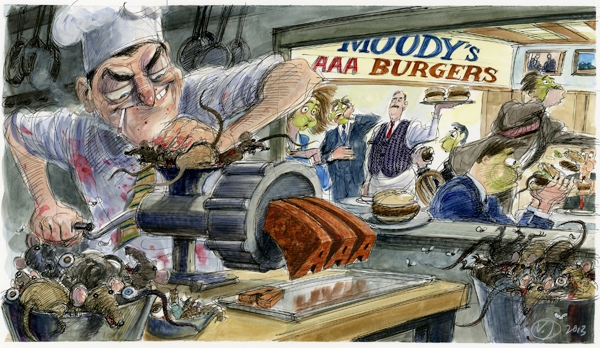

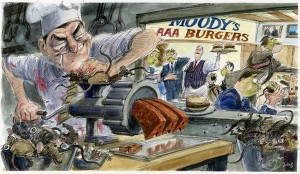

Former Treasurer (and current candidate for Treasurer) Frank Caprio reached out to me concerning my stories about the deceptive ratings practices of the ratings agencies.

Former Treasurer (and current candidate for Treasurer) Frank Caprio reached out to me concerning my stories about the deceptive ratings practices of the ratings agencies.

According to Caprio, the ratings agencies hands weren’t clean in the 38 Studios deal because they did in fact overrate the bonds. Furthermore, Caprio asserts that if he is re-elected as Treasurer, that he will dig into the ratings agencies.

As Ian Donnis reported in August 2010, Caprio visibly fought to prevent the 38 Studios deal from happening by going directly to the ratings agencies and investors. Unfortunately, his efforts were circumvented by the EDC, who had the discretionary power to issue the bonds. Some people have criticized Caprio for his initial support for 38 Studios and then changing his stance in opposition of the deal. In my opinion, it was courageous for Caprio to change his mind and he demonstrated leadership qualities by standing up for the taxpayers of Rhode Island.

To take action, Caprio said he would follow similar steps that he took in 2009 regarding the mismanagement scandal at the Central Landfill. Although he didn’t have an official oversight role as Treasurer, he pressured the State to take action. The result was that the right outside experts and attorneys were hired and without even having to file a lawsuit, his work led to a recovery against the Central Landfill board’s directors liability insurance of its policy limit of $5 million dollars.

Concerning the misdeeds by the ratings agencies, Caprio believes RI can look to the actions taken by the Obama administration and states such as CT and CA in seeing which law firms could be possible partners to work with RI against the ratings agencies.

Caprio also claims that the State can save substantial money by not voluntarily repaying the 38 Studios bonds. Instead, the State needs to call the bond insurer (Assured Guaranty) and the bond holders (large institutional investors) to the negotiating table to negotiate a settlement. He thinks that under the threat of non-payment by the State the insurer (who faces an $80 million dollar payout) and the bondholders would entertain the following:

- Since the bondholders have received over $20 million in payments already and the fact they can agree to a waiver of default per the bonds, the state should get the waiver (holders of 50 percent of aggregate principal of bonds have to agree – which is USAA and Transamerica) and start a deliberate negotiation. Caprio says, “I believe the bondholders will see it in their interest to take a haircut on future payments. The institutional holders of these bonds don’t want the national attention on this minimal investment they have in their multi-billion dollar portfolios.”

- The bond insurer should then be asked to be part of the solution with paying the new negotiated reduced amount to the bondholders and in return include them as leading the civil lawsuit currently being litigated against First Southwest, Wells Fargo, executives of EDC, etc. The bond insurer will then be in position to recover any payments it makes as part of this process.

All along this process the rating agencies will be briefed and updated by the State and it’s leaders. No default will happen since we will get time to negotiate per the waiver of default process allowed in the 38 Studio bonds (see page B-46: Waivers of Events of Default).

“I believe the State taxpayers will be relieved of having to make payments now for this failed deal. Remember that the RI taxpayers are not legally obligated to pay this bill per the bond nor by state law,” maintains Caprio.

Caprio has been outspoken on this issue for a while now. Last June, GoLocalProv reported:

Caprio says state, not Wall Street, has leverage

At a minimum, before making a decision on payment, Caprio said the state [needs to] convene a meeting of interested parties—including the bondholders and the insurer on the bonds—to attempt to negotiate a deal using the fact that it is not legally obligated to pay as leverage.

“I’m not going to lead the fight to defend multi-billion [dollar] insurance companies who are sophisticated investors to make sure they are made whole,” Caprio said, adding that the burden of paying back the bonds would fall on the average Rhode Island taxpayer. “If this money was coming out of every legislator’s personal pocket, would they be so quick to pay on debt which they have no legal obligation to pay?”

It seems to me that Caprio has a thorough understanding of the complexities of this issue and I commend him for that. I’ve been frustrated with a lot of other candidates and pundits who have simply been using Wall Street’s own talking points to bully Rhode Islander’s into thinking they have a bogus “moral obligation” to the 1%.

In my next feature, I’ll post candidate for Treasurer Seth Magaziner’s thoughts on how to deal with the ratings agencies.

During his campaign, Almonte has been critical of exploring all options before making a decision on repaying the 38 Studios loans. Now, after House Speaker Mattiello put on a display of cowardice by pledging that taxpayers will be on the hook to Wall Street for the 38 Studios debacle, Almonte issued a press release urging elected officials to negotiate a settlement.

During his campaign, Almonte has been critical of exploring all options before making a decision on repaying the 38 Studios loans. Now, after House Speaker Mattiello put on a display of cowardice by pledging that taxpayers will be on the hook to Wall Street for the 38 Studios debacle, Almonte issued a press release urging elected officials to negotiate a settlement.