanders can adopt to provide greater opportunities for Rhode Island families include:

- Increasing the state Earned Income Tax Credit to 20 percent of the federal credit.

- Further Increasing the minimum wage.

- Providing protections from predatory lending such as payday loans.

These and other measures that boost family incomes will help families set aside savings while investing in assets such as a home.

[From a press release]

]]> At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

“That’s something I’ve got my eye on,” said Mattiello, offering to collaborate with the business community to do something about it.

The idea of reforming the estate tax came out of a previous Summit, said Wiley, and the important thing, he continued, looking towards Raimondo and Mattiello, is that, “you guys are listening.”

“Rhode Island ends up at the bottom of a lot of the ratings of taxes and business climate,” said Wiley, and though he did not specify to what ratings he was referring, two annual business climate rankings, the SBEC (Small Business and Entrepreneurship Council)’s Small Business Policy Index and ALEC (American Legislative Exchange Council)’s Rich States, Poor States, include the mere existence of a state level estate tax as a negative in their questionable formulas for determining a state’s ranking.

The problem, says economist Peter Fisher, is that “the estate tax – which is paid only by the ultra-wealthy – doesn’t affect economic growth.”

Fisher says that Rich States, Poor States author Arthur Laffer, “and his co-authors devote an entire chapter to estate and inheritance taxes, incorrectly tagging them as ‘job killers’ that ‘strangle economic growth.’”

Laffer and company assert that states with an estate tax are losing ‘enormous amounts of accumulated wealth,’ and that this wealth would have created jobs, alleviated poverty, and increased tax revenue, but they fail to explain how this would happen. The wealth held by retirees typically is not the kind of capital normally used in job creation. The wealth that drives prosperity consists of real assets: natural resources, plant and equipment, public infrastructure, human capital, technological knowledge. By contrast, large estates typically consist of real estate, stocks and bonds, mutual funds, and other financial assets which could be located anywhere in the world. The future use of those assets is unaffected by where the person who owned them died.”

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As Bob Plain showed, the last time RI messed with the estate tax, the burden of public services and infrastructure was shifted onto poor and middle class Rhode Islanders, allowing the rich and the mega rich to become richer still. These policies contribute to our ever increasing wealth inequality and pervert our democracy, tilting us ever faster towards an oligarchy represented by the likes of “Cap” Wiley, if we aren’t there already.

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As Bob Plain showed, the last time RI messed with the estate tax, the burden of public services and infrastructure was shifted onto poor and middle class Rhode Islanders, allowing the rich and the mega rich to become richer still. These policies contribute to our ever increasing wealth inequality and pervert our democracy, tilting us ever faster towards an oligarchy represented by the likes of “Cap” Wiley, if we aren’t there already.

Citing an Economic Progress Institute (EPI) fact sheet, Plain wrote, “The clear winners are a small number of wealthy taxpayers whose estates will pay less in taxes and in many cases, nothing at all starting next year. The clear losers are tens of thousands of low- and modest-income Rhode Islanders who will pay more in taxes next year. Unemployed homeowners and renters are among the biggest losers, because they will no longer qualify for property tax assistance and are not eligible for the earned income tax credit (EITC). Many of the lowest-wage workers will also be negatively impacted by the loss of the property tax refund, even with an eventual boost in the EITC.”

“SBEC’s stated mission, says Fisher, “is to ‘encourage entrepreneurship and small business growth,'” but “its lobbying activities reveal a very conservative, anti-government agenda.” ALEC, “is a mechanism by which corporations pay substantial sums of money to draft legislation benefiting them.” Neither group has the interests of state economies or average citizens in mind when they advance their agendas under the guise of “economic research.” These groups are made up entirely of the oligarchic prosperous and their servile, deluded sycophants.

Our gullible state leaders are not searching for real economic solutions to our state’s budgeting issues, they are instead looking for the excuses they need to pass the legislation their corporate masters demand.

To truly help our economy and budget, instead of eliminating the estate tax we should be increasing it.

Also, do yourself a favor and familiarize yourself with Peter Fisher’s website:

]]>

The Economic Progress Institute (EPI) announced that Kate Brewster is stepping down as executive director. Rachel Flum, the Institute’s long-time senior policy analyst, has been promoted as the new executive director.

The Economic Progress Institute is a nonprofit, nonpartisan organization that works to improve economic security and opportunity for all Rhode Islanders, through research, advocacy and community partnerships. Brewster has been the executive director for 11 years, taking over from her mentor, Nancy Gewirtz, a co-founder of the Institute.

Brewster’s new job will be executive director of the Jonnycake Center of Peace Dale, a community-based organization that provides such basic needs as food and clothing for local residents while also engaging in individual and policy advocacy.

“It is with tremendous mixed emotions that I leave the Institute, an organization that has had a lasting and profound impact on the ability of Rhode Islanders to make ends meet,” Brewster said in a statement. “I am excited to start a new chapter of helping to make sure that people in my local community don’t go to school or to bed hungry.”

Flum, recently chosen as one of “40 under Forty” by Providence Business News, has been a senior policy analyst with the Institute for ten years and has also served as the project manager for the RI Health Coverage Project, a joint initiative of the Institute and RI Kids Count.

“We’re pleased that such a strong leader, with a wealth of knowledge about the issues facing Rhode Islanders, was available on the EPI staff,” said Alan Flam, secretary of the Institute’s board and head of the search committee. “Over the past ten years, Rachel has shown the commitment, talent and vision to lead this organization into the future.”

“We are so grateful for the leadership that Kate has provided for this organization and the people whose lives we work to make better,” said Flam. “The residents of South County are fortunate she will now be working directly on their behalf.”

[From a press release]

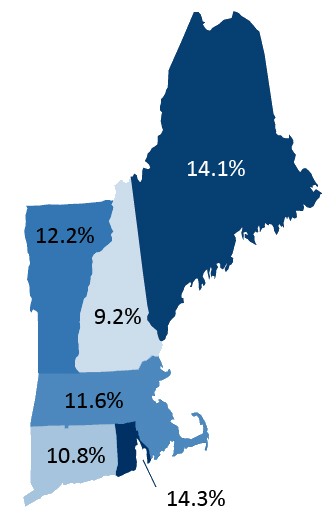

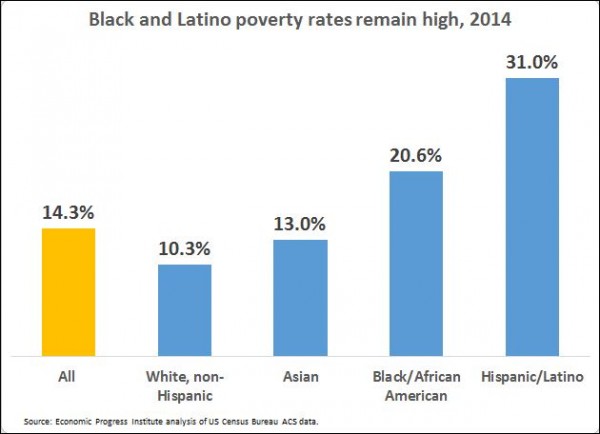

]]> The Economic Progress Institute (EPI), based on data released by the US Census Bureau, found that Rhode Island’s poverty rate remained unchanged in 2014, the highest rate in New England.

The Economic Progress Institute (EPI), based on data released by the US Census Bureau, found that Rhode Island’s poverty rate remained unchanged in 2014, the highest rate in New England.

Among EPI’s key findings, according to Juan Espinoza, Communications and Outreach Associate, are:

One in seven Rhode Islanders live in poverty.

Rhode Island has the highest poverty rate of all the New England states, and ranks 24th in the country.

One in ten white Rhode Islanders live in poverty.

More than one in five African Americans in Rhode Island are poor—twice the rate of white Rhode Islanders

Nearly one in three Latinos in Rhode Island are poor—three times the rate of white Rhode Islanders.

“It is disturbing that so many Rhode Islanders continue to live in poverty.” said Kate Brewster, executive director of the Economic Progress Institute, in a statement. “While there is certainly no silver bullet to address this crisis, one action lawmakers should take to help struggling working families is to continue to increase the state’s Earned Income Tax Credit. This would put more money in the hands of people working at low-wage jobs by letting them keep more of what they earn and would help lift their families above the poverty line.”

According to EPI, “Rhode Island lawmakers increased the state’s Earned Income Tax Credit last year to 12.5 percent of the federal credit from 10 percent. This is expected to put an additional $6 million back in the pockets of over 80,000 working families who live in every city and town in the state. Neighboring states already do more to help low-wage workers through the EITC. Connecticut offers a 27.5 percent state credit and Massachusetts recently increased its state credit to 23 percent. A recent study, documented in the book It’s Not Like I’m Poor, demonstrates that families receiving the tax credit spend it wisely: they pay current bills, including rent, utilities and groceries; they pay off debt; and they invest in their future, for example, by moving to a better neighborhood. Along with helping families get ahead, these purchases and payments boost the local economy.”

According to EPI, “Rhode Island lawmakers increased the state’s Earned Income Tax Credit last year to 12.5 percent of the federal credit from 10 percent. This is expected to put an additional $6 million back in the pockets of over 80,000 working families who live in every city and town in the state. Neighboring states already do more to help low-wage workers through the EITC. Connecticut offers a 27.5 percent state credit and Massachusetts recently increased its state credit to 23 percent. A recent study, documented in the book It’s Not Like I’m Poor, demonstrates that families receiving the tax credit spend it wisely: they pay current bills, including rent, utilities and groceries; they pay off debt; and they invest in their future, for example, by moving to a better neighborhood. Along with helping families get ahead, these purchases and payments boost the local economy.”

The one bright spot is that “the share of Rhode Islanders without health insurance coverage fell sharply from 11.6 percent in 2013 to 7.4 percent in 2014, ranking RI 9th best in the country for having insured residents.” EPI reports that, “recent data released by Healthsource RI shows that the uninsured rate in Rhode Island is even lower in 2015.”

Over the weekend the Economic Policy Institute (EPI) released a “Family Budget Calculator” that “measures the income a family needs in order to attain a secure yet modest standard of living.”

Over the weekend the Economic Policy Institute (EPI) released a “Family Budget Calculator” that “measures the income a family needs in order to attain a secure yet modest standard of living.”

To use the “Family Budget Calculator” simply enter your city, state or zip code. The budgets generated “estimate community-specific costs for 10 family types (one or two adults with zero to four children) in 618 locations,” says the EPI, “Compared with the federal poverty line and Supplemental Poverty Measure, EPI’s family budgets provide a more accurate and complete measure of economic security in America.”

Entering “Rhode Island” for two adults and two children brings results for the Providence/Fall River metro area, where monthly costs of living are estimated at $5,955, or $71,455 annually. This includes $913 for housing and $1338 for child care. One adult with no children needs to generate $2,543 monthly/$30,522 annually to maintain a “secure yet modest standard of living.”

Needless to say, many Rhode Island families are not meeting this basic income level. Locally, the Economic Progress Institute launched an online “Cost of Living Calculator” that showed that “Rhode Island’s recent move to raise the minimum wage from $9 to $9.60 is not nearly sufficient… since a ‘single adult without children needs to earn $24,640 a year or $11.85/hour to meet his or her basic needs.’”

The EPI report is one more indication that Rhode Island is not on the right track economically when it comes to working families. Members of the General Assembly need to take note.

The EPI describes itself as “an independent, nonprofit think tank that researches the impact of economic trends and policies on working people in the United States. EPI’s research helps policymakers, opinion leaders, advocates, journalists, and the public understand the bread-and-butter issues affecting ordinary Americans.”

]]>