The minimum wage in Rhode Island has risen every year since January 2013 and 2016 will be no different, moving up from $9 to $9.60 per hour. The measure passed on the floor of the state Senate in a 34-3 vote, and will soon be enacted into law. But as each year passes, the income gap in Rhode Island only grows larger, even with the minimum wage increases.

Voting against the increase were Republicans Nick Kettle, of Coventry, Mark Gee, of East Greenwich, and Elaine Morgan, of Ashaway.

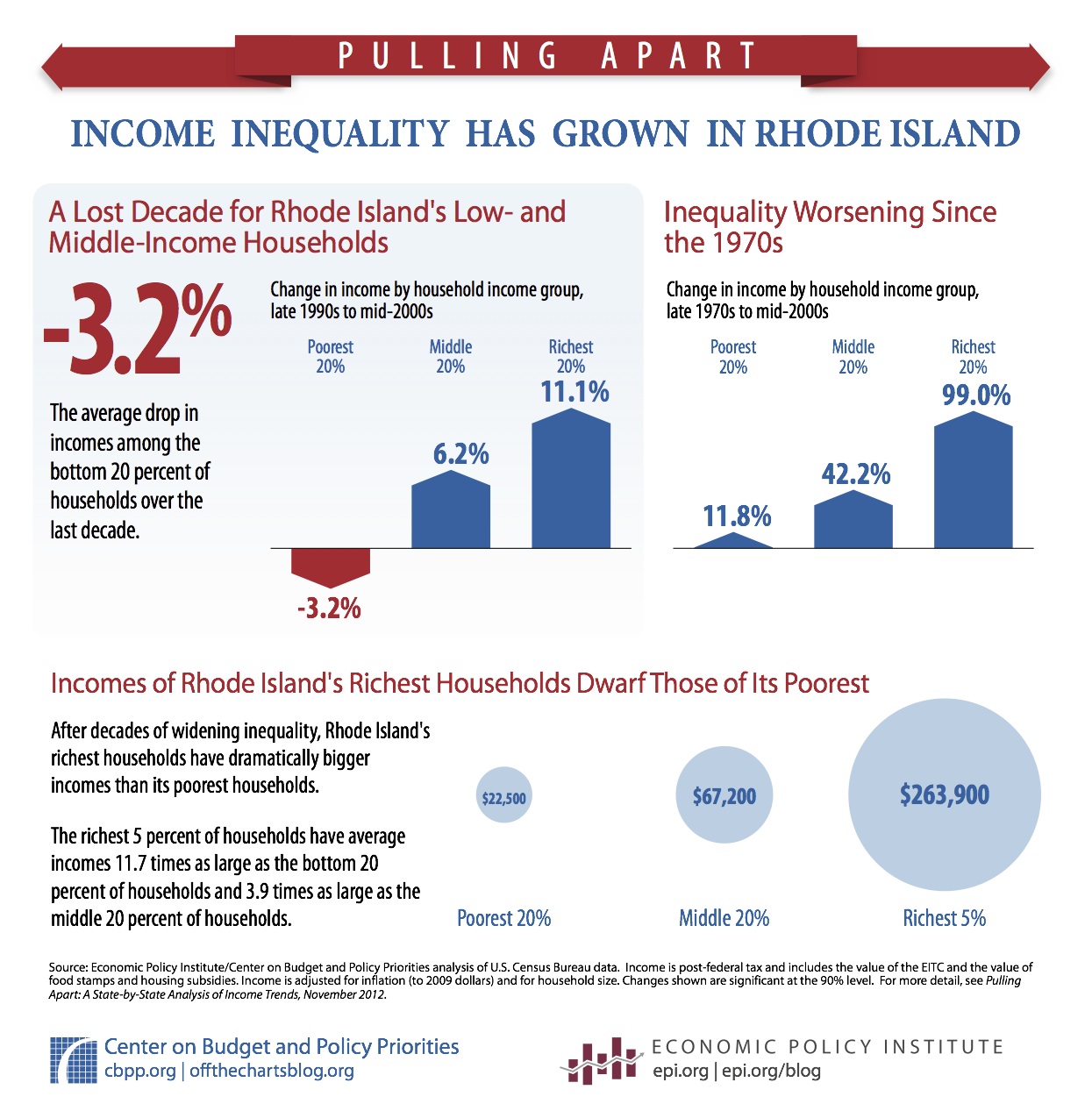

A study from 2012 conducted by the Center on Budget and Policy Priorities (CBPP) showed that from the 1970’s to the mid-2000s, the income gap has grown 70 percent. The poorest 20 percent of Rhode Islanders have only received a 11.8 percent raise in their household incomes, while the richest 20 percent have seen their income grow 99 percent.

In Connecticut and Massachusetts, the percentages are even more disconcerting. The poorest 20 percent of MA residents have seen no change in their income since the 1970s, but the richest 20 percent have had a 151.9 percent increase. Connecticut’s poorest residents have even seen a drop in their income by 4 percent since the 1970s, and a 9.8 percent drop in the past decade, more than both Rhode Island and Massachusetts.

How did this even happen? Kate Brewster, the executive director of the Economic Progress Institute, believes that trends have lead to the widening income gap.

“Our economy has shifted so dramatically,” she said. Brewster stated that over the years, Rhode Island has seen a move from the manufacturing to the service industry, as well as a decline in unionization among employees. These factors have lead to a decline in the minimum wage’s value.

Senator Erin Lynch (D-District 31), the sponsor of the legislation, said the move to $9.60 is a step in the right direction, even though she originally wanted $10.10.

“I would have loved for it to be $10.10,” she said. “I think any step forward is a good step forward.”

Lynch also added that even though raising the minimum wage is definitely a part of eliminating income inequality, it’s not the only piece of the puzzle.

“We want to continue moving in the direction we’re moving. There’s no one magic bullet. We’re working on all kinds of different things.”

Other pieces of the economic puzzle include workforce development, access to capital, and education. Lynch believes that those together can help to level out incomes in the state, especially because they will be able to help those who are providing for their families. Outside of the state house, Lynch works as a divorce lawyer, and sees the hardships that low wages can take on the family unit.

“I see a lot of parents. I see a lot of people getting second and third jobs. People are doing what they need to do to support their families,” she said.

Currently, Rhode Island has one of the highest minimum wages in the country, but will soon fall behind states like Massachusetts, California, and Washington, DC, as they move their wages upwards of $10 an hour going into 2016.

“An adult needs close to $12 to meet their basic needs,” Brewster said. “$10.10 would have been great, but $9.60 is better than $9.”

Lynch stated that she will continue working to move the state economy forward. Hopefully that means a brighter, more equal future for everyone in Rhode Island.

“This is home,” Lynch said. “We want to make it the best place it can be.”

Activists from the Restaurant Opportunity Center (

Activists from the Restaurant Opportunity Center (