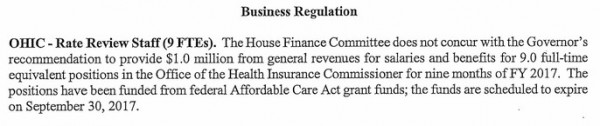

Though Speaker Nicholas Mattiello refuses to call them budget cuts, OHIC, the Office of the Health Insurance Commissioner, will suffer a 75 percent reduction in staff under the new budget unveiled last week. One health care advocate called the reduction in staff “a complete surprise.”

Though Speaker Nicholas Mattiello refuses to call them budget cuts, OHIC, the Office of the Health Insurance Commissioner, will suffer a 75 percent reduction in staff under the new budget unveiled last week. One health care advocate called the reduction in staff “a complete surprise.”

These cuts will reduce the effectiveness of OHIC in advocating for lower rates for consumers in Rhode Island, and are seen as a major giveaway to the health insurance industry.

A letter being widely shared throughout the health and medical advocacy community has been shared with RI Future:

The budget passed by the House Finance Committee June 8th cut 9 full-time staff from the Office of the Health Insurance Commissioner (OHIC), effective FY2017. This 75% cut in staffing leaves only the Commissioner, an administrative assistant, and one additional staff member to manage the functions of the office.

- The 9 positions that have been cut are essential for OHIC to carry out health insurance premium rate review, which OHIC uses to protect consumers from excessive rate increases; health benefit plan form review, which ensures that mandated services are covered, including preventive services like cancer screening; market conduct examinations (for example, mental health parity); and addressing consumer and provider complaints.

- Rate review alone has saved Rhode Island employers, employees, and consumers $196 million since 2012, including $40 million in 2015. These savings come from the Office’s review which can lower premium rates requested by insurers while ensuring that rates are based on sound actuarial standards.

- OHIC also reviews rates for Medicare Supplement Plans, which saves money for Rhode Island’s seniors, Student Health Plans, which saves money for students, non-Affordable Care Act Health Insurance Plans, and Dental Plans.

“If these cuts remain:

- OHIC will not have the staff to conduct adequate rate and form reviews, which will harm the state’s ability to protect consumers and employers from excessive premium rate increases.

- OHIC’s capacity to address consumer and provider complaints about insurer business practices will be severely limited, since staff to manage these cases is cut in the proposed budget. This will negatively affect Rhode Islanders. For example, OHIC investigated a company issuing short term limited duration coverage. The investigation discovered improper denials by the insurance company and OHIC required the company to pay improperly denied claims totaling $36,697.

- OHIC will not be able to adequately review health benefit plan forms. This means that there will be no watchdog to ensure that state mandated benefits are covered and covered fairly (parity), including services for mental health and substance abuse disorders, ensure that discrimination does not occur, and ensure that services are not unfairly excluded.

- OHIC will no longer have adequate ability to protect consumers from unscrupulous companies issuing non-compliant and misleading insurance plans.

“Rate and form review is a key component of health reform. It must be carried out by state governments, because the federal government does not have the authority to deny or modify premium increases in the states. In recent years the federal government has provided start-up and development grants to states to build and enhance rate review and oversight initiatives as a means to protect consumers and improve insurance affordability, with the expectation that states would continue the work. Rhode Island’s grants have allowed us to maximize our statutory authority to review rates and forms and to build one of the most comprehensive health oversight agencies in the country – but no further grant opportunities are being made available by the federal government.

“The 9 positions sought by the Administration for OHIC are integral to having a well-resourced watchdog agency in place to protect and maximize savings for employers, employees, and consumers. Only a well-resourced OHIC can provide the necessary level of oversight to protect Rhode Island consumers and businesses.”

Last week Speaker Mattiello defended the cuts at the Budget Briefing under questioning from Representative Teresa Tanzi. Mattiello said that these jobs were only made to last as long as there was federal funding to support them.

]]> A devastating fare hike for Rhode Island’s most vulnerable seniors and disabled people is the focus of a new budget fight. Although Rhode Island has long had a program where seniors and disabled people who have trouble affording bus trips ride free, the last year has seen efforts to end this program and charge more to those who can least afford it.

A devastating fare hike for Rhode Island’s most vulnerable seniors and disabled people is the focus of a new budget fight. Although Rhode Island has long had a program where seniors and disabled people who have trouble affording bus trips ride free, the last year has seen efforts to end this program and charge more to those who can least afford it.

Things are now coming to a head.

The recently revealed House budget includes money to put off the fare increase for six months, until January, but doesn’t quite put in enough funds to stop the fare increase altogether. RIPTA Riders Alliance is working to fight this, and there are several easy things people can do to help. When the budget comes up for a House vote Wednesday, there will be a proposed amendment to add a small amount of funds to RIPTA ($800,000) and stop the fare increase. Many disabled people and seniors have said publicly in the past year that they cannot afford to pay what RIPTA wants on their limited income, and RIPTA admits that they expect steep drops in how many bus trips disabled and senior Rhode Islanders will take. Fortunately, there are ways to make this better.

- One way people can help is by signing our online petition — it automatically sends messages to the State House when you sign. Please also share the petition link with others — we need people to respond quickly.

- Another thing you can do to help is to contact your state representative and state senator and ask them both to support budget amendments: $800,000 more for RIPTA to stop this attempt to squeeze more money from RI’s limited-income disabled and seniors who are already facing challenges. Go to vote.ri.gov to find your elected officials’ contact info — you can call them and/or email. RIPTA Riders Alliance has been distributing a flyer about this.

- Finally, RIPTA Riders Alliance will hold an event at 1:30 this Tuesday at the State House to talk about how important this is. We are sending the message that if Rhode Island’s senior and disabled people can’t afford to travel, they will be stuck at home, less able to shop, volunteer and visit loved ones — and isolation is deadly for seniors and the disabled. Protest makes a difference sometimes! Please come at 1:30 on Tuesday at the State House — and let people know about the Facebook event page.

Ironically, we’re facing this terrible fare hike on the most vulnerable because of a sneaky General Assembly move last year. When the House debated the budget last year, the House Finance Chair at the time, Raymond Gallison, put in a last-minute amendment to allow (that is, encourage) RIPTA to charge more to limited-income seniors and disabled people. Since then Gallison has had to resign. But it’s fitting that what began with one last-minute budget amendment is now leading to another, this time to save the most vulnerable who have been targeted as budget victims in the past. An amendment will be proposed in the House for Wednesday’s debate, and we are hoping to get an amendment in the Senate, too.

More useful information is available on RIPTA Riders Alliance’s Facebook page.

]]> Many worthwhile organizations doing important work found out that they had lost their grants when the budget was unveiled. Among those is Youth Pride Inc. (YPI). Having lost their Community Service Grant, the group now faces a $50 thousand shortfall. YPI is the only group in Rhode Island that specifically serves the needs of LGBTQ youth in the state.

Many worthwhile organizations doing important work found out that they had lost their grants when the budget was unveiled. Among those is Youth Pride Inc. (YPI). Having lost their Community Service Grant, the group now faces a $50 thousand shortfall. YPI is the only group in Rhode Island that specifically serves the needs of LGBTQ youth in the state.

YPI has sent an email to supporters, asking them to contact their legislators in the hope of having these funds restored.

We are asking our supporters to let the state know how valuable and important Youth Pride Inc.’s work with LGBTQQ youth is to our state and community. Let them know we are the only organization providing support and advocacy for LGBTQ youth in the state! Let them know that these youth need our organization!

“Please reach out to the Speaker of the House and Senate President immediately in support of YPI and the vital work that we do for LGBTQQ youth in Rhode Island TODAY. The Senate President can be contacted at: 401-222-6655 and the Speaker of the House can be reached at: 401-222-2466. Please reach out to your Representative as well.”

At yesterday’s House Budget briefing, I asked Speaker Nicholas Mattiello about the cuts to the program. He said that YPI serves a “very worthwhile purpose” but added, “Those services, needs, potentially are being serviced elsewhere.”

In the case of YPI, the Speaker said that he had heard the suggestion that, “guidance counselors in the school are in fact providing [these services]. Not specifically [for LGBTQ youth] but it’s something that is being addressed through other means.”

Given the range of services and programs YPI provides that specifically cater to the needs of LGBTQ youth in Rhode Island, it’s unlikely that guidance counselors are filling that need or have the time and ability to do so. That said, Mattiello, added towards the end of his statements, “We’ll take a look at [YPI] and we’ll see if it’s unique enough to fund.”

Representative Joseph Almeida entered the Budget Briefing late and asked about other worthwhile groups that have been denied funding, including the Opportunities Industrialization Center (OIC) which has provided employment training and placement opportunities since 2010 and the Institute for the Study and Practice of Nonviolence which works to reduce homicides and support victims of violence.

“It’s like all the poor people got cut, cut, cut,” said Almeida, who said afterwards that he was speaking from his heart, “Can’t you take money from Crossroads and give to people who really need it teaching peace in the streets and teaching people how to get jobs? I mean Crossraods? What? What do they do?”

Crossroads RI received $300,000 in the budget.

]]> The budget passed by the House Finance Committee last night, and slated to be vetted by the full chamber next Wednesday, contains some wins and some losses for the progressive left.

The budget passed by the House Finance Committee last night, and slated to be vetted by the full chamber next Wednesday, contains some wins and some losses for the progressive left.

The budget bill contains some money to restore low-cost bus fare for indigent people – a social service that RIPTA cut earlier this year. The RIPTA Riders Alliance declined comment until more information is available. House Speaker Nick Mattiello told RI Future the funding for this program is temporary and said larger changes with RIPTA are afoot.

The proposed budget also includes new money to pay nursing home caregivers and those who works with the developmentally disabled. The investment would help raise wages for underpaid caregivers, many of whom work full time and still live in poverty. SEIU officials hailed the move as a step toward a $15 an hour minimum wage for front line caregivers.

It also preserves Governor Gina Raimondo’s increase to the Earned Income Tax Credit, and increased the investment in housing for the homeless proposed by Raimondo.

“We find it encouraging that the House Finance Committee showed their commitment and concern for Rhode Islanders experiencing housing insecurity by supporting the Governor’s budget proposal for affordable housing production and adding an additional $10 million for urban revitalization and blight remediation for a total $50 million Housing Opportunity Bond,” said Jim Ryczek, executive director of the RI Coalition for the Homeless. “We appreciate that the House Finance Committee ensured that this year’s budget invests in the long-term solutions to addressing homelessness and the lack of affordable housing in our state.”

But the House budget left out a proposed increase to the minimum wage that Raimondo included in her budget proposal. The current minimum wage in Rhode Island is $9.60 and Raimondo’s budget proposal would have raised it to $10.10. While the minimum wage does not have a fiscal effect on the budget, it is customary in Rhode Island to include policy changes in the state budget.

The House budget also nixed Raimondo’s proposal to increase investment in the school construction bond money. Many urban school buildings in Rhode Island are in dire need of repair.

It reduced Raimondo’s proposed fee on medical marijuana plants from $150 to $25. While the House measure exempts low income people from the fee, it still requires a new state tag for each plant – a move opposed by independent growers of medical marijuana.

While medical marijuana patients will pay more, beach goers will pay less under the proposed House budget. According to a news release from the House of Representatives, “Just in time for beach season, the Finance Committee slashed parking fees at state beaches — mostly in half — to better enable Rhode Islanders and visitors to enjoy one of the state’s greatest treasures. The cuts, effective July 1, eliminate hikes made in 2012, and apply to all types of passes: single-day weekend and weekday as well as season passes for residents, nonresidents and senior citizens. (Admission to state beaches themselves is free.)”

Charter school opponents should be even more pleased with the House budget proposal than with Raimondo’s version. According to the news release, “The [finance] committee moderated the governor’s proposal somewhat, allowing districts to reduce payments by either 7 percent of the per-pupil tuition cost or the average difference between per-pupil unique costs of the sending districts and those of the charter schools, whichever is greater. The committee also provided some temporary relief for districts with particularly high concentrations of students attending charter or vocational schools.”

And the House budget seems to make it easier for Rhode Islanders to generate more renewable energy. The proposal “expanded the state’s net metering program to allow “virtual” or off-site net metering by all customers, opening up access to renewable energy generation to more Rhode Islanders. Net metering is a practice that allows those who install renewable energy systems such as solar panels to connect them to the electric grid and receive credit on their bill for any excess energy they generate,” according to the House news release.

But a reader sent this comment: “The budget article 18 expands net metering, but it has a completely silly cap on it (major concession to Grid), and messes up the rates (another major concession). It will serve as a disincentive to net metering, not an incentive. The PUC is in the middle of considering the right net metering rate, and this is sort of like sticking a monkeywrench into their machinery. This is in no way a win, except superficially.”

The House is expected to vote on the budget bill next Wednesday.

]]>

Compare the following two statements made by RI House Speaker Nicholas Mattiello near the beginning and end of Monday’s overlong press conference dealing with reforms to the legislative grants process. Mattiello early on suggests that these grants help fulfill the needs of Rhode Islanders in a way that delivers services cheaper, because we can avoid the cost of hiring state employees and giving these new employees benefits such as health care and retirement.

“There are vital citizenry needs that are being performed by community agencies that are not well performed by any other state department or state agencies,” says Mattiello, “And we’re able to address those citizens’ needs without having to hire additional state employees with all the benefits that that entails.”

About 30 minutes in, however, Mattiello bemoans the fact that there is no real way to know how effective these grants are because the legislature doesn’t have “direct control” over the entities receiving the money.

“It’s difficult… to give money to an agency that you don’t have direct control over. You don’t have the same safe guards and systems in place that you do with direct state departments. It’s easier to watch state dollars being administered by state departments so that was an inherent problem and it’s one that we were mindful of when we made the determination of eliminating the entire process.”

Mattiello’s take on legislative grants is incoherent. Since there is no oversight concerning the way much of this money is spent, it’s impossible to tell how effective these grants are. Our state may literally be throwing money away. However, if we demand a system of accountability we would have to fund and staff state employees to do this work, which means paying these employees, which we can’t afford to do, despite the “vital” needs of Rhode Islanders.

Mattiello’s contradictory statements confirm what many Rhode Islanders suspect: Either these grants don’t serve the needs of Rhode Islanders or Rhode Island’s needs are not truly being met by these grants. Worse, it seems that on some level, Mattiello is aware of this contradiction.

]]>The Economic Progress Institute‘s Douglas Hall does four things in the video below. First he gives us a basic, overall big picture economic context, then he “drills down further” into the economy of Rhode Island. Then we’ll see, in big pieces, what a “workers’ agenda” might look like before finally recapping some of the good things done in our state towards advancing a workers’ agenda.

Hall gave the talk as an introduction to The State of Working Rhode Island: Workers of Color, that “highlights the many challenges facing Rhode Island workers, showing the many areas where workers of color fare less well than others.” For more info see here.

Douglas Hall, Ph.D, is the Director of Economic and Fiscal Policy at the Economic Progress Institute. The video was prepared from the talk Hall gave at the 8th Annual Policy and Budget Conference on April 26, 2016, and the Powerpoint slides he prepared.

]]>

As the results of last Tuesday’s primary show, RI Speaker of the House Nicholas Mattiello is seriously out of step with Rhode Island voters. Progressives in this state demonstrated the kind of change they want, yet instead of course-correcting, the speaker is doubling down on policies Tuesday’s vote clearly rejected.

As the results of last Tuesday’s primary show, RI Speaker of the House Nicholas Mattiello is seriously out of step with Rhode Island voters. Progressives in this state demonstrated the kind of change they want, yet instead of course-correcting, the speaker is doubling down on policies Tuesday’s vote clearly rejected.

One key reform Mattiello has his eye on is lowering the estate tax, the tax levied exclusively on dead millionaires. In the ProJo, Mattiello said he is “‘hearing from successful folks in Rhode Island pretty regularly lately’ that, without assistance, ‘they will be forced to leave the state,’ adding that he is going to ‘work hard to get [this] done in the budget.’”

This isn’t a new idea for the Speaker. Back in January, at the 2016 Rhode Island Small Business Economic Summit, Grafton H. “Cap” Wiley IV told Governor Gina Raimondo, Speaker Mattiello and a room full of government officials and small business owners that “it would be great if we had enough revenue to get rid of the estate tax” or if we don’t have enough revenue, “look at an increase in the exemption.”

“That’s something I’ve got my eye on,” said Mattiello.

Here’s the problem: Lowering or eliminating the estate tax does nothing for the economy. It doesn’t lead to greater entrepreneurship, doesn’t create jobs and doesn’t put money back into the economy. It’s a straight up giveaway to the 1 percent. And lest we forget, the care and comfort of the 1 percent has always been Speaker Mattiello’s primary concern. Remember his comment last year that his “well-to-do” neighbors don’t see any tax relief?

The suggestion that “successful folks” are being “forced to leave the state” because of the estate tax is frankly idiotic. This economic hokum has been debunked time and again, yet our speaker clings to this lie to justify giving more money to the already rich.

To quote the speaker, “that discussion has to stop.”

Let your legislators know that you oppose these tax cuts for the rich. Tell them what their priorities should be. Remind them of the results of Tuesday’s primary, and let’s start using our newfound progressive political power to effect real, positive change.

]]>

The Governor’s Budget Article 13 increases the minimum wage to $10.10 next year and expands the state earned income tax credit from 12.5 percent to 15 percent of the federal credit (the Governor indicated an interest in further expanding the EITC pending available resources following the mid-year revenue forecast). Senator Goldin and Representative Slater have each introduced bills ((S 2156 and H 7347, respectively) to further increase the EITC to 20 percent of the federal credit. Lawmakers have made real progress in these two areas over the past two years and we are pleased to see a commitment to raising the labor and living standards of our workers going forward.

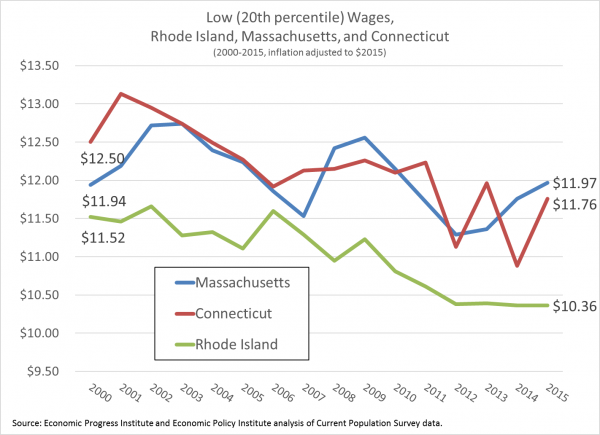

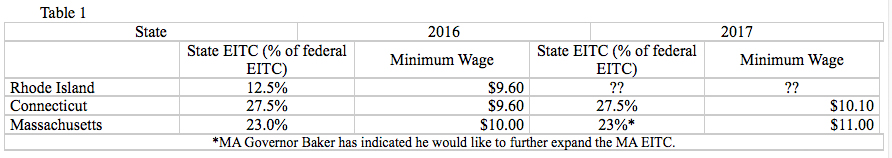

These two measures are particularly important in light of the persistent decline in Rhode Island’s low wages since 2000, and the gap between low wages in Rhode Island and those in Connecticut and Massachusetts, evident in Figure 1.

Research shows that coupling an EITC increase with an increase in the minimum wage has a greater impact on reducing poverty than either does on its own. This finding contradicts those who point to one approach as superior to the other in helping low-wage workers make ends meet. Both, together, have maximum beneficial impact. Using these policies together also requires that businesses and our government both play key roles in boosting incomes for workers in low-wage sectors, which is both fair and practical.

Today, minimum wage workers do not earn enough to meet basic needs. The Rhode Island Standard of Need, a study that documents the cost of living in the Ocean State, shows that a single adult needed to earn $11.86 per hour in order to meet his or her most basic needs in 2014.

As seen in Table 1, Rhode Island currently significantly lags its neighbors, Massachusetts and Connecticut, in the size of state EITC, and will fall behind Connecticut (and even further behind Massachusetts) for the minimum wage, unless the Rhode Island minimum is increased to at least $10.10 in 2017. Both of our neighboring states have steadily increased their minimum wages in recent years.

EITC filers pay payroll taxes, sales and property taxes, the car tax, gas tax. Even with the increase in the state EITC to 12.5%, Rhode Island still has one of the highest effective tax rates on low-income households, when looking at the combined state and local taxes – 7th highest among all states. The EITC is the best way to provide some targeted tax relief to those who need it most.

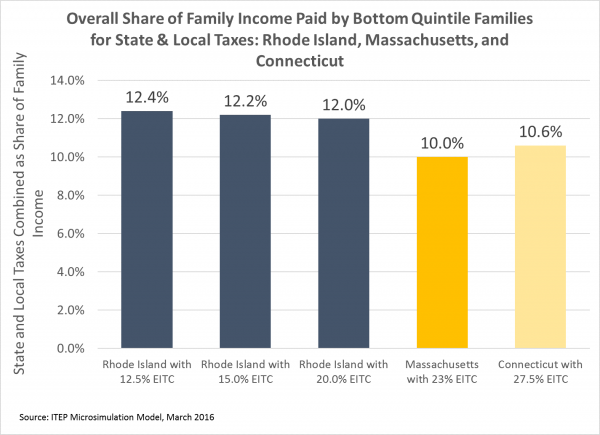

Compared to our neighboring states, families in the bottom quintile (bottom 20 percent of family income) pay 12.4 percent of their income in state and local taxes, compared with 10.0 percent in Massachusetts, and 10.6 percent in Connecticut. Increasing the RI EITC helps close this gap modestly – a 15 percent EITC in Rhode Island would lower bottom quintile taxes to 12.2 percent, and a 20 percent EITC would lower it to 12.0 percent, according to recent analysis by the Institute on Taxation and Economic Policy, evident in Figure 2. (Higher sales and excise taxes in RI account for much of the current gap).

Putting more money in the pockets of workers will also put more money in the cash registers of local businesses. Raising the minimum wage to $10.10 would put nearly $27 million in the pockets of 78,000 Rhode Island workers in low-wage jobs, money that would flow quickly into the local economy.

Raising the minimum wage and the EITC are important steps that lawmakers can take to help ensure that workers are able to keep their heads above water in the Ocean State, and to keep the Rhode Island economy on a path to full economic recovery.

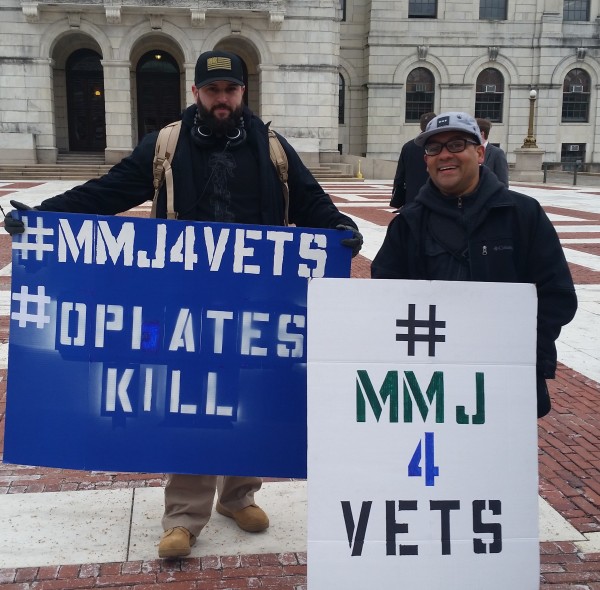

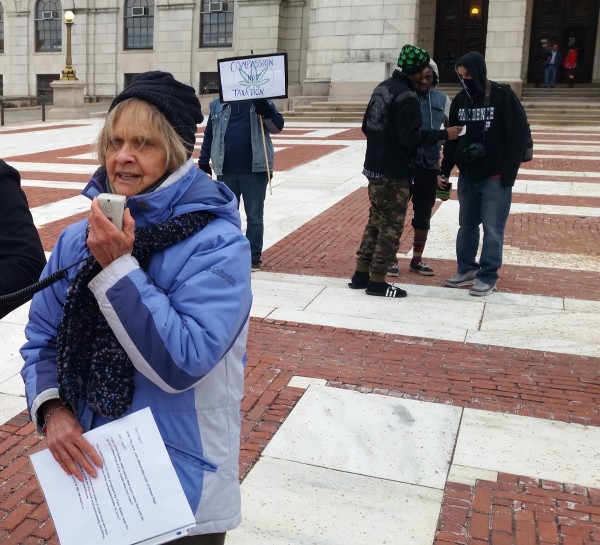

]]> Opponents of Governor Gina Raimondo‘s proposed tax on medical marijuana gathered outside the State House Tuesday evening to raise awareness about what some have called “an absolutely cruel proposal” to tax medical marijuana.

Opponents of Governor Gina Raimondo‘s proposed tax on medical marijuana gathered outside the State House Tuesday evening to raise awareness about what some have called “an absolutely cruel proposal” to tax medical marijuana.

There is no other proposal like it anywhere in the country, and under Raimondo’s proposal marijuana will be the only medicine taxed in this way. Since the proposal has been inserted into the budget, rather than submitted as a bill, there will be no opportunity for the public to comment on the idea in House or Senate committee meetings so the only route opponents can follow to stop this plan is to pressure their Representatives to remove the item from the budget or refuse to pass the budget if the tax is not removed.

Almost more pernicious than the tax, though, are the other provisions included in what amounts to a complete restructuring of the way medical marijuana is done in our state. Those who grow their own marijuana will be forced to comply with a 75 percent reduction, six plants only, drastically reducing the amount of medicine available to patients.

Almost more pernicious than the tax, though, are the other provisions included in what amounts to a complete restructuring of the way medical marijuana is done in our state. Those who grow their own marijuana will be forced to comply with a 75 percent reduction, six plants only, drastically reducing the amount of medicine available to patients.

Caregivers, those who grow marijuana for others may only posses 24 plants.

Opponents, such as Responsible Caregivers of Rhode Island, say this will not allow caregivers to provide an adequate amount of medicine for their patients.

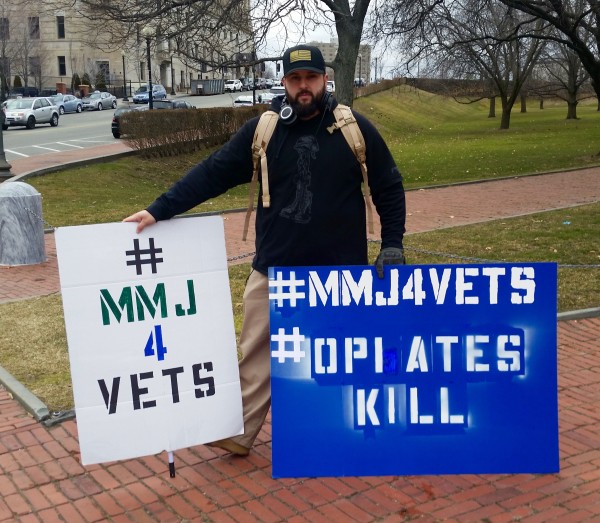

Then there is the financial devastation this plans wreaks upon caregivers. Purchase tags are now required for all plants. $150 per plant for patients who grow their own and $350 for each plant raised by caregivers for others. This makes the cost of farming marijuana prohibitive, and many will not be able to afford this. I earlier talked to a veteran who uses marijuana, legally, to keep himself from becoming re-addicted to opioids.

Then there is the financial devastation this plans wreaks upon caregivers. Purchase tags are now required for all plants. $150 per plant for patients who grow their own and $350 for each plant raised by caregivers for others. This makes the cost of farming marijuana prohibitive, and many will not be able to afford this. I earlier talked to a veteran who uses marijuana, legally, to keep himself from becoming re-addicted to opioids.

Since cultivating plants is essentially farming, a loss of a crop from infestation or power loss (marijuana is cultivated with grow lights) could mean that a person’s entire investment and crop will be lost. This will be a loss of money and vital medicine. Further, the process of farming marijuana is not an exact science. If the plants yield extra marijuana the law allows a grower to “gift” the excess to those in need. Raimondo has disallowed gifting in her proposal.

You can see Raimondo’s proposed changes to the law starting on page 194 of her proposed budget here. The reasoning behind this proposal is baffling. It is simply cruelty, and in truth, much damage has already been done to a community that uses medical marijuana to treat terrible illnesses and disabilities.

As Jared Moffat, executive director of Regulate RI said at the rally outside the State house today, rather than tax the medical marijuana that patients need, why not tax the use of recreational marijuana as is being done in Colorado with great success?

As I walked towards the State House on Tuesday for the Taxation Is Not Compassion event, I met Steve, a disabled veteran.

As I walked towards the State House on Tuesday for the Taxation Is Not Compassion event, I met Steve, a disabled veteran.

Steve served in Iraq in 2005. After he was injured, the Army gave him morphine and Oxy for his pain. That started a five year addiction to opioids. After cleaning himself up, Steve relapsed, but soon found that medical marijuana helped him deal with his medical issues without the need for opioids. Governor Gina Raimondo’s proposed tax on medical marijuana frightens Steve.

“22 vets commit suicide every day in this country,” said Steve, “but if they overdose on opioids their deaths are called accidental overdoses.”

This evening Steve will be meeting with fellow veterans to try and figure out how best to defeat Raimondo’s proposal.

]]>