A few months ago, I wrote about the intellectual bankruptcy of the economic model called STAMP, for State Tax Analysis Modeling Program, created by the Beacon Hill Institute (BHI), and beloved of the Rhode Island Center for Freedom and Apple Pie (CFAP). The good folks at the CFAP have been heavily promoting some of the results of this model, that predict that Rhode Island will enjoy a tremendous economic boom if only we would eliminate our sales tax.

A few months ago, I wrote about the intellectual bankruptcy of the economic model called STAMP, for State Tax Analysis Modeling Program, created by the Beacon Hill Institute (BHI), and beloved of the Rhode Island Center for Freedom and Apple Pie (CFAP). The good folks at the CFAP have been heavily promoting some of the results of this model, that predict that Rhode Island will enjoy a tremendous economic boom if only we would eliminate our sales tax.

As I detailed in that article, the RI STAMP model is flawed not only by a host of questionable assumptions, but also the laughable attempt to obscure those assumptions under an absurdly over-complicated presentation of the relevant equations. Really, there is no reason to do what they do except as a conceptual bulwark against reporters who are easily cowed by that sort of thing.

Now comes the Institute for Taxation and Economic Policy (ITEP) to say the same thing as me. In an epic takedown (summary here, report here), they cite STAMP’s many assumptions that either cannot be justified by the research literature or are completely contradicted by that literature or by experience. They further point out that the STAMP model accounts for almost no possible economic benefit of public spending, such as, say, educated children or good roads. The STAMP model also contains little help in estimating the actual rates of change due to new tax policies, allowing them to

“… mask the fact that some tax plans they believe would be economically beneficial are guaranteed to shrink the economy in the short-term.”

ITEP concludes that from this alone,

“STAMP analyses are of no use in informing the debate over what will be necessary to balance the state’s budget in the wake of a major tax change.”

There is plenty more, such as STAMP’s implicit assumption of full employment (!) and the assumption that households spend money in more or less similar ways to governments. (How many police officers did you employ last year?)

I am gratified by the validation of my review of this model, but really, the damning evidence is right in BHI’s own footnotes. That’s where, just to pick one example, the STAMP designers tell us they assume that all rich people — you know, the ones who have expensive houses and extensive business and social ties to their community — are more likely to move to another state for financial reasons than poor people, who frequently own nothing and have no such ties.

Of course that’s not how it reads. The actual text talks about elasticities and the sensitivity of participation rates, but that’s what it means, once you wade through the verbiage.

In an email responding to the ITEP analysis, Justin Katz, of the CFAP, said they think the appropriate response is to average their results with model results they like less.

“…[T]he Center has long maintained that it is an opportunity for policymakers that they have such divergent models. As we recommended in our recent brief, the General Assembly should take advantage of the two projections as a high-end and a low-end and implement the elimination or reduction of the sales tax with plans to adjust down or up as the monthly results become apparent.”

This, of course, is not the way it’s done. When the clown honks his little horn and says the sky at noon is inky black, the proper response is laughter, not to average his views with yours.

There are two ways people analyze mathematical models. One way involves detailed examination of the assumptions used to generate it. The STAMP model fails this test in spectacular fashion, according to me, and now according to ITEP. The other way is to validate the model against past events. That is, a model good at predicting the future should be good at predicting things that have already happened. If a model can predict 2014 results from 2013 data then it makes sense to use it to predict what will happen in 2015.

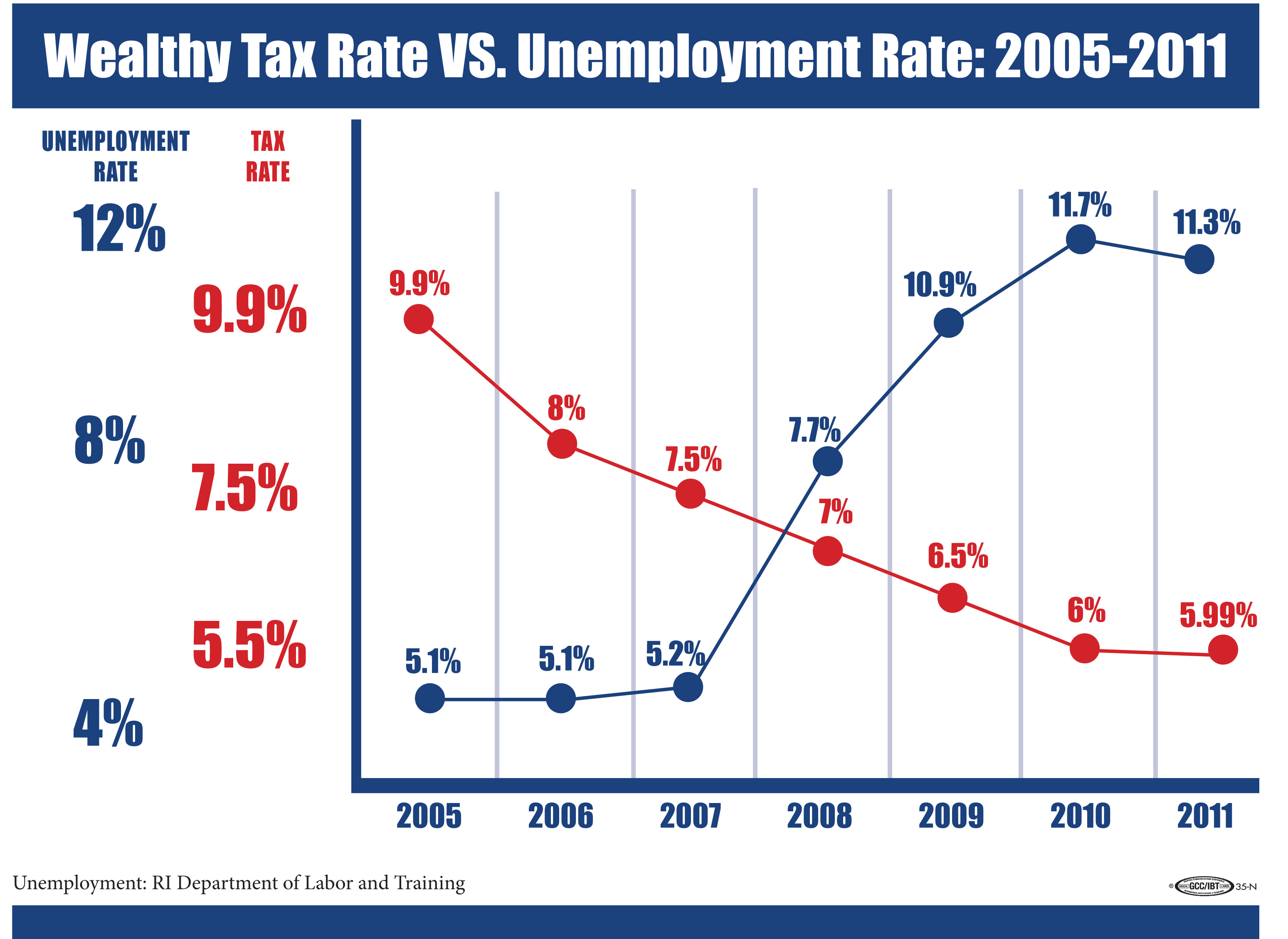

We have cut taxes several times in the past 20 years. There were the Almond income tax cuts of 1997-2002, the capital gains cuts passed in 2001, the flat tax passed in 2006, and several smaller cuts. When the CFAP can show us that their STAMP model would have accurately predicted what actually did happen — and that the same model predicts what they say about future tax changes — only then will it be useful to listen to their results. Until then, nothing but laughter from me, and hopefully everyone else they honk their little horn at.