In a recent post, I highlighted how the US Department of Justice is suing ratings agency S&P concerning their suspicious ratings practices that essentially fueled the financial crisis. In the same post, I also wrote about how I believe ratings agencies S&P and Moody’s also artificially inflated the 38 Studios bond ratings as investment grade.

Although not impossible, it is difficult for taxpayers to file lawsuits due to what is known as the standing law doctrine. It is therefore the obligation of attorneys general to defend taxpayers when they have been wronged.

Colorado became a recent addition to a list of attorneys general (both Democrats and Republicans) from Arizona, Arkansas, California, Delaware, the District of Columbia, Idaho, Iowa, North Carolina, Maine, Missouri, Pennsylvania, Tennessee, Washington, and Connecticut that have joined the DOJ in alleging that the ratings agencies violated their respective Unfair Trade Practices Acts:

Colorado Attorney General John Suthers filed a lawsuit ….. against Standard and Poor’s (S&P) in connection with the ratings that it issued on structured finance securities, including residential mortgage backed securities (RMBS) that were issued at the height of the market from 2004-2007. This lawsuit is part of a joint federal-state effort to hold those responsible for their part in the foreclosure and financial crisis. The congressionally-appointed bipartisan Financial Crisis Inquiry Commission concluded in its final report that the financial crisis “could not have happened” without ratings agencies such as S&P. Colorado’s lawsuit alleges that S&P put its financial interests above its self-described objectivity and independence.

Connecticut began the process in 2010 (you can read the filing here) and has been urging other states to join them in taking on the ratings agencies:

Inflated ratings of mortgage securities are considered a key cause of the 2008 financial crisis. Critics accused the ratings firms of lowering standards to win business and misleading bond investors to buy debt they thought was safe but turned out to be toxic .

It would seem that the ratings agencies were up to a similar ratings scam with regard to the 38 Studios bonds. Attorney General Kilmartin was the Majority Whip in the State House of Representatives at the time of the 38 Studios deal, so he might have to recuse himself from such a case, (correction: Kilmartin resigned as Whip in February 2010, prior to the 38 Studios vote) but taking no action on such an important matter would be a huge disservice to the citizens of Rhode Island.

Will Attorney General Peter Kilmartin stand up to the ratings agencies and fight for the taxpayers of Rhode Island? Dawson Hodgson, the Republican challenging him, has already staked out a strong position on 38 Studios – which promises to define the election this year up and down the ballot. Why hasn’t RI joined the other states and federal government in taking on the ratings agencies for their role in the financial crisis? Will the AG’s office sue S&P and Moody’s for artificially rating the 38 Studios bonds as investment grade?

]]>

If the ratings agencies are wrong to consider lowering Rhode Island’s credit rating for not making payment on the 38 Studios bond, they were really wrong when they gave the 38 Studios bonds an investment grade rating in the first place.

38 Studios was always a risky investment, and the state never had a legal obligation to pay on the bonds. The ratings agencies are responsible for an artificially high rating, and are now trying to push around the people of RI into paying for a deal they knew was bad all along.

The bond prospectus clearly states that “no guarantee can be made that the Company will meet it’s Loan Payment obligations under the Agreement or that the Company will continue to be in business now or in the future.”

On page 29, it says:

Development Stage Business. The Company is a development stage video game and entertainment company with no revenues from product sales, except those projected by the Company over the next several years. The company is currently considered “pre-revenue” and no guarantee can be made that the Company will meet it’s Loan Payment obligations under the Agreement or that the Company will continue to be in business now or in the future.

And on page 26, it says there has been “substantial doubt” the company would succeed since the summer of 2010:

On July 6, 2010, the Company’s auditor, PricewaterhouseCoopers LLP issued a “going concern” opinion in connection with the Company’s most recent audited financial statements stating that the Company will require additional financing to fund future operations and raising substantial doubt about the Company’s ability to continue as a going concern.”

But a company’s success or failure isn’t the only factor for investors to consider. These bonds had an insurance policy, and because of the insurance policy backed by Assured Guaranty, the bonds would receive an investment-grade issue rating of AA+/Aa3. But there was also an underlying rating of A/A2 issued to the bonds. The underlying rating of A/A2 means that the ratings agencies felt that the 38 Studios bonds were investment-grade even without the backing of an insurer.

The NY Times’ Mary Williams Walsh reported in August, 2012 that municipal bond defaults are in fact much higher than most people are aware of: “Moody’s Investors Service has reported that from 1970 to 2011, there were only 71 municipal bond defaults. But the Fed report counted 2,521 defaults in that time.” Economists at the Federal Reserve Bank of NY found that municipal bond defaults are only reported for investment-grade rated bonds, not for unrated (junk) bonds. Furthermore, their research showed that: “…financing projects using new technologies or projects with no historical track record tend to make up a majority of unrated IDB defaults.”

So the main reason we can’t default is because these were investment-grade bonds. But why were these bonds investment grade?

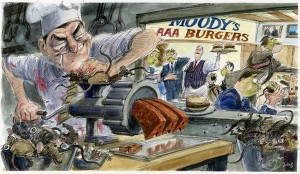

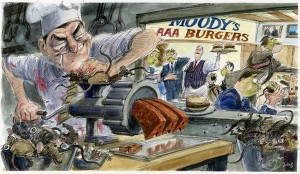

Is there the potential for a lawsuit? Maybe. Giving artificially high ratings to bonds backed by specious economic activity in the real world caused the mortgage crisis too. An ongoing federal lawsuit filed by Eric Holder in 2013 claims that credit rating agency S&P defrauded investors and fueled the financial crisis. At the center of the suit are the favorable ratings issued by the credit ratings agencies on what they knew were toxic assets.

“Holder accused S&P of falsely claiming that its high ratings were independent and objective,” reported the USA Today in Feb 2013. In reality, Holder charged, the ratings were influenced by conflicts of interest and the firm’s drive to reap higher profits by pleasing bond issuers at the expense of investors.

In other words, imagine the following scenario as outlined by Acting Assistant Attorney General Tony West: “buying sausage from your favorite butcher and he assures you the sausage was made fresh that morning and is safe. What he doesn’t tell you is that it was made with meat he knows is rotten and plans to throw out later that night.”

Beginning in the 1970’s, bond issuers began paying credit ratings agencies to get higher ratings on their bonds. This is a type of conflict of interest that Eric Holder was talking about above. Despite all of the evidence pointing to the ratings agencies gaming the system, little has been done to change business as usual. The issuer pay model still exists and the “Big Three” ratings agencies have seen their profits soar largely as a result of their ratings business.

For years, the ratings agencies have been shielding themselves from lawsuits by claiming that they are essentially financial journalists – their ratings are merely opinions protected by the free speech clause in the First Amendment. Litigants would have to show that the ratings agencies had “actual malice” in order to have a case, which is extremely difficult to prove.

But a 2009 federal district court ruling rejected the free speech defense that credit ratings agencies had been using for years:

The suit alleges the two ratings services issued misleading ratings to a $5.86 billion investment vehicle that collapsed in 2007. Scheindlin acknowledged that ratings typically are “matters of public concern,” protected by the First Amendment from liability. However, the protection doesn’t apply, she wrote, “where a rating agency has disseminated their ratings to a select group of investors rather than to the public at large,” as the plaintiffs in the case alleged.

Page 33 of the judge’s opinion states that because the ratings weren’t disseminated to the public at large, but instead to a select group of investors in connection with a private placement, that the free speech defense wasn’t viable. Court rulings in 2010 in California and 2011 in New Mexico yielded the same results.

These court cases are somewhat similar to 38 Studios, which was also a private placement. It therefore may be possible for a group of taxpayers (or the bondholders) to file a class action lawsuit against the ratings agencies for negligent/fraudulent ratings issued to the 38 Studios bonds.

A little more food for thought. The (sadly) slow implementation of the Dodd-Frank Act should hopefully make the big three ratings agencies less of an influential factor in the future. A recent SEC report showed that ratings practices by the ratings agencies still have some problems. Remember that the 38 Studios bonds were issued prior to Dodd-Frank being implemented at all, so we can probably assume that the ratings agencies had even more problems back then. In a 2013 Rolling Stone article I cited earlier, internal credit agency emails revealed:

Moody’s and S&P, have for many years been shameless tools for the banks, willing to give just about anything a high rating in exchange for cash.

In incriminating e-mail after incriminating e-mail, executives and analysts from these companies are caught admitting their entire business model is crooked.

“Lord help our fucking scam . . . this has to be the stupidest place I have worked at,” writes one Standard & Poor’s executive. “As you know, I had difficulties explaining ‘HOW’ we got to those numbers since there is no science behind it,” confesses a high-ranking S&P analyst.

It’s quite ironic that a few companies that fueled an enormous financial crises are now trying to bully the people of RI. Where has Wall Street’s moral obligation to Main Street been?

]]> Let me ad some very insightful commentary on the whole 38 Studios saga: it sucks.

Let me ad some very insightful commentary on the whole 38 Studios saga: it sucks.

It sucks that much of the legislature feels they were conned into providing the cash for the deal. It sucks that Don Carcieri would recruit Schilling to bring his company here. It sucks that anyone in the then-EDC would believe it was a worthwhile deal. It sucks that we’d invest so much money in a long-shot product. It sucks that 38 Studios collapsed, mainly due to sucky management. It sucks that there was little oversight from the state on 38 Studios, despite being a major investor. It sucks that we’re repaying the investors who were already insured in case of 38 Studios’ failure. It sucks that the state used a “moral obligation” bond rather than a “general obligation” bond to provide the money, and to circumvent voters. It sucks that all of Rhode Island’s credit is being threatened by ratings agencies if the General Assembly chooses to default on the repayment. It sucks that the ratings agencies are ignoring the law that’s very clear that we don’t have to repay.

But with all that out of the way, let me tell you that it doesn’t matter how much it sucks. What matters is that it’s happened. Commentators and politicians can cry and moan about the unreasonableness of this all; about how the ratings agencies are being unnecessarily punitive, about how the bond yields took into account the chance of default, about how the investors will get all their money back through insurance, etc., etc. All of that is crying over spilt milk. Now it’s up to us to act like adults and clean it up.

In the complaints against repayment, you can see a lot of how people wish things were. Unfortunately, Rhode Island doesn’t exist in a land of make believe. It exists in the here and now. At the end of the day S&P, Moody’s, and Fitch (the big three credit ratings agencies) don’t play by the rules Rhode Island sets. These are the same agencies that were vital in enabling the existence of toxic assets that fueled the Great Recession and got away scott free. These are agencies that determine the borrowing ability of sovereign nations. Rhode Island, which lacks many of the tools sovereign nations have to blunt the damage from traumatic downgrades of our bonds, cannot go up against them and win.

Were we perhaps the state of New York, and could make life miserable for the ratings agencies, I would be more bullish about our chances of taking them on. If RI was the United States of America, which is impervious to ratings agencies at the moment, I would say go ahead and ignore them.

But we’re not. The very same people calling for us to default are the same people who go around decrying our flaws. They’re the ones ignoring that the ratings agencies can make or break us. It’s awful that we have to kowtow to the whims of these idiots, and the idiot investors who put money into the 38 Studios bonds. But these are the idiots that set the rules for Rhode Island, not the other way around.

To those of you looking to right this injury, I say “forget it, Rhode Island. It’s Wall Street.” The best we can do is bow to circumstance, lick our wounds, and ensure that this can never, ever, happen again.

]]> Moody’s (the Wall St. ratings agency) has downgraded the R.I. Economic Development Corporation bonds that funded 38 Studios; and has issued further warnings that the rest of Rhode Island’s bonds are under review, what WPRI’s Ted Nesi called a “sharp rebuke” to the state. The threat is loud and clear: fail to pay bondholders for 38 Studios, and we will damage your credit. In this way, it fulfills prophesies that Wall Street would look to make an example out of Rhode Island should the state not pay back the bondholders.

Moody’s (the Wall St. ratings agency) has downgraded the R.I. Economic Development Corporation bonds that funded 38 Studios; and has issued further warnings that the rest of Rhode Island’s bonds are under review, what WPRI’s Ted Nesi called a “sharp rebuke” to the state. The threat is loud and clear: fail to pay bondholders for 38 Studios, and we will damage your credit. In this way, it fulfills prophesies that Wall Street would look to make an example out of Rhode Island should the state not pay back the bondholders.

But the downgrade is nonsensical, and mainly continues to demonstrate why trusting ratings agencies remains a terrible idea in this post-economic crisis world. The New York Times‘ quantitative geek Nate Silver pointed this out when Standard & Poor downgraded the United States’ credit rating: ratings agencies are very bad at predicting what will happen, which is ostensibly what a rating should be. The credit rating on the 38 Studios bonds should’ve already reflected the likelihood that the state would default on that debt; if anyone had bothered to do due diligence, it would’ve been very clear to Moody’s that that was a real likelihood.

First, 38 Studios CEO Curt Schilling was unable to secure investment from private investors, making him dependent on this cash. Second, anyone analyzing what he was attempting (building a World of Warcraft-killer) would’ve absolutely known it wasn’t likely to work out (not unless Schilling was going to switch products once he secured the $75 million from the state, and he wasn’t). Third, the deal was highly unpopular with the people of Rhode Island, meaning that in the event of a 38 Studios collapse, there would be pressure on politicians not to pay. Fourth, the state is in recession, meaning there would be increased pressure not to pay. All of these risks should have been built into the rating when the bonds were issued and thus we shouldn’t be seeing a downgrade now (the greater risk was built into the bonds via greater interest payments).

Of course, though, a smart investor would’ve seen all this and refused to touch these bonds. But the ratings agencies aren’t for smart investors, they’re for stupid investors that are easily fleeced (see; subprime mortgage crisis ratings). Which is why stupid investors will be taken in by the likely downgrade of R.I.’s general obligation debt. From a pure facts on the ground position, a downgrade there doesn’t make sense. Let’s see what Moody’s is suggesting could downgrade our debt:

* Failure to honor its legal or moral obligations to bondholders

* Mounting combined debt and pension liability burdens with no plan to address them

*Deterioration of state’s reserve and balance sheet position

* Persistent economic weakness indicated by lack of employment recovery when the rest of the nation rebounds

*Increased liquidity pressure reflected in narrower cash margins, increased cash flow borrowing, or a shift toward tactics such as delayed vendor or other payments to gain short-term liquidity relief

*Continued significant reliance on one-time budget solutions, particularly deficit financing

*Resolution of pension litigation in employees’ favor

So, Moody’s doesn’t distinguish between moral obligation bonds and general obligation bonds, making it a very unsophisticated ratings agency indeed. No one, anywhere, has suggested not paying back our general obligations. Moody’s though, prefers to dupe investors by suggesting that’s an actual possibility.

The rest is basically jargon for typical Wall Street priorities: cut the budget, cut pensions, don’t run deficits. Got it. Don’t worry, our lawmakers are mostly with you, Moody’s. Oh also, our employment issues. Well, luckily for idiot investors, our employment rate has been steadily dropping. Of course, that’s partly because many people are leaving the workforce, but such semantics shouldn’t bother a wise and all-knowing credit ratings agency like Moody’s. After all, it’s the stats that matter.

The really sad problem with all of this is that even though ratings agencies are for idiots by idiots, there’s nothing we can do about it right now. Until such a time as a ratings agency for ratings agencies comes along, a vast herd of investors will treat what a ratings agency says as Very Important, even when a ratings agency is dead wrong. Moody’s colleagues at S&P figured their downgrade of Treasury bonds would raise rates, instead it sent the safest investment opportunity in the world to record lows as frightened investors poured money into the U.S. Treasury.

These investors took a risk on the 38 Studios bonds, a risk they should’ve understood. They gambled and they lost. Some Rhode Islanders have suggested that these gamblers shouldn’t pocket anything for their failure. Moody’s has decided that means that all of Rhode Island’s debt is possibly a riskier investment than it initially thought. Why? Perhaps it’s because Moody’s seeks not to honestly rate the credit worthiness of particular instruments, but to influence policy. In which case, they appear to be in a good position to do so.

]]>