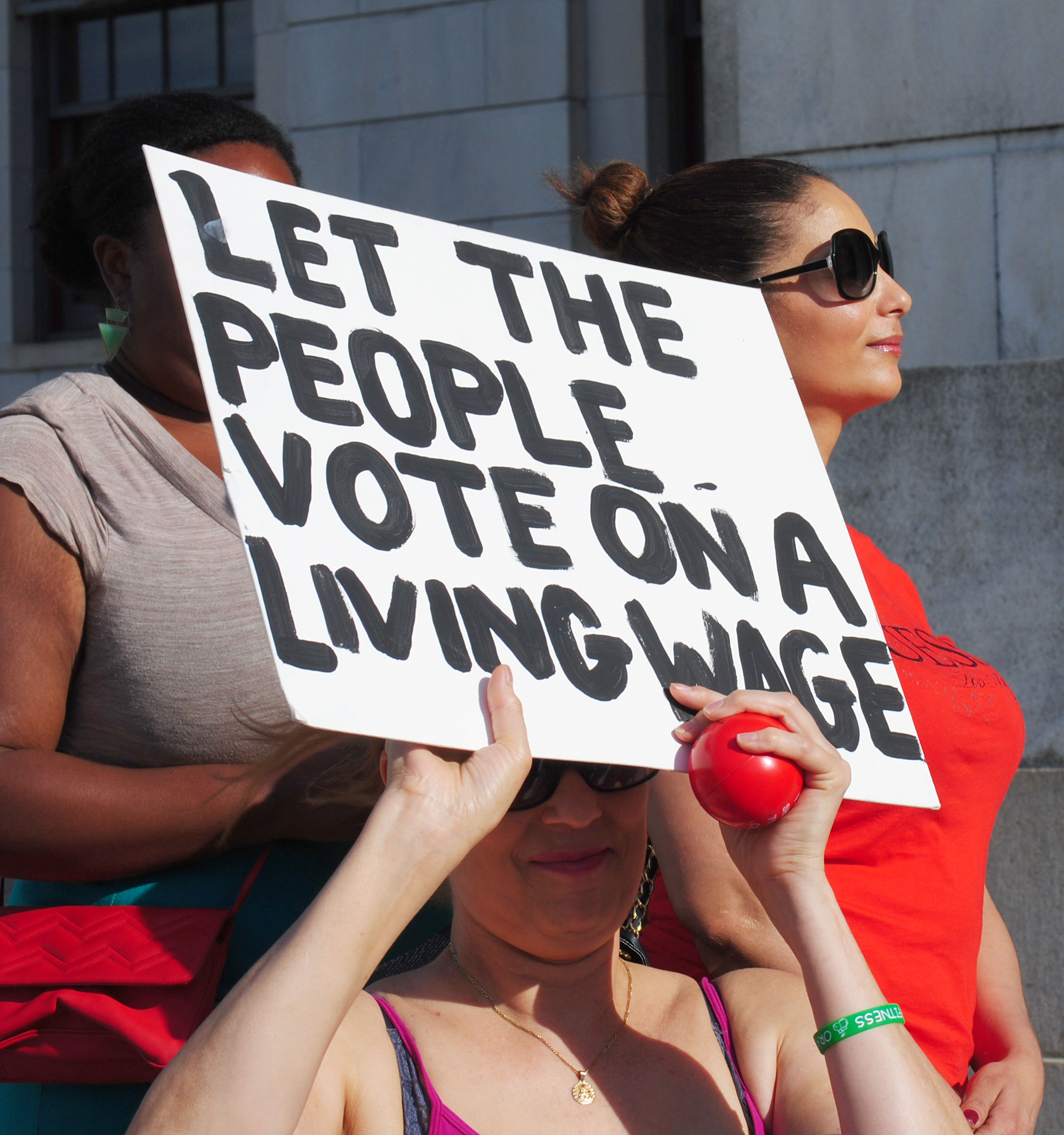

The most poignant and politically instructive story I covered in 2014 was the shameful treatment of the Providence hotel workers who, having successfully petitioned the Providence City Council for the right to place a $15 minimum wage measure on the ballot, were frustrated in their effort by the General Assembly, under the leadership of the newly elected Speaker of the House, Nicholas Mattiello.

The situation for many hotel workers in Rhode Island is bleak. Some hotels pay wages that are close to a living wage, but many do not, most notably the Hilton Providence and the Providence Renaissance, which are mired in a labor struggle with its staff. Both hotels are managed by The Procaccianti Group (TPG) a multi-billion dollar real estate and investment company headquartered in Cranston, Rhode Island. Properties managed by TPG are notorious for extracting profits from investments by keeping wages low and treating employees as disposable commodities.

Hotel employees organized by Unite Here Local 217, have been demanding fair wages, humane working conditions and a union. The hotels have responded punitively, firing high profile and vocal organizers such as Krystle Martin, Adrienne Jones and Marino Cruz.

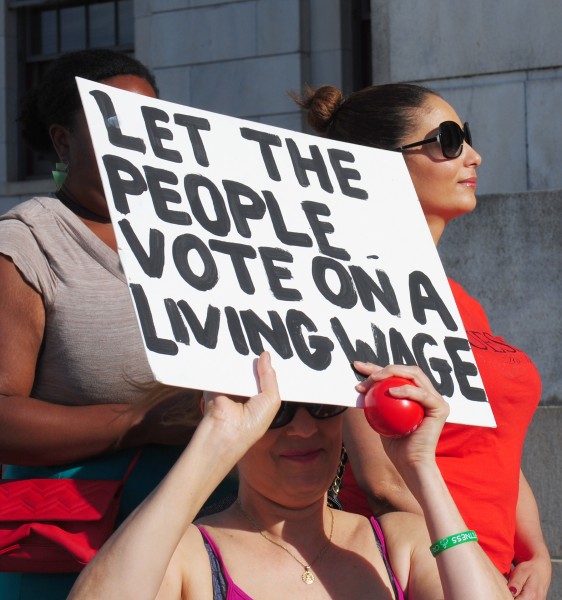

The hotel workers worked hard last winter and spring to collect the 1,000 signatures needed to compel the City Council to consider putting a $15 minimum wage ordinance for hotel workers on the November ballot, presenting their petition on April 10. The City Council held public hearings on the measure on May 27. Though the ProJo tried to convince the public that there were dozens of speakers on both sides of this issue, in truth there were 22 speakers in support and only five hotel lobbyists speaking against the measure.

But the hotels lobbyists still have power. They have so much power that the Providence Ordinance Committee cancelled a meeting to decide on the measure under pressure from… who knows? To this date no one has explained exactly why City Councillor Seth Yurdin cancelled the meeting. Rumor has it that Mayor Angel Taveras, who was planning a run for governor, was anxious to present himself as a friend to corporate interests, but of course, the mayor has no power to compel the cancellation of city council meetings.

What is known is that nearly one hundred hotel workers, their families and supporters made huge efforts to be at the City Hall that night, arranging child care or dragging their kids with them, getting to the City Hall by bus, carpool or walking, losing out on valuable paid work or rare time off in the process. Because the meeting was cancelled at the last minute, the hotel workers ended up in an empty City Hall, with no one to hear their case.

It is thought that actions to stall the passage of the measure were used because, despite the pressure on the City Council by corporate interests, early handicapping revealed that the measure would pass if put to a vote. In addition, polling indicated that Providence voters were quite receptive to the idea of raising the minimum wage for struggling workers.

So despite the financial and political power of the forces opposed to the measure, things were going well for hotel workers in Providence.

Enter ALEC

It’s pretty well known that Mayor Taveras had mixed feelings about the hotel worker’s minimum wage bill. It seems he did not want to be known as the kind of mayor who vetoed such popular measures, but he also did not want to end a promising political career by angering monied interests.

Fortunately for his future plans, Taveras avoided having to address the issue thanks to State Representative Ray Gallison, a “Democrat” from District 69, covering Bristol/Portsmouth. Gallison introduced House Bill 8276, which would take away the power of cities and municipalities to set their own minimum wages, effectively blocking the hotel worker’s efforts. According to a House spokesperson, Gallison’s bill was a direct response to the hard work and determination of the hotel workers, who had followed the rules and used the democratic process in an attempt to enact a positive change.

Gallison’s bill was modeled on legislation pioneered by the American Legislative Exchange Council, or ALEC, what Bob Plain called “the right wing bill mill that drafts corporate-friendly legislation for state legislators.” Why would a Democrat introduce a right-wing bill that caters to corporate interests by keeping hard working people in grinding poverty? I don’t know, because Gallison refused to respond to my requests for clarification.

Gallison’s mistake, however, was putting the proposal out in the form of a bill. A bill needs to be debated in committee, which invites public commentary and media scrutiny. A bill, introduced in the House, must also be passed in the Senate. That means more public commentary and media scrutiny. A bill requires each and every legislator to vote on it and essentially declare themselves for corporate interests or struggling workers. A bill would have to be ultimately signed by the Governor. All that democracy engenders uncertainty and becomes a huge problem when a multi-billion dollar corporation is demanding that something be done to protect its bottom line.

So Gallison, under the direction of the Speaker of the House Nicholas Mattiello, removed his bill from consideration and slipped the measure into the budget. As a budget item, the measure is just one little part of a huge pile of legislation that is passed all at once as an up or down vote. Legislators can say things like, “I don’t support every part of this budget, but as a whole it strikes a compromise I can live with.”

The budget passed the House and the Senate with barely a word spoken against the measure. One notable exception was Representative Maria Cimini, a Democrat. She introduced a measure to amend the budget and undercut Gallison’s ALEC inspired end run. The measure failed. In retaliation for this and other progressive sleights, Speaker Mattiello endorsed Cimini’s opponent, Dan McKiernan, in the Democratic Primary, successfully unseating her.

On June 13, the same night the House passed the budget, the Providence City Council, under the leadership of Michael Solomon, passed a measure putting the $15 minimum wage bill on the November Ballot in what amounted to a symbolic gesture. The efforts of the City Council didn’t matter. The deed was done. On June 16 the Senate passed the budget. All that was required now was Governor Chafee’s signature.

Still, the hotel workers did not give up. Amazingly, hotel workers Santa Brito, Mirjaam Parada and Yilenny Ferreras along with Central Falls City Councilor Shelby Maldonado (now a State Representative) organized a hunger strike, camping outside on the State House Steps for days as the Governor contemplated signing the budget into law.

Still, the hotel workers did not give up. Amazingly, hotel workers Santa Brito, Mirjaam Parada and Yilenny Ferreras along with Central Falls City Councilor Shelby Maldonado (now a State Representative) organized a hunger strike, camping outside on the State House Steps for days as the Governor contemplated signing the budget into law.

I visited the hunger strikers every day. I can’t speak highly enough of their determination and grace. On June 19, day three of the hunger strike, Governor Lincoln Chafee signed the budget into law, effectively ending the effort that had started months ago as hundreds of people collected thousands of signatures in order to get a bill placed on the November ballot that would have improve the lives of countless Rhode Islanders.

Since that day, economic prospects in Rhode Island have steadily worsened. Rhode Island has the highest poverty rate in New England. Despite such dour news, the idea that the General Assembly, following Mattiello’s lead, might do anything this coming session but cut assistance programs to the poor is almost laughable. Only 27% of the jobs in Rhode Island pay enough for a family with two children to survive on. The rest of Rhode Islanders are the working poor, disposable commodities for the rich to use, abuse and toss aside when broken.

When Rep Ray Gallison first introduced his ALEC inspired bill to cut off the efforts of the hotel workers to improve their lives, Santa Brito, housekeeper at the Providence Renaissance and hunger striker said, “House leadership is moving to jail us in poverty.”

Who would have thought that Rhode Islanders would stand by and actually let that happen?

The hardworking hotel workers had successfully petitioned the city council into placing a $15 minimum wage measure onto the ballot. Citizens of Providence would have voted on that measure Tuesday, if not for the actions of the General Assembly. There is little doubt that the measure would have passed here in Providence. I mean, seriously, are voters in Alaska, Arkansas, Nebraska and South Dakota more compassionate than voters in Providence?

The hardworking hotel workers had successfully petitioned the city council into placing a $15 minimum wage measure onto the ballot. Citizens of Providence would have voted on that measure Tuesday, if not for the actions of the General Assembly. There is little doubt that the measure would have passed here in Providence. I mean, seriously, are voters in Alaska, Arkansas, Nebraska and South Dakota more compassionate than voters in Providence?

Brett Smiley, running for the position of Mayor of Providence in this September’s Democratic primary isn’t letting the fact that he hasn’t been elected stop him from coming forward with some bold new initiatives.

Brett Smiley, running for the position of Mayor of Providence in this September’s Democratic primary isn’t letting the fact that he hasn’t been elected stop him from coming forward with some bold new initiatives.