Al Jazeera Examines Occupy Wall Street: Occupy Providence has thrown the buzzwords “American Spring” around on their Google Groups page a bit, and I’m still skeptical, but this video on Al Jazeera English’s “Fault Lines” program gives us a reminder of just what was going on then. Undoubtedly, Occupy changed the debate. Since Occupy retrospectives seem to be in vogue (bringing some attention to Rhode Island due to the negotiated ending), this one is good.

“Fault Lines” is a pretty good program, and I’ve largely enjoyed each new one. Most interesting to Occupiers is probably this one on Chile’s mass actions. I’d argue that Chile, with its Chicago School-designed free market economy, relative modernity and democratic government is far more similar to the United States than either Spain or Greece or any of the Arab nations that have faced mass movements, and it’s been far more successful at mobilizing youth despite a far more traditional organizing model.

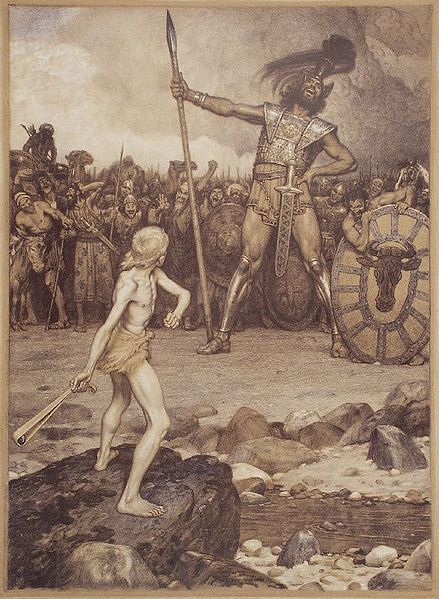

How Underdogs Can Win: Malcolm Gladwell provides a on the idea of David vs. Goliath, and dissects how undermining the rules of the game creates havoc when facing more traditional-minded opponents. For anyone who’s ever had to run on tight resources, it’s definitely rewarding. Mr. Gladwell is/was a tobacco industry shill, but there’s no denying he’s a capable writer. Though… I’m still not sure if on closer examination the whole thing doesn’t fall apart.

RI 10th Least At-Risk for Corruption In Nation: According to the corruption risk report cards released by the State Integrity Investigation. Since I’ve previously written about how RI isn’t really corrupt versus other states, I feel vindicated. Unfortunately, we got a C overall and the least corrupt was New Jersey with a B+. The naysayers are bound to point out that we got an A in redistricting, despite the CD1 maneuvers. But we got Fs in Judicial Accountability and State Civil Service Management, so I guess that’s where the conversation should focus (it probably won’t). The next step for the Investigation is to suggest solutions. Keep an eye out.

New Hampshire Libertarian Republican/Democratic Coalition Defeats Marriage Repeal: In a 211-116 vote in the House, libertarian Republicans and state Democrats joined up to defeat a socially conservative Republican attempt at repealing the extension of marriage to cover homosexual couples. Given that in Rhode Island, it was a struggle even with a gay Speaker of the House to pass civil unions, this defense of the right of marriage by social liberals in New Hampshire proves that it doesn’t matter what letter stands next to your name, you can still defend people’s rights. The question for the Republicans is if this means that the party’s social conservatives are finally facing a backlash after their success in 2010.

96% of Americans Admit to Receiving Welfare (When Told What Counts As Welfare): Yes, apparently when you don’t have to check in with a government agency to get welfare, you don’t acknowledge it as welfare. However, when you’re aware you’re receiving government welfare, you’re much more pro-government. Ezra Klein’s post for Washington Monthly ends up reinforcing the notion that our welfare system is dangerously screwed up. Basically, tax policy transfers a lot of wealth from the poor to the wealthy. The post doesn’t go into it, but in many ways, deficit spending does the exact same thing. Poor people don’t buy government bonds.

Rhode Islanders Take On Payday Lenders:* Speaking of tax policy, over at the Barrington Patch, a large group of people, churches, politicians, and advocacy groups have a letter laying out why reforming payday loans is a smart idea. It’s pretty clear that the industry makes an exorbitant profit and won’t go belly up if they have to deal with reduced profits, nor that the current rate (260% APR) is particularly necessary. In case you missed it, Cracked.com’s John Cheese wrote an article long ago about how one gets screwed being poor, and payday loans took #4.

__________________________________

*Correction: Earlier, this letter was falsely attributed to Barrington Patch editor William Rupp. Apologies for the mistake.