If the ratings agencies are wrong to consider lowering Rhode Island’s credit rating for not making payment on the 38 Studios bond, they were really wrong when they gave the 38 Studios bonds an investment grade rating in the first place.

38 Studios was always a risky investment, and the state never had a legal obligation to pay on the bonds. The ratings agencies are responsible for an artificially high rating, and are now trying to push around the people of RI into paying for a deal they knew was bad all along.

The bond prospectus clearly states that “no guarantee can be made that the Company will meet it’s Loan Payment obligations under the Agreement or that the Company will continue to be in business now or in the future.”

On page 29, it says:

Development Stage Business. The Company is a development stage video game and entertainment company with no revenues from product sales, except those projected by the Company over the next several years. The company is currently considered “pre-revenue” and no guarantee can be made that the Company will meet it’s Loan Payment obligations under the Agreement or that the Company will continue to be in business now or in the future.

And on page 26, it says there has been “substantial doubt” the company would succeed since the summer of 2010:

On July 6, 2010, the Company’s auditor, PricewaterhouseCoopers LLP issued a “going concern” opinion in connection with the Company’s most recent audited financial statements stating that the Company will require additional financing to fund future operations and raising substantial doubt about the Company’s ability to continue as a going concern.”

But a company’s success or failure isn’t the only factor for investors to consider. These bonds had an insurance policy, and because of the insurance policy backed by Assured Guaranty, the bonds would receive an investment-grade issue rating of AA+/Aa3. But there was also an underlying rating of A/A2 issued to the bonds. The underlying rating of A/A2 means that the ratings agencies felt that the 38 Studios bonds were investment-grade even without the backing of an insurer.

The NY Times’ Mary Williams Walsh reported in August, 2012 that municipal bond defaults are in fact much higher than most people are aware of: “Moody’s Investors Service has reported that from 1970 to 2011, there were only 71 municipal bond defaults. But the Fed report counted 2,521 defaults in that time.” Economists at the Federal Reserve Bank of NY found that municipal bond defaults are only reported for investment-grade rated bonds, not for unrated (junk) bonds. Furthermore, their research showed that: “…financing projects using new technologies or projects with no historical track record tend to make up a majority of unrated IDB defaults.”

So the main reason we can’t default is because these were investment-grade bonds. But why were these bonds investment grade?

Is there the potential for a lawsuit? Maybe. Giving artificially high ratings to bonds backed by specious economic activity in the real world caused the mortgage crisis too. An ongoing federal lawsuit filed by Eric Holder in 2013 claims that credit rating agency S&P defrauded investors and fueled the financial crisis. At the center of the suit are the favorable ratings issued by the credit ratings agencies on what they knew were toxic assets.

“Holder accused S&P of falsely claiming that its high ratings were independent and objective,” reported the USA Today in Feb 2013. In reality, Holder charged, the ratings were influenced by conflicts of interest and the firm’s drive to reap higher profits by pleasing bond issuers at the expense of investors.

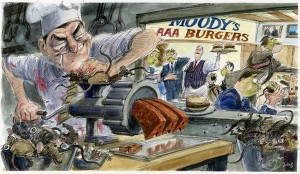

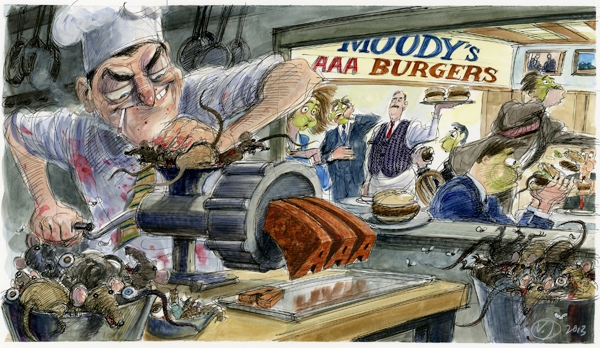

In other words, imagine the following scenario as outlined by Acting Assistant Attorney General Tony West: “buying sausage from your favorite butcher and he assures you the sausage was made fresh that morning and is safe. What he doesn’t tell you is that it was made with meat he knows is rotten and plans to throw out later that night.”

Beginning in the 1970’s, bond issuers began paying credit ratings agencies to get higher ratings on their bonds. This is a type of conflict of interest that Eric Holder was talking about above. Despite all of the evidence pointing to the ratings agencies gaming the system, little has been done to change business as usual. The issuer pay model still exists and the “Big Three” ratings agencies have seen their profits soar largely as a result of their ratings business.

For years, the ratings agencies have been shielding themselves from lawsuits by claiming that they are essentially financial journalists – their ratings are merely opinions protected by the free speech clause in the First Amendment. Litigants would have to show that the ratings agencies had “actual malice” in order to have a case, which is extremely difficult to prove.

But a 2009 federal district court ruling rejected the free speech defense that credit ratings agencies had been using for years:

The suit alleges the two ratings services issued misleading ratings to a $5.86 billion investment vehicle that collapsed in 2007. Scheindlin acknowledged that ratings typically are “matters of public concern,” protected by the First Amendment from liability. However, the protection doesn’t apply, she wrote, “where a rating agency has disseminated their ratings to a select group of investors rather than to the public at large,” as the plaintiffs in the case alleged.

Page 33 of the judge’s opinion states that because the ratings weren’t disseminated to the public at large, but instead to a select group of investors in connection with a private placement, that the free speech defense wasn’t viable. Court rulings in 2010 in California and 2011 in New Mexico yielded the same results.

These court cases are somewhat similar to 38 Studios, which was also a private placement. It therefore may be possible for a group of taxpayers (or the bondholders) to file a class action lawsuit against the ratings agencies for negligent/fraudulent ratings issued to the 38 Studios bonds.

A little more food for thought. The (sadly) slow implementation of the Dodd-Frank Act should hopefully make the big three ratings agencies less of an influential factor in the future. A recent SEC report showed that ratings practices by the ratings agencies still have some problems. Remember that the 38 Studios bonds were issued prior to Dodd-Frank being implemented at all, so we can probably assume that the ratings agencies had even more problems back then. In a 2013 Rolling Stone article I cited earlier, internal credit agency emails revealed:

Moody’s and S&P, have for many years been shameless tools for the banks, willing to give just about anything a high rating in exchange for cash.

In incriminating e-mail after incriminating e-mail, executives and analysts from these companies are caught admitting their entire business model is crooked.

“Lord help our fucking scam . . . this has to be the stupidest place I have worked at,” writes one Standard & Poor’s executive. “As you know, I had difficulties explaining ‘HOW’ we got to those numbers since there is no science behind it,” confesses a high-ranking S&P analyst.

It’s quite ironic that a few companies that fueled an enormous financial crises are now trying to bully the people of RI. Where has Wall Street’s moral obligation to Main Street been?

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387