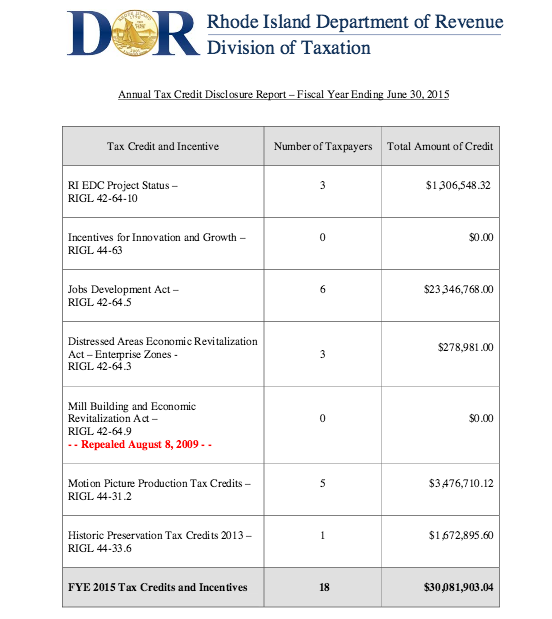

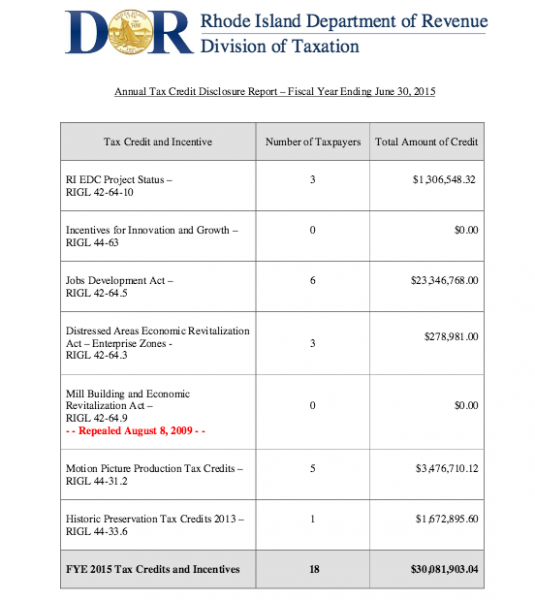

Rhode Island gave away more than $30 million to 18 companies in 2015, according to a new report from the state Division of Taxation. This is almost twice the $14.8 million it gave away in 2014, according to an analysis of that report by the Economic Progress Institute.

The new Division of Taxation report is not a complete list of tax subsidies the state offers. It “focuses on seven tax incentives that were created to help spur job creation and economic development – including sales tax exemptions, corporate tax rate reductions, and motion picture production tax credits,” wrote David Sullivan, the state tax administrator, in the report.

More than 60 percent of the lost revenue identified in the report went to CVS, which enjoys a $19 million “Jobs Development” tax break from the state. CVS also received more than $4 million in additional tax breaks not analyzed specifically in the report. The Jobs Development Act is the biggest corporate subsidy the state offers. In total, it accounted for 76 percent of the lost revenue, or $23 million.

Citizens Bank is the second largest beneficiary of the Jobs Development subsidy, saving $2,978,686 in taxes. A subsidiary of Citizens Bank, Citizens Security, which lists the same address as the bank, also received a $393,038 tax break under Jobs Development Act, which offers a discount to companies with more than 100 employees for every 50 new jobs that last for at least three years.

Fidelity, a Smithfield-based investment firm, received $4,083,791 in tax breaks from Rhode Island, according to the report, and Electric Boat received more than $3,277,000. Woody Allen’s Manhattan-based production company, Perdido Productions, received $3,214,346.63 in film tax credits. Allen filmed his new movie “Irrational Man” in Newport and Jamestown.

The Economic Progress Institute says the report leaves out valuable information for analyzing the data that is required by law.

“While the information provided in the report is important, it tells us nothing about whether these tax incentives have been effective tools for growing our state’s economy. That was supposed to change this year,” according to the EPI press release. “Two years ago, lawmakers recognized the need to understand whether tax incentives are benefiting the economy and enacted the Rhode Island Economic Development Tax Incentives Evaluation Act of 2013. The law requires state analysts to conduct cost-benefit analyses of several of the state’s economic development tax incentives, including the Jobs Development Act and Motion Picture Tax Credit. The law requires the Governor to include recommendations for continuing, modifying, or terminating recently evaluated incentives in her proposed budget. The first set of evaluations were scheduled to be produced by the Office of Revenue Analysis by June 30, 2015 but to date have not been issued.”

The report mentions this as well. “This report is not intended to provide an analysis as to the effectiveness of this or any other tax credit or incentive,” wrote Sullivan in the introduction.