Back in June 2009, there was a strong push for the state to make changes to the tax structure. Organizing from the grassroots was highlighting the inequity of what was then called the “flat tax.” Boring you with all the details now isn’t the point, but reminding you of the rhetoric from the business community is.

Back in June 2009, there was a strong push for the state to make changes to the tax structure. Organizing from the grassroots was highlighting the inequity of what was then called the “flat tax.” Boring you with all the details now isn’t the point, but reminding you of the rhetoric from the business community is.

On June 12, 2009, leaders of the business community, including Alex Taylor of FGXI (Foster Grant sunglasses), John Muggeridge of Fidelity, and Mark Higgins, dean of the Business School at URI, penned an op-ed in The Providence Journal, pleading with the leadership of the General Assembly to stay to the course and not abandon the flat tax. (The Journal archive will not let me link to the story.)

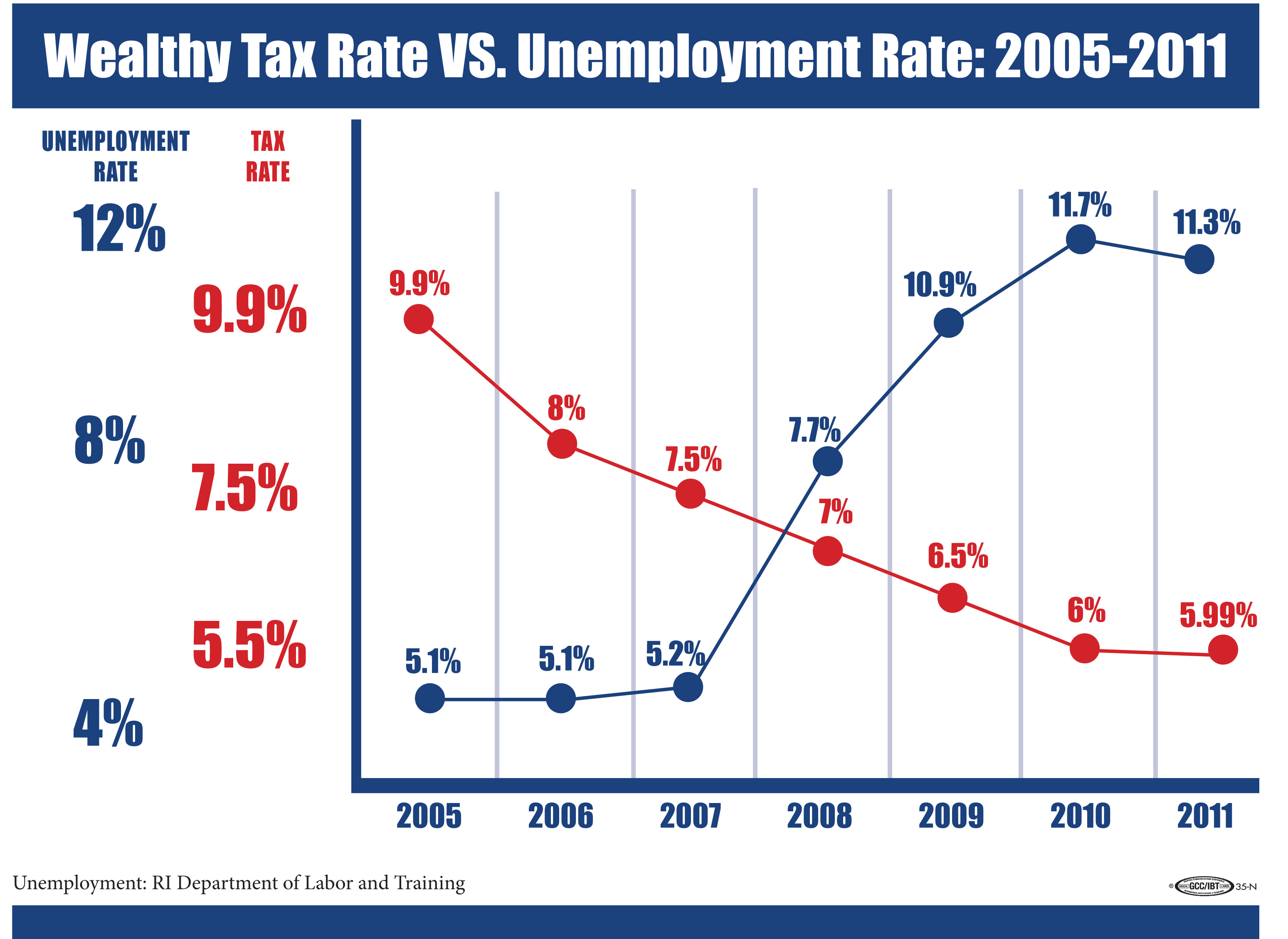

The businessmen describe Rhode Island at an “economic crossroads.” Our “significantly higher” unemployment rate (at the time, a seasonally adjusted 10.9 %) and our “dropping” economy are, if we follow the crossroad metaphor, down one path, and prosperity, jobs, and a better business climate are down the other path. The key, according to the businessmen, is to not tinker with the flat tax. In their words : “Now it’s time for state leaders to give the cure time to work.”

According to the last available data, Rhode Island’s seasonally adjusted unemployment rate was 11.2%.

I think it is crucial to revisit this 2009 op-ed from these leaders in the business community now in 2012 as we are debating a proposal to once again revisit our tax structure in Rhode Island. And once again, the business community is asking the General Assembly to “give the cure time to work.” Writing in another op-ed column for the Journal, R. Kelly Sheridan, legislative counsel for the Greater Providence Chamber of Commerce, said “It would extremely unwise to dismantle the 2010 reform before the first returns are evaluated.” Sound familiar?

The real key from the 2009 op-ed from the business community leaders is how the view the original tax reform. It is very clear from the rhetoric there is a direct correlation between tax cuts for the wealthy and job creation for the working class. They write “With it (the flat tax), private-sector business leaders can make decisions regarding the location of their facilities on the basis of workforce and real-estate availability, not on the variables of the personal-income-tax structure.” Again, according to RIDLT, unemployment in Rhode Island was 5.1% in June of 2006.

The economic strategies advocated by the business community simply have not worked for Rhode Island. For years now their only answer to critics of their approach has been “just give it more time.” But during that time more jobs are lost, more businesses close, and, ironically, taxes increase on working and middle class people at the local level in the form of property taxes and fees. All the while vital public services are cut. There has to be a better way because the business community’s cure for what ills Rhode Island seems certainly worse than the disease.