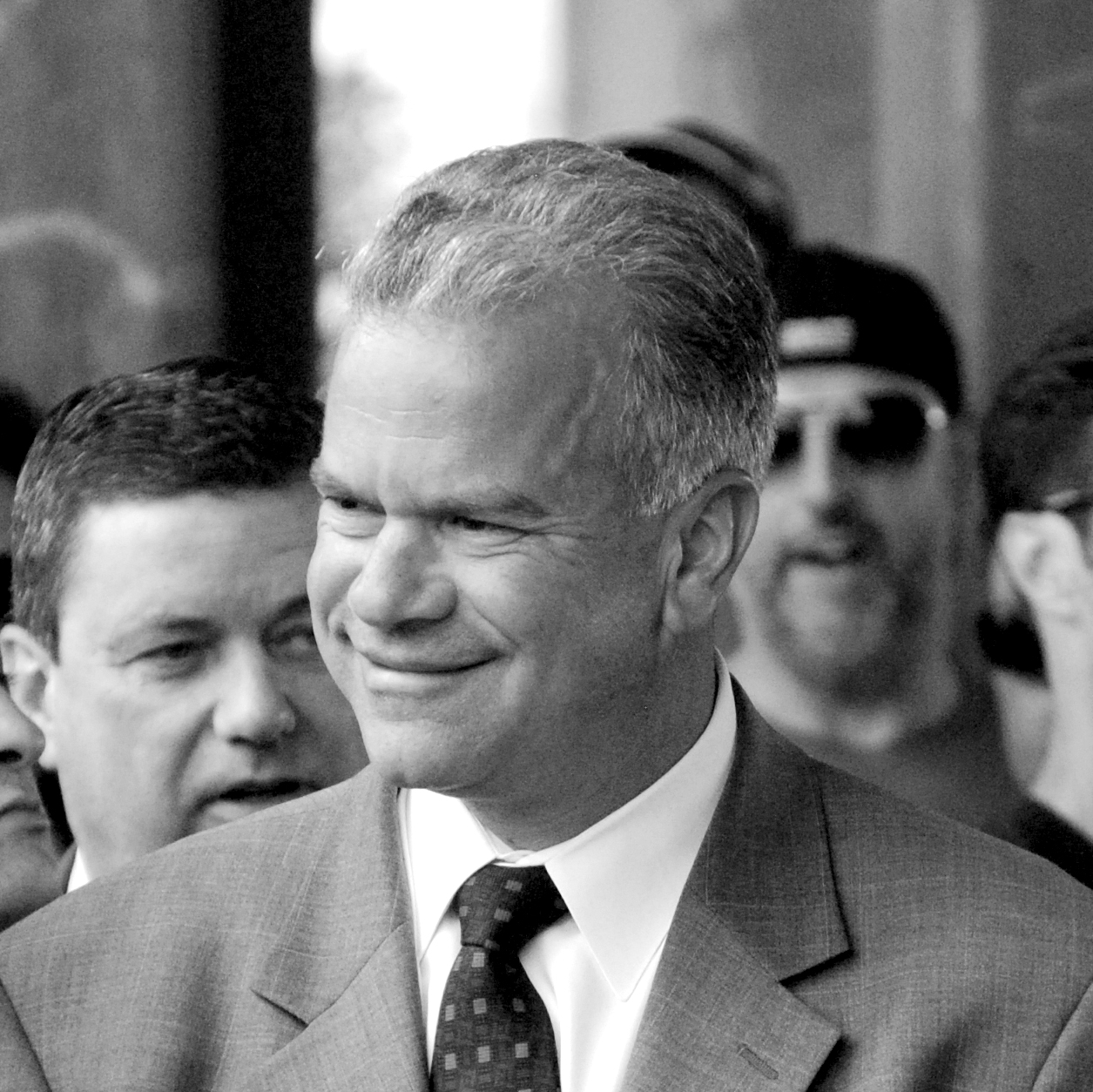

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

“That’s something I’ve got my eye on,” said Mattiello, offering to collaborate with the business community to do something about it.

The idea of reforming the estate tax came out of a previous Summit, said Wiley, and the important thing, he continued, looking towards Raimondo and Mattiello, is that, “you guys are listening.”

“Rhode Island ends up at the bottom of a lot of the ratings of taxes and business climate,” said Wiley, and though he did not specify to what ratings he was referring, two annual business climate rankings, the SBEC (Small Business and Entrepreneurship Council)’s Small Business Policy Index and ALEC (American Legislative Exchange Council)’s Rich States, Poor States, include the mere existence of a state level estate tax as a negative in their questionable formulas for determining a state’s ranking.

The problem, says economist Peter Fisher, is that “the estate tax – which is paid only by the ultra-wealthy – doesn’t affect economic growth.”

Fisher says that Rich States, Poor States author Arthur Laffer, “and his co-authors devote an entire chapter to estate and inheritance taxes, incorrectly tagging them as ‘job killers’ that ‘strangle economic growth.’”

Laffer and company assert that states with an estate tax are losing ‘enormous amounts of accumulated wealth,’ and that this wealth would have created jobs, alleviated poverty, and increased tax revenue, but they fail to explain how this would happen. The wealth held by retirees typically is not the kind of capital normally used in job creation. The wealth that drives prosperity consists of real assets: natural resources, plant and equipment, public infrastructure, human capital, technological knowledge. By contrast, large estates typically consist of real estate, stocks and bonds, mutual funds, and other financial assets which could be located anywhere in the world. The future use of those assets is unaffected by where the person who owned them died.”

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As Bob Plain showed, the last time RI messed with the estate tax, the burden of public services and infrastructure was shifted onto poor and middle class Rhode Islanders, allowing the rich and the mega rich to become richer still. These policies contribute to our ever increasing wealth inequality and pervert our democracy, tilting us ever faster towards an oligarchy represented by the likes of “Cap” Wiley, if we aren’t there already.

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As Bob Plain showed, the last time RI messed with the estate tax, the burden of public services and infrastructure was shifted onto poor and middle class Rhode Islanders, allowing the rich and the mega rich to become richer still. These policies contribute to our ever increasing wealth inequality and pervert our democracy, tilting us ever faster towards an oligarchy represented by the likes of “Cap” Wiley, if we aren’t there already.

Citing an Economic Progress Institute (EPI) fact sheet, Plain wrote, “The clear winners are a small number of wealthy taxpayers whose estates will pay less in taxes and in many cases, nothing at all starting next year. The clear losers are tens of thousands of low- and modest-income Rhode Islanders who will pay more in taxes next year. Unemployed homeowners and renters are among the biggest losers, because they will no longer qualify for property tax assistance and are not eligible for the earned income tax credit (EITC). Many of the lowest-wage workers will also be negatively impacted by the loss of the property tax refund, even with an eventual boost in the EITC.”

“SBEC’s stated mission, says Fisher, “is to ‘encourage entrepreneurship and small business growth,'” but “its lobbying activities reveal a very conservative, anti-government agenda.” ALEC, “is a mechanism by which corporations pay substantial sums of money to draft legislation benefiting them.” Neither group has the interests of state economies or average citizens in mind when they advance their agendas under the guise of “economic research.” These groups are made up entirely of the oligarchic prosperous and their servile, deluded sycophants.

Our gullible state leaders are not searching for real economic solutions to our state’s budgeting issues, they are instead looking for the excuses they need to pass the legislation their corporate masters demand.

To truly help our economy and budget, instead of eliminating the estate tax we should be increasing it.

Also, do yourself a favor and familiarize yourself with Peter Fisher’s website:

As the results of last Tuesday’s primary show, RI Speaker of the House Nicholas Mattiello is seriously out of step with Rhode Island voters. Progressives in this state demonstrated the kind of change they want, yet instead of course-correcting, the speaker is doubling down on policies Tuesday’s vote clearly rejected.

As the results of last Tuesday’s primary show, RI Speaker of the House Nicholas Mattiello is seriously out of step with Rhode Island voters. Progressives in this state demonstrated the kind of change they want, yet instead of course-correcting, the speaker is doubling down on policies Tuesday’s vote clearly rejected.

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

At the 2016 Rhode Island Small Business Economic Summit (Summit), Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, House Speaker Nicholas Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.” So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As

So why would Mattiello be so eager to look at an idea that amounts to both failed tax policy and a giveaway to the mega rich? As