It’s hard to tax the rich at the local level. The area within the borders of a local community is small, and tax avoidance becomes a game to people with money. One need simply relocate a block across the border to smack back at most local popular efforts. I’m not saying it’s right. I’m saying it’s true. But there is a way to tax the rich in Providence, and get away with it.

It’s hard to tax the rich at the local level. The area within the borders of a local community is small, and tax avoidance becomes a game to people with money. One need simply relocate a block across the border to smack back at most local popular efforts. I’m not saying it’s right. I’m saying it’s true. But there is a way to tax the rich in Providence, and get away with it.

Taxing parking might seem like another consumption tax, but it’s not. It’s a Robin Hood tax– and one that even businesses should be in favor of.

Why? A great piece on this appeared in Greater Greater Washington just a year ago. It points out, for instance, that the tax write-off for paid parking is larger than the one for transit, meaning that commuters who pay for parking already get a direct subsidy to repay themselves. But it also points out an even deeper point about the marketplace for (garage and lot) parking in cities.

Parking acts as an oligopoly more than many other markets, so (in garages and pay lots) it’s being sold at the highest bid it can sustain:

[P]arking operators are in the business to make money, so aren’t they already charging as much as the market will bear? In other words, if they could raise their prices when there’s a new tax, why don’t they just raise their prices now regardless?

Well, isn’t that true of all markets? But in most markets, competition drives down the prices of goods. If you’re making more money than a small profit over and above the cost of providing the service, someone else will enter the market too and try to undercut you.

Parking isn’t really a competitive market. In the short run, the supply of parking is absolutely fixed, and there isn’t empty land to turn into new parking in central DC. Also, many people also only really want to park in the building where they work, are going to the doctor, etc. and aren’t shopping around. That’s especially true when a company is buying parking for executives.

These factors make the parking market closer to a monopoly and/or oligopoly, and consequently, the pricing is more at the level that maximizes total revenue in the entire market, a level that’s higher than the perfect competition price.

The GGW piece cited a report commissioned by the Philadelphia Parking Authority in which garage owners complained that they would have to swallow any taxes levied on parking because there would be no one willing to pay a higher price for parking if they tried to pass it to consumers. When your business is an oligopoly, you’re already getting the best price you can, so a tax on your business just means a lower profit margin.

The GGW piece cited a report commissioned by the Philadelphia Parking Authority in which garage owners complained that they would have to swallow any taxes levied on parking because there would be no one willing to pay a higher price for parking if they tried to pass it to consumers. When your business is an oligopoly, you’re already getting the best price you can, so a tax on your business just means a lower profit margin.

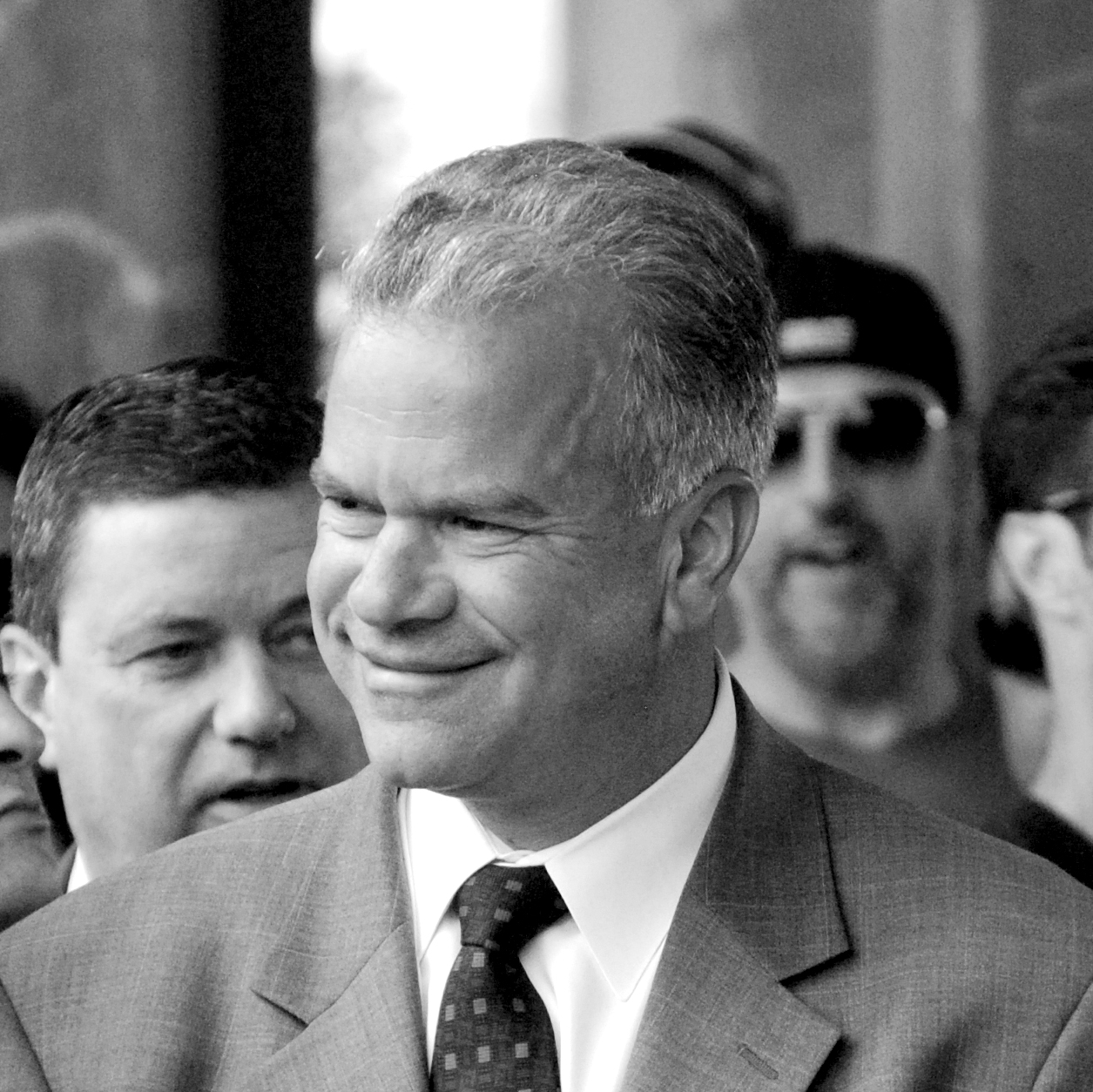

Not everyone buys my notion that keeping the car tax where it is makes sense, though the fourth grade math involved in showing why that tax cut isn’t progressive is pretty straightforward. But everyone agrees (including me) that taxing a person’s car purchase is a type of consumption tax. If the reports on parking are correct, taxing parking lots (and garages) is not. The owner pays. And in Providence, the largest owner of parking lots is one of the wealthiest people in the state: former mayor, Joseph Paolino.

A business argument

I started my argument with the “tax the rich” pitch for the parking tax, because try as I might to convince people otherwise, I’ve still encountered friction from some on the left who think taxing parking is a flat tax on consumers (some people on the left even like the idea that parking taxes are a tax on consumers, saying that it’s a way to get the suburbs to pay their share towards city services they use). But if you’re a local businessperson, you might not care for this argument. Why shouldn’t you be concerned about the parking cutting and running? Isn’t a tax on parking going to drive people away?

Short answer: no.

Parking lots and garages aren’t golden geese. You can tax them, but like all things, their owners have the ability to try to evade taxation. But we shouldn’t be troubled by the this possibility because of the mechanisms involved. The PPA report cited within the Greater Greater Washington piece had garage owners complaining that while they would pay the cost of the tax in the short-run:

In the long run the story is quite different. An increase in parking taxes discourages the rejuvenation of aging facilities, the replacement of facilities lost to development, and the construction of additional facilities. Thus higher parking taxes will decrease the long-run supply of parking, will increase the cost to the public of parking, and will decrease profits to owners of parking facilities.

Further, should an additional parking facility be required, a higher parking tax implies that the facility will require larger subsidies to develop than it would in the absence of the parking tax increase.

Parking lot/garage owners can only escape the parking tax two ways: they can sell their land to someone else (who still, of course, has to pay the parking tax), or they can turn the parking into something that’s not parking. The PPA report reveals a lot. For instance, why would a city worry that it’s not able to replace “facilities lost to development”? Doesn’t the fact that development is replacing parking imply a healthy local economy, and that people are visiting that new development by some means?

In the second paragraph, we have the even more revealing “a higher parking tax implies that the facility will require larger subsidies to develop than it would in the absence of the parking tax increase.”

Indeed, in many cities, parking garages are subsidized by a city or state authority because the all-knowing hand of government thinks that people need better access to parking above all else. (If you’re a local business owner and wondering why the all-knowing hand of government doesn’t have free money for you instead, you’d be right to wonder).

The truth is, parking lot/garage owners have three choices: pay up (and swallow the cost), develop something better (and make the neighborhood more desirable), or sell (at a cut-rate price, making it easier for the next person to develop something). As a business, none of these should worry you, because they all represent the neighborhood becoming healthier for your enterprise. Lower taxes or lower land prices will both mean more of the development that supports transit, and will also add to the tax rolls, so even as the revenue from the parking tax slowly dissipates, the problems that creates solve themselves.

Give it all back

If parking owners being unable to increase their prices, and the flat out arrogance of parking owners getting government hand-outs isn’t a good enough business argument, then how about this: the best use of the parking tax in Providence would be to directly lower other taxes.

Even in a hypothetical case where parking was more expensive, the collected money would equalize that shift in price, and returning the money to local businesses through lower taxes would help them compensate with better services or lower prices. But the more likely event is that parking prices will stay the same while allowing your taxes to go down. Who could argue against that?

You’re getting taxed anyway

The strongest argument against the parking tax is to ignore all the data and examples I laid out, and just cry Chicken Little. OH NO, EVERYTHING WILL COST MORE! OH NO, THERE WILL BE PARKING-GEDDON! OH NO, STOP TAXING US!

The problem with this argument is that you are being taxed.

Though rates technically went down on some taxes in the mayor’s budget, the amount paid has gone up on just about everything. One of the newly raised taxes is the “meal and beverage” tax.

If we were trying not to tax parking because we were worried it might chase people away from local businesses, was taxing restaurants instead the way to go?

Give it to me in a paragraph

Parking is a weird oligopoly, and the owners are charging you as much as they can. Taxing them more doesn’t actually allow them to pass that on to you, because they’ve already maximized their price. So parking taxes are a tax on rich people who are speculating on land. Parking taxes encourage those people to turn that parking into something else, but in the meantime, the city collects revenue that lowers your taxes. The city is “considering” taxes on parking rather than “implementing” taxes on parking because they’ve got cold feet about taking on one of the richest people in the city. You should tell the city government that you want a tax on parking, because if they don’t tax parking, they’re going to tax your house, your apartment, the restaurant you go to, and everything else first.

Tax parking.

The Providence City Council extended a tax break for the developers of a mixed use project on Valley Street because an anchor tenant relocated to Johnston.

The Providence City Council extended a tax break for the developers of a mixed use project on Valley Street because an anchor tenant relocated to Johnston.

The

The

The Executive Board of the Rhode Island Progressive Democrats wishes to express extreme displeasure that Hillary Clinton would name Governor Gina Raimondo as a co-chair of the Democratic convention. While this role is purely ceremonial, it indicates that some of Clinton’s advisors may consider Raimondo an acceptable figure within the national Democratic party, a sentiment that would be deeply chilling. Raimondo’s politics represent a brand of conservatism well to the right of basically anyone of prominence in the national Democratic party. Deeply unpopular in Rhode Island, Raimondo is known for her aggressive push to restrict women’s access to abortion coverage through plans sold on Rhode Island’s exchange. She is also one of the most aggressive proponents of pension cuts, which Democrats just voted to oppose in our party platform. She has been a feisty advocate of expanding fossil fuel infrastructure, and she even opposes repealing Rhode Island’s tax cuts for the rich. A former private equity executive, Raimondo epitomizes an extreme type of Wall Street politician. After the withdrawal of banker Antonio Weiss, the national party has had an informal rule against Wall Street appointees for top posts. Raimondo appears to violate that rule.

The Executive Board of the Rhode Island Progressive Democrats wishes to express extreme displeasure that Hillary Clinton would name Governor Gina Raimondo as a co-chair of the Democratic convention. While this role is purely ceremonial, it indicates that some of Clinton’s advisors may consider Raimondo an acceptable figure within the national Democratic party, a sentiment that would be deeply chilling. Raimondo’s politics represent a brand of conservatism well to the right of basically anyone of prominence in the national Democratic party. Deeply unpopular in Rhode Island, Raimondo is known for her aggressive push to restrict women’s access to abortion coverage through plans sold on Rhode Island’s exchange. She is also one of the most aggressive proponents of pension cuts, which Democrats just voted to oppose in our party platform. She has been a feisty advocate of expanding fossil fuel infrastructure, and she even opposes repealing Rhode Island’s tax cuts for the rich. A former private equity executive, Raimondo epitomizes an extreme type of Wall Street politician. After the withdrawal of banker Antonio Weiss, the national party has had an informal rule against Wall Street appointees for top posts. Raimondo appears to violate that rule.

Every night in downtown Providence, we see the darkened windows of our state’s tallest building. It’s a sad sign of failed development policies. Recently, the developers announced that they are going to hold the building empty for yet another year, waiting for a massive payout from the taxpayers. What a better way to bully Rhode Island into giving them subsidies than to insist on keeping the largest and most recognizable building in Rhode Island completely empty?

Every night in downtown Providence, we see the darkened windows of our state’s tallest building. It’s a sad sign of failed development policies. Recently, the developers announced that they are going to hold the building empty for yet another year, waiting for a massive payout from the taxpayers. What a better way to bully Rhode Island into giving them subsidies than to insist on keeping the largest and most recognizable building in Rhode Island completely empty?

The bill Representative Cale Keable introduced to the RI House that seeks to overhaul Rhode Island General Law 44-4-30 by giving the residents of Burrillville more power over whether or not Invenergy‘s proposed fracked gas and diesel oil burning power plant gets built in their town has been reviewed by Conservation Law Foundation (CLF) Senior Attorney Jerry Elmer, and his verdict is clear: “Despite its imperfections,” says Elmer, “the Keable Bill is an excellent bill that ought to be supported by enviros, because – for the two separate reasons outlined above — it makes it much less likely that the Invenergy plant will be built.”

The bill Representative Cale Keable introduced to the RI House that seeks to overhaul Rhode Island General Law 44-4-30 by giving the residents of Burrillville more power over whether or not Invenergy‘s proposed fracked gas and diesel oil burning power plant gets built in their town has been reviewed by Conservation Law Foundation (CLF) Senior Attorney Jerry Elmer, and his verdict is clear: “Despite its imperfections,” says Elmer, “the Keable Bill is an excellent bill that ought to be supported by enviros, because – for the two separate reasons outlined above — it makes it much less likely that the Invenergy plant will be built.”

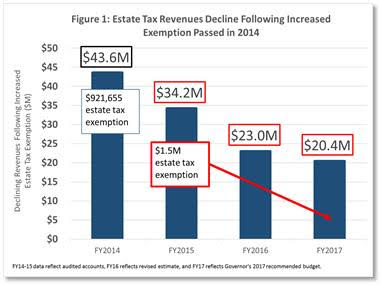

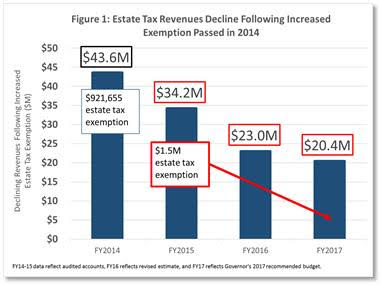

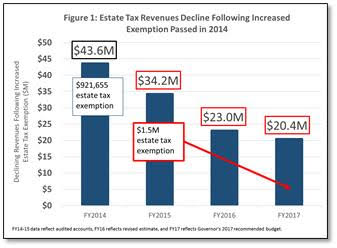

This report comes at an opportune time for Rhode Island, just a week after learning that policymakers are considering increasing Rhode Island’s estate tax exemption from the current $1.5 million to $2 million, a move that would benefit the heirs of fewer than 100 estates.[1] As seen in Figure 1, the increase in the estate tax exemption enacted two years ago already has significant negative impact on state revenues.

This report comes at an opportune time for Rhode Island, just a week after learning that policymakers are considering increasing Rhode Island’s estate tax exemption from the current $1.5 million to $2 million, a move that would benefit the heirs of fewer than 100 estates.[1] As seen in Figure 1, the increase in the estate tax exemption enacted two years ago already has significant negative impact on state revenues.

The GGW piece cited a

The GGW piece cited a

“I don’t [want to] throw cold water on your parade here,” said Burrillville Town Manager Michael Wood, “but you can’t simply just determine a tax at will and tax somebody… It’s not fair to leave you with the impression that this can be done when it can’t be done.”

“I don’t [want to] throw cold water on your parade here,” said Burrillville Town Manager Michael Wood, “but you can’t simply just determine a tax at will and tax somebody… It’s not fair to leave you with the impression that this can be done when it can’t be done.”

On Friday

On Friday The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change. On January 14, 2016, the Rhode Island Supreme Court ruled that wind turbines are manufacturing equipment and therefore exempt from local property taxes under state statute. The decision in

On January 14, 2016, the Rhode Island Supreme Court ruled that wind turbines are manufacturing equipment and therefore exempt from local property taxes under state statute. The decision in

As the

As the

Clinton’s tax policy was also touched upon. As President she wants to tax high frequency stock trades and tax hedge funds as income. Frank objects to Sander’s “McCarthy-ite suggestion that she’s soft on these issues because of the money she accepts.”

Clinton’s tax policy was also touched upon. As President she wants to tax high frequency stock trades and tax hedge funds as income. Frank objects to Sander’s “McCarthy-ite suggestion that she’s soft on these issues because of the money she accepts.”