I once had the following conversation with a state senator: She proudly told me that she favored letting the Bush tax cuts for the wealthy expire. So I asked her, “what about Rhode Island’s tax cuts for the wealthy?” “Well,” she told me, “we have to worry about our business climate.”

It is a disturbingly common refrain. Conservatives constantly point to business climate rankings that put Rhode Island towards the bottom. A few months ago, the state Senate, in collaboration with the right-wing lobbying group RIPEC, released a very silly report entitled “Moving the Needle” that harped on these curious business tax climate surveys. The most famous of these rankings is the Business Tax Climate Index put out by the Tax Foundation, a very conservative think tank. A few days ago, the Tax Foundation put out its 2014 rankings, giving our great state 46th place. There was the predictable flurry of bloviating about how this means we need to cut income taxes for the rich even more than we already have. So I felt it was time for a thorough debunking of the Index.

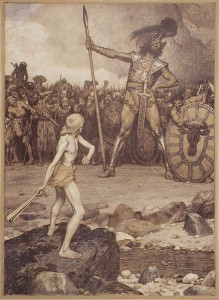

Part of the reason conservatives need statistics like the Index is that blue states tend to score a lot better than red states do on most conventional economic indices, like median household income.

Judging by real numbers, the blue states clearly are much wealthier than the red states. Many of the red states that do do well—Alaska, Wyoming, and North Dakota—have strong economies because they have large amounts of natural resources, not because of their economic policies. Red states, simply put, are generally economic disasters. So if conservatives want to argue things are worse in the blue states, they need to make up new numbers. That is precisely what the Index does. The Index supposedly measures how effective a state’s tax system is at promoting business. But it is actually just a fancy way of distorting tax data to favor conservative tax policies.

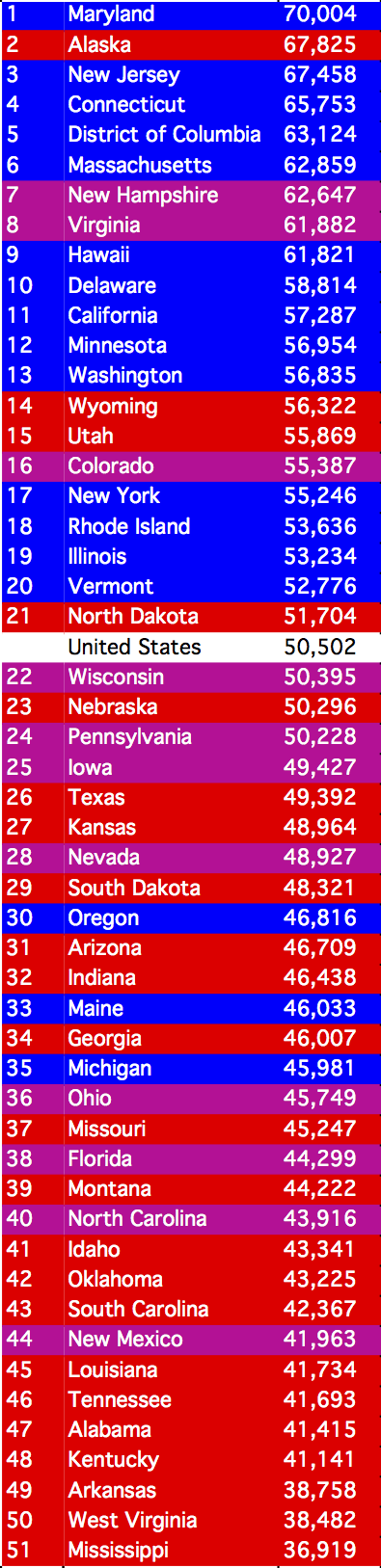

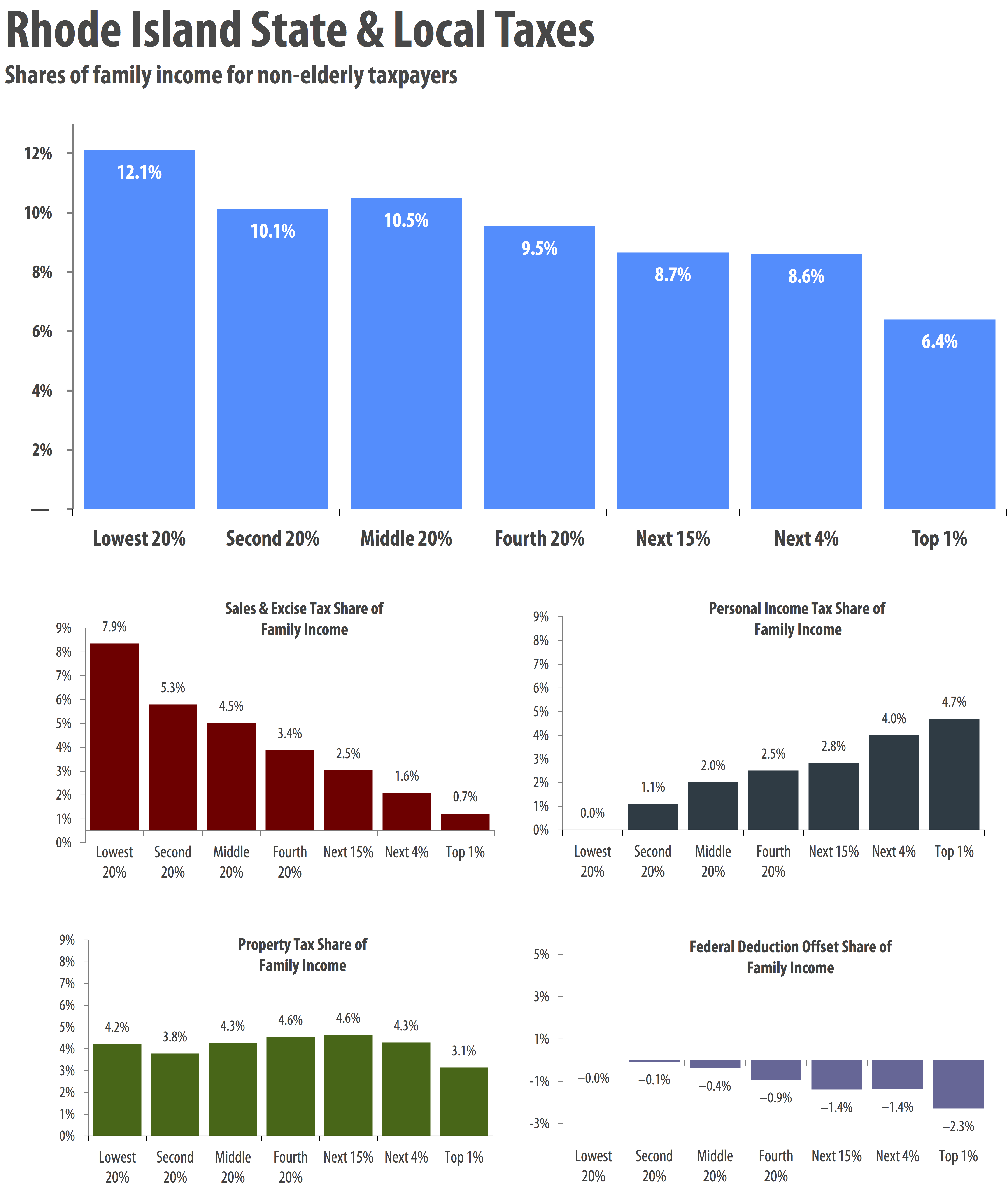

Before we jump into the weeds, I need to define two critical pieces of tax jargon: progressive taxes and regressive taxes. A progressive tax is a tax where you pay a higher rate the more you make, and a regressive tax is where you pay a lower rate the more you make. Most of the Index is designed around favoring regressive taxes. Simply put, the more aggressively a state redistributes wealth from the 99% to the 1%, the better it scores on the Index. So let’s break down the top five distortions:

1. Tax Weighting

This is the most important distortion. The Index examines five different taxes and weights them as follows:

Individual Income Tax — 32.4%

Sales Tax — 21.5%

Corporate Tax — 20.2%

Property Tax — 14.4%

Unemployment Insurance Tax — 11.5%

These weights are not derived from an estimate of how much each tax affects businesses. Instead, they come from how much each tax varies from state to state. This results in the oddity that the tax weighted highest—the individual income tax—is a tax few businesses pay. And the tax that the Index’s 2013 report admits plays the most important role in determining business location—the property tax—is weighted the second lowest. Perversely, the Index punishes states for shifting the tax burden from businesses to individuals. Now, there is a good reason the income tax makes the top of the list—it is one of the few progressive taxes states assess. Here is how the tax burden gets distributed in Rhode Island:

2. Excluding fees and charges

The Index does not incorporate all taxes. The biggest omission is fees and charges, which are the most regressive, anti-business component of taxation. A state that raised revenue exclusively through sky-high licensing fees, highway tolls, business chartering fees, code violation penalties, speeding tickets, parking tickets, drilling fees, mining fees, logging fees, and pollution charges would receive a perfect rank on the Index because none of those taxes would be included. But all of those taxes very much affect businesses.

3. Punishing lower tax rates for the middle class and small businesses

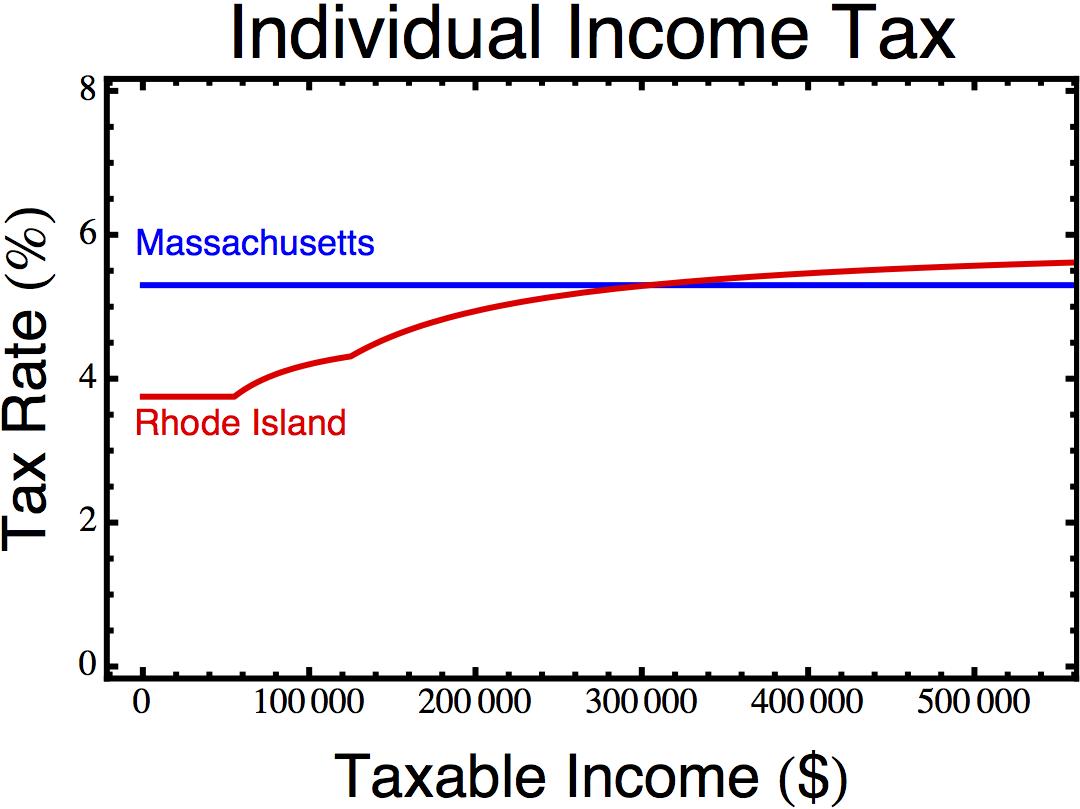

When the Index assesses the income tax and corporate tax components, it strongly penalizes progressive tax systems and favors more regressive tax systems. First, the Index ranks states by the top rate, and then it applies a penalty for having lower tax brackets for businesses and corporations that are less well off. The results can be absurd. States are severely punished for cutting income taxes for the middle class or cutting corporate income taxes for small business. If you make less than $300,000, which nearly everyone does, you pay higher taxes in Massachusetts than Rhode Island:

But the Index ranks Massachusetts’s income tax 13th, well ahead of Rhode Island’s 36th place ranking. The same logic applies to corporate income taxes. If a state creates a bracket with lower taxes for smaller businesses, the Index will penalize it. This merely reflects what conservatives believe the tax system should look like. It has nothing to do with helping businesses. Indeed, it is exceptionally difficult to imagine how increasing taxes on small businesses could possibly improve the business tax climate.

4. Further diluting property taxes

Even though the 2013 Index admits that property taxes are the most important factor in business location decisions, they have the second lowest weight. Even that does not tell the whole story, since property taxes are further watered down by lumping gift and estate taxes into the property tax category.

5. Punishing tax deductions that help businesses

Perhaps the strangest component of the Index is the penalties it imposes for tax credits designed to spur growth. These include job tax credits, research tax credits, and exemptions from sales taxes for basic goods like medicine and food. Although conservative orthodoxy favors simple taxes without exemptions, it is very hard to see how tax credits for businesses could possibly impose a serious burden on businesses. This peculiar hatred of deductions yields some quite comical results. Take Delaware for instance. With a corporate tax code that gives it far and away the most businesses per capita of any state in the union, Delaware is a famous corporate tax haven. So one might expect Delaware to rank highly on the Index’s corporate tax ranking. But it ranks last. Why? Because Delaware has quite high tax rates but enormous exemptions for out of state income. And the Index does not like exemptions.

Throughout its 56 pages, one theme shines abundantly clear—the Index prefers more regressive taxes. Needless to say, this has nothing to do with the business tax climate. It is just about right-wing ideology.

The sad truth is that a slavish obsession with these conservative business tax climate reports has created a seriously unfriendly business tax climate in Rhode Island. We have slashed income taxes for the wealthy and dumped much of the burden on businesses in the form of higher property taxes and fees, especially in core business areas like Providence. It is time to recognize these silly reports for what they are—right-wing propaganda that should not be taken seriously. That’s how national Democratic pundits treat them.