At the most recent Burrillville Town Council meeting, Town Councillor Kimberly Briquette Brown made some curious remarks about Invenergy’s obligations to ISO-NE, the organization responsible for managing the supply of electricity to Rhode Island and neighboring states. Invenergy is planning to build a $700 million fracked gas and diesel oil burning power plant in the town and residents of Burrillville strongly oppose the plant.

“It’s my understanding,” said Brissette Brown, “from speaking to Mike McElroy and learning about this just as much as everybody else has been over the last few months, that once the ISO had granted the power capacity in February to Invenergy, that regardless of whether not they enter into a tax agreement with the town, if they do not go forward with building the power plant they’re going to be fined, substantially, it’s my understanding, and I could be wrong, millions of dollars. At the time… there was a concern about the financial ramifications of leaving the bill to people that thought that by voting no to a tax agreement that they’d be basically sending the power company packing.”

The gist of her remarks seems to be that Burrillville town attorney Michael McElroy convinced her that the town might be on the hook financially for the fines that Invenergy might suffer for not delivering on its obligations to ISO-NE. I couldn’t see how this was possible, so I asked Jerry Elmer, senior attorney at the Conservation Law Foundation (CLF), for his insight. The added emphasis is all mine:

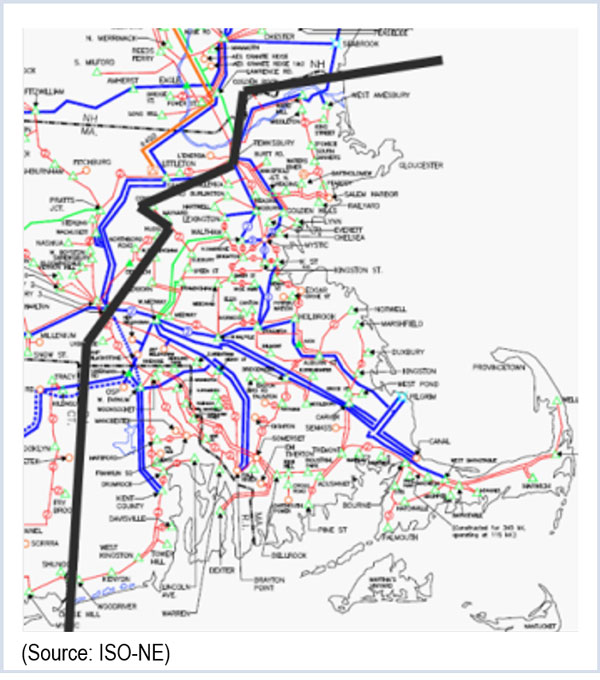

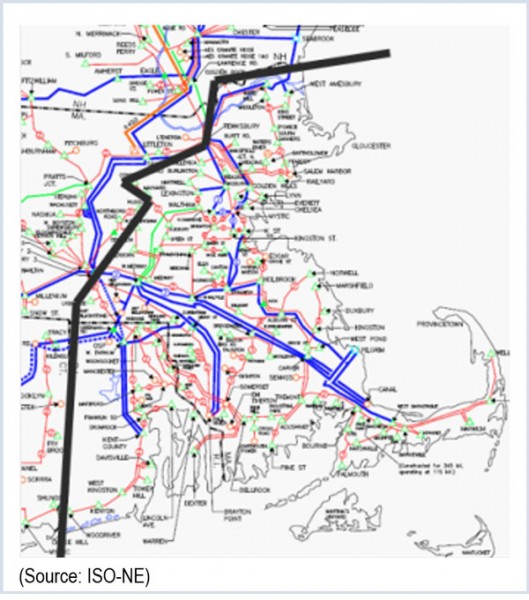

By way of background, I explain in general that the results of FCA-10 show that the Invenergy plant is not needed, here.

And I am well aware of the fact that the mechanics of these FCAs can be complicated and difficult to understand; I provide some general background, here.

“In FCA-10, Invenergy bid both of its turbines, or 997 MW, into the ISO’s auction. However, in the actual auction, Invenergy cleared only one turbine, or 485 MW. Thus, Invenergy acquired a CSO of 485 MW. Invenergy agreed to provide electricity to the regional grid operator, ISO-NE, for a one-year period of time running from June 1, 2019 through May 31, 2020. This period of time is called Capacity Commitment Period 10 (CCP-10), and it corresponds to FCA-10. In return for agreeing to be available to the regional grid operator during that specified, future period, Invenergy will receive a stream of payments called capacity payments.

“In effect, Invenergy is selling a commodity, capacity, in return for a stream of money, called capacity payments. (And those links above provide some needed background that may help readers understand this.)

“In order to be allowed to participate in the ISO’s Forward Capacity Auction (FCA), Invenergy (or any other entity) had to first “qualify.” In order to qualify to participate in an auction, Invenergy (or any other entity) had to show that it had a realistic chance to actually build its proposed plant. (The ISO requires this, because the ISO is responsible for keeping our electricity grid reliable. ISO cannot keep the grid reliable if entities that acquire CSOs cannot actually build and operate power plants.) Invenergy (or any other entity) also has to put up a huge amount of “Financial Assurance” to even be allowed to participate in an FCA. FA is a kind of bond, a way of securing (guaranteeing) that Invenergy will be able to perform its obligation. FA would be forfeited if Invenergy (or any other entity) acquired a CSO (in an auction) but then did not actually have a plant built by the beginning of the CCP.

“So, now that Invenergy did acquire a CSO in FCA-10, is Invenergy irrevocably committed to building the proposed plant in Burrilville? The answer is unequivocally not.

“Could Invenergy abandon its proposed plant in Burrillville completely, and not lose the FA (bond) posted with ISO? The answer is unequivocally yes.

“To be sure, Invenergy could not just walk away from the plant. However, between today and June 1, 2019 (the beginning of CCP-10, when Invenergy’s CSO kicks in) the ISO will hold three separate Reconfiguration Auctions. One will occur about 2 years before June 1, 2019; one will occur about a year before June 1, 2019; and the last one will occur just before the start of CCP-10. At each of these Reconfiguration Auctions, buyers and sellers buy and sell CSOs to each other.

“Invenergy could – if it wanted to – sell out of its CSO in any one of those Reconfiguration Auctions. Of course, because the ISO is still responsible for keeping the New England electricity grid reliable, any entity that wanted to buy Invenergy’s 485-MW CSO would have to be qualified by the ISO to participate in the Reconfiguration Auction. The qualification process would be very similar to the qualification process for participating in an FCA – show that you either have a power plant already or could realistically build one in the remaining time allowed, and post FA.

“Invenergy could elect to sell out of its CSO in any of the next 3 ISO-run Reconfiguration Auctions for any one of a variety of reasons. For example, Invenergy could decide that the political climate in Rhode Island has turned against it, and that the plant might not be permitted by the Energy Facility Siting Board. (This could happen, say, if Governor Raimondo were persuaded to oppose the proposed plant as a result of overwhelming constituent pressure.) Or Invenergy could decide that the New England energy market is less lucrative than it thought it would be, and it is not worth building the plant. (In fact, the auction clearing price crashed from over $17 per kilowatt-month in FCA-9 to $7.03 per kilowatt month in FCA-10.) Or, Invenergy could sell out of its CSO for no other reason than that it thought it was profitable to do so. (Remember that whatever entity buys the CSO from Invenergy would be buying the right to a future stream of income. This is a valuable commodity, and it is entirely possible that Invenergy simply flips the CSO for a quick profit. Note that in that last sentence I mean “possible” as being completely within the ISO Market Rules; I am not suggesting that this is a likely course for Invenergy – only that it can be done.)

“In fact, Invenergy could sell out of its CSO in any one of the next three Reconfiguration Auctions for any reason it wanted to do so. The fact is that, having acquired a CSO on February 8 does not mean that the plant must inevitably be built, and does not mean that Invenergy is powerless to walk away without forfeiting the huge bond it posted with the ISO.

“In this scenario, the Town of Burrillville would not be on the hook for any of Invenergy’s CSO. In fact, the Town of Burrillville could almost certainly not be qualified by the ISO to buy Invenergy’s CSO. But, in any event, if Invenergy sold out of its CSO, the Town of Burrillville would have no liability for the CSO.”

So, in summary, the Town of Burrillville is in no way responsible for Invenergy’s bad decision to buy into a forward capacity energy market before being sure that they would be able to supply the energy required.

Invenergy made the promise, not Burrillville.

So I ask again, “Why should anyone in Burrillville care about bad decisions made by a Chicago based energy company? How is it possible that Burrillville should be liable for Invenergy’s bad business decisions?”

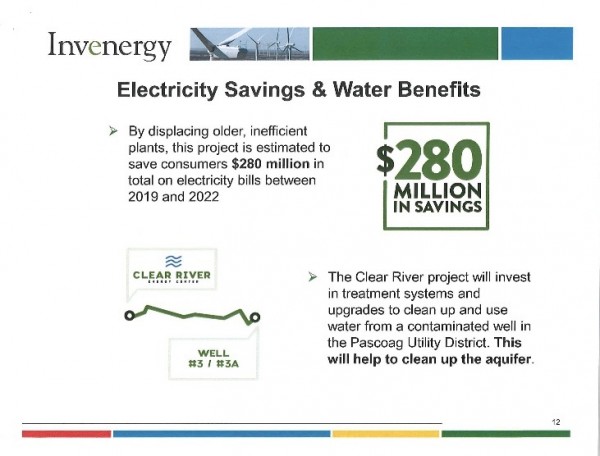

“…on March 31, in front of 700 people, Invenergy presented in two different ways… information that Invenergy knew, at the time, was false. First, the words “$280 million in Savings” appear in big, green letters on Slide 12 of Invenergy’s presentation… Second, the false information was emphasized by Invenergy’s John Niland, who said, “Talking about ratepayer savings, the analysis we’ve done looks at what happens to the cost of power to the region when you put in a plant like this. – – [T]hat’s really what the $280 million number represents.” [EFSB March 31, 2016 Hearing Transcript. page 16, lines 8-11; 15-17.)

“…on March 31, in front of 700 people, Invenergy presented in two different ways… information that Invenergy knew, at the time, was false. First, the words “$280 million in Savings” appear in big, green letters on Slide 12 of Invenergy’s presentation… Second, the false information was emphasized by Invenergy’s John Niland, who said, “Talking about ratepayer savings, the analysis we’ve done looks at what happens to the cost of power to the region when you put in a plant like this. – – [T]hat’s really what the $280 million number represents.” [EFSB March 31, 2016 Hearing Transcript. page 16, lines 8-11; 15-17.)

This is not what Invenergy expected when they presented their plans for the new plant. “If you look at Invenergy’s filing with the Energy Facility Siting Board (EFSB),” says Elmer, “they were talking about how desperately the plant is needed, it’s needed in RI to keep the lights on, and that the clearing price of capacity is going to be much higher in RI than in the rest of the ISO NE pool, what they call ‘rest of pool.’”

This is not what Invenergy expected when they presented their plans for the new plant. “If you look at Invenergy’s filing with the Energy Facility Siting Board (EFSB),” says Elmer, “they were talking about how desperately the plant is needed, it’s needed in RI to keep the lights on, and that the clearing price of capacity is going to be much higher in RI than in the rest of the ISO NE pool, what they call ‘rest of pool.’”