I have previously written about PawSox owner Larry Lucchino’s public/private partnerships’ in building PetCo Park for the San Diego Padres and Camden Yards for the Baltimore Orioles. These are the two major projects that Lucchino’s spokesman Dr. Charles Steinberg boasts about on the so-called ‘Listening Tour’ the team has been holding across the state. I will now conclude this series with a brief discussion of several different stadiums, their funding schemes, and the resulting impacts on the surrounding communities.

I have previously written about PawSox owner Larry Lucchino’s public/private partnerships’ in building PetCo Park for the San Diego Padres and Camden Yards for the Baltimore Orioles. These are the two major projects that Lucchino’s spokesman Dr. Charles Steinberg boasts about on the so-called ‘Listening Tour’ the team has been holding across the state. I will now conclude this series with a brief discussion of several different stadiums, their funding schemes, and the resulting impacts on the surrounding communities.

Let’s begin with Fenway Park. According to the City of Boston Tax Assessor’s online portal, team owner John W. Henry owns four parcels of land that are affiliated with the Red Sox organization, properties he pays very substantial taxes to the city on, as seen below.

- Fenway Park, Parcel ID 0504203000, FY2015 Total Assessed Value of $81,413,223.00, FY2016 Preliminary (Estimated) Total Tax Due $1,201,659.17 based on First Half of FY16 (Q1 + Q2), or predicted total FY16 Taxes of $2,403,318.34

- 2 Yawkey Way, Parcel ID 0504199000, FY2015 Total Assessed Value of $5,526,206.00, FY2016 Preliminary (Estimated) Total Tax Due $81,566.80 based on First Half of FY16 (Q1 + Q2), or predicted total FY16 Taxes of $163,133.60

- 12 Lansdowne Street, Parcel ID 0504200010, FY2015 Total Assessed Value of $16,557,920.00, FY2016 Preliminary (Estimated) Total Tax Due $244,394.90 based on First Half of FY16 (Q1 + Q2), or predicted total FY16 Taxes of $488,789.80

- Brookline Avenue, Parcel ID 2100066000, FY2015 Total Assessed Value of $5,992,000.00, FY2016 Preliminary (Estimated) Total Tax Due $88,441.92 based on First Half of FY16 (Q1 + Q2), or predicted total FY16 Taxes of $176,883.84

- Subtotal FY16 Predicted Taxes Due: $3,232,125.58

At the time of the original PawSox stadium proposal, the ownership claimed that their bid for a tax-free property was a reasonable and standard arrangement. This and other matters detailed below will demonstrate just how blatantly untrue that claim was and remains.

Consider the funding of the New England Patriots. When Gillette Stadium opened in 2002, it was a project that team owner Robert Kraft had asked for no public aid in commissioning or constructing. For an article surveying the costs of various venues in the Massachusetts, Bruce Mohl and Jack Sullivan wrote for CommonWealth Magazine:

Gillette Stadium in Foxborough also pays about $2 million, but not in the form of property taxes. Randy Scollins, Foxborough’s finance director, says the town owns the land underneath the stadium under an arrangement set up in the early 1970s to help lure the NFL team to the area… Under the arrangement, the Patriots make in-lieu-of-tax payments to the town funded by ticket fees paid by fans. Foxborough receives $1.42 for every ticket sold to soccer and football games and $2.46 for every ticket sold to concerts and other special events.

Scollins says the ticket fees are likely less than what the town would receive if the stadium paid property taxes, but he says it’s an arrangement that has worked well, particularly since the Kraft family has opened Patriot Place near the stadium, adding significantly to the town’s tax base.

The Patriots are not a tax-exempt organization and this past March, NFL Commissioner Roger Goodell announced the NFL would be giving up its 501 (c) 3 status entirely.

But there is one interesting exception to that rule, the Green Bay Packers. The team is the only not-for-profit, publicly-owned major sports franchise in America, as laid out in a New Yorker Magazine article several years ago. According to this 1999 report from the Wisconsin legislature, the team has an interesting ownership and management diagram:

Approximately 109,700 individuals own shares of Packers common stock but do not receive dividends or profits as a result of stock ownership. The shareholders elect the Packers’ 45-member board of directors, whose members serve staggered three-year terms. The board appoints seven of its members to an executive committee that is responsible for monitoring operations, which includes hiring and evaluating the performance of the president and chief executive officer.

The New Yorker article by Dave Zirin is impressive and worth reading in full, but this quote especially stunned me:

Volunteers work concessions, with sixty per cent of the proceeds going to local charities. Even the beer is cheaper than at a typical N.F.L. stadium. Not only has home field been sold out for two decades, but during snowstorms, the team routinely puts out calls for volunteers to help shovel and is never disappointed by the response.

If one examines the Articles of Incorporation of the team itself, they state clearly that the actual act of playing football is merely incidental to its true mission, “a community project intended to promote community welfare and that its purposes shall be exclusively charitable“. In this 2012 paper for the Oregon State Bar Nonprofit Organizations Law Section, Bay Toft-Dupuy writes:

Guided by the nonprofit nature of its organizational articles and community ownership structure, the Packers operate in an arguably nonprofit fashion. All profits are either invested back in the team or donated to local charities with a six million dollar impact reported in 2012 for one fiscal year alone.

Staying in Wisconsin for a moment, there is a recent article by Michael Powell at the New York Times regarding the Milwaukee Bucks that shows what happens when a sports team talking like Lucchino gets its way:

We’ll keep the Bucks in Milwaukee, the owners said, if the public foots half the cost of a $500 million arena. (The owners spoke of their “moral obligation” to the city and pledged $100 million toward their arena, with the remainder coming from other private funds.) N.B.A. officials acted as muscle for the owners and warned that if Wisconsin did not cough up this money within a year’s time, the league would move the team to Las Vegas or Seattle… Gov. Scott Walker signed a bill Wednesday to subsidize the arena, which could cost the public twice as much as originally projected… Milwaukee County’s portion of arena debt amounts to $4 million annually for 20 years; if the county fails to come up with its payments, the state could deduct the money from annual aid to the county. Abele has spoken of scrounging up the county’s payment by allowing the state to crack down on the county’s many debtors. That sounds fine in theory. In practice, it could mean hounding working-class homeowners for property taxes or pursuing residents who have delinquent ambulance bills. No county can afford to let taxes go uncollected, but that strategy registers as a touch repellent. [Emphasis added]

As the discussion of stadium building has become a national conversation, thanks in part to a recent piece featured on HBO’s Last Week Tonight with John Oliver, the conversation has now evolved to the point where Gigi Douban of Marketplace Business asked in an August 13 piece whether funding a sports complex is an investment or a subsidy.

When a government pours money into a sports venue, sometimes it’s hard to tell whether it’s a subsidy or an investment, Mark Rosentraub, sport management professor at the University of Michigan, says.

“It becomes an investment when there’s a clearly defined set of returns that are worth the risk of any investment,” he says.

Rosentraub says if the arena anchors a bigger redevelopment plan, that’s when it tends to make a city money. But arenas alone don’t equal jobs and new businesses, especially in a quiet city like Milwaukee, according to Andrew Zimbalist, economics professor at Smith College.

“If you’re hoping to promote the local economy by attracting or keeping a basketball team,” he says, “it’s not something that happens.”

Jason Notte over at MarketWatch wrote a piece on July 21 I encourage you to read in full but which I will summarize. Titled 5 CITIES GETTING THE WORST DEALS FROM SPORTS TEAMS, he tells the tale of woe for Milwaukee and four other municipalities that are getting the raw deal from major sports. Minneapolis was promised they would only pay $500 million but are now on the hook for $678 million for a new arena for the Minnesota Vikings. Cobb County, Georgia is borrowing $397 million from the funds for infrastructure and education so to give the Braves baseball team a new home. Glendale, Arizona, a sports mecca, is forking over $308 million for the Arizona Cardinals football team, $225 million for the Arizona Coyotes hockey team, they paid millions more for spring training sites used by the White Sox and Dodgers, and lost money hosting the 2008 Super Bowl, with more losses predicted for this year’s big game. Finally in the District of Columbia, residents are paying $150 million to keep the DC United soccer club from heading to the suburbs, funds that are coming out of badly-needed school renovation line items.

Beth Comery of Providence Daily Dose posted a story on July 29 called ATTENTION JORGE: MAYORS EVERYWHERE SAYING NO TO STADIUMS where, taking off from the recent move by Boston Mayor Marty Walsh in effectively canceling the Boston Olympics, she strongly hints that approving a stadium might be political poison if the Mayor Elorza hops on the bandwagon. It’s a pretty well-duh statement to say that Nicholas Mattiello has reached the highest point in his career, his anti-choice, pro-austerity, and anti-gun control stances would never fly with the DNC, who help fund national House and Senate races. But Gina Raimondo and Jorge Elorza do not strike me as anywhere near finished with their ascendancies. If they wish to hold onto votes with the ever-valuable East Side of Providence, folks who are also known for their wonderful campaign fundraisers, and the fiscally-cautious hinterlands of Cranston, Warwick, Johnston, and South County, they need to show some real strategy and weigh their options. Do they obey the wishes of the PawSox owners and fold, potentially stamping a noticeable black mark on their records, or do they follow the great unwashed masses who will one day be deciding if they keep their jobs?

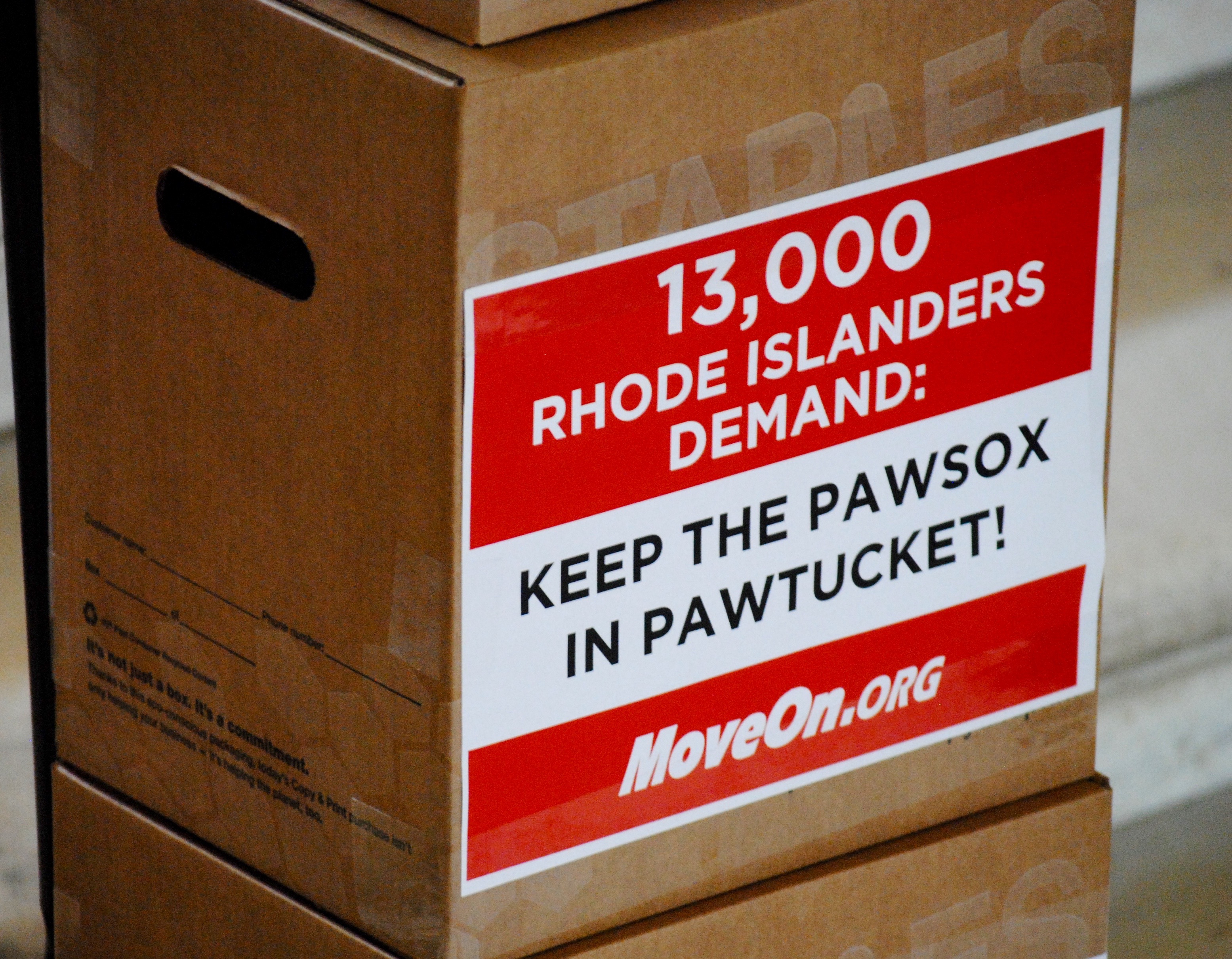

While it’s been widely reported that PawSox ownership’s dream of playing in a riverfront stadium on I-195 redevelopment lands in downtown Providence is dead, the Providence City Council may still get to drive the final – and conclusive – stake through its heart. The Stop the Stadium Deal group announced today in a press release that it will file with the city the necessary paperwork to compel the City Council to consider an anti-stadium ordinance.

While it’s been widely reported that PawSox ownership’s dream of playing in a riverfront stadium on I-195 redevelopment lands in downtown Providence is dead, the Providence City Council may still get to drive the final – and conclusive – stake through its heart. The Stop the Stadium Deal group announced today in a press release that it will file with the city the necessary paperwork to compel the City Council to consider an anti-stadium ordinance.