Most reviews of Les Miserables discuss the singing, editing, and acting, disregarding the original text of Victor Hugo. I write the simple reflections of a former prisoner who read this ex-con tale while sitting in a cell, with only a feint hope of ever being an ex-con at all.

Most reviews of Les Miserables discuss the singing, editing, and acting, disregarding the original text of Victor Hugo. I write the simple reflections of a former prisoner who read this ex-con tale while sitting in a cell, with only a feint hope of ever being an ex-con at all.

The movie, by the way, is a masterpiece.

To me, the story was always about politics and philosophy, as Hugo wrote this classic in 1862, in the same era as Fyodor Dostoevsky’s Crime and Punishment, where each tale uses individual conflicts to symbolize larger themes for people living under oppressive regimes of inequality. In Les Miserables, the unlikely hero is Jean Valjean, representing the downtrodden people whose station in life is based on the law of man, not of God, fabricated by the elites in order to maintain their economic superiority. Inspector Javert represents the government system, lacking in love and unrelenting in his determination to crush Valjean. The story, I believe, is truly about the journey of Inspector Javert (and the system he represents), even though it is through the eyes of Valjean we view his existence.

When I read this tale, there were many people around me who were imprisoned on something petty, often sentenced to the gills, and occasionally were clearly innocent; similar to Jean Valjean, who served 19 years for stealing a loaf of bread. It was easier to see America’s systemic issues in an honest light because I wasn’t biased by my own dilemma: I had actually committed a terrible crime and had accepted my sentence. Furthermore, it wasn’t as though the thousands of prisoners I was forced to eat, play, speak, and live with were chosen by me (there were plenty of wronged people who don’t make it easy to stick up for them). Anyone who has ever read or seen Jean Paul Sartre’s play, No Exit, recognizes that “hell is other people.” Yet in my fellow convicts’ eyes I saw all the Jean Valjeans, the desperate and desolate, trapped in a system of control that does not end at the prison gates. And I experienced the Inspector Javert, up close and personal.

Prisoners, perhaps more than anyone, will confront their own morals and courage in the face of perceived injustice. There is typically nowhere to turn when confronted by the Javert, the governmental force that imposes its authority. Like the rebellious youth of Hugo’s novel yearning for freedom, the question becomes how much poverty and pain can the people take? What is the straw that breaks the camel’s back, and under what banner will resistance come? Victor Hugo reinforced Valjean’s spine with the loving righteousness of a God that considers all mankind to be equal and worthy of fairness. Valjean’s resistance to Javert’s tyranny is rooted in a belief that there is a higher power than the laws of man (and France). At the battlements (the front lines of French civil uprisings), Hugo infused his rebels with the spirit of Communism, a political belief that all citizens are equal members, and all should shoulder the burdens collectively and reap the rewards together.

Unlike the varied choices of free people, there is no retreat for a prisoner choosing to confront injustice and champion Constitutional principles that relate to Search and Seizure, Effective Counsel, Confrontation of Witnesses, Suppression of Evidence, and Cruel & Unusual Punishment. This is why in the history of American prisons there have typically been only hunger strikes, work strikes, or riots. When one considers that even a work strike (such as the recent one throughout the prisons of Georgia) can result in a violent backlash from the uncompromising Javert: all of these tools of prisoner resistance bring forth violence and possible death. Like anyone else who ever sat in a cell observing this Javert, desiring a fair Justice System rather than a blunt instrument of vengeance, I wondered how I could respond in a way that was true to the highest laws.

Prisoners will challenge each other about what they will do when the “shit hits the fan,” and the Goon Squad comes in full riot gear. We know their work from the dead of night: hearing a cell door get popped open, and the distinct sounds of eight armed men trying to enter a 5’ x 8’ cage to pounce upon one man who had previously transgressed Javert’s law (whether the written or the implied law). Some of us will risk further retaliation by bringing a complaint in Javert’s court, and try to win a battle of words and concepts. Others condemn this practice as useless; and if there will be violent repercussions anyway, they argue that one might as well simply utilize violence in the first place. Even assisting another in their attempts to call out injustice will bring repercussions, which places an additional moral burden upon those of us with added resources. For some it might be their muscle, community, or education.

I felt knowledge is power, and built on it accordingly. For different reasons than Valjean, my Buddhist path reinforced my determination to use peaceful means to resist the Javert. I never was fully convinced, however, that it is the most effective, nor if there was hope of success. Any student of history knows that violence is the most common tactic of the winners. For this reason, it is all too hypocritical when the Javerts denounce violence with the use of violence, and rationalize it with an “Ends Justify the Means” philosophy. I’ve come to believe, like Victor Hugo’s young men at the battlements, that “Success” is not always defined by immediate victory. Whether historically in Harper’s Ferry, Johannesburg, Tiananmen Square, or this year in Cairo: people are propelled by a sense of duty that, win or lose, life or death, we simply do what is right.

Victor Hugo anticipated Mahatma Gandhi’s principle that the Javert, when forced to confront his own injustice, would turn from the path. Dr. King and the 1960’s Civil Rights Movement echoed this practice, to lay bare just how brutal, unreasonable, and unrelenting are the tactics of the oppressor. There, the ends justifying the means was Racism. And not enough people continued to agree with it to support that form of inequality; at least not as a state-sponsored body of laws. For Gandhi, it was Colonialism, as the exploitative foreign ruler lacked justification to rule. For Victor Hugo, it was the Capitalist elite; a wealthy class that supplanted the aristocracy through the blood of the French Revolution.

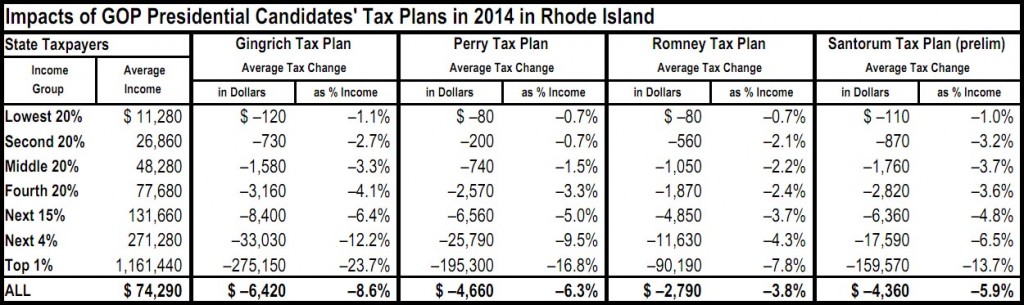

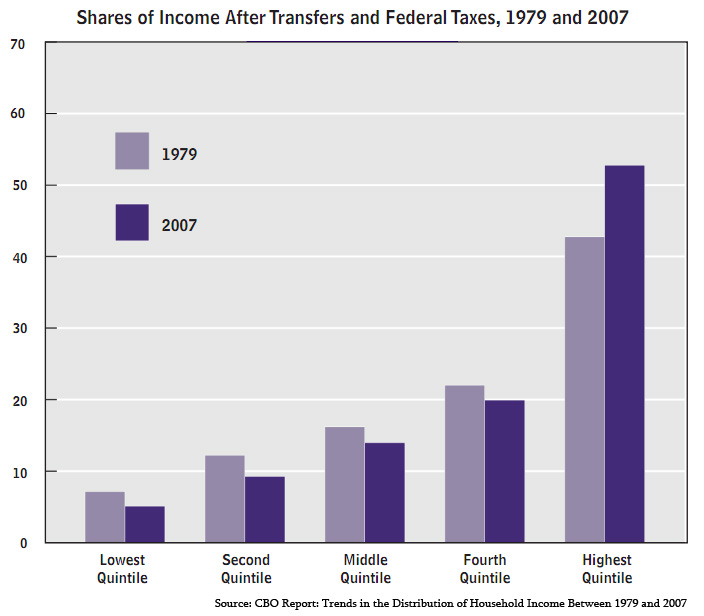

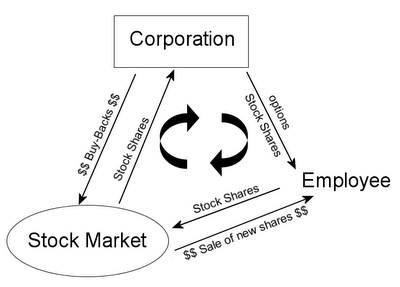

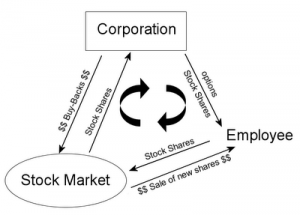

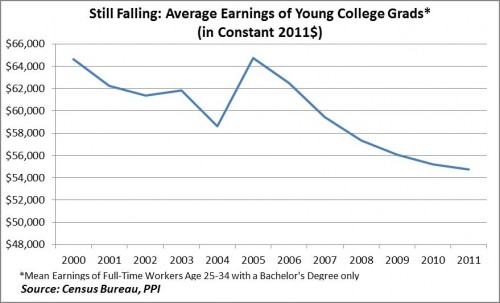

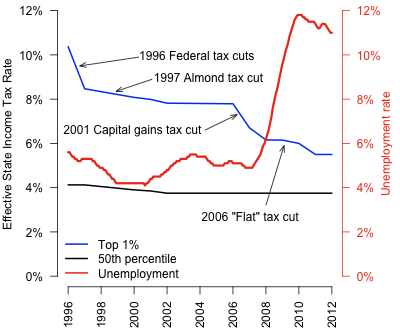

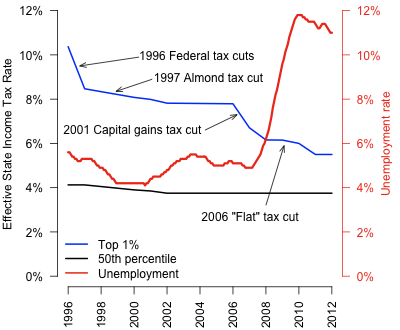

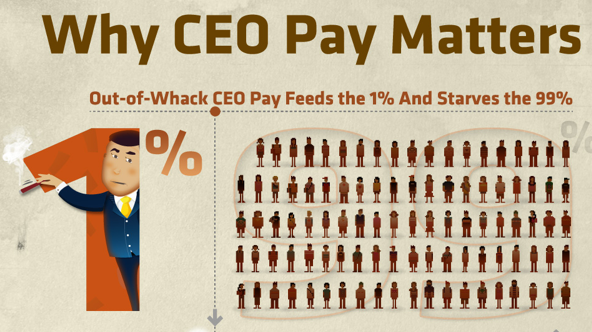

It is interesting that Hugo’s 19th Century inequality is the one that resonates most clearly today across America. Despite the growing recognition of the racist ripples that have always pushed the tide of our criminal justice system, most people are versed enough in the current dilemmas of our economic structure (even where they can’t correctly identify all the moving parts). We are backed into a corner of rich getting richer, outsourcing jobs to where labor is cheapest (and done by businessmen waving the flag while holding political office). Technology has put people out of work faster than jobs can be created. Millionaires of the 1% sit in Congress and uphold inequality through such extremes as the Big Bank Bailout, where a trillion dollars flowed to subsidize the criminal and reckless activity of Wall Streeters who simultaneously protest against all government regulation of their activities. And then there is the Javert.

Inspector Javert tells Jean Valjean he is from the same rabble, the same common stock, born inside a prison himself, “but he is no thief.” Both characters represent “France,” born of the Revolution and praying to the same God for guidance and support in their actions. Javert is the law of Man, maintained and executed by men. Javert today is the prison guard, police officer, prosecutor, judge, and politician. In America today, Javert often refuses to investigate the elites for criminal activity while devoting all attention, and resources, to the commoner. Javert, perhaps, does not even see the hypocrisy; conditioned by all the elements of a self-reinforcing system that prays to a God (that “says” whatever any self-appointed interpreter declares), and is educated by the most elite institutions that are funded by this self-replicating system. But the outsiders, the Valjeans (regardless of formal educations or material success), see truth with increasing clarity.

Javert’s oppression, which he sees as “Justice” for the longest time, poses the problem to those who seek fairness: Reform or Revolution? When Javert finally sees his own injustice, he then lacks the tools to truly transform into what the People genuinely need. He becomes a malfunctioning machine that cannot fulfill its mission.

SPOILER ALERT (skip the next sentence if the plot of Les Miserables concerns you):

Javert self-destructs and kills himself in Les Miserables. Again, as Gandhi taught, the oppressor simply cannot continue. Nelson Mandela sought to rewrite the tactic by encouraging (some would say “allowing” via Truth and Reconciliation Commissions) the Javert to reform and merge back into a wider society that reaffirms equality and justice. After nearly two decades of debate, in the front lines of American struggle, I am not firmly in either camp of (a) reforming our economic and/or criminal justice systems (the two have closer links than most believe), or (b) wholesale replacements. My goals are to unite reformers and revolutionaries in common cause, rather than haggle over the ideal end game, and see what best can come of it. (Side Note: some see the term “revolution” as requiring violence, but it does not. It simply means a massive overhaul in the status quo. Many within the political system have openly discussed a massive overhaul of our criminal justice, economic, electoral, or other systems. Like the Internet’s impact on global commerce, such changes could be “revolutionary.”)

With age and experience, any story will take on more layers of meaning. Les Miserables becomes another tale for a former prisoner, and for a father, both perspectives I currently hold. Having now studied millions, seen thousands, and personally known hundreds of people re-entering society after time spent in prison, I see the Javert can be just as ruthless in modern America than 19th Century France. Now, however, Jean Valjean would not have had the opportunity to break free of Javert. With cameras, computers, and databases, people bearing the mark of a conviction are forever branded. They may succeed as business owners, like Valjean did, or even become elected mayor (if a jurisdiction’s law allows people to truly elect any citizen of their choice) as Valjean was… but it will generally be done only where the person’s criminal past is constantly placed at the forefront.

Javert is adamant that “once a thief, always a thief.” We hear that philosophy regarding all manner of criminalized behavior, including addiction. The hypocrisy is most evident when members of the wealthy lawmaking class of citizens do not say the same about their kin. Some supporters of the Javert will exempt their own, saying they “have a problem” and “need help.” They do not get them help by calling the police and pushing for prison. None of them argue that the rehabilitative qualities of a cage are the best option for their own. High-priced thieves are considered to have had a “moral lapse.” Yet as these contradictions come to light, more supporters of Javert begin to recognize the path of 19thcentury class-based systems of judgment are illegitimate where lacking the principle of “All Men Are Created Equal” by a higher power than a body of laws.

People who push back against “Once a thief, always a thief” have drafted and advocated for simple laws that allow those millions of Americans to apply for work based on their ability rather than their former problem or moral lapse. “Ban the Box” is not a specific law, but rather the concept of eliminating the question “Have you ever been convicted of a felony?” Javert cannot ignore the fact that he deploys police forces where people’s skin tones are darkest, even into the schools, regardless of where the crime actually occurs. Javert also knows that decisions made by prosecutors, judges, and parole boards are also skewed by race… further magnified along a prisoner’s personal path of being formerly incarcerated. The evidence of racism in the criminal justice system is overwhelmingly accepted by those who believe it is either too challenging to change, or that the inequality is proper.

Like Jean Valjean, some will overcome Inspector Javert no matter how intense the repression. Exceptionalism, however, does not make for good social policy that affects so many families and, by extension, communities. “By hook or by crook” is street slang for Ends justifying the Means. Many Americans today are faced with violating the law in order to go Straight and Narrow. Most Americans have no idea about the laws and codes to be obeyed, and yet some will still pass judgment like an Armchair Quarterback who does not know the rules of football. Many convicted people lie about their past to get an education, an apartment, or a job, just like Jean Valjean. They violate probations and paroles just to go where the jobs are, or to live where they are accepted. When “doing the right thing” becomes a crime, it is time to sit down and discuss just what Javert is doing, because there is a good chance that even Inspector Javert does not know. The very principles of America are at stake.

There is room at every election for new voices – including the ideas of former communists and those of

There is room at every election for new voices – including the ideas of former communists and those of