My colleague Steve Ahlquist previously posted a great story covering the two meetings on July 27 about the proposed construction of the taxpayer-subsidized stadium. One point that was made at the Providence meeting, worth expanding on here, is the issue of the construction trade unions, which have endorsed this project. This piece will make an effort to appeal to both the general membership and leadership of these unions, who will prove to be some of the most important allies in this struggle and, on the other hand, will perhaps be the make-or-break of this deal.

It is important to empathize with the membership, they are facing a massive drop in employment and job sites, with a huge percentage of the rank-and-file out of work. This project would create jobs for a large swathe of their members, something I do not begrudge them for.

But this is a decision I do not think they have properly contemplated. First, while the governor has previously eluded to a hiring push that would target minority workers, the current contractor participating in this project, Gilbane, has one of the worst records of minority hiring in the nation. That is an important issue to discuss because the disenfranchisement of minority workers is a vital one.

Second, and perhaps more importantly, this stadium could generate short-term gains on one project but may in fact kill development in the I-195 land in the near future. As Kate Bramson reported on May 2, any and all further construction hinges on a super-permit that would install a stormwater mitigation mechanism at the proposed open park. Bramson wrote in that piece:

The master permit hinges on a plan to use parkland within the 195 district for stormwater mitigation. Builders are required to treat a percentage of stormwater on parcels they develop. However, if they can’t meet the entire stormwater requirement on a parcel, the master permit allows them to gain credit from the parkland’s treatment of stormwater.

Given the tides and ebbs of Rhode Island politics, this could end up killing future development on the I-195 corridor for up to five years. And on top of that, recall that the federal government also will need to be involved, prolonging the wait. That of course translates out to a much greater amount of time for unemployed union members to remain so. Between an extended waiting period and a traffic-clogging stadium, potential developers in the bio-med and education sectors might take their business elsewhere, keeping that land vacant for a very long time.

Bucking the trend and opposing an endorsement that has already been made by the union is always a tremendously problematic issue, no doubt. It takes courage, gumption, and being versed in the relevant documentary records so to make a cogent case. I would refer interested parties especially to this slideshow produced already by the I-195 Commission, an outline of proposed development by landscape architects that every taxpayer in the state already funded. Just to re-iterate, the state has already paid three times for this land. First, we paid for the de-comissioning and demolition of the old I-195 highway. Second, we paid to have it zoned and developed by the federal government. Third, we paid for the aforementioned landscape architects and other planners to work out the schematics of the park.

If this ballpark scheme goes through, it will cost taxpayers another three times. First they will need to pay for the stadium’s construction. Second they will pay to re-design the sewer and highway system to accommodate the stadium. Third we need to re-develop another parcel of land as a park should the government refuse to accept the idea of a smaller park on the grounds of the stadium.

There is simply too much risk as opposed to reward in this idea and organized labor should rethink their position, not so to undermine their standing but to promote and improve their reputation. This week Boston Mayor Martin Walsh rejected the move to finance the 2024 Olympics with Beantown tax monies, causing their bid for the Games to be voided. That move has probably bought Walsh another term in office and could very well give him a future bid for higher office. The unions in Rhode Island would be wise to take such logic into consideration. To be clear, I am no opponent of labor unions, I am a member of one and was an eyewitness to the Illinois Caterpillar strike in the 1990’s. But this project, should it come to pass due to labor’s support, will be seen by many as a black mark on its record and will be fantastic fare for union busters on both sides of the aisle.

]]>

Last year, after the General Assembly stole away the power of cities and towns in Rhode Island to set their own minimum wages, Providence City Councillor John Igliozzi told a packed room of disappointed hotel workers that the city was not prohibited from imposing higher minimum wage standards via tax stabilization agreements (TSAs), which are contracts between cities and private industry, and cannot be interfered with by the General Assembly.

Igliozzi said then that all future TSAs should include strong minimum wage requirements and many other worker protections and rights.

Igliozzi is the chair of the Providence City Council Finance Committee, so one would expect that he would follow up on this proposal, but so far, nothing like this has been incorporated into the new TSAs being cooked up in City Hall and expected to be voted on this week.

When Jesse Strecker, executive director of RI Jobs with Justice, testified before the Finance Committee of the Providence City Council, he presented a short list of proposals to ensure that whatever TSAs were adopted would truly benefit not just the investors and owners of billion dollar corporations but also the working people and families of Providence.

Strecker’s list included the following:

1. Provide good, career track jobs for Providence residents most in need by utilizing apprenticeship programs and community workforce agreements, hiring at least 50% of their workforce from the most economically distressed communities of Providence, with a substantial portion of that workforce made up of people facing barriers to employment such as being a single parent or homeless, or having a criminal record, offering job training programs so local residents are equipped with the skills necessary to perform the available jobs and hiring responsible contractors who do not break employment and civil rights law;

2. Pay workers a living wage of at least $15 per hour, provide health benefits and 12 paid sick days per year, and practice fair scheduling: offering full time work to existing employees before hiring new part time employees, letting workers know their schedule two weeks in advance, and providing one hour’s pay for every day that workers are forced to be ‘on call’;

3. For commercial projects, create a certain number of permanent, full-time jobs, or for housing developments, ensure that 20% of all units are sold or rented at the HUD defined affordable level. Or, contribute at an equivalent level to a “Community Benefits Fund,” overseen and directed by community members providing funding to create affordable housing, rehabilitate abandoned properties, or finance other community projects such as brown field remediation; and

4. Present projected job creation numbers before approval of the project, and provide monthly reporting on hiring, wages and benefits paid, and other critical pieces of information, to an enforcement officer, overseen by a Tax Incentive Review Board comprised of members of the public and appointees of the city council and mayor, to make sure companies are complying with their agreements, and be subject to subsidy recapture if they do not follow through.

Mayor Jorge Elorza submitted an amendment mandating that under the new TSAs, “projects over $10 million will be eligible for a 15-year tax stabilization agreement that will see no taxes in the first year, base land tax only in years 2-4, a 5% property tax in year 5 and then a gradual annual increase for the remainder of the term.”

In return, the “agreements include women and minority business enterprise incentives as well as apprenticeship requirements for construction and use of the City’s First Source requirements to encourage employment for Providence residents.”

But that short paragraph above contains few of the proposals suggested by Strecker.

Supporting the Jobs with Justice proposals are just about every community group and workers’ rights organization in Providence, including RI Building and Construction Trades Council, Direct Action for Rights and Equality (DARE), UNITE HERE Local 217, IUPAT Local 195 DC 11, District 1199 SEIU New England, RI Progressive Democrats of America, Teamsters Local 251, Fuerza Laboral / Power of Workers, Environmental Justice League of RI, RI Carpenters Local 94, Restaurant Opportunities Center RI (ROC United), Mount Hope Neighborhood Association, American Friends Service Committee, Occupy Providence, Olneyville Neighborhood Association (ONA), Fossil Free RI, Providence Youth Student Movement (PrYSM), Prosperity for RI, and the Brown University Warren Alpert Medical School Prison Health Interest Group.

]]>

A Senate version of Governor Raimondo’s truck toll proposal, also known as Rhode Works, contains tax breaks for truckers.

The new version of the bill, sponsored by Sen. Dominick Ruggerio (D- District 4), and heard by the Finance Committee Thursday, includes $13.5 million in tax credits and rebates for truckers. They would receive tax credits on their registration fees, rebates on their gas and property taxes, as well as $3 million in grants for those who frequent TF Green Airport and Quonset Business Park.

RIDOT has also slightly reworked their funding formula for the proposal, asking for $500 million in revenue bonds, rather than $700 million. According to Director Peter Alviti, the difference would be bridged by refinancing some of the debt the Department already owes the state, which would give them another $120 million. Without that $80 million to complete the funding, Alviti said the Rhode Works program would be extended over a longer period of time, 30 years, to achieve the same goal. With this new schedule, RIDOT’s interest would increase, and they would eventually pay back $1 billion to the state. According to RIDOT, the total funding for the project would be over $4 billion.

The proposal is based on a serious need to repair Rhode Island’s bridge and road infrastructure, which is ranked 50th in the United States. During the hearing, Alviti stressed safety as one of the main reasons for Rhode Works’ existence.

“This is becoming a more frequent problem, and it will become more frequent in the days and weeks coming unless we do something now,” he said.

The program would also create 11,000 job years in the construction industry. RIDOT also anticipates $60 million each year in revenue from the proposed tolls, $38 million of which would be put towards fees owed to the state. Any other revenue from tolls would directly go towards the repair of bridges and roads. RIDOT plans to reconstruct 155 bridges using this money, as well as upkeep others that are currently in fair condition. The tolls would only charge tractor-trailers, costing them $.69 per mile in Rhode Island, while most other states in the northeast are $1 or more per mile.

“It’s understandable that there’s a certain amount of resistance to the changes we’re proposing. But it’s a fair cost,” Alviti said.

Jonathan Wormer, the director of the Office of Management and Budget, also gave testimony in support of Rhode Works, and explained how much these tolls will end up costing the trucking companies. There are 123 trucks that drive explicitly in Rhode Island all day, whose tolls would be capped at $60 for the whole day, costing the company just under $1.8 million. The 3,111 interstate trucks that come through the state would be capped at $30 per day, and cost $14.9 million. Such toll costs are only about two percent of what companies spend per year. Fuel is considerably more, at 39 percent.

These fees would be collected via EZ Pass, which many truckers that pass through the state already have. If they do not, RIDOT would also implement camera technology that would charge the owner of the license plate. Alviti stared during the hearing that they would not build any tollbooths that would hold up traffic. There are 17 possible locations that the department is looking to install these gantries.

Although most of this information has been revised from the previous bill, Christopher Maxwell, the President of the Rhode Island Trucking Association, said it’s still not ready to become law. “The debate and dialogue should continue, it should not end now. It should begin now that we have all the information,” he told Senate Finance members.

Maxwell believes that directly tolling tractor-trailers will violate the commerce clause in the United States Constitution, and discourage interstate commerce. He stated that no other state is exclusively tolling trucks.

“This does clearly put interstate commerce, and these carriers that you’re not giving breaks to, at a disadvantage,” he said. So much of a disadvantage, that Maxwell added that his association could provide legal proof that such a toll would violate the commerce clause.

“We want to be part of the solution, we are not part of this bill,” he added, citing that the association does have ideas on what RIDOT should do, but did not offer an explanation of what those ideas are at the hearing.

Local truckers came to speak out against the bill as well. Frank Nardone, one truck driver, explained that he avoids tolls in almost all of his routes, and Rhode Island would be no different.

“I don’t like to pay tolls, I don’t think they’re necessary,” Nardone said. According to Nardone, tolls are not the way to make money, especially because Rhode Island truckers already have to pay $388 for the road use tax.

“I think I’m being taxed enough,” he said.

Ed Alfredi owns a trucking company based in Smithfield, and in his testimony, said that Rhode Works makes it impossible to figure out exactly how much the tolls would cost his business.

“If I was to try and sit down, and see what this was going to cost me and my company, it’s very difficult, because there’s no facts,” he said. “It’s going to have an effect, and we should be able to have an exact figure of what these tolls are, where exactly they’re going to be.”

Time is of the essence for the governor’s proposal. While those opposed want more, those in support keep pressing forward, wanting to pass the legislation as quickly as possible. If their efforts fail, Speaker of the House Nicholas Mattiello has hinted at a special fall session in order to fully consider the bill.

]]>

After much deliberation, the House Finance Committee gave a unanimous 19-0 vote on the FY 2016 budget late on Tuesday night, which included $37.7 million more than the proposed budget given by Governor Gina Raimondo back in March. The legislative budget proposal is for $8.67 billion dollars, with $3.55 billion from general revenue contributing to that.

“We concur with many of the governor’s initiatives for economic development,” House Finance Chairman Raymond Gallison (D-District 69) said in a press briefing tonight.

According to Gallison, the committee, in large part, accepted Raimondo’s budget, but there were some key provisions that saw change, including Social Security, Medicaid, and sales taxes to businesses.

Those who made between $80,000 and $100,000 will be exempt from paying social security income tax. These tax cuts will give retired Rhode Islanders $9.3 million in tax relief. Businesses are also now exempt from paying the sales tax on corporate utilities. Governor Raimondo had originally proposed phasing it out over five years, but will instead be taken out all at once this year. The earned income tax credit for middle to low income households has also increased from 10 percent to 12.5 percent.

The budget outlines a 2.5 percent Medicaid cut for hospitals, and a 2 percent cut for nursing homes. Gallison said this provides more protection for nursing homes. The House budget cuts Medicaid roughly $67 million, a far cry from the $90 million that the governor had proposed, but the hospital license fee has been increased to 5.862 percent, which would bring in $13 million in additional revenue.

“Funding to maintain HealthSource RI is included in the budget,” Gallison said, outlining the distribution changes to its funding. Now, individuals will pay a surcharge of 2.86 percent on their monthly premiums, and businesses will pay a .59 percent surcharge. The budget allocates $2.6 million for HealthSource RI going into FY 2016. There is also no more additional surcharge for outpatient and imaging services.

Full-day kindergarten is another key provision, with the governor allocating $1.4 million from general revenue to fund programs in the seven communities that don’t offer full-day kindergarten yet. Educational aid was increased by $35.8 million in order to pour money into the educational funding formula. There was also $20 million added for school construction purposes.

Higher education saw an increase of $7 million. The Rhode Island Higher Education Assistance Authority is being downsized, with its responsibilities now being transferred to the Council of Post Secondary Education and the Office of the General Treasurer.

Other major provisions within the bill include cuts to all eight local tourism bureaus, a $2 million increase for RIPTA, and a $0.25 increase in the state sales tax on cigarettes, bringing it up to $3.75 per pack. The tax increase is estimated to bring in $1.7 million in revenue.

What is absent from the budget is just as significant as what is present.

“This budget does not contain anything whatsoever to do with a proposal for a stadium, or any tolls on trucks as proposed by the governor,” Gallison said during the hearing. Also notably absent is the “Taylor Swift tax” on million dollar homes in the state.

Speaker of the House Nicholas Mattiello has gone on the record saying that the proposed budget is business friendly, and will allow for economic development in the state.

“The budget that’s going to be voted on tonight is very pro-business, pro-economy. It’s going to serve as a catalyst for existing businesses as well as working to attract new businesses to the state of Rhode Island,” he told members of the media on Tuesday.

Gallison agreed with that sentiment, giving his own statement at the beginning of the hearing.

“We continue to move Rhode Island onto an economic path to enable businesses to continue to grow,” he said.

The bill is scheduled to go to the House of Representatives floor next Tuesday.

]]>

A Senate Judiciary Committee hearing on Tuesday showed overwhelming support for legislation that would legalize marijuana in Rhode Island after its economic successes in both Colorado and Washington.

Jordan Wellington, a lawyer with Vicente Sederberg LLC in Colorado, came to speak in support of the legislation, S 510. Wellington has worked closely with Colorado’s state government to implement the retail and regulation of marijuana, and now works in their Department of Revenue’s Marijuana Enforcement Division as the single policy analyst.

“Instead of should or shouldn’t we, we discussed how to move forward with this responsibly,” he said.

Wellington said Colorado gained more than 20,000 jobs and saw $900 million in sales that brought in $125 million in tax revenue. The cost of enforcement, he said, was less than $10 million.

Money from the extra revenue was invested in educational programs about cannabis to teach youth about its effects and consequences.

“We have found that some of the messaging to youth has been very effective,” Wellington said. “A very cautious message has been given to Colorado’s youth.”

According to Wellington, Colorado has not been without its challenges by taking this step forward. Regulation and education has been key in making the policy work. “One of the biggest things we did was we put a lot of different restrictions on potency in edibles,” he said.

The question of youth cannabis use was touched upon several times throughout the hearing. Andrew Horwitz, an assistant dean at Roger Williams Law School, who also testified in support of 510, said the prohibition approach aken towards marijuana is completely ineffective, and disingenuous to children.

“We are fundamentally dishonest in the way we talk to our children about marijuana,” Horwitz said. “We talk to them like it’s crack, like its heroin. They know now to believe us, that marijuana does what we claim.”

Horwitz also stated that reforming juvenile use starts from the top, with how the state looks at marijuana as a whole. “We are doing terrible damage by the use of our criminal justice system to deal with a public health issue,” he said.

One of these damages includes a racial disparity in the number of African Americans who are arrested for marijuana related crimes, due to police saturation in communities of color, as well as racial profiling.

“We’re doing a number of things wrong,” he said. “We’re arresting people for distributing marijuana. If you legalize the distribution of marijuana, you eliminate the whole line item of law enforcement.”

Jared Moffat, director of Regulate Rhode Island, also came in support of 510, with an entire binder of studies regarding the legalization in Colorado. The most accurate study of youth use, called Healthy Kids Colorado, looked at 40,000 middle and high school children, and is re-done every two years.

“The best available data on youth marijuana in Colorado shows that the use has remained flat,” he said, especially when in comparison to alcohol and tobacco, which has continually fallen in recent years. Moffat, like Horwitz and Wellington, pointed to education as the key to reducing youth cannabis use. Looking at the context of use is important as well.

“If we are acknowledging that marijuana is available in our schools, we need to acknowledge that is readily available from drug dealers,” Moffat said.

Moffat said many of the studies that opponents brought up against the legalization of marijuana have cherry picked their data in order to make it look like youth use has risen. One such study compared the city of Denver to the United States as a whole.

“If you take any metropolitan area, you’re going to find higher use,” he said.

Youth use was definitely the biggest worry of both legislators and the few opponents who did come out to speak against the bill, such as Debbie Paragini, who came as a Rhode Island parent.

“I feel really upset living in a state that is thinking about legalizing yet another recreational drug. For an economic basis? I don’t understand that,” she said. “As a parent, I think this is a really bad idea.”

]]> Speaking at a Greater Providence Chamber of Commerce luncheon, Speaker of the House Nicholas Mattiello held court and spoke plainly about his economic priorities for Rhode Island.

Speaking at a Greater Providence Chamber of Commerce luncheon, Speaker of the House Nicholas Mattiello held court and spoke plainly about his economic priorities for Rhode Island.

Clearly upset that Politifact ruled false his recent statement in which he denied that there have been tax cuts for the rich in Rhode Island, Mattiello pointed out that when he speaks to his “well-to-do” neighbors, they “don’t see any tax relief.” Then in a gesture more suited to Imperial Rome than to Democratic Rhode Island, Mattiello declared, “That discussion has to stop.”

Of course, the discussion isn’t stopping.

Mattiello made no secret about his economic priorities: rich people. The real question is why any business interest in Rhode Island bothers to pay lobbyists any more, given that Mattiello has basically said that businesses will get everything they want, from lower taxes to fewer regulations. Says the speaker, “We have to concentrate on the things that are important… Let the business community know that they’re important to us, know that we are going to do the types of things they need to have done.”

No longer will people be the priority in Rhode Island. “We changed the tone,” said Mattiello, “The business community knows that they have priority, they know that they’re important…”

It follows then that people not in the business community do not have priority and are unimportant.

On HealthsourceRI, one of the most successful state run health exchanges in the country, Mattiello remains unconvinced, saying, “I’m informed that it’s not as good as we think it is… There are a lot of problems with the exchange… It should be no more expensive than it would cost us to have the federal government to do it…”

I can’t be the only one who detects a massive dose of hubris when Mattiello says, “I have not made my mind up as to whether or not we’re going to keep it in the state, give it to the federal government and so forth…”

Just in case you need a preview of what to expect as the years roll by under Mattiello’s House leadership, you can rest assured it’s going to be more of the same. “I would support [reducing or eliminating the $500 minimum corporation income tax] and I would support reducing and eliminating other taxes also. There’s a lot of taxes we could reduce or eliminate… I’m not sure that’s it going to be my priority this year, but it’s certainly something that I’m mindful of and it’s something that we ultimately have to address.”

One has to wonder when the General Assembly will get its House in order, and find new leadership.

]]> Speaker of the House Nicholas Mattiello has been making statements demonstrating his support for “dynamic analysis,” (also known as “dynamic scoring“) a fiscally irresponsible and economically discredited accounting trick supported nationally by congressional Republicans that amounts to little more than rebranded trickle-down economics.

Speaker of the House Nicholas Mattiello has been making statements demonstrating his support for “dynamic analysis,” (also known as “dynamic scoring“) a fiscally irresponsible and economically discredited accounting trick supported nationally by congressional Republicans that amounts to little more than rebranded trickle-down economics.

At Saturday’s 2015 Small Business Summit, held at Bryant University, Mattiello defended the $20 million tax break on social security income he’s proposed as a short term economic hit for long term economic gain.

“What I’ve been saying lately,” says Mattiello in the clip below, “is that everything we look at in state government, we look at the wrong way. We look at it from a very static point of view. ‘What is it going to cost us?’ ‘Oh, this year it’s going to cost us $20 million so forget it, we’re not going to do it. If we don’t have room in the budget to do it we’ll kick that issue out. Well, we have a structural deficit in Rhode Island, folks, so under that analysis we’re never going to do anything in Rhode Island to make our economy better. Sometimes you have to prioritize and you have to do what the economy needs to do to move forward.”

Then, in today’s GoLocalProv, Mattiello said, “I know that keeping people in Rhode Island, with more discretionary income in their pockets, will be a significant long-term gain for our economy. This initiative comes with a short-term cost in our state budget. But, we need to start using a more dynamic analysis that takes into consideration long-term benefits, instead of a static analysis that only looks at how much things cost.”

Mattiello has invested a lot of political capital to pass his signature tax break. And to make these tax breaks work, he’s going to cut the state budget accordingly. The cuts are most likely to be in the areas of social services, which the Speaker has repeatedly signaled his willingness to cut. But in order to pass his tax break, the Speaker needs an economic analysis friendly to his idea. Conventional, or what is known as static analysis, does not look kindly on Mattiello’s idea, but dynamic analysis does.

The economic analysis Mattiello wants to use here in Rhode Island is the same as what is being proposed nationally by the Republicans now in control of Congress, and it’s scarily reminiscent of the policies Kansas Governor Sam Brownback instituted in 2012 that eviscerated the economy of that state.

Congressman Chris Van Hollen of Maryland and Congresswoman Louise Slaughter of New York penned a piece criticizing dynamic analysis, writing that Republicans “are rigging the rules in favor of windfall tax breaks to the very wealthy and big corporations who can hire high-priced, well-funded lobbyists—once again choosing to leave behind working families. Their plan would further distort the nation’s fiscal outlook by applying this scoring model only to tax cuts—not the economic impact of investments in education, healthcare, infrastructure, and other areas. That means that the value of tax cuts to the economy would be exaggerated, and the value of investments in the middle class would be undercut.”

Shaun Donovan, Director of the Office of Management and Budget at the White House, outlines three reasons why dynamic analysis is little more than a ruse and it’s worth quoting from at length.

First, dynamic scoring requires CBO and JCT to make assumptions in areas with unusually great uncertainty. While all budget estimates are uncertain, there is substantially more disagreement among economists and experts about how policy changes affect the macroeconomy than about most other scoring issues. This helps explain why estimates from different CBO models of the long-run growth effects of a 10 percent tax cut differed by a factor of 15 – and ranged from positive to negative – when dynamic scoring was used.

“Second, and more fundamentally, dynamic scoring would require CBO and JCT to make assumptions about policies that go beyond the scope of the legislation itself. For example, when a tax cut or spending increase is deficit financed, its long-term effect on the economy depends heavily on how and when its costs are ultimately recouped – whether through higher taxes or lower spending, and after how large an increase in debt. When the legislation itself is silent on these questions, Congressional scorekeepers would have to make an assumption – potentially putting scorekeepers in the game, rather than just referees. Moreover, in standard models, these assumptions are often the difference between a positive or negative effect on the economy.

“Finally, dynamic scoring can create a bias favoring tax cuts over investments in infrastructure, education, and other priorities. While the House rule would require dynamic scoring for legislation making large changes in revenues and/or mandatory spending, and makes it permissible at the option of leadership for any such legislation (even if modest), it would not apply to discretionary spending, ignoring potential growth effects of investments in research, education, and infrastructure. More insidious, economic models that find large growth effects of tax cuts are often based on the assumption that they would be paid for entirely through reduced spending – without taking into account at all the economic consequences the reduction in government investment.”

Speaker Mattiello seems intent on implementing the kind of economic policy here in Rhode Island that has long benefited the rich and connected over the middle class and the poor. These policies have led to massive wealth acquisition by the very few amid crushing poverty for many. In doing so Mattiello has aligned himself with the Republican Party and against the Democratic Party of which he claims to be a member.

]]> It’s always gratifying when one of the best and most deserving folk actually get a position in government where they can make a powerful difference. We recently learned that RI Future contributor Tom Sgouros has been appointed as senior policy adviser to Seth Magaziner, the new treasurer of Rhode Island.

It’s always gratifying when one of the best and most deserving folk actually get a position in government where they can make a powerful difference. We recently learned that RI Future contributor Tom Sgouros has been appointed as senior policy adviser to Seth Magaziner, the new treasurer of Rhode Island.

Tom was himself a candidate for the office of treasurer in 2010 but dropped out early in the race that Gina Raimondo would go on to win. He is known for his incisive, well-researched and often sarcastic insights into the economics and policies of Rhode Island.

In addition to writing for RI Future, Tom recently started — and will suspend — an excellent column in the Providence Journal. Which is a shame, but a fair tradeoff for honesty and transparency in government.

Tom’s most recent book, Checking the Banks is subtitled “The Nuts and Bolts of Banking for People Who Want to Fix It”, so it looks like they’ve picked the right person for the right job.

In the book, Tom goes into great detail about what’s wrong with the banking system, like the mortgage crisis, lack of loans to small businesses, and predatory practices. He also offers alternatives, solutions and possibilities for change.

We hope that Tom and Treasurer Magaziner will create bold initiatives to make banking more innovative. Maybe we can start our own state bank, and save taxpayers millions while priming the local economy’s pump…

At the beginning of the session everything is possible. Now the hard work begins.

(DISCLAIMER: As the editor and publisher of two of Tom’s best books, this article is 100% biased and slanted.)

]]>

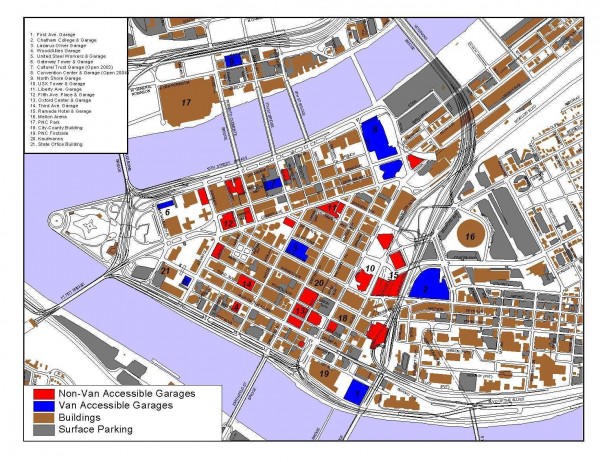

Cities with less parking do better economically and environmentally, so getting Jorge Elorza firmly behind a parking tax should be one of our top concerns.

When asked whether he would support a parking tax during his administration, Jorge Elorza blew a dog whistle for potential supporters and opponents, saying in effect “not now.” On balance, Elorza’s reply makes me confident that the mayor-elect’s administration will institute a parking tax if Providence voters push him on the issue. A parking tax is one of the most important economic development and transportation initiatives that the mayor could take on, and progressives should ready themselves to ask for its passage.

I feel comfortable trumpeting the impending passage of a parking tax because of the particular caveats Elorza had with passing one. He at first said “we can’t adopt it right now”, but then added this:

The larger reality is that our citizens are already over taxed, and we can’t consider adding anything new to that burden. Over the long term, if we can manage to lower some of the other taxes – property tax, the car tax, etc. – I would consider a parking tax, because it’s much more progressive tax. First, it requires visitors to the city to share a portion of the tax burden, unlike the property and car taxes, which only impact residents. It also incentivizes other forms of transportation and ride sharing. (my emphasis)

Why do I think such a seeming non-answer is hopeful? Because the caveats are built into the proposal itself. Proponents of a parking tax ask that the city tax parking, and use 100% of the revenue to reduce other taxes. A parking tax means a tax cut on your house or apartment. We should take this as a yes and start pushing Elorza to keep his promise. Yours truly much prefers a lowered property tax to a lowered car tax for obvious reasons, but even a lowered car tax in return for a parking tax wouldn’t be a non-starter.

Pittsburgh currently has the highest parking tax in the country, at 40% of value, and it brings in more revenue than income taxes for the city (I would favor a parking tax arrangement that also taxes “free” parking–see article here–but getting commercial lots to pay a tax would be a start). Allowing Providence to tax parking could create the right balance that would both favor development and create a fairer environment for ordinary people.

As a type of de facto carbon tax, a parking tax works much better than, say, the gas tax, because if the mechanism that discourages driving works to actually reduce vehicle miles traveled, the result will be an economic situation that favors less driving even more. When drivers reduce their vehicle use, gasoline tax revenues are reduced, and programs like public transportation budgets suffer. Raise the tax to get more revenue, and driving is reduced yet again. But drivers who shun the parking tax by driving less will leave lot owners with less revenue, not transit agencies. The owners of lots, who previously may have calculated that it was worth developing nothing and taking a fee each day from commuters, might get a different idea. On the other hand, if drivers continue to park, the city collects revenues which can be put into property tax reductions. This, too, would encourage infill. So we have a positive feedback loop.

A parking tax dodges some of the objections people could have to a land tax. Residents with big yards don’t need to worry that the city is going to try to punitively charge them for green space*. And a parking tax would favor smaller businesses that often struggle to compete with big boxes, but which produce more benefit with less cost to cities. Big business need not even worry so much, since catching up would simply mean following the set of incentives the city is offering. Got parking you’re not using? Build another store on it, or lease it out to developers for housing.

The parking tax, unlike the car excise tax, has the advantage of taxing non-residents as well as residents, making it a more progressive way of pricing the cost of automobiles to society. This set up also answers a critique I’ve heard of the car tax, which is that some people may find themselves unable to give up a car due to long exurban commutes out of the city. A parking tax would inherently tax those who work in the urban core the most, meaning that city residents who normally drive from nearby neighborhoods to their jobs in the core out of convenience would likely be the first to change their habits and use other methods to get to work, while those who live on the South Side but work out in the boonies at a Walmart would be unaffected. Since a parking tax would raise the effective cost of driving to the core while lowering the cost of living there, many residents would experience the parking tax as a break-even tax or even a tax reduction.

A parking tax, by lowering property taxes, would encourage infill. Currently, the city frequently awards tax stabilization agreements (TSAs) to downtown developers to help ameliorate the city’s huge parking crisis and get new building stock. TSAs have a built-in logic that makes economic sense, but residents nonetheless have good reason to feel annoyed at them. With very high property and commercial taxes (Providence has the highest commercial taxes of any city in the country, in fact), it just doesn’t make sense to develop parts of Downcity without some reduction in cost, so TSAs get something where the city might have gotten nothing. But instituting a parking tax will help to lower these overall tax burdens in a more equitable way. Now, not just those with connections to City Council, but also renters or homeowners in every neighborhood of the city, will see a reduction in their taxes.

The parking tax should also please progressives because it asks for as much as it gives back. TSAs fundamentally lower taxes for certain people without any immediate short-term plan for revenue. In a city facing yet another fiscal shortfall in the coming year, that’s a problem. Raising revenue for the city from a parking tax while giving that revenue back would be a more balanced approach.

The immediate challenge for the parking tax will be getting a City Council resolution in favor of its passage. Based on my best advice from talking to a variety of city and state officials, I understand that the legislature would have to give Providence authorization to institute a parking tax. I know there are some who have said they’re interested in helping with this effort, but first City Council has to move forward.

I’m going to be working with City Council to build support for a parking tax in the coming year, and I hope that RI Future readers will join individually and as organizations to call on Council and the mayor-elect to pass it.

~~~~

*I don’t contend that this is something that really happens under a land tax, as, in fact, land taxes often effectively act as parking taxes, but what I would say is that this clarifies the issue in voters’ minds.

]]> Does the success of the ballot measures mean Rhode Islanders don’t believe in austerity? Can libertarians and progressives work together to make Rhode Island the first east coast state to legalize marijuana? Will the new crop of Democrats be much different from the old bosses?

Does the success of the ballot measures mean Rhode Islanders don’t believe in austerity? Can libertarians and progressives work together to make Rhode Island the first east coast state to legalize marijuana? Will the new crop of Democrats be much different from the old bosses?

NBC10’s Bill Rappleye and the GOP’s Rob Paquin and I discuss here:

]]>