One of my last posts touched on how corporations are spending their money, what they are doing and not doing with the piles of record profits they’ve been making in the past few years while median wages have stagnated or fallen.

Here’s some additional information. First, the cites:

http://online.wsj.com/article/SB10000872396390444657804578052472320753336.html

http://www.thereformedbroker.com/2012/10/12/the-buyback-epidemic/

If you piece the two of them together, you will glean that dividend payments to shareholders are near an all-time low. Something like 34% of earnings are being paid out in dividends today. OTOH, stock buybacks by the S&P 500 hit $112 billion just for the second quarter of 2012. You will also learn that, in contrast, companies paid out about 60% of their earnings in dividends in 1960. This is despite a top tax rate of 91%. No, that’s not a typo. 91%.

Why the preference for stock buybacks over dividend payments? Again, apply the principle of ‘cui bono’: to whose benefit?

Dividends generally benefit the average holder, the smaller holders. In fact, as I’ve said before, prior to about 1990, one bought stocks in order to collect the dividend paid, not with the idea of the price of the stock going up. In fact, stocks like utilities were considered ‘widows and orphans’ stocks because of the generous dividends they generally paid.

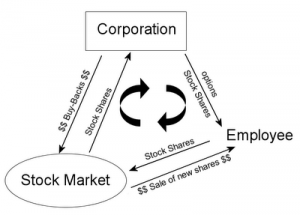

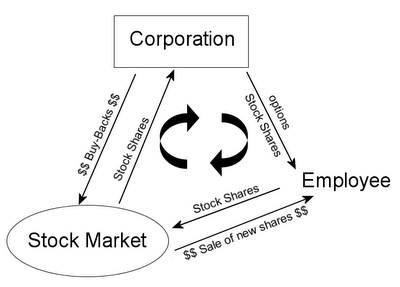

Buybacks, OTOH, generally benefit the corporate executives because the bulk of their compensation is in company stock. One component in the price per share of stocks is the number of shares outstanding. In fact, it’s the denominator in the equation. Since corporate compensation comes from huge issues of common stock, the denominator grows, which drops the average price, which means that the shares executives increase in value. Shares that are bought back are retired, decreasing the number of shares outstanding, which has the impact of pushing the price up, other things being equal.

Yes, the average holder gains from this too, but the benefit is much more limited. Let’s say I own 1,000 shares, which is a big holding for most middle-class folks. If the price goes up a dollar, I’ve made $1,000. Not bad. But if I own 100,000, or 500,000 shares, the gain is much higher. And grants of hundreds of thousands of shares are not unusual. An executive holding a million share is not unusual.

Plus, this gain is completely tax-free, until the stock is sold. This benefits the executive who can then borrow against the shares and perform feats of legerdemain with the money. The small holder, OTOH, will generally never see the benefit f the capital appreciation because s/he is less likely to sell shares.

Yes, they may, and then turn around and buy others. However, this sort of trading mentality is very dangerous for the small investor. 80% of professional investors do not ‘beat the market’ through frequent trading. If these professionals can’t, then what chance does the small investor have? A small one, and then usually only for a short time before regression to the mean sets in. The safest strategy for the small investor is to buy stocks that pay a decent dividend and hold them for the income. Now, that few companies do this any longer is certainly a problem. Once again, the market is tilted in favor of the larger investor who can make a lot of money on fairly small increases in price, or who can hedge, or who has access to resources and information that the small investor does not have.

Cui bono? The corporate executive.

In the WSJ (yes, Wall St Journal), note the following quote:

- …More than seven decades ago, in his classic book “Security Analysis”, the great investor Benjamin Graham made a call so radical that it still sounds shocking today. Complaining of the “despotic powers wielded over dividend policy by corporate executives and directors, Graham argued that companies should no longer be allowed to direct surplus cash away from paying dividends–even for reinvesting in the business–without first obtaining formal “consideration and appraisal” from their investors, most likely through a vote at the annual meeting.

- Capitalist to his core, Graham was dead serious with this Bolshevik-sounding suggestion. He wanted shareholders–who, after all, own the company–to force management to provide at least a general justification for using cash for any purpose other than paying a dividend.

- With the percentage of profits paid out as dividends today near all-time lows, at 34%, Graham’s drastic proposal is just what we need to cattle-prod companies out of being such skinflints.

One “argument” that tax-cutters like to use is that it’s our money, not Washington’s. Fair enough. But those corporate profits belong to the shareholders, not to the CEO. So why should the CEO decide?

(Yes, he is a shareholder, but he & his board almost never control a majority of shares. Plus, Graham’s point was to make them explain why they were not issuing larger dividends. You know, make them accountable? Radical notion, I realize. Only people on the bottom are accountable for anything. Those on top can do whatever they damn well please.)

(Point 2: the fact that dividends are ‘double taxed’ is completely irrelevant to the argument. But let’s put it this way: they are double taxed. So what? What difference does that make?)

Here’s how the other article describes the buyback/dividend issue:

…One other thing — executives use buybacks to offset compensation, they issue themselves shares or options, and then get the board to approve a stock buyback to counter the effect of dilution. If you’re asking yourself “wait, so buybacks can be used as a tool to transfer shareholder money to executives?” then you’ve got it figured out, that’s exactly what they can be used for. And they often are.

As I said, cui bono? The corporate executive. He does not own the company. He–in theory, anyway–works for the shareholders, and yet he’s following policies that enrich himself (and it’s pretty much always a ‘he’) at the expense of those he works for. Somehow, I suspect that if he found an underling at the company doing something similar, the underling would be fired, if not prosecuted.

As an aside, the comments section of the WSJ article is hilarious. Note the utter horror–The horror! The horror!–with which they regard a tax rate of 39% on dividends. Somehow, the returns to capital should be privileged above actual work. And note how they throw out retirees who will be hurt by paying an hypothetical 39% in taxes on their dividend income, after the confiscatory Obama plan of letting the Bush tax cuts expire. But, 39% is the top tax rate. Only people making the highest incomes would pay at that rate. For the rest of us, we would pay at the rate we pay on the rest of our income. The only retirees who would be hit by the top tax rate are those who are earning in the top level of income.

One final word. A while back I wrote a post about how the purpose of allowing capital to accumulate was so that business could expand and benefit more people through hiring. IOW, there’s an implicit deal: we allow capital formation so you can increase the number of people you hire, which benefits everyone. However, the capital side of deal has not kept up its end of the bargain. For pointing this out, I was excoriated as a…whatever. You can fill in the blank. But this is exactly what is happening: the profits are not being reinvested in the US, those receiving the benefits of the profits are not paying taxes to support our society, even though they benefit disproportionately from the peace and security provided by the US government. They’ve breached the contract.

Finally finally, here’s something about the effects of income polarization.

- “If a man is not an oligarch, something is not right with him.”

http://blogs.reuters.com/great-debate/2012/10/15/the-billionaires-next-door/

OK, feel free to excoriate mindlessly by calling me all sorts of names, and saying I’m wrong without ever quite showing how I’m wrong.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387