The Nuns on the Bus came to Providence Saturday night as part of a 13 state tour that ended at the Democratic National Convention in Philadelphia. At each stop, the Nuns held meetings where concerned residents could share their concerns about a range of topics – including tax justice, living wages, family-friendly workplaces, access to democracy, healthcare, citizenship and housing. These meetings were held under the general title of “Mending the Gaps” and the discussion points and concerns from each meeting are to be delivered in Philadelphia.

The Nuns on the Bus came to Providence Saturday night as part of a 13 state tour that ended at the Democratic National Convention in Philadelphia. At each stop, the Nuns held meetings where concerned residents could share their concerns about a range of topics – including tax justice, living wages, family-friendly workplaces, access to democracy, healthcare, citizenship and housing. These meetings were held under the general title of “Mending the Gaps” and the discussion points and concerns from each meeting are to be delivered in Philadelphia.

The Nuns arrived at St. Michael’s Church in South Providence to the music of the Extraordinary Rendition Band and St. Michael’s own drummers.

During the discussions the Nuns learned about the obscene child poverty rates in Rhode Island, the criminality and disconnect of many of our elected leaders and our state’s support for the fossil fuel industry and the environmental racism such support entails. The meeting filled the basement of St. Michael’s.

From Providence the Nuns headed to Hartford, Scranton and Newark before arriving in Philly on July 26. You can follow their progress here.

Today I declined a cost of living adjustment increase to my legislative salary, and committed that I will not take a raise until Rhode Island raises the minimum wage for all low-income workers.

I recognize this is an entirely symbolic move, and in fact that it is a particularly tiny symbol, considering how minuscule this legislative salary increase is (it’s real, real small). And I support the COLA on principle – in fact, I think that the (comparatively) low compensation for state legislators in Rhode Island is a significant barrier keeping a lot of Rhode Islanders from serving in elected office, particularly low-income Rhode Islanders whose voices we desperately need in the General Assembly. But as a legislator, I do not personally feel comfortable taking any cost of living adjustment knowing that Rhode Island’s lowest-paid workers have not received any adjustment.

It is past time for our state to declare that no Rhode Islander that works full-time should live in poverty. Our current minimum wage is a starvation wage, and too many Rhode Island families are struggling to get by on this inadequate pay. We need a LIVING wage, which is why I support the Fight for $15, and why I will continue working to increase our minimum wage and refuse future salary increases until we are at least on par with our neighbors here in New England.

Speaker Nicholas Mattiello said that though he “is very supportive of raising the minimum wage,” and that Rhode Island “needs to be competitive” with our neighboring states, he has, “heard from the business community” that they need time to absorb the current wage before increasing it again. Mattiello said that the minimum wage has gone up four years in a row and, “I’ve indicated that we’re going to look at it next year.”

Speaker Nicholas Mattiello said that though he “is very supportive of raising the minimum wage,” and that Rhode Island “needs to be competitive” with our neighboring states, he has, “heard from the business community” that they need time to absorb the current wage before increasing it again. Mattiello said that the minimum wage has gone up four years in a row and, “I’ve indicated that we’re going to look at it next year.”

Massachusetts currently has a $10 minimum wage and they are going to $11 in 2017. Connecticut has a $9.60 minimum wage and will go to $10.10 in 2017. Rhode Island’s minimum wage of $9.60 will remain in effect until at least 2018, making our state an outlier. Speaking at a community event in Providence last night Governor Gina Raimondo expressed some disappointment that the 50 cent increase in the minimum wage that she had proposed was not in the budget.

Douglas Hall, Director of Economic and Fiscal Policy at the Institute, had this to say:

]]>We are disappointed that the house budget does not include an increase to the state’s minimum wage. Increasing the minimum wage to $10.10 would have raised the wages of 78,000 Rhode Island workers. What businesses in Rhode Island need most are consumers with disposable income–the real ‘job creators’–to buy their goods and services. A $10.10 minimum wage would have given our lowest income workers an additional $27 million in wages. While we are happy to see a slight increase to the Earned income tax credit, the research shows that coupling both an EITC increase with an increase in the minimum wage reduces poverty and boosts the economy.

“And while we hate to see Rhode Island’s minimum wage workers fall further behind neighboring Connecticut and Massachusetts, the real concern is that every year we do not increase the minimum wage, we’re effectively cutting the wages of our lowest income earners, as inflation eats away at their already inadequate wages. More than a quarter of those who would have benefited from an increase to $10.10 have children, and more than a quarter are married. One in five Rhode Island children have a parent who would have seen an increase in wages. Instead, a full-time, year-round worker earning the Rhode Island minimum wage will see the buying power of their $19,960 eroded by inflation. With one in five Americans living in a jurisdiction that’s on a path to a $15.00 minimum wage, Rhode Island families working hard for low-wages are being told they have to wait.”

Wage inequality continued its rise unabated in 2015, according to a new report from EPI senior economist Elise Gould. In Wage inequality continued its 35-year rise in 2015, Gould analyzes real (inflation-adjusted) wage trends in 2015 and shows that, while real wages increased across the board, wage growth was faster at the top of the wage distribution than the bottom—the gap between top earners and the typical worker continues to grow.

Wage inequality continued its rise unabated in 2015, according to a new report from EPI senior economist Elise Gould. In Wage inequality continued its 35-year rise in 2015, Gould analyzes real (inflation-adjusted) wage trends in 2015 and shows that, while real wages increased across the board, wage growth was faster at the top of the wage distribution than the bottom—the gap between top earners and the typical worker continues to grow.

Due to a sharp dip in inflation, real hourly wages grew for all workers in 2015. However, falling inflation is unlikely to be a source of durable wage gains in the future. Growth in nominal (non-inflation adjusted) wages has not accelerated, and there is no evidence to indicate that the Federal Reserve Board should raise interest rates in an effort to slow the economy and ward off incipient inflation.

“It’s no surprise that typical workers are frustrated with the economy since wage growth has been slow for so long,” said Gould. “Real wage growth in 2015 is welcome news, since it means workers’ standards of living increased. However, this comes with two large caveats. First, wage inequality showed no sign of slowing down last year. And, meanwhile, relying on falling inflation is an unwanted and unsustainable strategy for increasing living standards.”

The strongest wage growth in 2015 occurred among men at the top of the wage distribution and women at the bottom of wage distribution. Men’s wages at the 95th and 90th percentiles grew by 9.9 percent and 6.2 percent, respectively, compared with only 2.6 percent at the median. Low wage workers, meanwhile, saw greater wage gains in states that increased their minimum wage. Women’s wages at the 10th percentile, which are lower than men’s at the bottom decile and therefore may be more likely to be impacted by changes in the wage floor, grew 5.2 percent in states with legislated minimum wage increases, compared with only 3.1 percent growth in states without increases.

[From an Economic Policy Institute press release]

]]>

The Governor’s Budget Article 13 increases the minimum wage to $10.10 next year and expands the state earned income tax credit from 12.5 percent to 15 percent of the federal credit (the Governor indicated an interest in further expanding the EITC pending available resources following the mid-year revenue forecast). Senator Goldin and Representative Slater have each introduced bills ((S 2156 and H 7347, respectively) to further increase the EITC to 20 percent of the federal credit. Lawmakers have made real progress in these two areas over the past two years and we are pleased to see a commitment to raising the labor and living standards of our workers going forward.

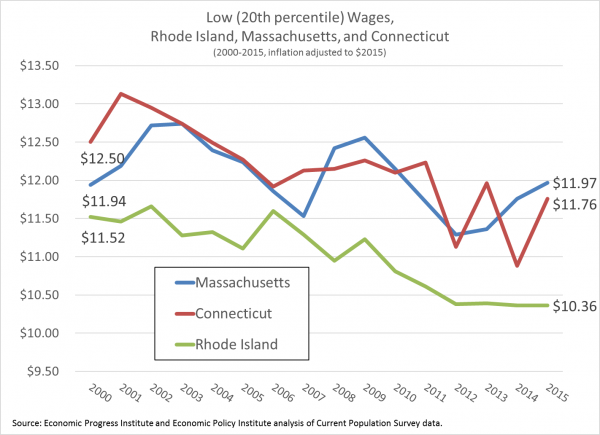

These two measures are particularly important in light of the persistent decline in Rhode Island’s low wages since 2000, and the gap between low wages in Rhode Island and those in Connecticut and Massachusetts, evident in Figure 1.

Research shows that coupling an EITC increase with an increase in the minimum wage has a greater impact on reducing poverty than either does on its own. This finding contradicts those who point to one approach as superior to the other in helping low-wage workers make ends meet. Both, together, have maximum beneficial impact. Using these policies together also requires that businesses and our government both play key roles in boosting incomes for workers in low-wage sectors, which is both fair and practical.

Today, minimum wage workers do not earn enough to meet basic needs. The Rhode Island Standard of Need, a study that documents the cost of living in the Ocean State, shows that a single adult needed to earn $11.86 per hour in order to meet his or her most basic needs in 2014.

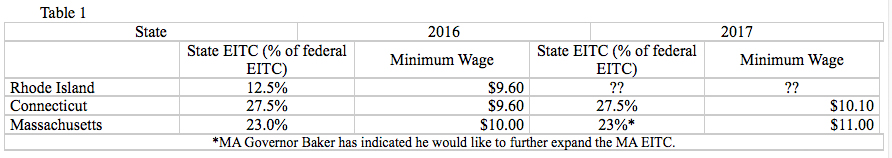

As seen in Table 1, Rhode Island currently significantly lags its neighbors, Massachusetts and Connecticut, in the size of state EITC, and will fall behind Connecticut (and even further behind Massachusetts) for the minimum wage, unless the Rhode Island minimum is increased to at least $10.10 in 2017. Both of our neighboring states have steadily increased their minimum wages in recent years.

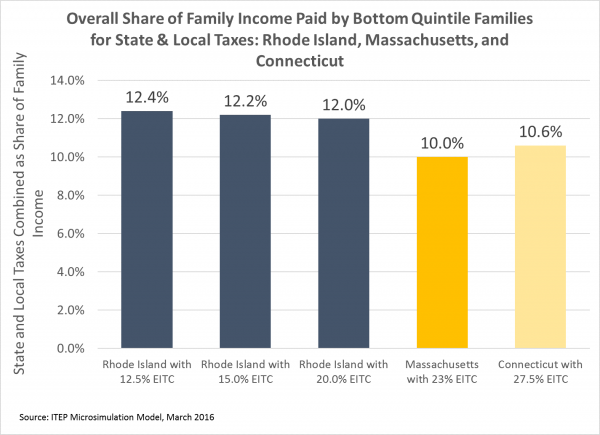

EITC filers pay payroll taxes, sales and property taxes, the car tax, gas tax. Even with the increase in the state EITC to 12.5%, Rhode Island still has one of the highest effective tax rates on low-income households, when looking at the combined state and local taxes – 7th highest among all states. The EITC is the best way to provide some targeted tax relief to those who need it most.

Compared to our neighboring states, families in the bottom quintile (bottom 20 percent of family income) pay 12.4 percent of their income in state and local taxes, compared with 10.0 percent in Massachusetts, and 10.6 percent in Connecticut. Increasing the RI EITC helps close this gap modestly – a 15 percent EITC in Rhode Island would lower bottom quintile taxes to 12.2 percent, and a 20 percent EITC would lower it to 12.0 percent, according to recent analysis by the Institute on Taxation and Economic Policy, evident in Figure 2. (Higher sales and excise taxes in RI account for much of the current gap).

Putting more money in the pockets of workers will also put more money in the cash registers of local businesses. Raising the minimum wage to $10.10 would put nearly $27 million in the pockets of 78,000 Rhode Island workers in low-wage jobs, money that would flow quickly into the local economy.

Raising the minimum wage and the EITC are important steps that lawmakers can take to help ensure that workers are able to keep their heads above water in the Ocean State, and to keep the Rhode Island economy on a path to full economic recovery.

]]> As corporations achieve extraordinarily high profit levels and executive pay reaches new heights, wages in certain sectors are so low that even those who work full time must rely on government assistance to make ends meet. A new report from EPI economic analyst David Cooper finds that raising wages for low-wage workers will significantly reduce government spending on public assistance, making billions of dollars a year available for improvements to other anti-poverty programs.

As corporations achieve extraordinarily high profit levels and executive pay reaches new heights, wages in certain sectors are so low that even those who work full time must rely on government assistance to make ends meet. A new report from EPI economic analyst David Cooper finds that raising wages for low-wage workers will significantly reduce government spending on public assistance, making billions of dollars a year available for improvements to other anti-poverty programs.

“When employers pay wages so low that working people have to turn to public assistance to make ends meet, they’re effectively receiving a subsidy from taxpayers,” said Cooper. “Policies that raise wages would free up resources that could then be used to strengthen anti-poverty programs or make investments in any number of other policy priorities. The simplest way we can do this is by raising the federal minimum wage.”

The majority (66.6 percent) of individuals and families who receive public assistance work or are in a family in which at least one adult works. This number grows to 71.6 percent when focusing on recipients under the age of 65. More than two-thirds (69.2 percent) of all public assistance benefits that go to non-elderly families go to families in which at least one adult works.

If the bottom 30 percent of wage earners received a $1.17 per hour pay raise, more than 1 million working people would no longer need to rely on public assistance. For every $1 that wages rise among these low-wage workers, spending on government assistance programs falls by roughly $5.2 billion. Because this estimate is conservative and does not include the value of Medicaid benefits, it has the potential to be even higher.

Other findings from the paper include:

- Raising the minimum wage to $12 by 2020 would reduce public assistance spending by $17 billion. These savings could be used to make improvements other anti-poverty programs, such the President Barack Obama’s proposal to expand the national school lunch program to provide food for children during the summer months.

- Workers in the arts, entertainment, recreation, accommodation, food services, and retail trade industries are disproportionately represented among public assistance recipients.

- Roughly 60 percent of all workers making less than $7.42 per hour receive some form of government-provided assistance, either directly or through a family member.

- More than half (52.6 percent) of workers paid between $7.42 and $9.91 per hour receive public assistance, either directly or through a family member.

- Nearly half (46.9 percent) of all working recipients of public assistance work full time.

[From a press release]

]]> “The worker deserves his [or her] wages.”

“The worker deserves his [or her] wages.”– Apostle Paul (1 Tim 5:18)

Let’s get real. Any adult working for $7.25 an hour is being exploited, and the $9.60 Rhode Island minimum beginning January 1, 2016 also falls far short of being just.

Ask any Haitian garment worker: Survival requires servitude—-even if paid a scandalous 64 cents an hour.

Slavery is forced labor which legally rescinds all freedoms. A poverty wage is wage slavery, legally allowing employers to pay wages which eliminate many freedoms: The freedom to obtain decent housing; the freedom to take a paid vacation or sick day; the freedom to spend time with children; the freedom to retire; and, for some families, even the freedom to eat every day of the month.

Of course, the minimum wage promotes at least one freedom: The freedom to work two or three jobs.

The Declaration of Independence speaks eloquently to the minimum wage, stating that the Creator endows us “with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.”

How can a person experience Life when their work is punished with poverty? How can a person experience Liberty when unjust wages impose soul-crushing limitations? How can a person pursue Happiness with the drudgery of constant work? Are Life, Liberty and the pursuit of Happiness truly today’s “unalienable Rights”?

Living Wage Benefits Many

Two practical arguments win the day for a minimum wage which is a living wage. First, a raise stimulates the economy because minimum wage workers spend virtually all they receive. For example, with a raise to $10.10, the Economic Policy Institute estimates the boost in Gross Domestic Product would support the creation of 85,000 new jobs.

Second, a raise also decreases government spending to assist minimum-wage workers. Think corporate welfare. Government’s indirect subsidies to unethical businesses cease when a living wage is mandated.

The most pertinent argument for a living wage is moral. As the Apostle Paul wrote: “The worker deserves his [or her] wages.”

I recently heard a politician cynically argue we could raise the minimum wage to $50. This logical fallacy is absurd. Similarly, we could argue for a minimum wage of three dollars. Of course, the minimum wage should be the legally permissible minimum enabling a decent life.

Some opponents maintain the minimum wage is for training teenagers. To the contrary, the Department of Labor reports 88 percent are at least age 20. Moreover, even a single adult requires $11.86 an hour to escape poverty.

At least $12 an hour—and a benefits package which includes health insurance, vacation time, sick time and retirement pay—would provide a living wage. Indeed, the Institute for Policy Studies estimates that if the 1968 minimum wage was adjusted for income growth and inflation, workers would receive $21.16. The U.S. permits 34% of this wage.

Pols Opposing Minimum Wage

This prompts the question: Who is responsible for this repugnant impoverishment of workers? The answer is straightforward. While raises are frequently passed when Democrats are in charge, Republicans blocked all raises during the 16 years of the Ronald Reagan and George W. Bush administrations.

In what moral universe do these politicians live?

The jargon of plutocrats and pols tell the story: They cite ‘capitalism’ (meaning the choice of those with capital to fleece workers); they cite ‘the free market’ (meaning misers seek freedom from regulation so they can pay paltry wages); and they cite ‘supply and demand’ (meaning employees are priced the same as goods and services—-ignoring the requirements for Life).

Worshipping at the altar of unregulated capitalism justifies treating people as property. Isn’t this the very definition of slavery? What a crude and callous obscenity.

Want to make a difference? Encourage your RI Senator and Representative now to introduce a living wage bill this January. You can identify your state legislators at https://sos.ri.gov/vic. Oppose the moral outrage of today’s slave labor with a demand for wise and caring justice.

Rev. Harry Rix is a retired pastor and mental health counselor living in Providence, RI. He has 50 articles on spirituality and ethics, stunning photos, and 1200 inspiring quotations available at www.quoflections.org. ©2015 Harry Rix. All rights reserved.

]]> A “single-parent, with an infant (age 0-1) and a school-aged child (age 6-12) needs to earn $62,693 a year or $30.14/hour to cover the basic expenses required to raise a family in Rhode Island,” says the Economic Progress Institute, (EPI, formerly The Poverty Institute) a nonpartisan research and policy organization dedicated to improving the economic well-being of low- and modest-income Rhode Islanders. “More than one-fourth of that family’s expenses will go towards child care; a whopping $1,446 a month.”

A “single-parent, with an infant (age 0-1) and a school-aged child (age 6-12) needs to earn $62,693 a year or $30.14/hour to cover the basic expenses required to raise a family in Rhode Island,” says the Economic Progress Institute, (EPI, formerly The Poverty Institute) a nonpartisan research and policy organization dedicated to improving the economic well-being of low- and modest-income Rhode Islanders. “More than one-fourth of that family’s expenses will go towards child care; a whopping $1,446 a month.”

The EPI released this sobering news along with an updated version of its Cost of Living Calculator, designed to provide “a more realistic measure of economic security than the commonly used federal poverty level (FPL) which measures economic security based on the cost of food,” according to a press release. “The Calculator allows users to see what it costs families of different sizes to pay for housing, child care, health care, food, transportation and taxes and then calculates the pre-tax (gross) income they need to meet their expenses.”

Rhode Island’s recent move to raise the minimum wage from $9 to $9.60 is not nearly sufficient says the EPI, since a “single adult without children needs to earn $24,640 a year or $11.85/hour to meet his or her basic needs.”

In addition to the Cost of Living Calculator, the EPI also publishes a “comprehensive ‘Guide to Assistance’ explaining the government assistance programs and community resources available to help individuals and families meet basic needs including food assistance, tax credits, and child care subsidies which can all help lower-wage working families make ends meet.”

“We hope these tools serve to better educate the public and policymakers about the cost-of-living in the Ocean State and the importance of government assistance programs for the large number of Rhode Islanders working in low-wage jobs” said Kate Brewster, executive director of the Economic Progress Institute, in the press release. “Many people often don’t realize they are eligible for help paying for basic needs like child care and food. We encourage Rhode Islanders who are struggling to pay the bills to review the Guide to see if they qualify for assistance.”

]]>

Lost in all the discussion surrounding the reformation of Tax Stabilization Agreements (TSAs) in Providence is the fact that a multi-billion dollar resort hotel chain is an intended recipient of Rhode Island taxpayer’s largess.

TSAs are enormous breaks on property taxes negotiated by the City Council as an incentive for businesses to locate in the city. This week the Providence City Council is expected to vote on a package of TSAs that will clear the path for the so-called “meds & eds” project on part of the I-195 land.

The Providence Journal reported that included in the I-195 land life-science park proposal is “a Le Meridien hotel with 175 rooms and 10,000 square feet of meeting space.” The Le Meridian is to be operated by Starwood Hotels and Resorts, a company that regular reports cash flows of approximately $850 million to $950 million a quarter. Starwood runs 1,200 hotels and resorts, and paid dividends to their investors to the tune of $2.4 billion last year.

Under the new TSAs, “projects over $10 million will be eligible for a 15-year tax stabilization agreement that will see no taxes in the first year, base land tax only in years 2-4, a 5% property tax in year 5 and then a gradual annual increase for the remainder of the term.”

In essence, Providence will be giving away millions of dollars to billionaires.

In return, the “agreements include women and minority business enterprise incentives as well as apprenticeship requirements for construction and use of the City’s First Source requirements to encourage employment for Providence residents.”

Unfortunately, Finance Chair Igliozzi has declined to deliver on the suggestion he made last year when he said that companies that pay less than $15 an hour should not receive tax breaks from the city.

Unfortunately, Finance Chair Igliozzi has declined to deliver on the suggestion he made last year when he said that companies that pay less than $15 an hour should not receive tax breaks from the city.

Igliozzi has not responded to a request for comments.

]]>]]>