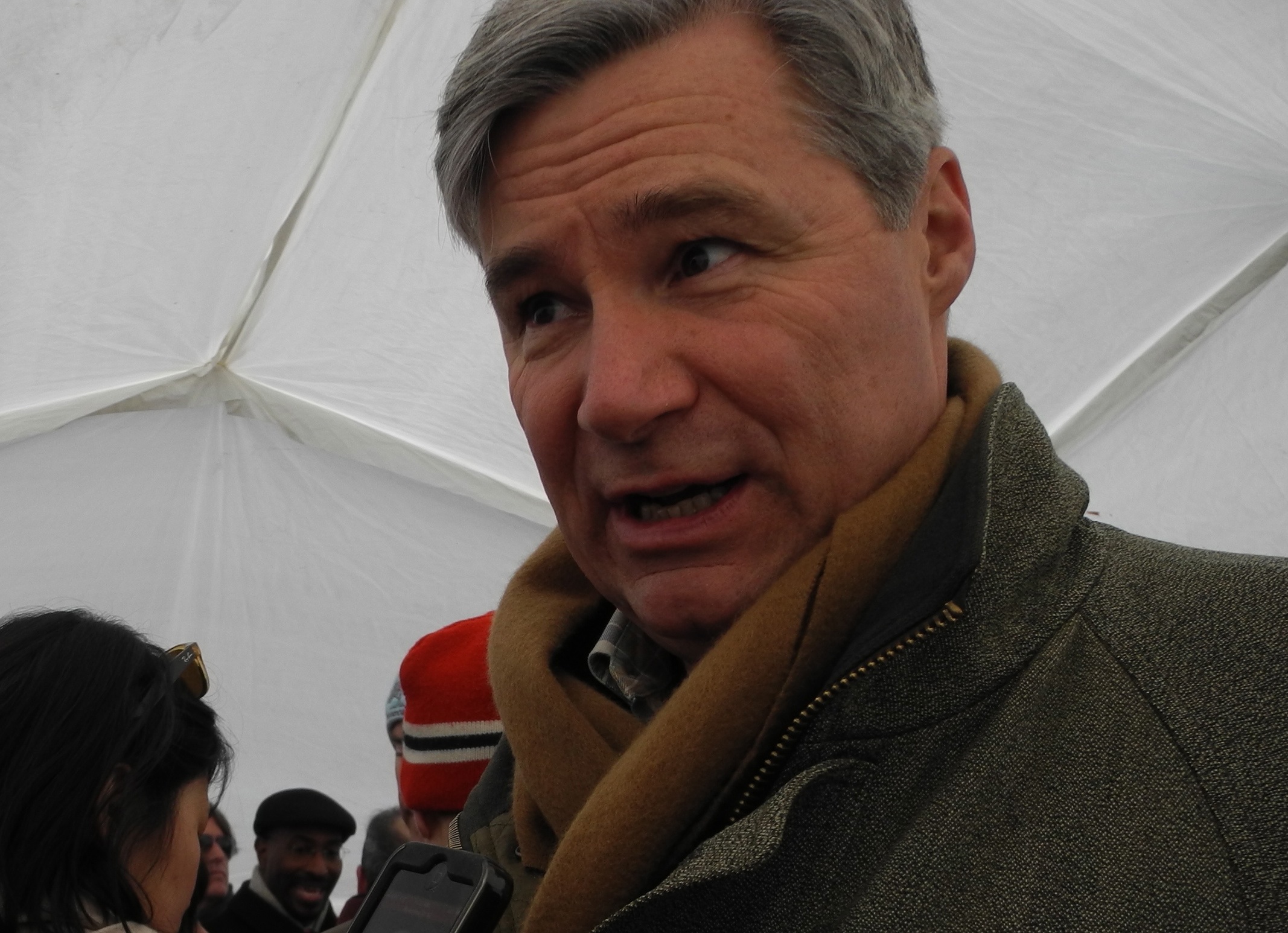

Working with Elizabeth Warren, Sheldon Whitehouse just introduced what I humbly submit is the second-best bill introduced in this Congress. He introduced the Marquette fix.

This is a bit of a wonkish issue, but it’s also a BFD, so please bear with me for a moment. Basically, this bill would overrule Marquette v. First of Omaha, the 1978 Supreme Court decision that was the biggest bank deregulation in American history. What Marquette did was deceptively simple. It said that when a bank chartered in one state makes a loan in another state, it’s the laws of the state in which the bank is chartered that apply, not the laws of the state in which the loan is made. That seems innocuous, but here’s what happened after the decision came down: South Dakota and Delaware completely deregulated their banking industries, and a bunch of banks chartered themselves in those states, effectively wiping out the vast majority of sensible state-based banking safeguards.

Usury laws were the most important banking restriction to fall. A hard cap on interest rates, usury laws used to prevent banks from charging ridiculously high interest rates. But South Dakota and Delaware do not have usury laws, which effectively allows all US banks to charge whatever interest rates they want to. That’s a big deal. Before Marquette, the business of abusive consumer lending really could not exist, and it was actually somewhat difficult for banks to cheat their customers. Obviously, things have changed.

Perhaps most importantly, blue states no longer have the power to protect their citizens from banking abuses. States like California and Massachusetts might like to protect their citizens from the banks, but they are essentially powerless. Unsurprisingly, Rhode Island has some fairly right-wing lending laws. Our usury rate is pretty high (21% or 9% above the Wall St. Journal prime rate, whichever is higher), and one of Bill Murphy’s first acts as Speaker was to put in a special carve-out for credit card issuers.

Because of Marquette, this is largely irrelevant, but there are some things we can do to combat banking abuses. Payday lenders, interestingly, do not really have Marquette protection because of federal regulations, and states can and do regulate them. (Of course, with former Speaker Murphy lobbying for the payday lenders and Gordon Fox as Speaker, that’s a long way from happening in Rhode Island.)

What Whitehouse’s bill does is grant states the ability to set cap interest rates. If this bill passed, blue states would actually have the tools they need to really crack down on abusive practices by the big banks. And immediately, a large body of pre-Marquette law would slam back into place. We would have usury laws again.

The odds for this bill are slim, but I’m glad to see Senator Whitehouse keeping the conversation alive, and I’m glad to see Senator Reed, long a quiet champion of financial reform, cosponsoring this excellent piece of legislation. Good work, Senators!