The Capital Good Fund is proving investors will support efforts that promote economic justice. The non-profit lending agency that focuses on helping people out of poverty has raised $650,000 since October through a Direct Public Offering.

“We are thrilled by the response to this social impact investing model,” said Andy Posner, the founder and CEO of Capital Good Fund. “It was our hypothesis that people would be inspired by the opportunity to connect their capital with their conscience, and the past few months have borne that out.”

Posner’s beleif is that people will invest in things that help the community. That’s what the Capital Good Fund does, from the bottom up. CGF gives financial coaching to low-income Rhode Islanders and is perhaps best-known for offering a non-predatory alternative to payday loans.

It “provides small personal loans that range from $300 to $15,000 and unbiased financial advice to poor and low-income Rhode Islanders who would normally only have access to capital through fringe and predatory lenders such as payday lenders, pawnshops, and rent-to-own stores,” according to a news release.

The Providence-based “social change organization” is trying to raise $4.25 million to issue 17,000 loans and create 60 jobs in Rhode Island in the next five years, Posner said. Since 2009, Capital Good Fund has made more than 1,000 loans and for more than $1million, with a payback rate of 90.4 percent. “Our financial coaching covers the basics of finances and health, so things like creating a budget, reviewing credit, managing debt, and eating well on a budget,” Posner said.

The first $500,000 raised is already helping Posner create new jobs in Rhode Island. It’s helped put Capital Good Fund in a position to hire several new employees. The news release says there are “five open positions in loan origination, loan servicing, and systems development. The Fund expects to hire five more positions in the third quarter of 2016. Interest applicants can learn more at www.goodfund.us/jobs.”

The Direct Public Offering (DPO) is like an Initial Public Offering (IPO) with a different name. “Because we are a nonprofit we cannot issue stock or shares, however we can issue debt,” Posner said. Investors, he said, can earn 6 percent interest on a $1,000 loan. And that investment helps CGF lift working class Rhode Islanders out of the cycle of poverty.

“Capital Good Fund is using a market-based solution that has the potential for dramatic scale and impact,” said Randy Rice, Capital Good Fund’s board chair who is also the communications director at Trillium Asset Management. “I invested in the DPO because I believe that if we are to solve pressing social and environmental challenges such as poverty, income inequality, and climate change, we need to take advantage of new approaches.”

Potential investors can learn more at www.socialcapitalfund.org

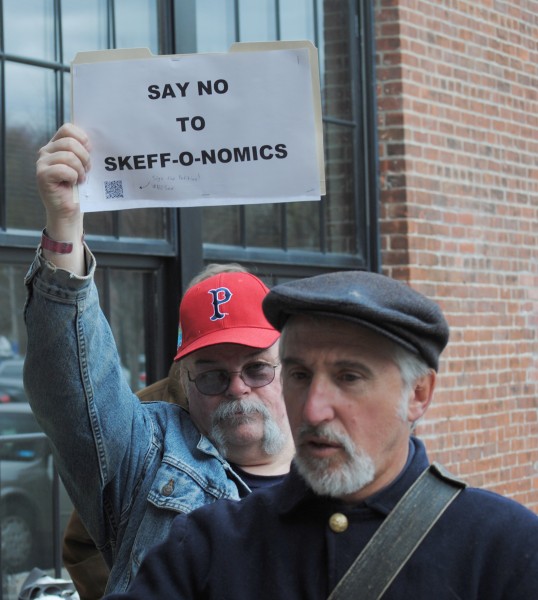

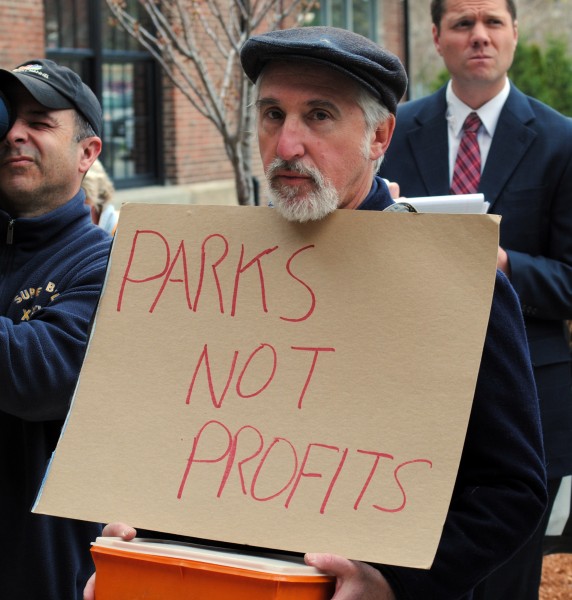

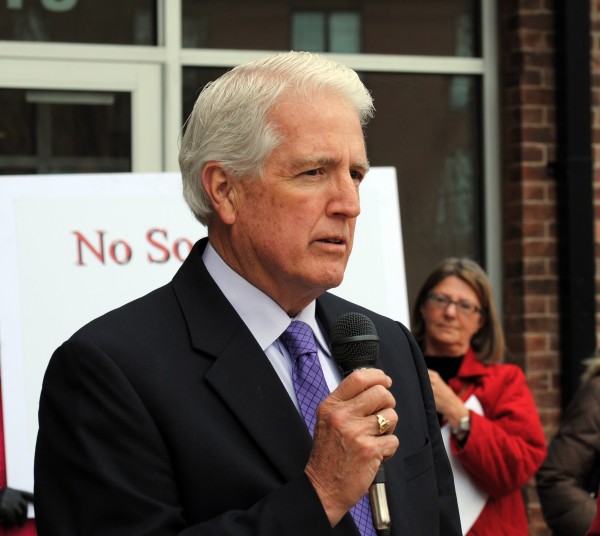

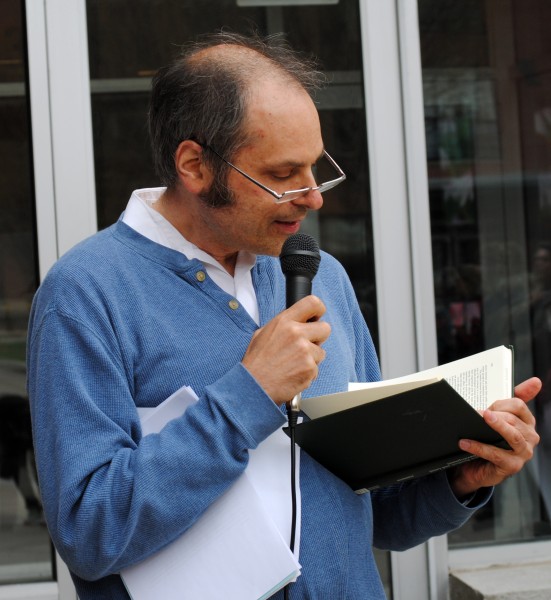

An unlikely coalition of opponents to the proposed downtown Providence stadium deal greeted new PawSox owner Jim Skeffington as he exited his chauffeured ride and quickly entered the Rhode Island Commerce Corporation (RICC) offices at 315 Iron Horse Way.

An unlikely coalition of opponents to the proposed downtown Providence stadium deal greeted new PawSox owner Jim Skeffington as he exited his chauffeured ride and quickly entered the Rhode Island Commerce Corporation (RICC) offices at 315 Iron Horse Way.