A new report released this morning by the Center on Budget and Policy Priorities (CBPP) emphasizes the importance of state estate taxes as tools for broadly shared prosperity and as a means to ensure that the very wealthy don’t avoid taxes by sheltering their wealth.

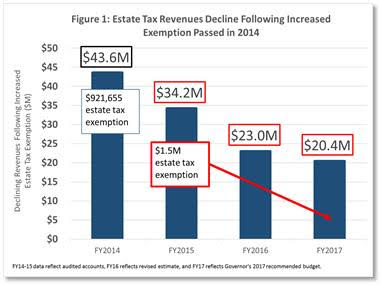

This report comes at an opportune time for Rhode Island, just a week after learning that policymakers are considering increasing Rhode Island’s estate tax exemption from the current $1.5 million to $2 million, a move that would benefit the heirs of fewer than 100 estates.[1] As seen in Figure 1, the increase in the estate tax exemption enacted two years ago already has significant negative impact on state revenues.

This report comes at an opportune time for Rhode Island, just a week after learning that policymakers are considering increasing Rhode Island’s estate tax exemption from the current $1.5 million to $2 million, a move that would benefit the heirs of fewer than 100 estates.[1] As seen in Figure 1, the increase in the estate tax exemption enacted two years ago already has significant negative impact on state revenues.

As Rachel Flum, Executive Director of the Economic Progress Institute, notes, “We face a choice: we can either invest in the things that help our communities thrive and all of us prosper, or hand yet another tax break to a few of our state’s wealthiest people.” Changes to our estate tax have already compromised our ability to make critical investments in the Ocean State. Increasing the estate tax exemption from $1.0 million to $1.5 million in the 2014 General Assembly depleted revenues by $8.4 million in 2015 and by $6.1 million already in 2016, according to the Department of Revenue.[2]

The CBPP report, State Estate Taxes: A Key Tool for Broadly Shared Prosperity, calls on states that have repealed their estate taxes to reinstate them, and suggests that the eighteen states that have estate taxes in place (including every state in the Northeast except New Hampshire) consider improving them. At $1.5 million, the Rhode Island estate tax exemption falls midway between the $1.0 million exemption in Massachusetts, and the $2.0 million in Connecticut.

The CBPP report emphasizes three compelling public policy purposes that result from estate taxes:

- Providing revenue for investments that promote a strong economy. Estate tax revenue supports services that make a state an attractive place to do business and live.

- Reducing inequality. The vast majority of taxpayers would never owe estate taxes. These taxes are paid by a small share of very wealthy families — those most able to afford them.

- Taxing income that would otherwise escape state taxation. Without an estate tax, many unrealized capital gains go untaxed at the state level. This happens when an asset that has increased in value is not sold during the owner’s lifetime, leaving the heirs to gain the profit.

Report author, Elizabeth McNichol, emphasizes the price we pay when we erode state revenues:

You can’t get something for nothing. States that have reduced or eliminated their estate taxes have less money for public investments, so they are seeing higher tuition at public colleges; cutbacks in teachers at K-12 schools; and deteriorating roads, bridges, water treatment facilities, and other public infrastructure.”

Important investments in tens of thousands of Rhode Island’s low- and middle-income working families – such as increasing the state earned income tax credit to 20 percent of the federal credit, and helping families pay for child care–should take priority over tax breaks for a few dozen of our wealthiest families. These investments are particularly important given Rhode Island’s overall tax system, which is “upside down”. The more money you make the smaller share of your income you pay in state and local taxes. A robust estate tax helps to reverse that upside-down tax system, as do changes at the lower end, such as increasing the state EITC.

Douglas Hall, Director of Economic and Fiscal Policy at the Economic Progress Institute notes that “Preserving the estate tax at its current levels gives us revenues needed to give Rhode Island working families a boost, strengthen our economy, and invest in education and infrastructure, while making our tax structure more fair, and preventing those most able to pay from avoiding taxes on their accumulated assets.”

[1] Based on the most recently available data, after reducing by more than half the number of estates subject to the estate tax via changes adopted in 2014, only about 86 filers would remain, 39 of which would see their estate tax completely disappear if we were to raise the exemption to $2.0 million

[2] Revenue projections from the estate tax, seen in Figure 1, incorporate the revenue impact from changing the exemption level, but also reflect the number of estate tax filings, which vary from year to year.

On Friday

On Friday The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation (

Sen. Frank Ciccone III and Rep. Anastasia Williams introduced legislation ( As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”

As for taxes, a report from the Economic Progress Institute (EPI) demonstrates that “Undocumented immigrants contribute more than $11.6 billion to state and local coffers each year, including $33.4 million in Rhode Island, according to a new study released by the Institute on Taxation and Economic Policy (ITEP).”