Rep. Jeremiah O’Grady thinks banks bear the responsibility for some of the multi-family rental properties that blight Rhode Island’s urban areas because they have been foreclosed upon.

To articulate his point, he used as an example 63 Kossuth St. in Olneyville, a property he knows well because his company, Olneyville Housing Corp. is restoring the abandoned property “at taxpayer expense,” he said, using federal money from the Neighborhood Stabilization Program.

The property was sold five times between 2002 and 2005, he said. In early 2002 it was sold for $35,000, then $67,000, then $134,000. In 2004, it was sold for $268,000 and in 2005 it sold for $350,000.

“Not surprisingly that building went into foreclosure when there was no one else to flip it to,” he said, “The bank evicted and the [tenants] walked away.”

O’Grady said by the time it sold for $134,000 banks should have known better than to issue such a loan because there was no realistic way a landlord could have made money renting the four one-bedroom units in the property.

“When banks lend on a commercial property then they ought to as responsible lenders lend on the value of that income stream and this is something that lenders did not do, to their detriment, to the detriment of their portfolio and to the detriment of the neighborhoods around them,” he told the House Judiciary Committee last night as it considered a bill that would prevent banks from evicting tenants who live in foreclosed properties.

To service a $350,000 mortgage, he told the committee, the landlord would have had to rent each unit for more than $1,000. The average rent for a one bedroom apartment in this neighborhood, he said, is about $525

“It’s just unreasonable and it’s reckless and that is why the banks should take some responsibility,” O’Grady said.

The legislation wouldn’t prevent banks from making bad loans, but it would prevent them from evicting tenants who rent in properties that go into foreclosure.

“The people who are innocent are the ones who are being punished the most,” said the bill’s sponsor, Rep. John Edwards, D- Tiverton, noting that Massachusetts and New Jersey already have such laws on their books.

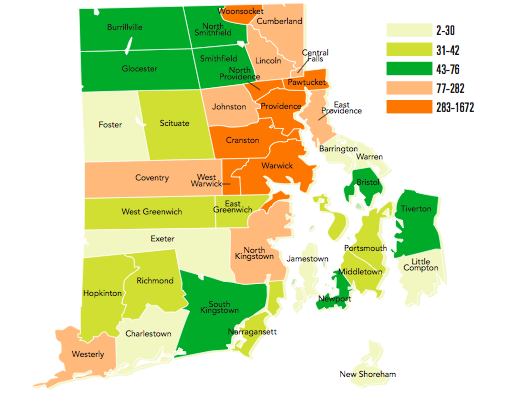

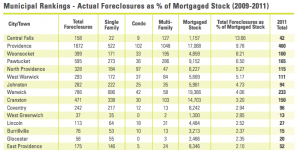

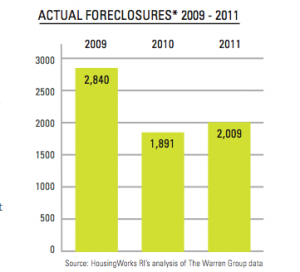

But the issue is particularly problematic in Rhode Island, where a third of the foreclosures since 2009 have been multi-family homes, according to a recent HousingWorks RI report.

“The high rates of multifamily foreclosures in the state have resulted in the rental housing market becoming one of the most vulnerable segments of our economy,” says the report. “Each multi-family foreclosure affects multiple rental homes, which in turn threatens tenants with possible eviction. For every multi-family property foreclosed, approximately two to three families find themselves without shelter.”

This is refreshing policy-making for the 99%:

This is refreshing policy-making for the 99%: