I read in Monday’s newspaper about the terrible state of the retiree health-care system in our cities and towns. The trust funds that are supposed to pay for retiree health benefits (called “Other Post-Employment Benefits” or OPEB) decades into the future are deeply in the red. But as usual, there are some very troubling assumptions made in order to paint this bleak picture. If you do the math, you’ll see that the actuaries who predict this disaster do so by assuming a catastrophe.

I read in Monday’s newspaper about the terrible state of the retiree health-care system in our cities and towns. The trust funds that are supposed to pay for retiree health benefits (called “Other Post-Employment Benefits” or OPEB) decades into the future are deeply in the red. But as usual, there are some very troubling assumptions made in order to paint this bleak picture. If you do the math, you’ll see that the actuaries who predict this disaster do so by assuming a catastrophe.

Where does this terrible debt come from? It comes from the exploding cost of health care, extended out a few decades into the future. Even a small inflation rate, sustained over 50 years, can become a huge number. So what have the actuaries assumed in order to make these bleak predictions? I surveyed some of the reports, and found that Providence’s actuaries assumed that 2011 would see 7.5% inflation, scaling down to 4.5% in 2022 and for all the years thereafter. From my casual survey, this seemed typical, even low, and it sounds reasonable, right? East Providence’s actuaries assumed 9%, sloping down, Barrington’s 8% and so on. Health care inflation has been at 8-10% for far too long, so a declining rate of inflation actually seems optimistic, doesn’t it?

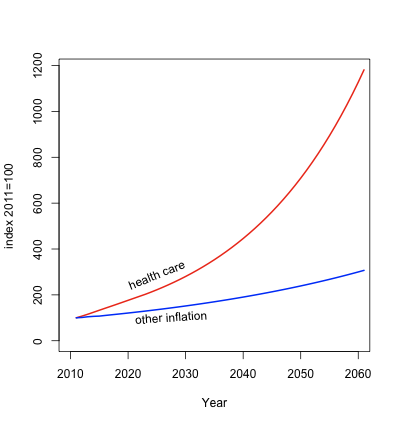

But let’s do more math, because there’s an interesting story lurking in it. There are lots of city and town employees who will still be getting this health care benefit 50 years from now. (And state employees too. The report on Monday was about municipal benefits, but the state system has the same problem.) So what will happen 50 years from now? According to these projections, in the year 2061 health care costs will be around 12 times what they were in 2011. A procedure that costs $1,000 in 2011 will cost $12,000. If we make a similar projection with ordinary inflation, 50 years out we’re looking at around a factor of three, as in the graph above. So the actuaries are predicting that your income, food, gas, whatever, will be up by a factor of three, but health care more than four times as much.

That is a truly remarkable number, and should be scary for anyone who is promising these benefits to their employees today. One way to look at the problem is to panic that our cities, towns, and state have not put away nearly enough money to pay for these benefits down the road. This is the point of the OPEB benefits report, and the unquestioning articles that fan the panic over these costs. This panic has serious results, including tax increases, cuts to other important services, and the potential for still more municipal bankruptcies. Providence is said to owe over $1.1 billion, Pawtucket $300 million and Warwick over $230 million. Collectively the debt is over $3 billion, more than the cities and towns owe for their pensions. Indeed, that was the screaming headline of the email I received from the “RI Taxpayers” group on Tuesday morning.

The other way to look at the problem is that it’s a complete crock. I cannot predict the future, so I don’t know how exactly it will happen, but I am quite confident that 50 years from now health care costs will not be 12 times what they are today. More importantly, if costs are as high as that, the matter of how to pay them for people who have retired will be the least of our worries.

Let’s do a little more of the math. These days health care costs run a little more than half of average housing costs. Do you believe in a world where health care costs more than twice what you pay for your mortgage? That’s what these projections predict. Health care costs today — for employees, prisoners, poor people, DCYF clients, and so on — represent about $2 billion, around a quarter of the state budget. By these projections, in 50 years they will be well over half the budget. What few private corporations who still offer health insurance will be paying equal amounts in salary and health benefits. Looking at the share of GDP that goes to health care, our nation will be paying well over 20% for health care, approximately twice as much as any other developed country today.

These are not sustainable increases. I do not have to know how or when these increases will be reined in, but only observe that they are not feasible to know that they will be reined in somehow. Herb Stein, economic advisor to Richard Nixon, put it this way, “Things that can’t go on forever, don’t.”

In other words, these OPEB projections are complete malarkey, compiled by actuaries whose noses are so deep in their spreadsheets that they can’t seem to see they are predicting the end of civilization as we know it and wondering how to pay for retiree health benefits when it happens. Put it in perspective. As I said, the state’s budget contains around $2 billion in health care costs. The cost for retiree health care? Around $50 million. I sometimes while away idle moments wondering about what would happen if an asteroid hit the earth, but my concerns are about survival, not how would I pay the electric bill. Yes, it is true that runaway health care costs are a serious threat to our nation, but to imagine that the threat is only to our system of paying health care for retirees is laughable.

The good news is that health care inflation rates have tumbled since Obamacare became law in 2010 — current estimates are about 1.3% per year — rendering the doom and gloom of these reports even less relevant to the real world then they were when they were made a couple of years ago. This is a big deal. Providence is said to have a $1.1 billion deficit, using those inflation rates. Rates of 1-2% instead of 7-8% over the next two or three years could cut $200 million from Providence’s OPEB deficit and have a similar effect on everyone else’s deficit.

The lesson here is this: if you’re serious about fiscal responsibility, you prove it by being serious about finding ways to reduce health care costs, which drive the vast bulk of the increases in state and local government expenses over the last 20 years. You do not show seriousness by simply negotiating these benefits out of contracts, or by cutting benefits. Rising health care costs are a problem for everyone, and a solution that benefits everyone is the only solution worth consideration.