When Seth Magaziner ran for General Treasurer in 2014, he promised that his top priority would be putting Rhode Island’s ailing pension funds in a better position by securing higher returns on investment at the lowest practical risk.

When Seth Magaziner ran for General Treasurer in 2014, he promised that his top priority would be putting Rhode Island’s ailing pension funds in a better position by securing higher returns on investment at the lowest practical risk.

I spoke to Seth this afternoon about his new plan for the pension funds which was unanimously approved today by the State Investment Commission.

The state’s public pension funds currently hold around $7.6 billion of which about $1.1 billion has been invested in so-called “hedge funds” that were originally intended to provide investors with good returns and security.

However, as numerous reports have shown, hedge fund performance hasn’t matched hedge fund promises, except perhaps for their managers who have become billionaires while handling other people’s money.

Searching for alternatives, the Treasurer’s office conducted months of research and consultation with financial experts. They also ran “thousands of models and projections” to come up with a better way to get better returns on investment without undue risk.

The result was announced by Seth today – a “Back to Basics” plan to move about half of the money the state has invested in hedge funds – around half a billion dollars – into safer, better investments such as low-fee index funds.

This will take place over the next two years.

I asked Seth to talk about the challenges of coming up with such a plan, such as public impatience with the pace of change.

“When you’re moving this much money,” he said, “You have to do it in an orderly fashion.” He said making such changes was “like steering an aircraft carrier – you can’t turn on a dime.”

Then there is the matter of exit fees involved when leaving investment vehicles such as hedge funds. “We wanted to make sure we avoided early redemption fees” which in some cases could be significant.

The other factor requiring a careful, deliberate approach is the need to find solid investment alternatives.

I told Seth that the dream of many people, me included, is to see pension fund money used to create local jobs and businesses. But I acknowledged the fact that pension law doesn’t really allow that to be a major pension fund priority.

Seth pointed out that the first duty of any pension trustee is to secure the best rate of return for beneficiaries with the least risk.

That said, among the alternatives they’ve explored are funds that invest in infrastructure. He noted the infrastructure investment market is very “hot” at the moment so the cost of buying in is high. Of course, the basic rule of investing is “buy low, sell high” not vice versa, so timing is a key issue.

Rhode Island has used its pension funds’ proxy voting rights to join with other public pension funds around the country to support shareholder resolutions against excessive executive pay and other abusive corporate practices. These pension funds control millions of shares so they carry some weight at corporate annual shareholder meetings.

The state pension fund is no longer in crisis as it was six years ago. Since Seth took office two years ago, the fund has run in the black for the two years, earning more than $390 million and beating the fund’s goal.

Rather than give back so much to hedge funds, the “Back to Basics” plan should reduce costs while boosting earnings while taking a cautious, prudent approach to risk.

In 2016, Treasurer Seth Magaziner has voted “no” on executive compensation plans at 75 companies, including Facebook, eBay, and the parent company of Google, “due to a misalignment between CEO pay and company performance or because the compensation plans were deemed excessive or otherwise inappropriate.”

“My job as Treasurer is to deliver strong financial performance for the state’s pension fund. When the companies we invest in award excessive pay packages to executives, it comes at the expense of the pension fund and the public employees we serve,” Magaziner said. “Our say-on-pay effort reflects our position that executive compensation should be transparent and based on performance.”

Earlier this year Magaziner announced that he will use the power of the Treasurer’s office to “vote against appointing white men to corporate boards of directors that are already comprised of mostly white men.” This latest announcement can be seen as a continuation of Magaziner’s belief that corporate reform can come through ethical voting from progressive investors.

Magaziner says that since the 1970s, inflation-adjusted CEO pay in the U.S. increased by almost 1,000 percent, according to a study last year from the Economic Policy Institute. Six of the highest paid U.S. CEOs make more than 300 times the salary of their typical employee, according to the compensation analysis firm PayScale.

Facing increasing shareholder advocacy amid a volatile market and slower growth rates, many of America’s biggest corporations are under an intense spotlight to link chief executive pay to company performance, according to the Korn Ferry Hay Group 2015 CEO Compensation Study.

Magaziner has sent a letter to all companies that received “no” votes to inform them of Rhode Island’s opposition to their executive pay packages, and offer to open a dialogue about how they can make progress on this important issue.

]]>

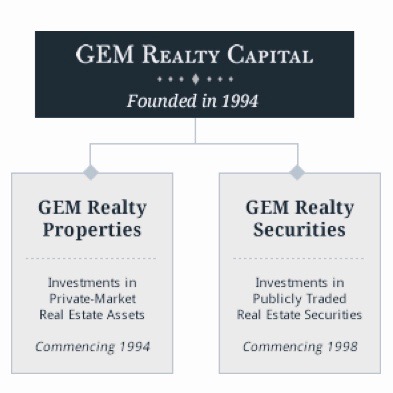

The RI State Investment Commission voted to invest $20 million with GEM Realty Capital, despite the company’s claim that the health and safety of employees at the Sofitel Los Angeles Hotel in Los Angeles, one of the many properties owned by the company, is not something they can have any affect on.

GEM Realty describes itself as a real estate investment company that invests in “private-market real estate assets and publicly traded real estate securities”. At the meeting on Wednesday morning, two GEM Realty representatives admitted that there were problems at the Sofitel Los Angeles Hotel, but said that as they are not the majority investor in the enterprise or involved in the day-to-day management of the business, there is little they can do to effect positive change in the way workers are being treated at the properties they invest in.

Treasurer Seth Magaziner lead the questioning of the company reps about the allegations of unsafe and un-sanitary labor conditions at the hotel and Commission member Marcia Reback asked about the use of a firm known for union busting to prevent workers from unionizing. The GEM Realty reps assured the Commission that the union-busting firm was no longer employed by the hotel and that the health and safety issues were in the process of being resolved via the National Labor Relations Board (NLRB).

On April 25 employees filed a complaint with the CA Division of Occupational Safety and Health complaining about the hotel’s failure to provide safety equipment to employees charged with cleaning medical waste from Sofitel Los Angeles Hotel rooms. Many guests receive treatment at a nearby hospital and leave medical waste behind. Though management shows an instructional video every year about the proper disposal of needles and bloodied linens, employees say “the hotel does not provide the safety equipment shown in the video”.

The Sofitel LA Hotel has also drawn “multiple Unfair Labor Practice charges that are currently being investigated by the regional office of the NLRB alleging that since employees raised the health and safety issues, hotel management has responded by threatening and surveilling employees and in one case illegally firing one of the employee leaders,” says Jim Baker coordinator for Unite Here. These case can be accessed here.

The Sofitel LA Hotel has also drawn “multiple Unfair Labor Practice charges that are currently being investigated by the regional office of the NLRB alleging that since employees raised the health and safety issues, hotel management has responded by threatening and surveilling employees and in one case illegally firing one of the employee leaders,” says Jim Baker coordinator for Unite Here. These case can be accessed here.

Then there’s the class action lawsuit seven employees have brought against the hotel alleging wage theft. Business Wire reports, “Six of the plaintiffs allege being paid less than the minimum wage while working at the Sofitel Los Angeles at Beverly Hills. A former barback, as well as three housekeeping workers, a banquet worker, and a restaurant server, allege that management underpaid or have been underpaying them by up to $5.37 per hour.”

Aside from the allegations of deplorable labor practices, there may be sound financial reasons to avoid investing in GEM Realty, says Sam Bell, executive director of the Rhode Island Progressive Democrats of America, has concerns about the very idea of private equity investments for our pension funds.

“With their high fees, private equity investments are a bad deal for our pension fund,” says Bell, “As Treasurer, Gina Raimondo, who made her fortune in this controversial industry, made a big move into high-fee funds, and that decision continues to drive our pension fund’s poor performance. Seth Magaziner campaigned on a new kind of politics. Expanding private equity investments, while other funds are pulling out of high fee options, would represent a move back to the aggressively pro-Wall St. policies of the previous Treasurer.

“Real estate private equity funds are especially poor choices, given their distinctive record of pushing policies that hurt American families,” says Bell, ” In the case of GEM Realty Capital, it is aggressive violations of workers’ rights that stand out, but across the real estate investment industry in general there is a serious and pervasive culture of immorality.”

Though the GEM Realty reps were asking for a $30 million investment from the state, the board seemed to feel that a $20 million investment was more in line with their investment strategy.

One New York City official in an April 14 Reuters story said of hedge fund managers, “Let them sell their summer homes and jets, and return those fees to their investors.”

The board of the New York City Employees Retirement System (NYCERS) voted to leave blue chip firms such as Brevan Howard and D.E. Shaw after their consultants said they can reach their targeted investment returns with less risky funds. The move by the fund, which had $51.2 billion in assets as of Jan. 31, follows a similar actions by the California Public Employees’ Retirement System (Calpers), the nation’s largest public pension fund, and public pensions in Illinois. “Hedges have underperformed, costing us millions,” New York City’s Public Advocate Letitia James told board members in prepared remarks… NYCERS had $1.7 billion invested in hedge funds at the end of the second quarter 2015, according to its financial report. That amounted to 2.8 percent of total assets and was the smallest portion of its ‘alternative investments’ portfolio, which included $8.1 billion in private equity.

This begs the question: when will General Treasurer Seth Magaziner do likewise?

This begs the question: when will General Treasurer Seth Magaziner do likewise?

To help me parse through this further, Ted Siedle, who is now working on his third forensic audit of the pension, this time dealing with the real estate investment portfolio, sat down with me for an interview. He compared the pension scheme to “nothing Buddy Cianci would have ever dreamed of.”

Click the player below to listen to my full interview with Siedle

“My sense is that, from some some comments I have seen attributed to Seth Magaziner, is that he is preparing to distance himself from at least the Governor’s hedge fund gamble with pension assets. So it appears that he is moving from a ‘stay-the-course and incrementally fire poor performing hedge fund managers and replace them with promising hedge fund managers and make the case that the good outweighs the bad’, moving to an approach where he says either he will abandon the hedge fund strategy altogether or, going forward, or he will jettison perhaps half of the hedge funds and keep the remaining.

Siedle added, “But I think he’s making noises like he may make a bolder move to distance himself from the investment strategies that the Governor implemented. I think that Magaziner is heading in a better direction. I am not hearing a clear indication that his predecessor was wrong about anything and his predecessor was wrong… The massive benefit cuts and the massive investment in speculative hedge funds, high-risk high-cost hedge funds and private equity funds, was a foreseeable disaster, it was foreseen by me, I wrote about it before the strategy had been even fully implemented. Warren Buffett warned this was something that should not be done.”

Projected savings from pension cuts could soon be evaporated by poorly performing hedge funds, Siedle said.

“The benefits were cut to save $2 billion over the next twenty years. Within four or five years … the pension’s lost probably about $2 billion. So all of the projected savings have been, I suspect … will have been eliminated by foreseeable losses. So this has been probably the most disastrous investment decision ever made in the history of Rhode Island.”

He said, “So what I would submit a responsible, courageous State Treasurer would do would to be to call out that this was a horrific mistake, but I’m not hearing that. I’m hearing a distancing but not a mature, responsible response.”

To further clarify what Siedle feels about Magaziner’s time on the job, just look to his recent writings for Forbes:

]]>At 31, Magaziner—lacking any meaningful investment experience—somehow convinced voters in 2014 that he could competently oversee the massively underfunded, embattled $7 billion state pension. Talk about chutzpah—a kid whose personal income the year before assuming office was reportedly approximately $5,183 (yet he somehow loaned his campaign $550,000)… Not only has Magaziner failed to follow through on his transparency promises, despite five years of dismal hedge fund performance at the pension he oversees, he remains committed to Governor Raimondo’s secretive, costly deal with Wall Street.

It’s morning again in Rhode Island. At least that’s what it feels like to the progressive left the day after Bernie Sanders beat Hillary Clinton in the Ocean State’s presidential primary poll.

The socialist-leaning senator from Vermont all but conceded the nomination to the more conservative Clinton after losing four other states in the so-called Acela Primary. Last night even Bernie Sanders admitted he probably won’t be the next president. It was not a good night for those holding out hope he might pull closer in pledged delegates.

But by pulling off a convincing victory in Rhode Island, a state dominated by neoliberal leadership, Sanders sent a strong message that Rhode Islanders want progressive change. He won 55 to 43 percent.

He won 66,720 votes, Clinton got 52,493, Donald Trump got 39,059 and John Kasich took 14,929. The difference between Sanders and Clinton was greater than the difference between Clinton and Trump. The two Democrats got well more than twice as many votes as all three Republicans. Rhode Island seems very open to the idea of a progressive political revolution.

“I hear all the time, ‘…that is too liberal, we’ll get voted out if we do that,’” said progressive Providence Rep. Aaron Regunberg at the Sanders victory party last night. “That argument no longer holds any water.”

Sanders won 35 of 39 municipalities in Rhode Island. Clinton took Barrington and East Greenwich, the two most affluent suburbs in the state, and Central Falls and Pawtucket, very close to her campaign headquarters. Sanders took the rest rather convincingly.

Providence was close, with 51 to 47 percent for Sanders. But he won cities like Warwick, Cranston and Woonsocket by substantial margins. His key to victory was the rural vote – the Swamp Yankee Progressives. Sanders won in affluent liberal enclaves like South Kingstown (62%-37%) by similar margins that he won working class communities like Coventry (61%-36%).

Burrillville backed Sanders over Clinton 64 to 34 percent, but only 1,337 people voted in the Democratic primary compared to 2,167 in 2008. In the Republican primary, which Trump won with 73 percent of the vote, 1,261 people voted compared to 399 in 2008. More Burrillville residents voted for Clinton in 2008 than voted for a Democratic in 2016. There were three polling places open this year compared to four in 2008.

Burrillville was an important bellwether because of a controversial proposal for a fossil fuel power plant there. The Invenergy methane gas facility is backed by Governor Gina Raimondo and organized labor but opposed by residents and grassroots activists. Congressional climate champion Sheldon Whitehouse has tried to avoid taking a position.

This is a lot like the Clinton/Sanders divide in Rhode Island. Raimondo was a regular on the campaign trail for Clinton while Whitehouse called Clinton’s position on climate change “adequate” and didn’t really publicly stump for her. Whitehouse and Raimondo probably represent the range of local elected officials who backed Clinton, which also included Secretary of State Nellie Gorbea, General Treasurer Seth Magaziner and the entire congressional delegation.

I strongly suspect there’s a high correlation between Bernie voters and Burrillville power plant opposers. For liberal Democrats like Whitehouse, Sanders big win is an invitation to tack left on issues ranging like climate, economic and social justice. For neoliberal Democrats like Raimondo, who would rather reinvent Medicare than the energy grid, it’s a cautionary tale. Bernie Sanders beat Hillary Clinton 55 to 43 percent. Raimondo did even worse than Clinton when she ran in the 2014 Democratic primary, winning only 42 percent of the vote.

]]> Treasurer Seth Magaziner has a plan to make corporate board rooms more diverse. Rhode Island’s pension fund will vote against appointing white men to corporate boards of directors that are already comprised of mostly white men.

Treasurer Seth Magaziner has a plan to make corporate board rooms more diverse. Rhode Island’s pension fund will vote against appointing white men to corporate boards of directors that are already comprised of mostly white men.

“Research has shown that diversity leads to better performance. It’s true in government, it’s true in education and its true in the business world as well,” Magaziner said at a news conference today. “Study after study has shown that when you have diverse management teams in corporations those companies perform better, they perform better financially and their stocks perform better. Despite this many corporations are not doing enough to diversify their leadership and it starts at the board level.”

Noting that less than 20 percent of the boards of directors for the S&P index corporations are female and less than 15 percent are people of color, Magaziner said, “This lack of diverse viewpoints hurts these companies, and hurts our pension fund.”

So the state Pension Board approved a new policy to use its proxy votes in the corporations we invests in to vote against appointing white men to boards of directors that have fewer than 30 percent women or racial minorities represented on the boards.

“I believe this will improve our performance and help us financially for the members we serve,” Magaziner said.

The state plans to vote against Hess, Hersheys, ConocoPhillips, Phillips 66 and EMC Corporation, a Massachusetts company, to start. Because it invests in hundreds of companies, there will be hundreds of opportunities to vote against appointing more white men to corporate boards.

“We anticipate that we will be voting against the board slates at a number of large companies because a number of large companies aren’t taking this seriously enough,” Magaziner said. There are no Rhode Island-based companies that the state is voting against yet, but that situation will arise.

Rhode Island doesn’t have large stakes in these businesses, so it can’t block any appointments. But Magaziner said it will send a message.

“There are a number of other large institutional investors who are progressive and who would care about this from an opportunity-building point of view, there are other large state pension funds, there are union funds out there,” he said. “But ideology aside, everyone cares about making good returns. So what we need to do is keep taking about the fact that the research shows that stronger diversity is good for performance. We’re going to keep evangalizing and beating this drum.”

He said Rhode Island won’t divest from companies for appointing too many white men.

“If we were to divest from these companies then the only voting members that would be left would be the ones that don’t care,” he said. “My philosophy is you stay engaged, you keep voting the right way and you recruit other investors to start voting the right way too.”

Jim Vincent, the executive director of the Providence chapter of the NAACP, and Dariah Kreher, chairwoman of the Women’s Fund of Rhode Island, both applauded the move.

“It’s so important to have inclusion on the part of all Americans, not just the precious few that have always been a part of these boards,” Vincent said. “We feel that it is a very important step for Rhode Island to make. To say that you can’t find talented people of color to be on boards and commissions is not only insulting but it is counter-productive to having the best pension fund we can have. So it’s a win, win in the state of Rhode Island today. I look forward to seeing how the companies respond to this bold initiative.”

Kreher said the trend in Europe is for the government to impose quotas on corporate boards of directors. Germany, she said, recently mandated corporate boards become at least 30 percent female, and that similar laws have been passed in Norway, Spain, France, Belgium and Italy and Iceland “The EU is considering a mandate to bring the numbers to 40 percent,” she said.

“Businesses in the United States don’t like mandates,” Kreher said. “But they might not be providing optimum returns for their investments based on the limited talent and the myopic vision of their decision-making bodies. Changes are necessary if the US is to keep up with world economy.”

]]>

Former Massachusetts Representative Barney Frank was in Providence Monday morning campaigning for Hillary Clinton in the form of an interview with RI Treasurer Seth Magaziner. The Congressperson was the chairman of the House Financial Services Committee from 2007-2011 and the Frank half of the Dodd-Frank Act, a major reform of the financial industry signed into law under Obama.

Frank says that the United States is trapped in a vicious cycle: People have lost confidence in a government that responds to their needs, so they elect anti-government candidates who produce a government that is even worse than before. Frank believes that the only way out of this is to elect Hillary Clinton as president.

Bernie Sanders, says Frank, is being too critical of anything that falls short of his own lofty ideals. Frank thinks this is a mistake and strongly disagrees with this way of thinking.

“Almost every representative committed to progressive change is for Hillary Clinton,” says Frank, including the entire congressional LGBT caucus and every member of the Black caucus, save one. This isn’t because they are part of the “establishment” says Frank, but because they are committed to progressive change.

“If you tell people it’s either revolution or nothing worth fighting for,” says Frank, “you open up the not-voting behavior.”

As for taking money from Wall Street, Franks says that Sander’s idea that politicians taking money from businesses they want to change cannot be counted on “goes against every person I’ve ever served with.”

Frank then went into his experiences passing Dodd-Frank, which reversed 12 years of a Republican-controlled Congress loosening the regulations that controlled Wall Street. He noted Rhode Island Senator Jack Reed’s contributions to that process.

Sander’s promise to break up the big banks makes no sense to Frank. The problem “isn’t that institutions are too big, it’s that they had more debt than they could handle.”

Frank says that he helped pass legislation to prevent too much indebtedness. “AIG couldn’t happen today,” he says. He helped to outlaw sub-prime loans and increased the companies on-hand capitol.

“General Electric got out of the financial business because of these laws,” says Frank.

Under Frank’s legislation, regulators can look at a company’s holdings and in the event that it looks dangerous, can order divestment. Clinton’s plan to regulate Wall St would lower the bar for divestment, giving her enhanced authority to order divestment.

In contrast, says Frank, Sanders isn’t coherent on this issue. “How can you say something is too big if you don’t know what size it should be?” asks Frank.

“Hillary,” says Frank, “understands how it all works.”

Clinton’s tax policy was also touched upon. As President she wants to tax high frequency stock trades and tax hedge funds as income. Frank objects to Sander’s “McCarthy-ite suggestion that she’s soft on these issues because of the money she accepts.”

Clinton’s tax policy was also touched upon. As President she wants to tax high frequency stock trades and tax hedge funds as income. Frank objects to Sander’s “McCarthy-ite suggestion that she’s soft on these issues because of the money she accepts.”

Clinton will increase taxes on people making more than $1 million and especially those who make more than $5 million, says Frank.

When asked about health care, Frank was not in favor of introducing single-payer system, at least not quickly. “People need to be shown how this can be done,” said Frank. “I think Sanders will be a disaster [on health care],” says Frank, “People are not ready to have a tax increase to pay for universal health care.”

Clinton will crack down on big pharma pricing, prevent tax dodging of companies incorporating overseas and expand health care, says Frank.

Frank, who was among the first openly gay members of Congress, ended with some words on LGBT rights. “Though Sanders has always voted the right way on LGBT issues there is near unanimous support in the LGBT community for Hillary,” he said.

Clinton’s Supreme Court picks, Frank said, will help reverse the Hobby Lobby decision and uphold legislation, like the kind being worked on by RI Representative David Cicilline, to prevent private action discrimination against LGBT people.

One final note: Frank did say that if Sanders wins the nomination, “Of course I’ll campaign for him.”

]]> Recent testimony by Steven Costantino before the House Oversight Committee was a long-overdue step in the right direction.

Recent testimony by Steven Costantino before the House Oversight Committee was a long-overdue step in the right direction.

While newsworthy, the appearance by the former House Finance Chair falls seriously short of the full investigation that clean-government groups have been demanding.

Margaret Kane, president of Operation Clean Government (OCG), said, “State House leaders want to move past 38 Studios, but they want to do so by sweeping it under the rug. The public deserves to know how this disaster occurred, and without an independent investigation it is unlikely that Rhode Islanders will ever learn the truth.”

OCG is also concerned that little effort has apparently gone into preventing similar disasters from happening in the future. “Even Mr. Constantino testified that he was generally opposed to moral obligation bonds,” Kane points out.

She added that Treasurer [Seth] Magaziner’s plan to strengthen a finance board which he largely appoints isn’t exactly the independent oversight that is needed.

Operation Clean Government is a member of the Investigate38StudiosNow.org coalition, which has been calling for the 38 Studios scandal to be investigated not only by the legislative oversight committees, but also by an independent investigator hired outside the legislative branch. Since the coalition called for these investigations, the Oversight Committee has for the first time been allowed to issue 38 Studios subpoenas. However, Governor [Gina] Raimondo has still refused to appoint a truly independent investigator.

The 38 Studios scandal, which has already cost the state many millions of dollars, shows no sign of going away.

[From a press release]

You watch the full testimony in the videos below:

]]>

“Today is about you putting your issues on the table and [about] how you can influence the decision making process that we have in this great state,” Mark Hayward, District Director of the Rhode Island Small Business Association (SBA) told an eager gathering of business owners, lobbyists and politicians, “Your participation at this Summit will essentially decide… the direction of [economic and business] issues that are going to be critical to you over the next year.”

The 2016 Rhode Island Small Business Economic Summit (Summit) is held at Bryant University and sponsored by the SBA and the Center for Women and Enterprise. A long list of state senators, representatives and gubernatorial staff come out to this event every year. Big names include Speaker Nicholas Mattiello, General Treasurer Seth Magaziner and Governor Gina Raimondo. It took Hayward two minutes to list the the government reps appearing, and he didn’t get them all. It’s the kind of political access social justice groups cannot imagine.

The point, says Hayward, “is to provide an opportunity for members of the small business community to have a discussion with members of the General Assembly and the [Governor’s] administration and,” he says, “over the years, we have succeeded because many of the issues that are being taken up today, derive from the Summit.”

Hayward introduced speaker Stefan Pryor, Rhode Island’s Secretary of Commerce. Pryor painted a rosy picture of Rhode Island’s economic future, saying, “We’re beginning to see the optimism lift, we’re beginning to see the unemployment drop, we are starting to see the new projects start, and we are starting to see the pessimism dissipate.”

Pryor did not mention the cruel poverty that affects nearly 1 in 5 children in our state, but he did mention that the state is “still suffering from unemployment. We still compete for the worst unemployment rate in New England.”

Pryor did not draw a connection between the high unemployment, high poverty and what he called a “favorable tax climate” for business. “We have the lowest corporate tax rate in the northeast, a hard-earned distinction at 7 percent. In the recent session we completely eliminated the sales tax on energy, the Business Energy Tax. It’s not an easy tax to eliminate a tax entirely but it’s gone. Gone forever.”

Pryor assured those in attendance that Rhode Island will not be raising taxes on business owners. “We have not raised a major tax, corporate, income or sales, in twenty years,” said the Secretary with pride, “Think about that relative to tax stability and at the same time we’re axing taxes.

“Why do we think we can maintain that kind of stability going forward? In this past session we put the final touches on and solidified pension reform that then General Treasurer Raimondo had begun. With all your help, Medicaid reform, in a substantial way, was undertaken.

“These structural reforms will save Rhode Islanders over $4 billion dollars over the next 20 years” and “this will ensure future retirement security and future budgetary stability, said Pryor, “That’s the platform we’re building. The hybrid of generations of discipline and not raising taxes, even when times were tough.

“These are the signs of responsible budgeting and sensible fiscal stewardship.”

You can watch all of Pryor’s remark Here:

]]> As of January 1, the Rhode Island minimum wage will be raised to $9.60. Although a good step towards financial equality, it cannot compensate for the nation’s polarizing wealth divide. We need banks to do that.

As of January 1, the Rhode Island minimum wage will be raised to $9.60. Although a good step towards financial equality, it cannot compensate for the nation’s polarizing wealth divide. We need banks to do that.

In 2013, 63 million Americans spent a combined $455 billion nationwide on alternative financial services, as reported by the Federal Deposit Insurance Company. This includes scams such as payday loans, pawnshops, and check-cashing services. Pay day loans offer immediate loans with steep interest and short payback, pawn shops take expensive collateral with hefty fees for small cash loans, and check-cashing services charge significant flat-rates, often around $40 per paycheck. United For A Fair Economy believes alternative financial services outnumber McDonald’s and Starbucks franchises combined in America today. Alternative financial services set up in areas they believe densely impoverished to prey on the financially disadvantaged. Institutionally, they operate to widen the wealth gap.

In his 2014 campaign, Rhode Island General Treasurer Seth Magaziner highlighted that one in four Rhode Islanders are underbanked. In Magaziner’s words, underbanked citizens “don’t have a bank account at all, or they have a bank account and they’re still relying on high-cost financial services like payday loans, pawn shop check cashing and so on.” Of the 63 million consumers that are underbanked in America, 24 million of them have no bank account at all. The families with limited bank account usage spend an average of $3,000 a year working while the average underbanked family spends $43,000 in their careers on check-cashing services. For these 63 million underbanked Americans, the vision of banks is a dark one. Among the most common reasons for using alternative financial services instead of banks, the top responses were “lack of money”, “I don’t like dealing with or trust banks”, “inconvenient hours or location.” These responses show a fundamental misunderstanding of the comparably greater convenience, affordability, and security of banks.

Communicating this is one of the smaller barriers banks have traditionally held, like extensive documentation, high minimums and maintenance fees, and new account screenings. Others responded “account fees are too high or unpredictable.” Many of these individuals live paycheck to paycheck and do not earn enough to meet minimum balance or direct deposit requirements for free checking. What should they do?

Put money in the bank. Bank accounts provide the financial security needed to build wealth. While accumulating interest, your money is protected from fires, burglary, misplacement, or other damage. With a bank account you build a credit history, critical for loans for cars, for home mortgage, and for higher education. And bank accounts are cheaper and more convenient than alternative financial services, from free bill pay, to free check cashing, to free ATM withdrawal.

As of 2015, nine banks or credit unions in Rhode Island have little to no minimum balance requirement nor require direct deposit for free checking. Many have no minimum balance and free checking. Almost all have free online statements, credit building opportunities, mobile banking, and free ATM access. Looking to the future, financial literacy is on the rise in Rhode Island’s schools, and a new state backed program College Bound incentivizes saving for the higher education of Rhode Island’s next generation.

Banks still need lower entry barriers for Rhode Islander’s looking to open checking accounts. New account screenings must offer forgiveness for previous debts. With financial guidance banks could aid in paying off the prior institution to which their new customer is indebted. It is equally as crucial that banks and credit unions offer an entry-level checking account with no minimal fees and balances.

Some banks would object to the operating cost they incur for maintaining an account with little immediate return. These banks need to look forward. The short term loss in revenue will be returned manifold as Rhode Island’s poor accumulate the wealth they then reinvest in said bank. Banks understand the delayed but greater return of a bond. Banks need to bond with Rhode Island’s consumer, for delayed but greater returns for both.

America today resembles a plutocracy. The assets of the top 1 percent is now approaching 45 percent of the nation’s wealth, having steadily risen toward levels unseen since the Great Depression. The wealth of the bottom 90 percent continues to hover between 10-20 percent of the nation’s wealth for the last century. The stagnant trend makes clear that growth in national income has not yielded a more equitable distribution of wealth.

Expert on urban and racial inequality and poverty, Melvin Oliver says, “Income feeds your stomach, but assets feed your head.” Many Rhode Island stomachs will be fuller by sixty cents an hour come January 1st. But will their heads will still be hungry? Wealth breaks the cycle of living day to day. Alternative financial services drain wealth while banks can nurture it. Rhode Island and Rhode Island’s banks: stop living day to day on pennies, and bond.

]]>