Politifact did itself great credit this month by calling out the “American LeadHERship PAC” — the political action committee concocted to support the prospective gubernatorial campaign of Wall Street acolyte Gina Raimondo — on its shameful hit-piece about her likely Democratic opponent, Providence Mayor Angel Taveras. The PAC’s prospectus implies the preposterous slander that Taveras is to blame for a downgrading of Providence’s bond ratings. Any Rhode Islander old enough to, as they say, remember where 38 Studios “used to be” surely knows the real story:

Politifact did itself great credit this month by calling out the “American LeadHERship PAC” — the political action committee concocted to support the prospective gubernatorial campaign of Wall Street acolyte Gina Raimondo — on its shameful hit-piece about her likely Democratic opponent, Providence Mayor Angel Taveras. The PAC’s prospectus implies the preposterous slander that Taveras is to blame for a downgrading of Providence’s bond ratings. Any Rhode Islander old enough to, as they say, remember where 38 Studios “used to be” surely knows the real story:

As Politifact writes: All three downgrades occurred about two months after Taveras took the oath of office — and only after a committee of financial experts empaneled by Taveras found and disclosed that the city had a $110-million structural deficit. (A structural deficit is a built-in long-term gap between revenue and expenses.)

The structural deficit, equal to one-sixth the size of the budget and aggravated by a depleted rainy day fund, was inherited from Taveras’ predecessor, David N. Cicilline. In his final months in office, as he was campaigning for his current seat in Congress, Cicilline declared that the city was in “excellent financial condition” — an assessment that he apologized for after winning his new political office.

Thick in cynicism but bereft of wit, ALP and Raimondo are devious enough to warp the truth but too dense to notice the sharp irony at hand: ALP will strive to leverage the bond downgrade deception (and surely many others to come!) into even more campaign funds for Raimondo — who’s spent her tenure as Treasurer paying court to and benefiting from the largess of a shockingly broad swath of the architects of the financial crisis of 2007–tbd. That of course being the very same crisis that helped compel the Providence downgrading that Raimondo’s backers so tactlessly tag onto Taveras.

Raimondo’s supporters insist: “We’re really nice guys.” But would you vote for a gubernatorial candidate whose campaign was backed by hundreds of Joe Mollicones? That’s precisely what they demand.

Under the contemporary economic predicament it is possible for an earnest person to push solemnly for modest pension reforms, lamenting all the while that the detritus of the demolition of our economy rolls downhill to states and cities. Recognizing that so many very wealthy, ever greedy people who run our economy and government wrecked it for the rest of us, even while making it impossible to institute appropriate fiscal policies that might have blunted the impact on the likes of you and me — on our parks, roads, schools, buses, pocketbooks, bellies, and so on. Working people aren’t to blame for the deficits, but cities and (especially small) states only have a few tools in their kits, so: tradeoffs, tough choices, and all that.

That stinks, but fine.

But that’s not at all what Raimondo’s been up to. Rather, she has networked her way into the closed chambers of precisely those same wealthy, greedy people (and is no doubt quite impressed by herself for having pulled off such a feat from her modest perch in a down ballot office in the smallest state).

First, Raimondo convinced Wall Street’s 1% to pay for a secretive propaganda campaign to advocate for deep cuts in the state pension system. Doing so garnered her effusive praise from right-wing stalwarts: from the Wall Street Journal’s editorial page, to the National Review, to Rhode Island’s own tiny Tea Party, which congratulated Raimondo for her “true leadership” as General Treasurer. Then there are the fetes by the likes of ALEC, the Manhattan Institute and the Hedge Fund Industry Awards (for running one of the hedge-fundiest of mid-sized public pensions).

Unfortunately for Rhode Island’s working stiffs, Raimondo’s “true leadership” consisted of slashing benefits even for already-retired seniors on fixed incomes while sending millions of Rhode Island taxpayer dollars to pay the bloated fees demanded by her hedge fund manager friends — for which she’s even been derided in the pages of Forbes Magazine.

Their palates now whetted, Wall Street is lining up to pay for her hoped-for ascent to the state’s highest office. The names that pop out during just a cursory review of the hundreds of people who’ve max-ed out to her still-unannounced gubernatorial run represent a who’s-who of Washington-to-Wall Street revolving door corruption in the extreme.

-Pete Peterson, the billionaire former Chairman and CEO of Lehman Brothers, who now runs the foremost Social Security and Medicare “reform” “think tanks” in Washington, DC, urging the slashing of benefits from these and other programs that are critical for middle class and poorer Rhode Islanders.

-All of the dearest relatives of Robert Rubin, America’s #1 most “Corrupt Capitalist” and the revolving door poster child who oversaw the deregulation of Wall Street during is tenure as Treasury Secretary — between the obligatory stints at Goldman Sachs and Citibank.

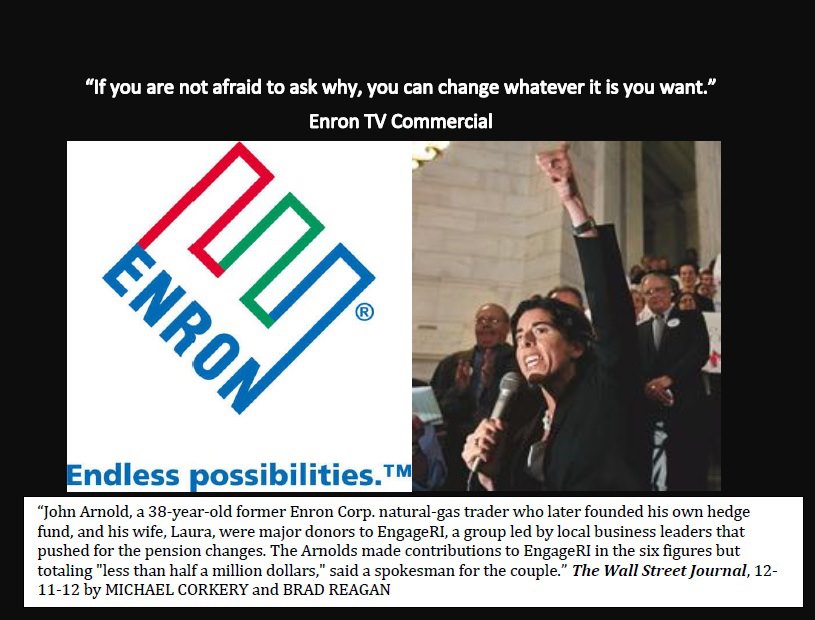

-John Arnold, a billionaire Houston-based former Enron energy trader who funds anti-worker campaigns across the country. Read Salon’s recent write-up of Arnold here.

–Securities and Exchange Commission target and former administration official Steve Rattner, another exemplar in extremis of Washington-to-Wall Street revolving door crony capitalist corruption.

Few states have been more harshly impacted than Rhode Island by the of the instantiation of the the will of the global financial elite: from NAFTA’s expediting the decline of the local manufacturing industry, to the outsized local impact of the housing/mortgage crisis and broader economic collapse. If Raimondo’s benefactors get their way, Rhode Island’s relatively aged population will endure the slashing of Social Security, Medicare, and other programs on which they rely; even the modest banking reforms urged by Dodd-Frank will fail to be implemented, and we’ll remain exposed to future cycles boom and (in Rhode Island mostly) bust.

These people and institutions give her money not for concern for the people of Rhode Island, but because under the reign of the Rhode Island proto-Romney, our bright blue state will bleed as the proving grounds for further right-wing financial “innovations”. And because she will serve as a trusted sycophant to Wall Street’s wizard’s should she ever (God forbid) realize her ambition of achieving federal office. Let’s please not let that happen, no matter the deceitful propaganda onslaught that she and her Wall Street backers and the shameful LeadHERship PAC will surely be foisting on Rhode Islanders in months to come.