Nabisco made the announcement in January.

“They said, ‘we’re laying off 600 people, we’re sending the production down to Mexico, you can basically deal with it,’” explained Nate Zeff, of the BCTGM International Union. Zeff was in Rhode Island to explain the plight of the Nabisco 600, workers who once made products such as Oreos, Honey Grams, Fig Newtons, Animal Crackers and Ritz Crackers in Chicago, who watched as their good paying jobs were sent to Monterrey and Salinas Mexico.

The workers were told that they could prevent the company moving to Mexico, said Zeff, if they would agree to a staggering $46 million a year in concessions, in perpetuity; an impossible demand to make of working class families.

Mexican workers are paid a tiny fraction of what United States workers earn, allowing Nabisco to pay starvation wages in one country while wiping out an entire community of workers in another. And lest you think these savings might be passed along to consumers, think again. The money ‘saved’ is funneled directly into the pockets of overpaid corporate executives like Irene Rosenfeld, CEO of Nabisco parent company Mondelez International, who made a shame worthy $21 million in 2015.

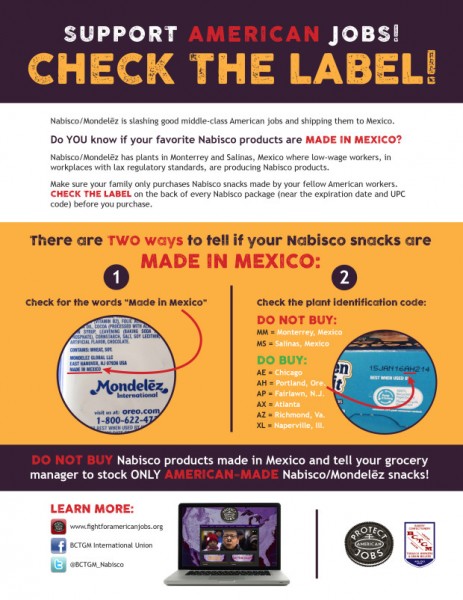

To counter Nabisco’s move, and to bring these jobs back to the United States, the BCTGM has announced an audacious plan: A targeted boycott of Nabisco products made in Mexico. There are two ways to determine if a product on the shelf is made in Mexico, as seen in the video and picture below. One, the package may simply have the words “Made in Mexico” in the fine print near the ingredients label. Otherwise, check out the “plant identification code.” MM and MS stand for Monterrey and Salinas, Mexico, respectively.

There are a couple of things to note about this boycott. One is that there are still plants in the United States making Nabisco products. This boycott is not against all Oreos, it’s a targeted boycott against Oreos made in Mexico. Note also that it’s not enough to simply not buy the Mexican made products. Take the product to the store manager and tell them why you are not buying.

Sure, the manager will say that they are not responsible for ordering the product, or that they have no control over where the product comes from, but if enough people complain, the complaints will start their way up the chain of command.

Anthony Jackson, a disabled veteran, was also in Rhode Island as part of the tour. He had a job paying him $26 an hour, now that job has gone across the border to a worker who makes less than $100 per week. “This is a $35 billion corporation,” said Jackson, “the Oreo alone made $2.9 billion last year.”

Jackson was at a shareholder’s meeting and asked CEO Rosenfeld why the company couldn’t treat Chicago workers fairly. Rosenfeld said the workers received “fair-market value.”

“To this day we’ve received zero dollars and zero cents,” said Jackson, “So what [Rosenfeld] said to us is that we are nothing.”

Jackson had five requests for those who want to support this effort.

1. Go to fightforamericanjobs.org and learn more about the boycott and the Nabisco 600.

2. Like their Facebook page.

3. Call the number on Oreo packages and complain about the fact that American jobs are being lost even as Mexican labor is being unfairly exploited.

4. Check the label (as seen above) for the country of origin and don’t buy made in Mexico products

5. Tell somebody. Spread the word. “We want to be the first company to bring production back from Mexico,” said Jackson.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Our friends at Ocean State Current-Anchor recently published a piece against the concept of a guaranteed minimum or guaranteed basic income. Justin Katz argues that a GMI would interfere with price discovery, which is an important mechanism in free markets. He is wrong.

Whoo hoo!

Okay, first, let’s celebrate. The fact that Katz is addressing this is a sign that substantial success has been made in promoting the concept of a guaranteed minimum income among liberals and conservatives. He even acknowledges that ‘[e]ven on the political right, some folks are willing to entertain the idea as a reimagining of the welfare state. . .”.

First they ignore us, then they laugh at us, then they fight us. . . We’re somewhere around step 2 1/2, because we’re not getting laughed at, but the argument being made against us is not emanating from an immediate bill to make this happen.

The Right and the Basic Income

Who does Katz mean when he says that some on the right are willing to entertain a guaranteed minimum income?

He might be referring back to a recent (fairly epic) conversation I had with Ken Block, Katz, C. Andrew Morse, and several other people about RI H7515. I won’t rehearse the ins and outs of that, but the gestalt of it was me pointing out that many land use, tax, and transportation disincentives to business are more significant than the labor movement in chasing away small business in Rhode Island.

C. Andrew Morse, though in concert with the others (and against me) on just about everything else, did say that he thought it was plausible to imagine a future where benefits like SNAP or Section 8 could be swapped out for a general income to all people in the country.

On a grander level, though, the right has always been the biggest proponent of a guaranteed minimum income (with substantial left support). The kingpin of economic conservatism, Milton Friedman, was a huge supporter:

Don’t worry. Though Friedman is not usually the sort of person many of us would claim common ground with, guaranteed minimum income programs are an important part of most social democracies, and even (in a weaker form) exists in the U.S. through the Earned Income Tax Credit (EITC). In fact, the GMI is arguably more important than the minimum wage in creating lowered inequality in a market economy, because in places like Denmark it allows what’s called “labor flexibility” while also providing an effective bargaining shove in the favor of working class organizing.

Building from Lincoln Logs

The argument that Katz is making about price discovery is not false. Katz says:

What ought to happen [in economic hardship] is that prices adjust to reflect the new economic reality. If your entire industry is displaced, many people won’t be able to afford the latest gadgets, so the industry that makes those gadgets will have to find a way to lower their prices. Every industry will have to lower its prices to reflect the reduction in demand at current prices. That sounds terrifying, but remember that the premise is that technology is displacing people and making everything less expensive to produce.

This is true.

To take an example: in the housing crisis, it was bad for a person who owned a house for their housing price to dip, and a lot of effort has been made to re-inflate the housing bubble so that prices would return to an upward trend. But obviously having housing prices dip would be good for someone who might want to buy a house but previously couldn’t. It’s more complex than that, of course, but mainly that’s because we have a string of regulatory and tax externalities that get in the way of very poor people taking advantage of that price change. For instance, we zone away affordable housing types, we make it illegal for certain people or certain numbers of people to share housing, we have a tax system that rewards interest payments that primarily are accessed through loans by wealthy people, and so on. But the point, overall, is still true. If you live in Providence as a poor person you are much more likely to be able to find affordable housing than if you live in a housing market like San Francisco where the prices have gone sky-high.

Where Katz goes wrong is in building an economy out of Lincoln Logs. He imagines a very small scale village, perhaps, where giving the village’s poor is a huge input into the economy, and has an outsized effect on prices. It’s true that poor people getting a basic income will have a slight stabilizing effect on prices, but the effect on the poor people’s poverty is going to be a lot bigger to them than to the community. It’s like rolling a bowling ball down a ramp and having it bounce off a super-ball. The laws of physics say that each is affected equally in opposite directions, but the mass and elasticity of the super-ball mean that it is the actor that is affected most dramatically.

The problem here is that Katz ignores orders of magnitude. We have a huge economy, and currently in that economy the top 0.1% of the U.S. owns more than the bottom 150 million people the bottom 90% (287 million= 318.9 million x 0.9, see reference from Politifact). Making sure that an even smaller slice of that 150 million 287 million has a basic amount of money to not go homeless or hungry is insignificant compared to the size of the economy.

Other Flaws– Forgetting Costs

This’ll be a basic rehearsal for many people on the left, but the right should remember that just removing one cost does not always mean solving a problem. In fact, this shouldn’t be a controversial thing to impress upon a conservative who is thoughtful, because conservatives are the group that most seeks the concept of a business-like “cost-benefit analysis”. A liberal might be inclined to say that certain things just are good no matter what, but conservatives are supposed to be the people who say, “Wait, what are the other factors?”

Here are some other factors I can think of:

Violence: When people are in absolute desperation, they are more likely to turn to violence. We can assume that we’re going to take a tough stance on these folks, but that means building prisons and paying for more police. Since we already have the largest prison population in the world– bigger than China’s, both per capita, and absolutely– we’re not really in a place to dillydally on this issue. Welfare reform sucked for lots of reasons, but the oddest one of all was perhaps that it ultimately has cost us more money than welfare did to get rid of welfare and put people in prisons.

Violence: When people are in absolute desperation, they are more likely to turn to violence. We can assume that we’re going to take a tough stance on these folks, but that means building prisons and paying for more police. Since we already have the largest prison population in the world– bigger than China’s, both per capita, and absolutely– we’re not really in a place to dillydally on this issue. Welfare reform sucked for lots of reasons, but the oddest one of all was perhaps that it ultimately has cost us more money than welfare did to get rid of welfare and put people in prisons.

Educational gaps: In the long-run, the market corrects many things, but as Keynes said, “In the long run we’re all dead.” If a child has a short-term shortage of nutrition, even if a very effective private charity eventually fixes that problem, the gap in the meantime is likely to cause longterm harm to their educational achievement.

Health: Whether we have a fully private health system, or a fully public one, or a weird mishmash of public and private like what we have here in the U.S., the costs to mental and physical health are great when people are in tough times.

Bureaucracy: As Friedman points out, we’re not starting from scratch. We have numerous bureaucracies that handle many overlapping and competing forms of aid. Martin Luther King made a similar point, if from a very different perspective, during his Poor People’s Economic Human Rights Campaign. The biggest single advantage of the guaranteed minimum income over other programs is that it deals with aid more efficiently. Conservatives should stop acting as though some magical world without aid of any kind is going to come about, and instead start thinking of how existing aid programs can be made to benefit the most people for the least amount of money.

Markets are Good, Extremes are Bad

The Schumpeterian “creative destruction” of the market which is part of the very laissez faire Austrian school of economics says that bad things happening in an economy can produce great progress in the long run. While we’re not terribly open to this idea on the left, we should be. For one, it’s merely a reflection of the Marxist belief in the same thing, and was in fact developed in response to the idea of Marxism.

More to the point, creative destruction is all around us. When a business fails, someone is able to buy up the resources from that business at pennies on the dollar and repurpose them. It’s like the succession of a forest: a fire happens, thousands of trees are lost, but the conditions that allow small plants to grow up and mature are created, and soon a new forest is born. But this metaphor fails when it’s taken to the micro-level. We don’t think of people as like trees. We think of people as people. We value them (because, after all, we’re biased) as individuals. In the long run, the creative destruction happens. The welfare system exists to make sure the change happens without harming individual people.

A guaranteed minimum income is a good way to balance the forces of creative destruction without sacrificing what’s most important to us: people. Conservatives should adjust to that.

~~~~

Update: Justin Katz wrote a response to mine this morning, drawing heavily on the physics metaphor. I think he still misses the point, and in some ways he digs himself into a less reasonable position than he initially took.

Elasticity

Much of his post really draws on the elasticity aspect of the physics metaphor. Quoting from the most recent piece:

First, though, I’ll point out a technicality. My post was explicitly not about using a UBI as a welfare mechanism for a small population of very poor people, but rather about using it as a way to reconfigure our economy when technology makes large numbers of human jobs superfluous. In that case, Kennedy’s argument about size and elasticity does not apply.

Well, yes, Katz’s article was about how the GMI could be used to protect the Big Other of the tech industry, but that is exactly the reason the elasticity argument does apply. Let’s review what Katz said in his first piece:

As David Rotman writes in the MIT Technology Review, some folks are seeing a UBI as a way to address the social change when technology ensures that fewer and fewer people actually have to do anything resembling work:

[Quote block within Katz’s piece] “… among many tech elites and their boosters, the idea of a basic income seems to have morphed from an antipoverty strategy into a radical new way of seeing work and leisure. In this view, the economy is becoming increasingly dominated by machines and software. That leaves many without jobs and, notably, society with no need for their labor. So why not simply pay these people for sitting around? Somehow, in the thinking of many in Silicon Valley, this has become a good thing.”

It’s not surprising that tech oligarchs and other comfortable groups of people would favor the idea, because the healthier, more-natural economic path forward would put some risk on them, rather than just on the poor folks losing their jobs. If you’re out of work and the government gives you money (from somewhere), then you can go on buying devices and software, keeping Silicon Valley humming. (My emphasis)

Whatever Rothman or Katz might say, my point is the GMI has never been offered as a way to prop up specific industries. Its biggest advantage is the fact that it gives tremendous choice to individuals who use it, not that it acts as some kind of constraint on choice through corporate welfare or state-owned-industries. The disappearance of particular jobs due to industrial change may in fact be the reason a given population has no work, or has lousy work, at any given time, but the mechanism of addressing that problem– giving them money– does not in any way protect an industry. Recipients can “go on buying devices” but they can also buy other things if they wish. There’s no implicit guarantee for the industries.

So Katz says elasticity is good.

But Katz moves the goal posts from the beginning of his rebuttal to the end, because he states that:

Right now, we’ve got a pretty stiff approach to welfare, delivered mainly in specific products and services, and it’s processed through a slow bureaucracy. In addition to the simple wastefulness of doing anything through government, this creates complications and has an effect on the economy (decreasing the incentive to work, for example), but we have to consider pluses and minuses in our specific context. Cash, on the other hand, is a very elastic medium, and using it for welfare would rocket the economic and individual problems much higher.

Money is fungible, of course, so if we all pay for somebody’s food, that person can spend his or her other money on things of which we do not approve, but at least he or she gets the food. If we simply hand out cash, then the person can skip the food and go right to paying for… say… hard drugs. Being compassionate, what does our society do then? Finally cut the people off, and declare their destitution beyond our responsibility? (My emphasis)

So Katz says elasticity is bad.

Today, Katz’s blog trumpets a vote to make using SNAP benefits for drugs or gambling illegal. So while Katz’s reply to me does acknowledge an outside chance of fraudulent SNAP use (“Of course, giving people things they don’t want above other things, but that have value, we probably increase the tendency toward fraud (to convert the food into cash”), he argues that the benefit of the SNAP program is that it mostly guards against that result (“If we fund just food, the person still has to come up with money for things he or she wants. That could mean incentive to work.”). Yet if SNAP’s advantage is that it prevents the elastic use of its benefits for things like drugs, why does Katz’s blog highlight an effort to make that use illegal at the state level? It is already illegal to use SNAP for this purpose at the federal level. The answer is that the 66-1 vote to make welfare fraud doubly illegal is more about casting doubt on the morality of poor people than about addressing a real problem.

So Katz may be a hobgoblin, but consistency is not part of his mind.

Nonetheless, drug abuse is a real thing, and it is not at all hard to imagine that some people do manage to use their food stamps for purposes other than food. Milton Friedman had answers to the idea of drug use directly. He felt that government did its best work in providing basic and mostly undifferentiated services to the general public, while very complex social issues were best handled at the ground level by private individuals. I think this is a solution that is commensurate with social democratic thought, but at its very roots it is a conservative idea. So in Friedman’s world, all people would have some basic money to do with what they might, and private charities could educate them to the risks of drug use, provide needle exchanges to prevent disease amongst those who still choose drug use, and provide varied approaches to treatment for those getting out of drug abuse. The housing needs of individuals suffering from this problem would be privately met– untrammeled by exclusionary zoning. This is a vision where the vast majority of the complex work of fixing a complex issue is done by the private sector. This is the vision offered by the left. The right, on the other hand, has worked to make basic benefits hard to get, but has also tied the hands of private individuals who might want to help with drug abuse. Needle-exchanges, drug decriminalization, and other programs that might let the private sector shine have generally been anathema to the right (I couldn’t find anything immediately demonstrable of this on Katz’s blog, and it’s not fair to paint all conservative thought with one brush, but to illustrate my point, here’s an example from Kentucky. Some Republicans in New Hampshire had a better approach this year, though their party was split).

Mass

Katz does not address relative masses, but I think mass is actually the more important factor. And, in fact, I actually think my first metaphor was too modest. The difference between an individual getting modest help and the size of the economy is less like a basketball-to-golf-ball comparison than it is to an Earth-to-basketball comparison. The economy of the country is huge, and the amount of help needed to provide sustenance is tiny. It’s impacts are felt heavily on the individual and weakly on the economy not just because the individual is more elastic (can make more individuated choices) but also because the mass difference is so great.

Think about it: you move the Earth. Everyday. When you jump off the ground, you push on the Earth and the Earth pushes back. Equally. It’s an astounding thought when you first think of it, but it’s a law of physics (Newton’s Second). But though the law states as an ironclad rule that the effects are equal in terms of their physical force, the three feet you may be able to jump are much greater than the tiny, many-zeroed, decimals-of-a-micrometer that your motion affects the trajectory of the Earth– though it technically does affect its trajectory.

Astounding. The world around us is amazing. Let’s make sure everyone can enjoy that wonder.

~~~~

If you like what you see, you can donate to my PayPal at james.p.kennedy@gmail.com.

]]>judgment, shame and contempt

[for families with felons]

are felt most acutely.”

Michelle Alexander

Time for a pop quiz question. Ready? In what year did the U.S. end slavery?

Most agree it’s 1865. Some historians disagree. Their answer: 1942.

True, the Triangle Trade’s enrichment of slave shippers ended with the Civil War. Tragically, however, legally coerced work continued. Some southern states were sly. Police falsely imprisoned blacks, and judges ordered lengthy sentences at hard labor.

“Convict leasing” was legalized. Douglas Blackmon describes this practice as “a system in which armies of free men, guilty of no crimes and entitled by law to freedom, were compelled to labor without compensation, were repeatedly bought and sold, and were forced to do the bidding of white masters through the regular application of extraordinary physical coercion.”

The penal system became the new slavery.

Still, the answer to our black-history-month query may not be 1942. Ready for a shocker? Enslavement of blacks exists today.

The War on Drugs intensified in the 1980s. In just two decades, those jailed for drug offenses increased ninefold. The Director for National Drug Control Policy, retired General Barry McCaffrey, referred to this imprisonment system as a “drug gulag.”

Mass incarceration is aggressively focused on communities of color. Despite blacks and whites having similar drug usage rates, a 1999 Human Rights Watch report states, “Black men are admitted to state prison on drug charges at a rate that is 13.4 times greater than that of white men.” Indeed, black men imprisoned, on parole and probation now exceed all men enslaved in 1850.

Bondage for drug offenses is inflicted almost exclusively on black and brown men. Whites are usually ‘off the hook.’ Even when arrested, whites are more often given alternatives to jail. When jailed, whites’ average sentences are 16.3 percent shorter than blacks.

Enormous numbers of black bodies are placed in bondage, their prison labor extracted, for non-violent drug offenses. Isn’t this a new system of slavery? Isn’t this massive discrimination also subjecting prisoners’ families—parents, spouses and children—to excruciating emotional and financial bondage?

As a permanent undercaste, the black community also suffers wage slavery. Whites’ average household income is 68.5 percent higher than blacks—and the black unemployment rate is twice that of whites. This severely depressed income continually increases economic inequality: Average white families now have thirteen times the assets of average black families.

It gets worse: Black prisoners’ sentences continue after release.

Imagine leaving prison. Determined to lead a good life, you plan to go to college—but you’re barred from getting a federal loan. Or you need a job but, if a black man, only five percent of employers will even grant you an interview. You may be desperate for public housing assistance. You can’t get it. By law, you probably can’t receive any public benefits—including food stamps if your kids are hungry. With all these cruel barriers, what choices remain? Can we see why ex-cons often return to prison?

Again, this discrimination primarily decimates blacks.

So who should correct these many forms of racialized financial rape? Why not the white community which perpetrates and often benefits from black bondage?

The first step is education: More fact-packed articles detailing the destructive impacts of racism can be found at www.quoflections.org\race.

Second, share these injustices with friends and family.

Third, let’s seek legislation ending the War on Drugs (really, the War on Black Men). Let’s eradicate laws discriminating against ex-felons. Let’s legalize a living wage. Also, our nation has the wealthiest white community in history, primarily due to centuries of labor stolen or cheated from African Americans. In the name of justice, we who are white can advocate for long-overdue reparations to be invested in neglected black communities.

Oh, and our pop quiz answer: Even in 2016, slavery continues on a massive scale.

]]> A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

A new report calls into question many of the job growth strategies being pursued and implemented by our state leaders. “To create jobs and build strong economies,” say economists Michael Mazerov and Michael Leachman in their new report, “states should focus on producing more home-grown entrepreneurs and on helping startups and young, fast-growing firms already located in the state to survive and to grow ― not on cutting taxes and trying to lure businesses from other states.”

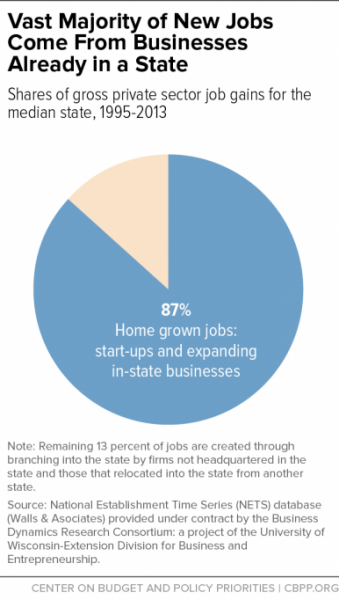

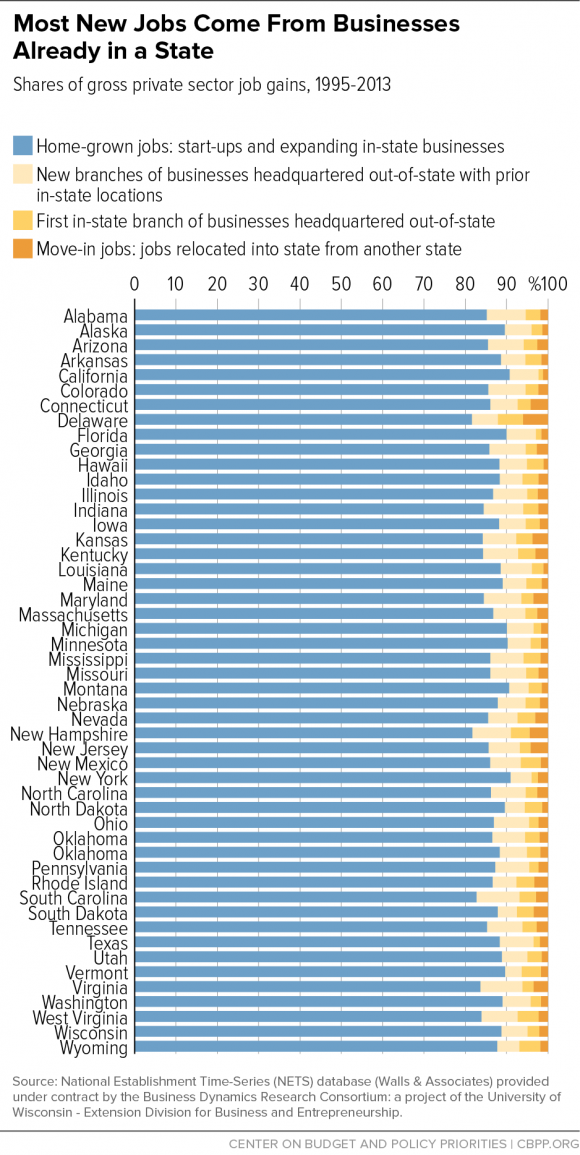

The report, “State Job Creation Strategies Often Off Base” takes advantage of new data accumulated over the last fifteen years “about which kinds of firms create jobs” and the data shows that the “vast majority of jobs are created by businesses that start up or are already present in a state — not by the relocation or branching into a state by out-of-state firms.”

The immediate takeaway from this report for Rhode Islanders is that Governor Gina Raimondo’s planned (yet not realized) trip to Davos and the time she spent trying to persuade General Electric (GE) to move to Rhode Island rather than to Massachusetts are wastes of time and money. Raimondo’s offer to GE was in the “same neighborhood” as Massachusett’s $140 million in state and city incentives and grants. Given the conclusions in this report, Rhode Island dodged a bullet when GE turned Raimondo’s offer down.

I asked the authors of the piece directly about the governor’s plan to travel to the World Economic Summit in Davos and they told me, “That is not where state economic development comes from and that’s really not where policy makers should focus. They should focus on homegrown businesses and try to stimulate startups and helping their businesses that are already in the state to find customers and find the skilled workers they need. Business recruitment accounts for such a tiny share of job creation and that’s really a major point of this paper. It is not where the priority should be placed.”

In other words, we are, as a state, pursuing failed economic and job creation strategies, and we will continue to fail unless we take this new data seriously.

On average, 87 percent of new jobs are created by businesses already in the state. In the chart below, you can see that Rhode Island is no outlier in this department. The remaining 13 percent of jobs come from out of state businesses branching into the state (think of a restaurant chain in Boston adding a store in Providence) or a business actually relocating into the state, as GE recently did when they moved to Massachusetts.

What kind of businesses stimulate job creation? The report stresses that “startups and young, fast-growing firms are the fundamental drivers of job creation when the U.S. economy is performing well.”

The report quotes economist John Haltiwanger and his colleagues as saying, “Overall, the evidence shows that most start-ups fail, and most that do survive do not grow. But among the surviving start-ups are high-growth firms that contribute disproportionately to job growth. These high-growth young firms yield the long-lasting contribution of start-ups to net job creation.”

The firms that take off are called “gazelles.” Think Google, Amazon, Tesla or Under Armour, or, in Rhode Island, think NuLabel. These kind of firms accounted for about 15 percent of all businesses, but were responsible for half of gross job creation from 1992-2011.

Failed Policies

In trying to create a “business friendly climate” that will lure small businesses to the state, our leaders, like leaders in many other states, have pursued strategies that are “bound to fail because they ignore the fundamental realities about job creation revealed by the new data and research discussed above.” A favorite failed strategy is tax cuts for “small businesses.”

These tax cuts are not properly aimed at young businesses, they are aimed at small businesses. Most small businesses don’t have employees or plan to add employees. And targeting tax cuts to young businesses has little effect because most young businesses spend so much money on new equipment, product testing and marketing that they have little in the way of taxable income in the first place.

Tax cuts don’t help a state’s business climate, but they do hurt a government’s ability to do the important work of funding education and maintaining a top notch infrastructure. The report cites an Endeavor Insight study that showed that only 5 percent of entrepreneurs cited low tax rates as a factor in deciding where to locate their company, whereas 31 percent cited access to talent (education) and a city’s quality of life as a factor.

Offering tax breaks and non-tax incentives to lure out-of-state companies to our state is also a losing game. In Rhode Island we are addicted to TSAs, Tax Stabilization Agreements, which allow companies and developers to avoid paying their fair share of taxes and shifts the businesses’ tax burden onto the rest of the city or state taxpayers. As the report clearly shows, “jobs gained due to firm relocation are such trivial factors in a state’s overall job creation record that they should not be a consideration in formulating state tax policy or economic development policy more broadly.”

A look at statements made at the recent Greater Providence Chamber of Commerce luncheon reveals that our elected leaders haven’t gotten this message yet.

Here’s Senate President Teresa Paiva-Weed talking about the importance of tax cuts:

Here’s Senate Majority Leader Dominick Ruggerio talking about tax stabilization agreements to spur development:

Here’s Senate Minority Leader Dennis Algiers on “broad-based” tax cuts, which we’ve seen are not only not effective, they are counter-productive:

Here’s Speaker of the House Nicholas Mattiello talking about how “incentives” (i.e. tax breaks) “attract new people to our state.”

Continuing to pursue strategies that have been shown to hinder rather than help in job creation would be foolish in light of the data in this new report. Instead, “policy needs to focus on encouraging entrepreneurship generally, helping new businesses to survive, and enabling businesses with the potential to become high-growth firms to fulfill that potential.”

]]>

“An unfettered pursuit

of money rules. That is

the dung of the devil.”

Pope Francis

The Pope doesn’t care much for greed.

The wages of 30 million U.S. workers cause so much misery they leave within a year. The Economist states this chaos continues because, “The most obvious incentive—more money—is often the last to be considered.”

Often, the issue is greed.

Retail and fast-food businesses also stiff taxpayers. Walmart pays ‘low, low’ wages to impoverished employees: Forbes reports taxpayer assistance totals about $6.2 billion annually.

James Parrott, the Fiscal Policy Institute’s Chief Economist, states, “Wages are so low that 60% of fast-food workers qualify for public assistance.”

What to do? Purdue University’s study concluded that doubling Indiana’s fast-food workers’ wages to $15 an hour would raise prices only 4.3 percent. A $3.99 hamburger would increase 18 cents.

This increase is slight because employee turnover is significantly reduced: Recruiting and training costs decrease; worker morale and productivity improves. With current turnover greater than 100 percent, retail and fast-food industries, on average, lose all employees every year.

This can change. Seattle restaurant owner Jeremy Price says of paying $15 an hour, “It has been a positive change for our staff and our business.”

A living wage is a win/win/win: Employees receive a just wage; employers overcome high turnover and reduced productivity; and taxpayers avoid paying ‘corporate welfare’ for low-wage workers.

The primary problem is greed.

The wealthy counter with the myth: “The rich are makers, the poor are takers.” The reverse is true.

First, lobbyists write laws giving corporate welfare for ‘the takers.’ According to the conservative InvestmentWatch, their loopholes and looting are so brazen that, in 1950, corporations paid $3.00 for every dollar paid by workers; corporations now pay 22 cents.

Second, corporations have stashed $2.1 trillion overseas. This ‘takers’ tax scheme, according to the nonpartisan New America Foundation, eliminated 1.3 million to 2.5 million jobs through 2011.

Third, aristocrats’ paltry effective tax rate on inheritance is 17 percent. The wealthy pay only 20 percent on capital gains.

Fourth, it bears repeating: Taxpayers bankroll corporate profits. New York Governor Andrew Cuomo is livid, “It costs this state $700 million a year to subsidize the profits at McDonald’s and Burger King—and that is wrong, and that must stop.” UC-Berkeley estimates public subsidies for corporations’ low wages totals $153 billion.

The greedy rich are takers. Justice requires they pay their fair share—in taxes and wages.

Fifth, this myth states government rewards poor people who avoid work. Actually, nearly 90 percent receiving benefits are working or disabled. The rest have job training or must find work to avoid losing their safety net. All laborers, ‘the makers,’ should be paid wages which escape poverty.

Sixth, poor workers pay significant taxes: Sales taxes; Social Security; other taxes on wages; and property taxes—directly, or indirectly through rent.

Seventh, by spending all their pay, the working poor create demand for more products and services. This demand ‘ripples’ from one business to the next, multiplying business spending. Thus, living wages spur economic growth—and poor workers’ increased spending creates jobs.

Eighth, the system cheats workers. Laborers’ wages kept pace with productivity from 1948 to 1975. Since then, productivity increased 100 percent—but wages for ‘the makers,’ adjusted for inflation, declined seven percent.

The working poor are makers. Justice requires they are paid their fair share.

Wage slavery requires abolition. The ‘Fight for $15’ movement is right: The minimum wage must become a living wage.

Barriers to wage justice include ignorance and fear, but the main obstacle is greed, “The dung of the devil.”

Absent government action, businesses can still win—achieving low turnover and high productivity—by paying substantial annual increases until $15 is achieved. In this season of wonderment and thankfulness, businesses must act with courage and caring to restore dignity and decency.

Rev. Harry Rix has 60 articles on spirituality and ethics, stunning photos and 1200 quotations for reflection available at www.quoflections.org. ©2015 Harry Rix. All rights reserved.

]]>

At recent State House hearings on raising the minimum wage and eliminating the tipped minimum wage, restaurant owners, beginning with Bob Bacon of Gregg’s Restaurants, (who is also the president of RIHA, the Rhode Island Hospitality Association) have repeatedly brought up the specter of automation replacing low wage workers if labor costs are raised. Raising the wage, say entrepreneurs, will price minimum wage workers out of the market, and these robots are being developed now.

Following this argument to its inevitable conclusion, workers should realize that unless they are prepared to always sell their labor at rates below the price of a robot, they will be unemployable. As the price of such technology falls, workers should expect to have their wages slashed accordingly. It’s not just workers in restaurants who will be replaced, but taxi cab drivers, long haul truckers and soldiers. According to NBC News, even skilled workers like pharmacists and supposedly skilled workers like writers may find themselves displaced. In fact, one study estimates that 47% of jobs are at risk of being lost to robots.

I suppose that in the face of this threat we could fight for our jobs, selling our labor ever cheaper, exhausting ourselves in John Henry-like feats of frenzied work that demonstrate our indefatigable spirit even as our hearts explode in glorious exertion…

Or we can flip the script.

Whenever a new robot is developed, the owner simply lays off a bunch of workers, presses the “on” button and relaxes as the profits roll in. This allows the entrepreneur to enjoy a steady stream of income as the unemployed workers struggle to survive.

As more and more robots come online, less and less people will be employed. Eventually, even skilled robot mechanics will lose their jobs as robots will be able to repair each other. The humans of this world will be divided into those who own the robots and those who are starving to death. I think this is what Paul Krugman meant by “uncomfortable implications” when he discussed the future of robotics.

The problem with this scenario should be obvious. As this transition to the robo-centric world of tomorrow develops, there will be less and less people able to afford to buy the many things the robots are making. Long before we get to the point where the 1% of the 1% own the entire world and an army of robots to do their bidding, the economy will have collapsed.

No one will be able to afford to eat at Gregg’s.

So what’s the answer? Robert Reich suggests that it “may be that a redistribution of income and wealth from the rich owners of breakthrough technologies to the rest of us becomes the only means of making the future economy work.”

We already subsidize the restaurant industry with our taxes. Mike Araujo of ROC United RI says that “tipped workers in Rhode Island currently receive $638,325 in food stamps every month.” That’s because the wages the restaurants pay to these workers are too low, and as more workers are replaced by robots and become unemployed, we’ll need to expand our social safety net. To do that we’ll have to tax the owners of the robots.

In light of this logic, our best bet is to get on with this now. We need a progressive income tax structure to increase taxes on the top earners in our state. We need to strengthen and increase, not eliminate, the estate tax. We need to tax capital gains and we need a transaction tax on all stock trades. I’m sure there’s a lot more good tax policy ideas I’m missing, but for the problem of robots and automation in particular, we need a robot tax.

In the future predicted by the leaders of the Rhode Island Hospitality Association, there will be fewer and fewer people able to pay taxes or in any way participate in the economic system of our state. Robots, however, will be productive and very taxable. Instead of allowing a system where workers strive ever harder for less, we need to impose an automation tax on industries that replace workers with robots.

]]>

Four of the five newly elected general officers – Governor Gina Raimondo, Lt. Governor Dan McKee, Secretary of State Nellie Gorbea and General Treasurer Seth Magaziner – toured Harrington Hall, a homeless shelter in Cranston, on Tuesday to garner the support needed to end homelessness in Rhode Island.

There are over 1,000 people in Rhode Island experiencing homelessness, a crisis for any society, but a moral crisis for a country as rich as ours.

Rhode Island has been chosen to participate in Zero: 2016, a national campaign to end homelessness among veterans and the chronically homeless by the end on 2016. Union leaders Lynn Loveday, George Nee and J. Michael Downey have pledged to support Zero: 2016. Now they are looking to elected officials for their support.

Jim Ryczek, executive director of the Rhode Island Coalition for the Homeless, opened the press conference at Harrington Hall reading off some of the sobering results of last December’s homeless census, in which 500 volunteers asked 855 homeless men and women about their lives in order to construct a Vulnerability Index for all homeless Rhode Islanders.

Jim Ryczek, executive director of the Rhode Island Coalition for the Homeless, opened the press conference at Harrington Hall reading off some of the sobering results of last December’s homeless census, in which 500 volunteers asked 855 homeless men and women about their lives in order to construct a Vulnerability Index for all homeless Rhode Islanders.

In Rhode Island, homeless adults range in age from 19 to 85, with the median age being 45 years old. 68% identify as male, 32% as female. About a third are sleeping outside, not in shelters. This means on the street, sidewalk or doorway, in a car, in a park, on the beach, in cemeteries, or in abandoned buildings. 58% have been homeless for more than two years. 7% are veterans.

The homeless cost us in terms of social services. 64% use emergency rooms for medical care. 39% have had interactions with the police. 4 in 10 have been transported by ambulance and about a third have received in-patient hospitalization. Being homeless is unsafe. 29% have been attacked while homeless. About half have admitted to needing psychiatric treatment and visited the ER for mental health reasons. A third have learning disabilities, and a quarter have brain injuries.

Governor Raimondo said, “I love the goal of ending homelessness, and we know how to. Build affordable housing and get people homes… and by the way, building affordable housing puts people to work in the process…”

“Some other public policy issues are a lot harder and take a lot more time,” said Secretary of State Nellie Gorbea, “affordable housing is a case of, there isn’t affordable housing, you build it, you build wrap-around supportive services around it and you save money in the end and save lives. What could be better than that?”

General Treasurer Seth Magaziner got to the heart of the issue when he refuted the fantasy of eliminating the social safety net. “No matter how many jobs we have, no matter how strong our economy is, there are always going to be people who need help. There are always going to be people, whether it’s a disability, mental or physical, or it’s just bad luck, who are going to need help and going to need support.”

George Nee put it simply when he said, “We know what to do. We know what works… it’s been demonstrated.”

Homelessness is a problem with a solution. Solving the problem is a moral choice we can make.

Update, Jan 8: In response to our request House spokesperson Larry Berman sent the following reply:

Update, Jan 8: In response to our request House spokesperson Larry Berman sent the following reply:

Speaker Mattiello, “means that if we alleviate poverty, there will be not need for a safety net. He wants to improve the economy and get people working to eradicate poverty.”

Speaker Nicholas Mattiello established himself as a cartoon super villain at the 7th annual Rhode Island Interfaith Coalition to Reduce Poverty Vigil when he told an assembled crowd of faith leaders and poverty advocates that when it comes to ending poverty, job creation and appropriate funding of the social safety net are important, but, “the focus has to be on eradicating the safety net and not bolstering the safety net.”

It’s obvious that the Speaker is no longer pretending to be a Democrat. You can hear the entirety of Mattiello’s short speech below.

]]> It took too long, but eventually, after the election of FDR, the United States got around to actually doing something about the Great Depression. The Works Progress (or Work Projects) Administration (W.P.A.) started putting Americans back to work, Keynesian style, in 1935. Economists may argue about the efficacy of stimulus programs, but one benefit cannot be argued:

It took too long, but eventually, after the election of FDR, the United States got around to actually doing something about the Great Depression. The Works Progress (or Work Projects) Administration (W.P.A.) started putting Americans back to work, Keynesian style, in 1935. Economists may argue about the efficacy of stimulus programs, but one benefit cannot be argued:

The W.P.A. built sidewalks, parks and public buildings that I, and countless others, still use everyday. I enjoy the safety of not walking in the street and a weekly farmer’s market at a nearby park because from 1935 to 1941, the United States did not just pay people to work, it invested in our infrastructure.

Most of the work done by the W.P.A. is adorned with simple and elegant plaques. The plaques were built to endure, and they have. These beautifully designed monuments to a time when the United States was smarter and less beholden to crank economic theories based on greed and the punishment of the poor are all around us, 80 years later. We all reap the benefits of this investment. I foresee enjoying these parks, walkways and other amenities long into my senior dotage, thanks to investments made 30 years before I was born.

Has anything of similar value come out of our recent Great Recession? Where are the new bridges and bike paths, green energy systems and smart grids, refurbished parks and improved public facilities? Where is the legislation to prevent future catastrophes? Where are the criminal prosecutions for economic malfeasance?

They don’t exist. Not only did we learn nothing from the Great Recession, we’ve forgotten everything we learned from the Great Depression.

Below is a collection of W.P.A. plaques I’ve photographed in and around Providence. I hesitate to say exactly where I found these plaques, because of the picture above, taken in Roger Williams Park, where many of the roads, bridges and sidewalks were built by the W.P.A. from 1935-1940. The picture shows a piece of sidewalk in the park where a W.P.A. plaque has been forcibly removed, most likely stolen by someone hoping to make a few dollars from a scrap metal dealer.

That our most vulnerable populations finance themselves through the theft and sale of scrap metal serves as a demonstration that our nation not only continues failing to properly invest in the future, we don’t even bother investing in the present. As a result we have begun the process of cannibalizing our infrastructure for petty cash.

Is it too late to turn this all around?

We can invest in our future by investing in the present. The W.P.A. shows one means by which investing in exciting projects today translates into real payoffs for the future. The interstate highway system, the moon landing and the Internet are more examples of investments that continue to pay dividends. If we were willing to, large investments in education, clean energy and financial regulation would reap enormous rewards for our children, and put parents to work today, on projects they can be proud of.

Not only can we can do it again, we can do it better.

Everyone knows that Rhode Island has the highest unemployment rate in the nation, right? After a few years of lagging Michigan and sometimes Nevada, we are now the nation’s leaders, despite the rate having ticked down slightly last month.

Everyone knows that Rhode Island has the highest unemployment rate in the nation, right? After a few years of lagging Michigan and sometimes Nevada, we are now the nation’s leaders, despite the rate having ticked down slightly last month.

But consider this: what do you learn by comparing a tiny state like ours to relatively gargantuan states like Michigan and Nevada? Is that comparison useful? Huge parts of Nevada are desert; huge parts of Michigan are farms; there are no huge parts of Rhode Island. Could that be relevant to the three states’ economies?

Comparing states to each other is a decent way to get a handle on differing state policies, but do we think that state policies are at the heart of our high unemployment rate? Are there no other differences you can think of between, say, Texas and Rhode Island? I believe our state’s policies certainly contribute to our economic condition, but sometimes another analysis can be revealing, too.

I looked last week at the unemployment rates for metropolitan areas (“Metropolitan Statistical Area” or MSA), as defined by the Census Bureau, and learned that the Providence MSA (which includes what you think of as greater Providence, as well as stretching out to include Fall River) has unemployment of 9.7%, higher than the statewide rate. We rank 339 out of 372, a pretty dismal showing. But that’s not dead last, so I also learned that there are 32 MSAs in 11 different states that rank lower than ours, including New Bedford, at 11.1%, and bottoming out at Yuma, Arizona, at over 22%. And Westerly and Hopkinton are part of an MSA centered in Connecticut, and their rate is 7.9%, or number 268 on the list. Nothing to be proud of, but better than 104 other places.

Half of the MSAs in California are doing worse than we are, as are three out of five in New Jersey, and four out of 25 in Texas. But those states also contain some high-performing MSAs, so the devastating performance of some areas are washed out in the statewide averages. There are several one-party states in that mix — from both parties — as well as several with divided control of their governments. It seems to me that anyone who wants to claim that Rhode Island’s high unemployment rate is entirely due to state policy has the burden of explaining why we should adopt the tax and regulatory policies that have brought Brownsville, Texas to a 9.8% unemployment rate or Yuma to 22%.

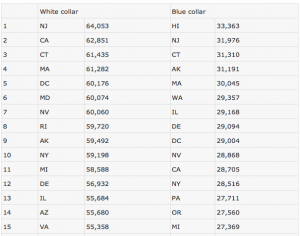

A few years ago I did an analysis that suggested the structure of the labor market might be relevant. Nestled between two richer states, Rhode Island’s white-collar jobs pay comparable wages to those neighbors. Jobs like these are good jobs, for which you might commute a long way, or even move your home. For jobs like being a psychologist, computer programmer, architect, or lawyer, this is pretty much a single job market. An employer in Warwick looking to hire a staff attorney competes for a pool of attorneys who might easily take a job in New London, Attleboro, Sharon, or Boston.

It’s not like that for hiring a cashier in a convenience store. You wouldn’t commute to Boston to work in a deli, and so it turns out that while white-collar wages here are at least comparable to wages for similar jobs in Massachusetts and Connecticut, blue-collar jobs vary much more, and in fact pay much worse here in Rhode Island.

I made a couple of rankings of states based on a selection of job categories, and I learned that some areas ranked high on my white-collar job list and low on my blue-collar list, while in some it was the other way around. (Read more about them in my book, “Ten Things You Don’t Know About Rhode Island.” The table is below, but you’ll have to check out the book to get all the details.)

In truth, I have no idea why these rankings differ, though it is entertaining to speculate. I noticed, for example, that places with a long history of union manufacturing (Ohio, Pennsylvania) pay good blue-collar wages, even for non-manufacturing jobs, and places that are very attractive to live (Hawaii, Oregon) tend to pay relatively poor white-collar wages. Agricultural areas tend to pay poor blue-collar wages, even for non-agricultural jobs. Rhode Island, with high white-collar wages and very low blue-collar wages, is an anomaly in the Northeast, and belongs with the states of the South, Southwest, and California.

Here’s what else I notice: the places that pay the worst blue-collar wages dominate the high end of the unemployment ranking.

This seems counter-intuitive — why would lower wages mean higher unemployment? — but it also seems to be true. On closer examination, maybe it’s not so crazy. People at the low end of the income spectrum tend to spend the money they have because they have to. More money in those people’s hands means more money being spent, so it makes sense that an area with better-off low-wage workers will enjoy higher levels of economic activity. This is just speculation, but it is broadly consistent with the basic Keynesian model of the economy that dominates our economic discourse.

But we can go one step farther, too. If we want to bring state policy into the equation, it seems that the metropolitan areas with the highest unemployment are not only places with low blue-collar wages, but are often in states where taxes on the low end of the wage scale are relatively high. According to the Institute for Taxation and Economic Policy (ITEP), Texas, Arizona, Illinois, and New Jersey are all places where total state and local taxes on the poorest people approach or top 12%, just like here. In other words, these are largely places where poor people are paid badly and taxed at high rates, too.

ITEP tells us that state and local taxes on poor people in Rhode Island average 12.1% of their income, while for people in the top 1%, the average rate is 6.4%. The tax cuts for the rich that we have given year after year have not resulted in lower taxes all around. Rather what has happened is that the state simply shirked its responsibilities to education and local aid. The cities and towns took up the slack by raising their property taxes, which fall most heavily on those with the least ability to pay. Taking money away from people who are most likely to spend it is what you might call the opposite of economic stimulus, so it is little surprise that the result is what you might call the opposite of prosperity.

What could we do about this? Pushing up the minimum wage would be a start. Cracking down on wage theft and the mis-classification of employees might help, too, as well as finally being honest about what we’ve been doing to our cities and towns.

Just something to think about when you read about the unemployment rate. As usual, it seems the things that everyone knows sometimes get in the way of understanding what’s going on.

| White collar | Blue collar | |||

| 1 | NJ | 64,053 | HI | 33,363 |

| 2 | CA | 62,851 | NJ | 31,976 |

| 3 | CT | 61,435 | CT | 31,310 |

| 4 | MA | 61,282 | AK | 31,191 |

| 5 | DC | 60,176 | MA | 30,045 |

| 6 | MD | 60,074 | WA | 29,357 |

| 7 | NV | 60,060 | IL | 29,168 |

| 8 | RI | 59,720 | DE | 29,094 |

| 9 | AK | 59,492 | DC | 29,004 |

| 10 | NY | 59,198 | NV | 28,868 |

| 11 | MI | 58,588 | CA | 28,705 |

| 12 | DE | 56,932 | NY | 28,516 |

| 13 | IL | 55,684 | PA | 27,711 |

| 14 | AZ | 55,680 | OR | 27,560 |

| 15 | VA | 55,358 | MI | 27,369 |

| 16 | GA | 55,323 | MN | 26,989 |

| 17 | HI | 55,231 | CO | 26,900 |

| 18 | CO | 55,141 | MD | 26,848 |

| 19 | NC | 54,849 | IN | 26,777 |

| 20 | TX | 54,734 | OH | 26,724 |

| 21 | OR | 54,552 | NH | 26,406 |

| 22 | PA | 54,415 | MO | 26,152 |

| 23 | TN | 54,110 | RI | 25,994 |

| 24 | WA | 54,105 | VA | 25,913 |

| 25 | MN | 54,096 | WI | 25,903 |

| 26 | WV | 53,906 | KS | 25,728 |

| 27 | OH | 53,878 | AZ | 25,445 |

| 28 | WI | 53,769 | TN | 25,396 |

| 29 | FL | 53,269 | IA | 25,294 |

| 30 | IN | 52,910 | GA | 25,153 |

| 31 | MO | 52,649 | WY | 24,968 |

| 32 | NH | 52,622 | VT | 24,708 |

| 33 | UT | 52,536 | NE | 24,635 |

| 34 | ID | 52,128 | ID | 24,611 |

| 35 | MS | 51,840 | SC | 24,333 |

| 36 | AL | 51,311 | UT | 24,299 |

| 37 | ME | 51,104 | MT | 24,161 |

| 38 | SD | 50,725 | ME | 24,075 |

| 39 | AR | 50,489 | LA | 24,004 |

| 40 | LA | 49,971 | NC | 23,983 |

| 41 | WY | 49,790 | KY | 23,967 |

| 42 | VT | 49,734 | SD | 23,850 |

| 43 | SC | 49,478 | ND | 23,841 |

| 44 | NM | 49,132 | OK | 23,753 |

| 45 | KY | 48,838 | TX | 23,502 |

| 46 | IA | 48,564 | FL | 23,466 |

| 47 | OK | 48,361 | WV | 23,353 |

| 48 | ND | 48,171 | NM | 22,634 |

| 49 | NE | 48,039 | AR | 22,562 |

| 50 | KS | 47,308 | AL | 22,428 |

| 51 | MT | 46,128 | MS | 22,097 |

(Source: SalaryExpert.com, 2005 data, methodology described here)

]]>