Over one hundred forty thousand (141,035) Rhode Islanders lived in poverty in 2015, according to new data released today from the Census Bureau. The drop in the rate to 13.9% in 2015 from 14.1% in 2014 is not statistically significant. The poverty level for a family of four is approximately $24,000.

Over one hundred forty thousand (141,035) Rhode Islanders lived in poverty in 2015, according to new data released today from the Census Bureau. The drop in the rate to 13.9% in 2015 from 14.1% in 2014 is not statistically significant. The poverty level for a family of four is approximately $24,000.

The one in seven Rhode Islanders with income below the poverty level do not have enough to meet basic needs. Child Care Assistance, SNAP and health insurance coverage help working families make ends meet when earnings are not enough. Rhode Islanders unable to work on a temporary or permanent basis turn to cash assistance and other programs to protect themselves and their children. The new on-line integrated eligibility system can facilitate enrollment in these vital programs. But the new technology cannot replace the need for staff. “In the two years that the HealthSource RI on-line system has been operative, most new applicants have required help either over the phone or in-person to complete their application. Access to computers and knowing how to navigate an on-line application have also been issues.” said Rachel Flum, Executive Director of the Institute. “With more programs accessible through the system, the need for one-on-one assistance is even greater. The state must ensure that there are sufficient staff to help people access these critical benefits.”

The Ocean State had the highest rate of its residents living in poverty among the New England state and ranked 26th among all states.

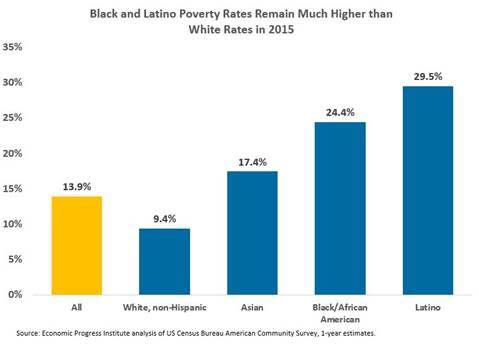

Today’s data also show that Rhode Island’s communities of color were much more likely to struggle to meet basic needs with nearly one in three Latinos, close to one in four African Americans and more than one in six Asians living in poverty. While the one-year census data does not permit sub-group analysis, multi-year analysis shows that South East Asians are not as economically secure as the Asian population as a whole (See analysis of five-year median wage data in “State of Working Rhode Island, 2015: Workers of Color”).

“It is unacceptable that so many Rhode Islanders are living in poverty and shocking that Black, Latino, and Asian households face such deeper economic distress compared to the white majority. To truly achieve economic equity now and into the future, our state must be intentional about targeted policies to address racial disparities in wages, income, and total wealth,” said Jenn Steinfeld, facilitator for the Racial Justice Coalition, a new collaborative effort to address shared barriers faced by all non-white Rhode Islanders.

The Census Bureau released extensive information on the economic and health insurance status of Americans. The Economic Progress Institute website provides additional analysis of the new data for Rhode Island, including the more positive news that median income increased in 2015 to $58,073 from $54,959 in 2014.

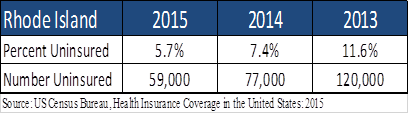

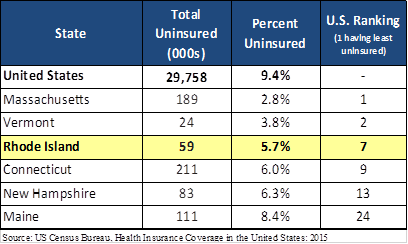

New Census data show that the percentage of uninsured Rhode Islanders was 5.7 percent in 2015, half the rate it was in 2013, the year before the Affordable Care Act (ACA) went into effect. In 2014, 7.4 percent were uninsured.

New Census data show that the percentage of uninsured Rhode Islanders was 5.7 percent in 2015, half the rate it was in 2013, the year before the Affordable Care Act (ACA) went into effect. In 2014, 7.4 percent were uninsured. “Rhode Islanders should be proud that we are 7th in the nation for the percent of residents who have health insurance coverage”, said Linda Katz, Policy Director at the Economic Progress Institute. “With health insurance, people are more likely to keep up with yearly preventive care visits and people with chronic conditions can get the treatment they need to promote their well-being. Besides the obvious benefits for families and individuals, having a healthy work force is a good selling point for our state. Medicaid and coverage through HealthSourceRI are vital to ensuring that thousands of our residents can afford comprehensive health insurance.”

“Rhode Islanders should be proud that we are 7th in the nation for the percent of residents who have health insurance coverage”, said Linda Katz, Policy Director at the Economic Progress Institute. “With health insurance, people are more likely to keep up with yearly preventive care visits and people with chronic conditions can get the treatment they need to promote their well-being. Besides the obvious benefits for families and individuals, having a healthy work force is a good selling point for our state. Medicaid and coverage through HealthSourceRI are vital to ensuring that thousands of our residents can afford comprehensive health insurance.”

On Friday

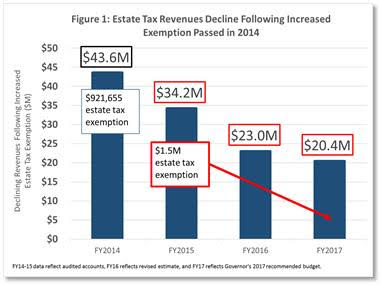

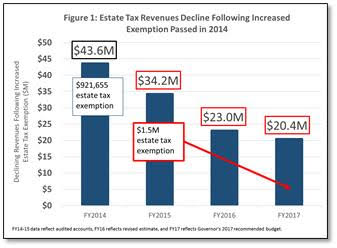

On Friday The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.

The state increased the estate tax threshold in 2014 effective January 2015, essentially increasing estates exempt from paying the tax from $1 million to $1.5 million and reducing the tax on higher income estates. The estimated revenue from the estate tax in 2014 was $43.6 million, dropping to $34.2 million in 2015, a 20% loss of revenue after the change.