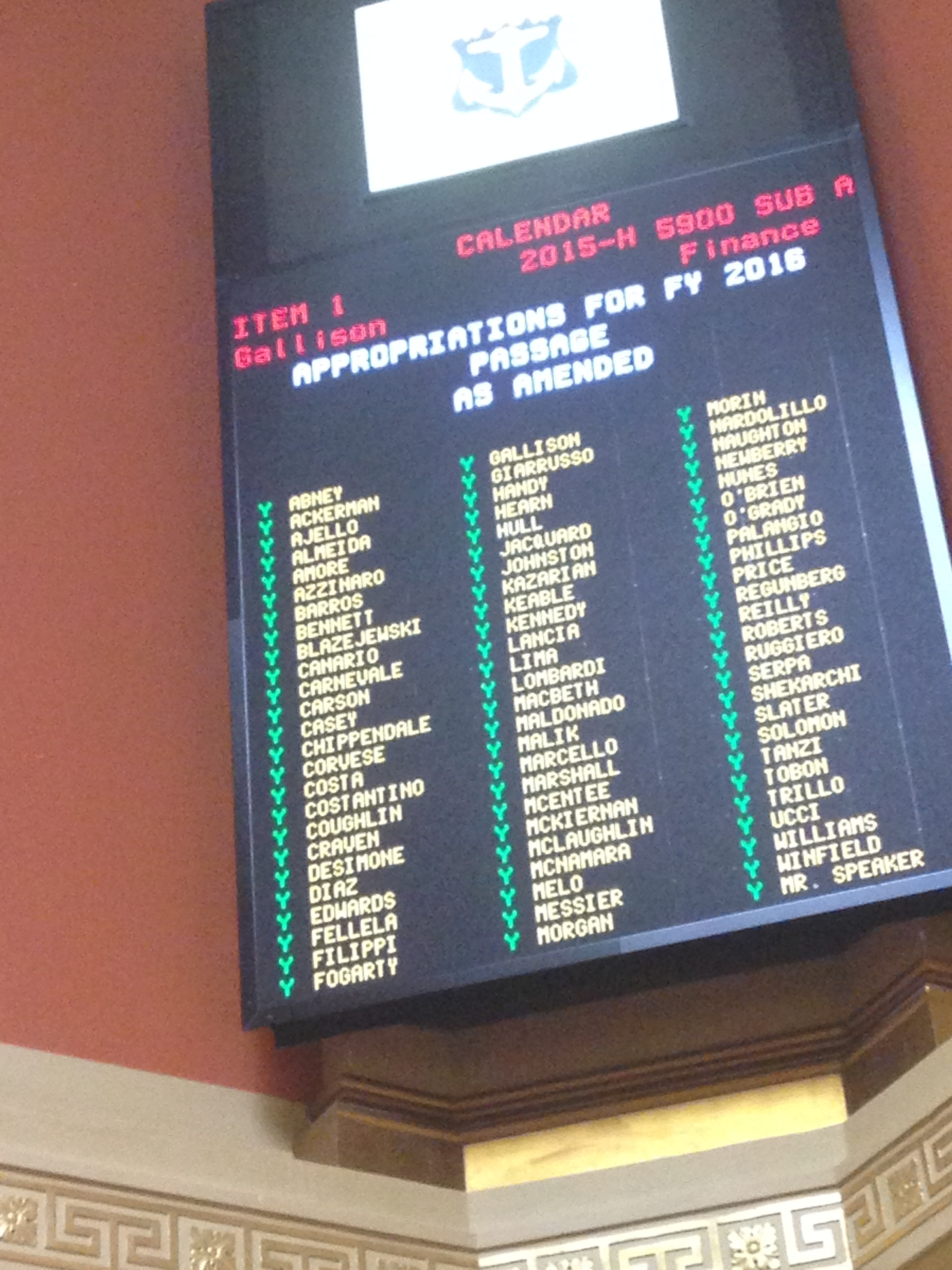

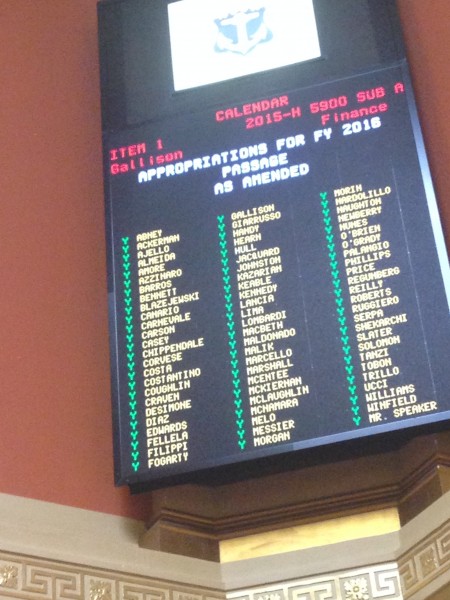

In what everyone thought would be a firestorm of debate, the RI House of Representatives unanimously passed the $8.7 billion FY 2016 budget with little to no discussion about many of the articles, including the much contested Medicaid cuts and pension settlement, as well as Governor Raimondo’s so called “job tools.” According to a House spokesperson, this is the fastest that the budget has gone through in nearly three decades.

The only budget articles that were seriously debated on the floor were numbers 11, which concerned taxes and revenues; and 18, which provided the funding to HealthSource RI, Rhode Island’s Affordable Care Act state exchange. There were two article introductions during the debate, one concerning the funding for the Rhode Island Public Transit Authority (RIPTA), and one simply to renumber the articles in the bill after its introduction. Representative Patricia Morgan (R-District 26), was going to introduce an article to fund bridge repairs, but recognized that she did not have the support to pass it.

Although discussion was sparse on the floor, Rep. Morgan was one of the few members who continually sparked debate, particularly over article 11, which had the longest discussion out of all of the sections voted upon. Amendments had already been proposed to the article, but had been struck down. Morgan proposed two amendments herself, the first of which would promote lean government standards for the state, and according to her, dramatically decrease costs for running state government.

“Many states at this point, have already started lean government initiatives, and it has given them a lot of fruit,” she said. “There are incredible efficiencies that have resulted from lean government.

Morgan planned to pay for the new service by taking $500,000 from the Newport Grand Casino and putting it towards creating a lean government initiative, which Governor Raimondo has already stated she supports. Her reasoning? That the casino was not in dire need of the funds.

“Last year, the new owner proposed $40 million for remodeling,” Morgan said. “If he has $40 million for that, I guess he can give up $500,000.”

The amendment saw staunch opposition, especially because, according to several representatives, 60 percent of the casino’s money goes directly back into the state.

“Just because Newport Grand may be part of corporate America, we are here to help businesses thrive in our economy,” Representative Dennis Canario (D-District 71) said.

“To take $500,000 out of Newport Grand would jeopardize the integrity of that business,” House Majority Leader John DeSimone (D-District 5), argued.

Although Morgan’s first amendment failed 71-4, she brought up another amendment immediately after that tried to use the same funds from Newport Grand to pay for a 38 Studios investigation.

“The people of this state deserve to know how it happened, why it happened, who did it, and try to keep it from ever happening again,” Morgan said.

Her second amendment did not even get the chance to go up for debate, as it was ruled not germane to the discussion. The ruling was met with cheers from other representatives.

Article 18 funded HealthSource RI, which has been hotly contested over the past few days due to restrictive abortion coverage language. However, Finance Committee Chairman Representative Raymond Gallison (D- District 69) introduced an amendment that would curb such restrictions, and allow access for those who require abortions even if their insurance plan has cited religious exemptions from covering them.

Surprisingly, the amendment passed with no discussion, but the article itself saw debate due to King V. Burwell, the current Supreme Court case determining whether or not states should receive tax subsidies from having their own healthcare exchanges. While some representatives thought that keeping the exchange would make Rhode Island less business friendly, it was upheld in the vote.

What is more striking than what was debated, though, is what was not. Cornerstone legislation in the bill went by without so much as a peep from representatives. Medicaid cuts, the pension settlement, Raimondo’s jobs initiative, professional licensing, all day kindergarten, school construction, and even appropriations of funds from FY 15 are just some of the examples of what saw next to no discussion. Even Gallison’s surprise article that raised RIPTA fares for the elderly and low income to $1, up from no cost at all, saw little debate.

After only three short hours, the budget was unanimously passed, with daylight still shining down on the State House.

“The House of Representatives is very committed to working together on behalf of the citizens of the state of Rhode Island,” Speaker Mattiello said of the speedy voting process. “That the House has worked very collaboratively with the Governor and the Senate President, and that there’s a focus on jobs and the economy. When we put out a pro-jobs budget, pro-economy budget, the members rallied around it and responded appropriately.”

Mattiello also did not rule out the option of a special fall session to handle Governor Raimondo’s proposed toll tax. It is actually very likely, he said.

As for Rep. Morgan, she believes that she was one of the only members of the House who actively stood up for what they believe in on the floor tonight.

“I’ll fight for the people of Rhode Island all day long. I’ll fight for better government in our state,” she said after the meeting. “But, I can’t do it alone. The people need to send me more support.”

“I don’t know why they didn’t speak up,” Morgan added. “There were things that should have been said. There was debate that should have gone on. There are things that are objectionable. I have no idea why people didn’t stand up and fight for the things that they believe in.”

But, even without the support for her amendments, Morgan still voted in favor of the budget because it was, for the most part, in line with her beliefs.

“I voted for the budget because there were a lot of really good Republican proposals in it, that I think will help Rhode Island, and I didn’t want to see them not get support.”

The bill will go to the Senate floor for hearing on Wednesday, where if approved, will become the official FY 16 budget for Rhode Island.