Look around any impoverished neighborhood in Rhode Island and you’ll easily find a neon sign above a storefront offering a payday loan. This is what legalized loan sharking looks like.

Such stores have sprung up all over the poorest parts of Rhode Island since the legislature passed an exemption to state usury laws in 2001. Payday loans are illegal in every other New England state. But where they are legalize, they are extremely popular – there are more payday loan stores in the United States than McDonalds, Home Depots and Walmarts combined.

Inside these stores, desperate poor people with few other options – and certainly none so neon and readily found – buy quick cash in exchange for usuriously high interest rates. In Rhode Island, the General Assembly allows payday lenders to charge up to 260 percent annual interest while every other type of lending is capped at 36 percent.

Only 2 percent of payday loans get paid back on time, and in Rhode Island the average borrower will need 8 additional payday loans to pay the first one off. Those who turn to payday lenders are twice as likely to eventually file for bankruptcy.

The Rhode Island Coalition for Payday Lending Reform, led by community activists Margaux Morrisseau and Rev. Don Anderson, has waged a high profile campaign to reform predatory payday loans in recent years and a 2012 Public Policy Polling survey found that three-fourths of Rhode Islanders want them reformed.

Governor Gina Raimondo has been a strong advocate.

“She believes we need to protect Rhode Islanders from predatory lending practices, and supports developing alternatives to create access to fair, responsible, low cost alternatives for borrowing,” said Raimondo spokeswoman Marie Aberger yesterday in an email.

Raimondo was more blunt at a 2012 press conference. “It’s a predatory product,” she said then. “People need to know about the dangers of payday lending so they can take care of themselves. Everyone needs a loan once in a while and you ought to be able to do it in a way that is safe and reliable and doesn’t trap you.”

Despite bipartisan support from 80 legislators in both legislative chambers, House Speaker Nick Mattiello won’t allow the General Assembly to vote on the bill. His personal friend and poltiical ally, former Speaker Bill Murphy, is a paid lobbyist for the payday loan industry. It’s really that simple. Two powerful people, Mattiello and Murphy, are preventing the people of Rhode Island from ending this predatory practice.

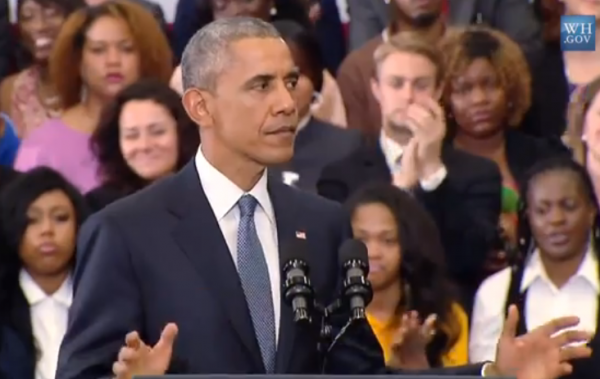

But as of yesterday Mattiello and Murphy, nominally Democrats, have yet another adversary in their quest to defend payday lenders instead of impoverished Rhode Islanders. President Barack Obama joined the chorus against this predatory practice yesterday in announcing the Consumer Financial Protection Bureau will increase federal regulations of payday lending.

Speaking in Birmingham, Obama said, “You’ve got some very conservative folks here in Alabama who are reading their Bibles and saying, ‘well that ain’t right.’ The Bible’s not wild about someone charging $1,000 worth of interest on a $500 loan.”

Payday loan reform is also a bipartisan issue here in Rhode Island. House Minority Leader Brian Newberry is a lead sponsor of the reform bill and yesterday new GOP executive director Luis Vargas tweeted, “horrible, horrible businesses that prey on those in poverty. We definitely need to get rid of payday lenders.”

Obama said reforming payday loans is part of his middle class economy agenda. “One of the main ways we can make sure paychecks go farther is to make sure working families don’t get ripped off,” he said.

The CFPB proposes to limit the number of consecutive payday loans and require some credit verifications. But these protections aren’t air tight, according to a press release from the RI Coalition for Payday Lending Reform.

The proposal unveiled today by the Consumer Financial Protection Bureau takes an important step toward reining in a wide range of abusive lending products but also includes a gaping loophole that in essence puts a government stamp of approval on unaffordable back-to-back loans with interest rates that average near 400 percent. The RI Coalition for Payday Lending Reform urged the CFPB and Director Cordray to reconsider and leave this loophole out of the rule.

The proposed affordability standard, which is smart, fair and flexible, would require small-dollar lenders to do business the same way we expect responsible banks and mortgage lenders to – by making good loans.

If adopted, this simple change would end the cycle of debt that is the business model of payday lending, where 75 percent of all fees are generated from borrowers who take out more than 10 loans a year. It would strengthen access to good credit for consumers who need it and give responsible lenders a fighting chance to compete, thrive and profit in a fair environment.

But sanctioning even one abusive loan, let alone six, will keep responsible lenders out of the marketplace and open the door to the kinds of creative manipulation of the rules that payday lenders have a history of using to exploit loopholes and continue business as usual.

After all, these are the same people who managed to circumvent the Department of Defense’s efforts to cap loan rates to members of the military by, for example, making loans for three months and a day to get around rules governing three-month loans.

Along similar lines, in Ohio, when payday lenders became subject to a rate cap the lenders simply changed their names, calling themselves mortgage lenders to skirt new rules.

As the Bureau moves forward to protect consumers, The RI Coalition hopes that it removes the “look-the-other-way,” standard for the first six loans and applies a strong affordability standard to the first loan and to every loan.

Only with consistent, airtight standards that require loans to be affordable will protections work to stop debt trap lending, keep hard-working Americans from being lured into financial quicksand, and maintain and grow a strong, responsible, low-dollar loan market.

At the same time, states must continue their work to enact and enforce what the Consumer Financial Protection Bureau cannot –rate caps that end usury once and for all.

The CFPB can’t change the interest rates states set for payday loans. In Rhode Island, it seems only Mattiello and Murphy can do that.