Voting against the increase were Republicans Nick Kettle, of Coventry, Mark Gee, of East Greenwich, and Elaine Morgan, of Ashaway.

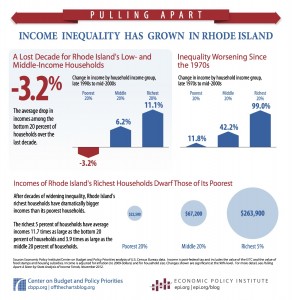

A study from 2012 conducted by the Center on Budget and Policy Priorities (CBPP) showed that from the 1970’s to the mid-2000s, the income gap has grown 70 percent. The poorest 20 percent of Rhode Islanders have only received a 11.8 percent raise in their household incomes, while the richest 20 percent have seen their income grow 99 percent.

In Connecticut and Massachusetts, the percentages are even more disconcerting. The poorest 20 percent of MA residents have seen no change in their income since the 1970s, but the richest 20 percent have had a 151.9 percent increase. Connecticut’s poorest residents have even seen a drop in their income by 4 percent since the 1970s, and a 9.8 percent drop in the past decade, more than both Rhode Island and Massachusetts.

How did this even happen? Kate Brewster, the executive director of the Economic Progress Institute, believes that trends have lead to the widening income gap.

“Our economy has shifted so dramatically,” she said. Brewster stated that over the years, Rhode Island has seen a move from the manufacturing to the service industry, as well as a decline in unionization among employees. These factors have lead to a decline in the minimum wage’s value.

Senator Erin Lynch (D-District 31), the sponsor of the legislation, said the move to $9.60 is a step in the right direction, even though she originally wanted $10.10.

“I would have loved for it to be $10.10,” she said. “I think any step forward is a good step forward.”

Lynch also added that even though raising the minimum wage is definitely a part of eliminating income inequality, it’s not the only piece of the puzzle.

“We want to continue moving in the direction we’re moving. There’s no one magic bullet. We’re working on all kinds of different things.”

Other pieces of the economic puzzle include workforce development, access to capital, and education. Lynch believes that those together can help to level out incomes in the state, especially because they will be able to help those who are providing for their families. Outside of the state house, Lynch works as a divorce lawyer, and sees the hardships that low wages can take on the family unit.

“I see a lot of parents. I see a lot of people getting second and third jobs. People are doing what they need to do to support their families,” she said.

Currently, Rhode Island has one of the highest minimum wages in the country, but will soon fall behind states like Massachusetts, California, and Washington, DC, as they move their wages upwards of $10 an hour going into 2016.

“An adult needs close to $12 to meet their basic needs,” Brewster said. “$10.10 would have been great, but $9.60 is better than $9.”

Lynch stated that she will continue working to move the state economy forward. Hopefully that means a brighter, more equal future for everyone in Rhode Island.

“This is home,” Lynch said. “We want to make it the best place it can be.”

]]>

A Senate Judiciary Committee hearing on Tuesday showed overwhelming support for legislation that would legalize marijuana in Rhode Island after its economic successes in both Colorado and Washington.

Jordan Wellington, a lawyer with Vicente Sederberg LLC in Colorado, came to speak in support of the legislation, S 510. Wellington has worked closely with Colorado’s state government to implement the retail and regulation of marijuana, and now works in their Department of Revenue’s Marijuana Enforcement Division as the single policy analyst.

“Instead of should or shouldn’t we, we discussed how to move forward with this responsibly,” he said.

Wellington said Colorado gained more than 20,000 jobs and saw $900 million in sales that brought in $125 million in tax revenue. The cost of enforcement, he said, was less than $10 million.

Money from the extra revenue was invested in educational programs about cannabis to teach youth about its effects and consequences.

“We have found that some of the messaging to youth has been very effective,” Wellington said. “A very cautious message has been given to Colorado’s youth.”

According to Wellington, Colorado has not been without its challenges by taking this step forward. Regulation and education has been key in making the policy work. “One of the biggest things we did was we put a lot of different restrictions on potency in edibles,” he said.

The question of youth cannabis use was touched upon several times throughout the hearing. Andrew Horwitz, an assistant dean at Roger Williams Law School, who also testified in support of 510, said the prohibition approach aken towards marijuana is completely ineffective, and disingenuous to children.

“We are fundamentally dishonest in the way we talk to our children about marijuana,” Horwitz said. “We talk to them like it’s crack, like its heroin. They know now to believe us, that marijuana does what we claim.”

Horwitz also stated that reforming juvenile use starts from the top, with how the state looks at marijuana as a whole. “We are doing terrible damage by the use of our criminal justice system to deal with a public health issue,” he said.

One of these damages includes a racial disparity in the number of African Americans who are arrested for marijuana related crimes, due to police saturation in communities of color, as well as racial profiling.

“We’re doing a number of things wrong,” he said. “We’re arresting people for distributing marijuana. If you legalize the distribution of marijuana, you eliminate the whole line item of law enforcement.”

Jared Moffat, director of Regulate Rhode Island, also came in support of 510, with an entire binder of studies regarding the legalization in Colorado. The most accurate study of youth use, called Healthy Kids Colorado, looked at 40,000 middle and high school children, and is re-done every two years.

“The best available data on youth marijuana in Colorado shows that the use has remained flat,” he said, especially when in comparison to alcohol and tobacco, which has continually fallen in recent years. Moffat, like Horwitz and Wellington, pointed to education as the key to reducing youth cannabis use. Looking at the context of use is important as well.

“If we are acknowledging that marijuana is available in our schools, we need to acknowledge that is readily available from drug dealers,” Moffat said.

Moffat said many of the studies that opponents brought up against the legalization of marijuana have cherry picked their data in order to make it look like youth use has risen. One such study compared the city of Denver to the United States as a whole.

“If you take any metropolitan area, you’re going to find higher use,” he said.

Youth use was definitely the biggest worry of both legislators and the few opponents who did come out to speak against the bill, such as Debbie Paragini, who came as a Rhode Island parent.

“I feel really upset living in a state that is thinking about legalizing yet another recreational drug. For an economic basis? I don’t understand that,” she said. “As a parent, I think this is a really bad idea.”

]]> Since Rep Nick “Jobs and Economy” Mattiello has risen to the throne of speaker of the house, there seems to be a wave of pro-corporate, anti-human legislation making its way through the halls of the Marble Monolith, and quickly. The latest of these ‘improve-the-business-climate’ bills to bubble to the greasy surface of the General Assembly is Senator Daniel Da Ponte’s legislation to reduce the corporate tax rate in Rhode Island.

Since Rep Nick “Jobs and Economy” Mattiello has risen to the throne of speaker of the house, there seems to be a wave of pro-corporate, anti-human legislation making its way through the halls of the Marble Monolith, and quickly. The latest of these ‘improve-the-business-climate’ bills to bubble to the greasy surface of the General Assembly is Senator Daniel Da Ponte’s legislation to reduce the corporate tax rate in Rhode Island.

Frankly, I’m getting really tired of debunking the idea that reducing the corporate tax rate will do anything to revive the stagnant economy in Rhode Island but, in the immortal words of David Coverdale, “Here I go again, on my own. Going down the only road I’ve ever known.”

In a press release, dated May 6, 2014, Senate Finance Committee Chair Daniel Da Ponte says that he will introduce legislation to reduce the corporate tax rate from nine to seven percent, beginning in 2015. There are several telling – and disturbing – passages in the release. The first passage that pricked up my progressive ears and raised my journalistic hackles was this.

Chairman Da Ponte developed the legislation, with assistance from the Rhode Island Public Expenditure Council, following a series of meetings with large employers from a cross section of industries.

Hmmm, meeting with “large employers.” I’m going to guess that doesn’t mean small business men and women that happen to be portly. Let’s just assume that the “largest employers” in R.I. are those that occupy the top six tax brackets. According to the R.I. Division of Taxation, there are 2,144 businesses in those six brackets. I don’t want to downplay the importance of these large businesses on our economy, but on the other hand there are 47,555 businesses in the bottom two tax brackets. I’m no economist, but it seems to me that if one wanted to have a significant and broad impact on businesses across the state, one would focus their attention on the most significant and broadest swath of businesses, that is, small businesses.

I’m going to write the next sentence in bold caps so that everyone understands the situation, and, yes, I am “internet yelling.”

THE ONLY SECTOR OF RHODE ISLAND CORPORATE ENTITIES THAT PAY ANYWHERE NEAR NINE PERCENT INCOME TAX ARE BUSINESSES THAT POST LOSSES OR EARNINGS UNDER $250,000 PER YEAR!

Did you get that? Only the smallest businesses in RI actually pay anything vaguely resembling the 9 percent mandated by our tax code, and then some. In fact, the 18,390 Rhode Island businesses that posted adjusted net losses of $161,284,348,417 actually paid $10,181,122, which is an astronomically high tax rate. To put that in perspective, the 214 businesses in the top bracket – earning $500 million or more – and whose adjusted income was a whopping $344,338,188,611, paid only $18,641,027; a mere .00541 percent.

Tom Sgouros has an Op-ed on the Providence Journal today which breaks down this misconception nicely. Sgouros writes, in response to his recent debate with right-wing hack-conomist Stephen Moore, who advocated for reducing the corporate tax:

“Moore was apparently unaware that a Democratically-controlled legislature could act this way, and went on to talk about Rhode Island’s corporate income tax, calling it among the highest in the nation. Well, yes, the rate is the fourth-highest, at 9 percent. But in reality, the tax is so riddled with exemptions and credits that 94 percent of businesses pay only the minimum. The tax will raise $133 million next year, and according to the Division of Revenue, 42 percent of the exemptions and credits are worth $83 million. (They have no idea how much the remaining exemptions and credits cost us.)”

Maybe this wouldn’t be so bad if the words, ‘Small business is the lifeblood of the Rhode Island economy’ fall lugubriously from so many willfully ignorant or intentionally deceitful elected officials’ lips. My question is this: If 94 percent of corporations already pay only the minimum tax rate, which I believe is 4.5 percent, what impact does reducing the rate from 9 to 7 percent have? The answer is simply this: none. Da Ponte is quoted in his release as saying:

“A two percentage point reduction in the corporate tax dramatically improves Rhode Island’s competitive position nationally and regionally. After meeting with more than a dozen important corporate partners, I’m convinced this will improve the business climate here. This allows existing companies to expand, and helps to attract new companies and new jobs to our state.”

Is Sen. Da Ponte really that gullible? After meeting with the folks that stand to benefit from the reduction , he’s “convinced” that this will help the Rhode Island economy? Maybe I’m missing something here, but I fail to see how this move will benefit anyone except those 2,144 large corporations which, by the way, represent only 3.65 percent of all Rhode Island businesses, and already pay well below 9 percent in income taxes. The release also states that:

The bill would shift Rhode Island to a single-sales factor apportionment formula, calculating a corporation’s tax based on its sales in Rhode Island versus its total corporate and affiliate sales.

This very well could be an important piece of the puzzle when it comes to righting our economic ship, but only if the same standards are applied to small businesses that sell and ship products out-of-state. The state’s historical propensity to screw the small businessperson gives me little hope that this will actually be the case if the bill passes.

There is one bright spot in the bill, however. There is a provision to introduce combined reporting to multi-state businesses that are headquartered in RI. Bob Plain has done a nice job right here on RI Future of outlining the benefits to our state of combined reporting for RI-based companies that do interstate and international business.

But hey, don’t take my word for it. You can see the 2012 corporate tax revenue table for all Rhode Island businesses here. The table lays it all out in black and white; or red, if you’re one of the 18,000-plus small businesses that posted a loss in 2012. Math was never my strong suit, but it seems to me that Da Ponte’s numbers don’t add up. This is just another case of the Rhode Island legislature fellating Big Biz, while continuing to screw small business sans lubrication.

]]> Progressive activist Margaux Morisseau, best known for leading the charge against payday loans in Rhode Island, is running for state Senate District 21, the seat currently held by Republican Nick Kettle.

Progressive activist Margaux Morisseau, best known for leading the charge against payday loans in Rhode Island, is running for state Senate District 21, the seat currently held by Republican Nick Kettle.

“I am running because I want to be a part of the solution that helps improve our state for all people,” she said. “With my background in small business and community development, I know I can bring people and resources together to work on creative solutions and actually get initiatives accomplished. District 21 deserves a public servant who is dedicated to improving communities and is passionate about helping people move up the economic ladder.”

Morisseau is the director of Community Building and Organizing for Neighborworks Blackstone River Valley, a nonprofit Community Development Corporation which builds homes and communities for low-to-moderate-income families in Northern Rhode Island. She’s also the founding director of the RI chapter of New Leaders Council, a national non-profit that works to train and support progressive political activists.

And she’s already shown her political chops at the State House by going head-to-head with former speaker-turned-lobbyist Bill Murphy over payday loans.

On April 14, she is having a campaign kick-off event at the Corner Bistro in North Scituate (1115 Hartford Pike). You can support her campaign here.

District 21 includes parts of Coventry and West Warwick as well as Foster and Scituate, which is Morisseau’s hometown. She lives in the Clayville hamlet which straddles Foster and Scituate.

]]>