A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

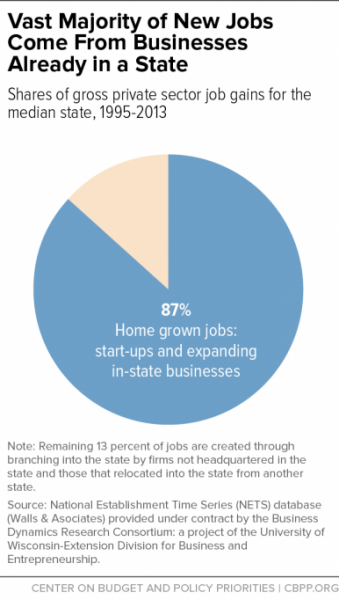

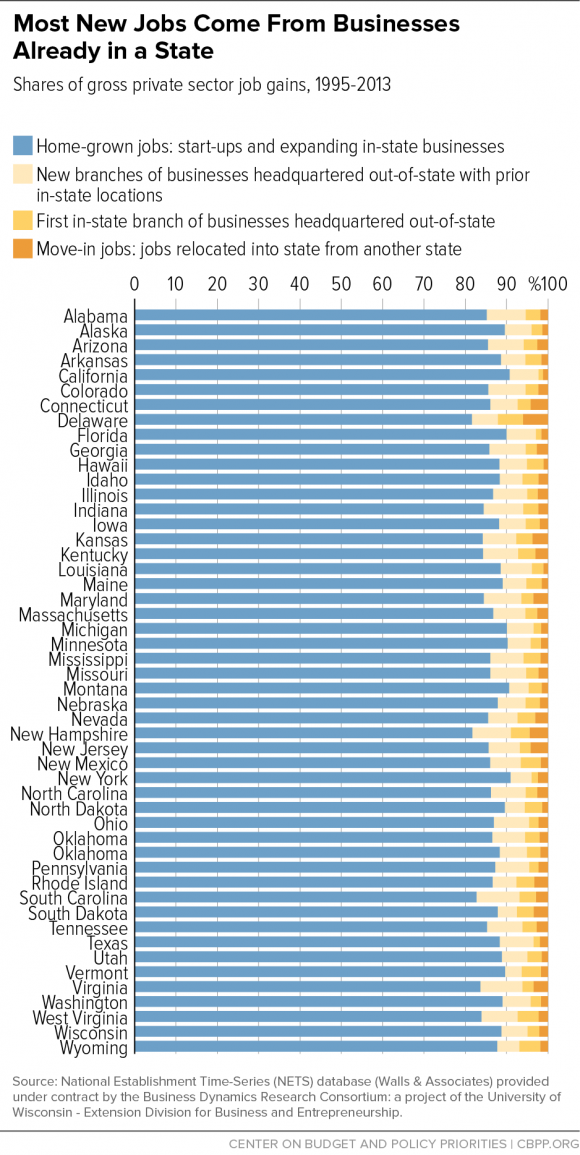

The report, “State Job Creation Strategies Often Off Base” takes advantage of new data accumulated over the last fifteen years “about which kinds of firms create jobs” and the data shows that the “vast majority of jobs are created by businesses that start up or are already present in a state — not by the relocation or branching into a state by out-of-state firms.”

The immediate takeaway from this report for Rhode Islanders is that Governor Gina Raimondo’s planned (yet not realized) trip to Davos and the time she spent trying to persuade General Electric (GE) to move to Rhode Island rather than to Massachusetts are wastes of time and money. Raimondo’s offer to GE was in the “same neighborhood” as Massachusett’s $140 million in state and city incentives and grants. Given the conclusions in this report, Rhode Island dodged a bullet when GE turned Raimondo’s offer down.

I asked the authors of the piece directly about the governor’s plan to travel to the World Economic Summit in Davos and they told me, “That is not where state economic development comes from and that’s really not where policy makers should focus. They should focus on homegrown businesses and try to stimulate startups and helping their businesses that are already in the state to find customers and find the skilled workers they need. Business recruitment accounts for such a tiny share of job creation and that’s really a major point of this paper. It is not where the priority should be placed.”

In other words, we are, as a state, pursuing failed economic and job creation strategies, and we will continue to fail unless we take this new data seriously.

On average, 87 percent of new jobs are created by businesses already in the state. In the chart below, you can see that Rhode Island is no outlier in this department. The remaining 13 percent of jobs come from out of state businesses branching into the state (think of a restaurant chain in Boston adding a store in Providence) or a business actually relocating into the state, as GE recently did when they moved to Massachusetts.

What kind of businesses stimulate job creation? The report stresses that “startups and young, fast-growing firms are the fundamental drivers of job creation when the U.S. economy is performing well.”

The report quotes economist John Haltiwanger and his colleagues as saying, “Overall, the evidence shows that most start-ups fail, and most that do survive do not grow. But among the surviving start-ups are high-growth firms that contribute disproportionately to job growth. These high-growth young firms yield the long-lasting contribution of start-ups to net job creation.”

The firms that take off are called “gazelles.” Think Google, Amazon, Tesla or Under Armour, or, in Rhode Island, think NuLabel. These kind of firms accounted for about 15 percent of all businesses, but were responsible for half of gross job creation from 1992-2011.

Failed Policies

In trying to create a “business friendly climate” that will lure small businesses to the state, our leaders, like leaders in many other states, have pursued strategies that are “bound to fail because they ignore the fundamental realities about job creation revealed by the new data and research discussed above.” A favorite failed strategy is tax cuts for “small businesses.”

These tax cuts are not properly aimed at young businesses, they are aimed at small businesses. Most small businesses don’t have employees or plan to add employees. And targeting tax cuts to young businesses has little effect because most young businesses spend so much money on new equipment, product testing and marketing that they have little in the way of taxable income in the first place.

Tax cuts don’t help a state’s business climate, but they do hurt a government’s ability to do the important work of funding education and maintaining a top notch infrastructure. The report cites an Endeavor Insight study that showed that only 5 percent of entrepreneurs cited low tax rates as a factor in deciding where to locate their company, whereas 31 percent cited access to talent (education) and a city’s quality of life as a factor.

Offering tax breaks and non-tax incentives to lure out-of-state companies to our state is also a losing game. In Rhode Island we are addicted to TSAs, Tax Stabilization Agreements, which allow companies and developers to avoid paying their fair share of taxes and shifts the businesses’ tax burden onto the rest of the city or state taxpayers. As the report clearly shows, “jobs gained due to firm relocation are such trivial factors in a state’s overall job creation record that they should not be a consideration in formulating state tax policy or economic development policy more broadly.”

A look at statements made at the recent Greater Providence Chamber of Commerce luncheon reveals that our elected leaders haven’t gotten this message yet.

Here’s Senate President Teresa Paiva-Weed talking about the importance of tax cuts:

Here’s Senate Majority Leader Dominick Ruggerio talking about tax stabilization agreements to spur development:

Here’s Senate Minority Leader Dennis Algiers on “broad-based” tax cuts, which we’ve seen are not only not effective, they are counter-productive:

Here’s Speaker of the House Nicholas Mattiello talking about how “incentives” (i.e. tax breaks) “attract new people to our state.”

Continuing to pursue strategies that have been shown to hinder rather than help in job creation would be foolish in light of the data in this new report. Instead, “policy needs to focus on encouraging entrepreneurship generally, helping new businesses to survive, and enabling businesses with the potential to become high-growth firms to fulfill that potential.”