There are those who want to give credit for what we accomplished in the September primary to some vague anti-incumbent sentiment, or even tolls. I’m writing this piece to dispel that notion. Progressives won big on Tuesday for two reasons: hard work and Rhode Islanders’ commitment to progressive change.

There are those who want to give credit for what we accomplished in the September primary to some vague anti-incumbent sentiment, or even tolls. I’m writing this piece to dispel that notion. Progressives won big on Tuesday for two reasons: hard work and Rhode Islanders’ commitment to progressive change.

This victory truly belongs to the women and men who made it happen. Those people include the candidates, but they also include the people who did work behind the scenes, people who never get nearly enough credit. People like Laufton Ascencao-Longo, Kavelle Christie, Grizzel Clemetson, Craig O’Connor, Georgia Hollister-Isman, Abby Godino, Andy Cagen, Judith Finn, Duncan Weinstein, Nate Carpenter, Johanna Harris, and the whole Ranglin-Vassell family.

Laufton Ascencao-Longo, a native Rhode Islander and the son of a Portuguese immigrant who moved from Madeira to Fox Point, he had gone away to Pittsburgh to attend college. There, he became a leader in the Progress Pittsburgh movement, the wildly successful campaign to take back Pittsburgh that progressive activists around the country dream of emulating. He also worked on President Obama’s campaign, Tom Wolf’s successful campaign for Governor of Pennsylvania, a winning state senate race in Virginia, and a host of other smaller races. Laufton had spent half a decade working hard to win races and create change, and in his own words, he “was done.”

He moved back to Rhode Island to “retire.” He was done with working 15 hours a day, seven days a week. He was done with sleeping on couches he didn’t even own. He was done. To Laufton, Rhode Island was the place where he could kick back and become a bystander again. Thanks in no small part to me, he got dragged back in.

We would meet for the first time in late December when he walked into a Progressive Democrats meeting to drop off Sanders swag he had gathered while in Virginia.

I wanted a political revolution. I’ve long believed that the people of this state have been betrayed by a corrupt, conservative political machine. A machine that is only interested in pursuing the interests of corporations, insiders, and right-wing groups. The machine is allowed to continue to function because it’s never challenged, and earlier this year, I reached my breaking point. People told me I was being “unrealistic,” that change would only come if we played along with the machine. I never agreed, and I refused to give up. I wanted a slate of primary challengers to rise up and give Rhode Island a choice.

But we needed candidates, we needed workers, and we needed money. I knew I couldn’t do it alone.

For far too long, the Rhode Island progressive movement has lacked professional campaign know-how. Sure, I knew all about the kind of campaigns local progressives have always run. I knew loosely what a mail program should look like, and I knew knocking on doors was far and away the most important thing. But when it came to the modern cutting-edge tactics that came largely out of the Obama campaign, I was clueless. And I knew it. That’s why Laufton was exactly what we needed. I wanted him on board, so I bullied him into agreeing to meet with some of the prospects we had who would be running for office.

The first introduction was with Moira Walsh. Moira was one of the earliest to decide to run for office, and she was exactly what we needed to get Laufton hooked. She had grown up in Smith Hill and had spent the previous year fighting for an increase in the tipped minimum wage. She knew the conservative political machine wasn’t fighting for her neighborhood because she had seen what happens at the State House. She knew something had to be done. So she decided to run. Moira impressed Laufton (and me) with her honesty, her passion, and her unbelievable work ethic. Not fully onboard yet, Laufton agreed to help her once a week.

The first introduction was with Moira Walsh. Moira was one of the earliest to decide to run for office, and she was exactly what we needed to get Laufton hooked. She had grown up in Smith Hill and had spent the previous year fighting for an increase in the tipped minimum wage. She knew the conservative political machine wasn’t fighting for her neighborhood because she had seen what happens at the State House. She knew something had to be done. So she decided to run. Moira impressed Laufton (and me) with her honesty, her passion, and her unbelievable work ethic. Not fully onboard yet, Laufton agreed to help her once a week.

Both loud and openly dismissive of those who were in charge, Laufton and Moira were a perfect match. Within a week, Laufton had gone from helping on occasion to sitting down with Moira nightly. I was giving them fundraising and volunteer prospects and they were fundraising and recruiting for a few hours every night. Two weeks in, Laufton sat down and drafted a campaign plan, not five pages (as we usually see in Rhode Island) but 28 pages, not counting the appendix. He broke down every piece of the district and examined every single street, mapping out a strategy of what Moira would have to do every week to win. Moira was more than happy to do all of it. She wanted to win poured everything into making it happen.

The plan was working. It was just the first step in the revolution but it was one hell of a step. In just a few months, we had gone from monthly meetings to a well oiled operation ready to score some major upsets.

In early March, while the General Assembly was busy enacting conservative policies, Moira was out knocking doors. Even given her close ties to her district, Moira blew us away with how hard she worked. Usually, campaigns keep track of how many times the candidate has walked the district. Sometimes that number is as low as one or two. With Moira, we quickly lost count. Laufton was at her side every step of the way.

I went back to work on recruiting candidates. I met with people at bars and coffee shops. I worked hard to persuade candidates to make the jump and join a race. I told them that if they wanted to continue on the fight Bernie had started this was the way to do it. By May, our two candidates had grown to more than ten. Every one of them was working hard to make change. Our revolution was becoming a reality.

Bernie’s surprise Rhode Island win gave us a huge boost of confidence. I couldn’t have been more excited about Bernie. In 2008, Hillary Clinton became the first politician I ever voted for. But the man who broke the corrupt, conservative machine that once ran Burlington through its death grip on the Democratic Party has always been my political hero. What he achieved in a town without primaries was the original political revolution. Bernie’s Vermont story inspired me long before he decided to run for president, so I did everything I could to help him win Rhode Island. (The real work, though, was done by the army of volunteers put together by Lauren Niedel, the Deputy State Coordinator of the Progressive Democrats.) Everyone in Rhode Island political circles predicted that Hillary Clinton would sweep our state. The whole machine lined up behind Hillary, and one reporter was so confident that he bet me two dollars Bernie would lose. (He still hasn’t paid up.) So when Bernie won, we were beyond ecstatic. At the victory party, I gave a short speech to the crowd, asking folks if they were ready to take the political revolution to the General Assembly. “Yes!” was the response, and it was resounding.

It was then that we decided to take on our biggest target yet, John DeSimone. John had long been a thorn in Moira’s side, and he was actively supporting Palangio (which Laufton did not like). Most considered him untouchable. We knew it would be brutally tough, but we thought it was doable.

While others saw a powerful incumbent with one of the largest war chests in Rhode Island and one of the most infamous patronage networks in our state, Laufton saw something else. He saw an incumbent who had lost touch with his district, who cared more about being a politician than fighting for his neighborhood. Laufton saw a target primed for a takedown, and he had the data to prove it. As he always does, he crunched the numbers for every block, walking me through the path to victory. It wasn’t going to be easy, but it could be done. Laufton said if we were serious about change we had to do this.

With DeSimone, I saw a man who was actively promoting the NRA despite his district’s constant struggles with gun violence. I saw a man who happily interfered in a women’s right to control her own body. I saw a man who clearly cared more about wealthy special interests than the people he was supposed to be representing. DeSimone wasn’t just conservative. He was a leader in the most far-right wing of the machine. I knew taking him on was a risk. I knew DeSimone bore grudges, and I knew he would take it out on the progressive movement if we lost. But I also knew that defeating DeSimone would send a shock wave through our political system. It would show that no machine politician, no matter how powerful, no matter how wealthy, no matter how feared, could afford to push policies that hurt his constituents. I also had faith that the people now working in the movement would get it done.

It wasn’t going to be easy to find someone with the courage to go up against the machine, but teachers have always been an important base for the progressive movement, even when their unions won’t always stand up for them. I talked to a friend of mine who was upset with DeSimone’s meddling inside the Providence Teachers’ Union, and I heard about a teacher with a legendary passion for progressive change. Her name was Marcia Ranglin-Vassell. (Concerned about retribution from union leaders, among others, my friend asked to remain anonymous for this piece.)

My friend took Laufton to meet Marcia at her home. Laufton was thrilled. He said she talked about the students she had lost to guns and incarceration, about the crippling devastation wrought by poverty in her neighborhood. He said her passion blew him away. He said of all the candidates and people he had met over the years, she was easily one of the most impressive. He encouraged her to run right there on the spot. I have to say, I was initially skeptical. But then I finally met Marcia in person. And boy was I sold.

When Marcia made the decision to run, the team got to work. Laufton crafted the winning strategy (another 28 page campaign plan) and Marcia assembled her inner circle. Her sisters Lisa and Val came first. The head of the Rhode Island Black Business Association, Lisa is widely respected around the city. Grizzel Clemetson was a longtime friend with previous campaign experience and deep ties in the Latino community. Andy Cagen would join the team soon after. A Providence attorney, Andy was inspired by Marcia’s story and threw himself into the campaign. Marcia’s husband, Van, was always there for both his wife and the team.

A few days later Laufton recruited Kavelle Christie to the team. Herself a Jamaican immigrant, Kavelle was a longtime friend of Laufton’s and a partner in his work in both Pittsburgh and Virginia. She had recently relocated to Rhode Island to work on environmental issues. After a meeting with Marcia, Kavelle was also fully committed. Like so many campaigns, Marcia’s lived and breathed around its field operation, which was why Kavelle was so key. As field director, she set her life aside and poured not just her free time but her heart and soul into making Marcia’s earth-shattering win a reality. Kavelle’s true value wasn’t just the unbelievable number of doors she knocked on or the army of volunteers she inspired but making the whole operation run smoothly and efficiently.

Marcia knocked doors literally almost every day from the moment she declared until election night. She wasn’t just knocking random doors either. Laufton had designed a ranking system to target only the most valuable and most persuadable voters. This ranking system incorporated in dozens of variables and was based on a similar model used by President Obama’s team. Her sisters Val and Lisa were always there to support her, and Grizzel immediately established herself as an irreplaceable piece of the team. Reaching pieces of the district that no one else could, Grizzel brought endless enthusiasm to the campaign. Andy always seemed to be doing work, and Kavelle used her experience to ensure nothing fell through the cracks. Every piece of the team was essential, and everyone on the team had a clear role they fully committed to.

By mid July, the team was completing a full pass of the district every week, and at every door, Marcia was getting more and more persuasive. Once a voter gave Marcia their support, they weren’t set aside. Marcia would follow up with a handwritten note and check in every few weeks to ensure they were still onboard. All contact was carefully tracked and carefully maintained.

What we heard on the doors was what we had predicted. While everyone knew who DeSimone was, very few had met him. Even among those that had, there was no guarantee that they would support him. The patronage network “Johnny Jobs” was famous for wasn’t enough to get voters to vote against their values. People were hungry for progressive policies. A $15 minimum wage and gun control were both widely popular.

I’m proud to say that the Progressive Democrats were the first to endorse Marcia, and our members were fired up to get her elected. Planned Parenthood, RI NOW, Sierra Club, Our Revolution, Working Families, and other allies soon jumped on board, committing more time and more resources to Marcia and Moira. Led by Craig O’Connor, Planned Parenthood’s political operation has always been at the core of our movement, and Marcia’s campaign was a perfect example of how indispensable they are. Led by legendary Massachusetts progressive operative Georgia Hollister Isman and Abby Godino, Rhode Island Working Families is a new project of the national progressive group, which is excited about investing in Rhode Island. The mastermind behind Mass Alliance, the powerhouse of progressive politics in our northern neighbor, Georgia jumped enthusiastically onto Marcia’s campaign. With support from these key allies and more, oceans of door knocks and phone calls flooded the district.

Laufton worked with Judith Finn, a local graphic designer, to craft the mail program for both Moira and Marcia. Inspired by the feedback the campaigns were getting on the doors, Judith created gorgeous pieces that resonated beautifully across both districts. (Judith also did indispensable work for campaigns outside of Providence.) When we started the campaign, we thought DeSimone’s money would mean he’d have a better program. DeSimone may have had way more money, but I really believe the mail program Judith and Laufton put together had a stronger impact. They created pieces that were so specific and targeted that they would sometimes only be sent to 20 or 30 voters.

Exposing DeSimone’s record was crucial to Marcia’s victory, so our research team played a vital role. Duncan Weinstein, who had worked with me on our NRA investigation (and had also done research for former Illinois Governor Pat Quinn), was indispensable, pouring hours into tracking down and exposing what DeSimone had done. Johanna Harris, a prominent Providence anti-corruption activist (and one of Marcia’s most generous donors), published many crucial investigative pieces on her blog and helped guide the overall messaging. Nate Carpenter, communications director for the Progressive Democrats, worked the media hard to get the message out.

Marcia’s campaign got a huge boost when Rhode Island for Gun Safety, a group funded by Alan Hassenfeld and coordinated by Jerry Belair, launched a major independent expenditure campaign. Fighting the NRA’s death grip on our elected “Democrats” has always been a core priority of our movement, so it was great to see gun control emerge as such an important issue in this race. One of the long-terms effects of Marcia’s win is sending a message that Rhode Islanders reject the NRA’s dangerous agenda.

By the week of the election, Marcia’s team had knocked on over 10,000 doors and had had more than 2,000 conversations with voters. From this work, they had isolated out 823 supporters in the district.

The weekend before the election, while DeSimone was holding a picnic in North Providence (outside the district) with politicians like Nick Mattiello and Jorge Elorza, Marcia’s team was out knocking doors and reminding people to vote. On election day, when John’s supporters were waving signs at polling places, Marcia’s volunteers were working down their lists of carefully cultivated supporters and bringing them one by one to the polls. With careful targeting, Marcia’s army of volunteers put in hour after hour to talk to as many voters as possible, reminding them to vote.

DeSimone’s strategy hinged on hinting at Marcia’s race. With his slogan of “From our neighborhood. For our neighborhood,” he subtly implied that Marcia, who had lived in her home for more than two decades, wasn’t really from the community. He even told voters that Marcia was just “some woman from Jamaica.” Promoted by a piece Johanna wrote, “some woman from Jamaica” became a theme of Marcia’s campaign, perfectly encapsulating how political insiders dismissed her candidacy.

DeSimone focused his get out the vote efforts on, as he described them, “the old Italians.” And he certainly had deep networks in the Italian community. But many Italian voters, after shaking hands with their friends working the polls for DeSimone, whispered to Marcia and her volunteers that they were voting for her.

Throughout the whole campaign, Moira had never once stopped knocking doors, and she was also victorious. This race wasn’t just about defeating DeSimone and Palangio. It was also about electing Marcia and Moira. Our city now has two new fiery populist champions committed to fighting for the working families of Providence. That matters.

This victory didn’t just happen. It happened because of every door Moira, Marcia, and their volunteers knocked on and every phone call they made. It happened because of the activists and campaign professionals who guided the campaign. It happened because of strong movement allies. It happened because of hundreds of progressives who reached deep into their pockets to give what they could afford. It happened because two women had the courage to run against a fearsome political machine.

The credit for any revolution belongs to those who fought in it. And our Providence wins belong to the women and men who fought to make them happen.

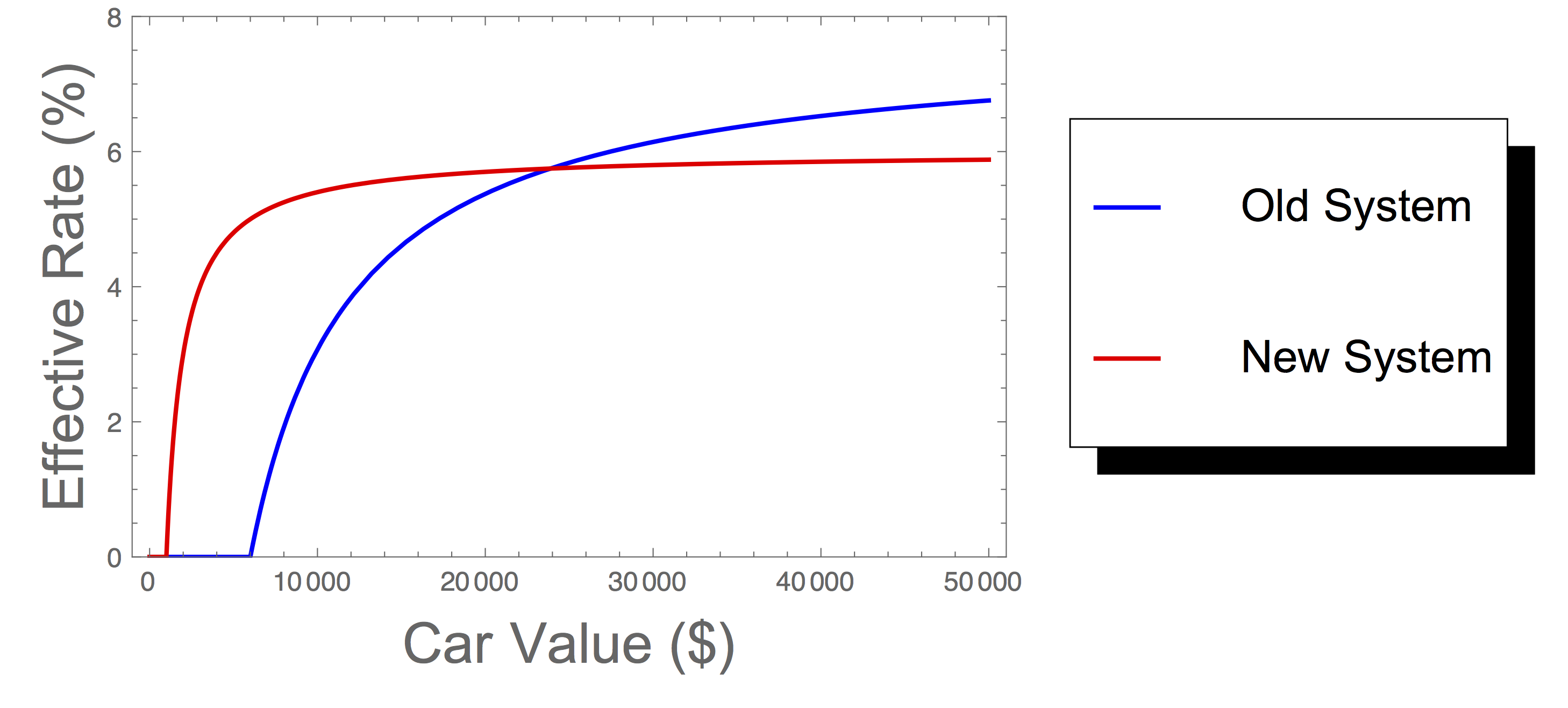

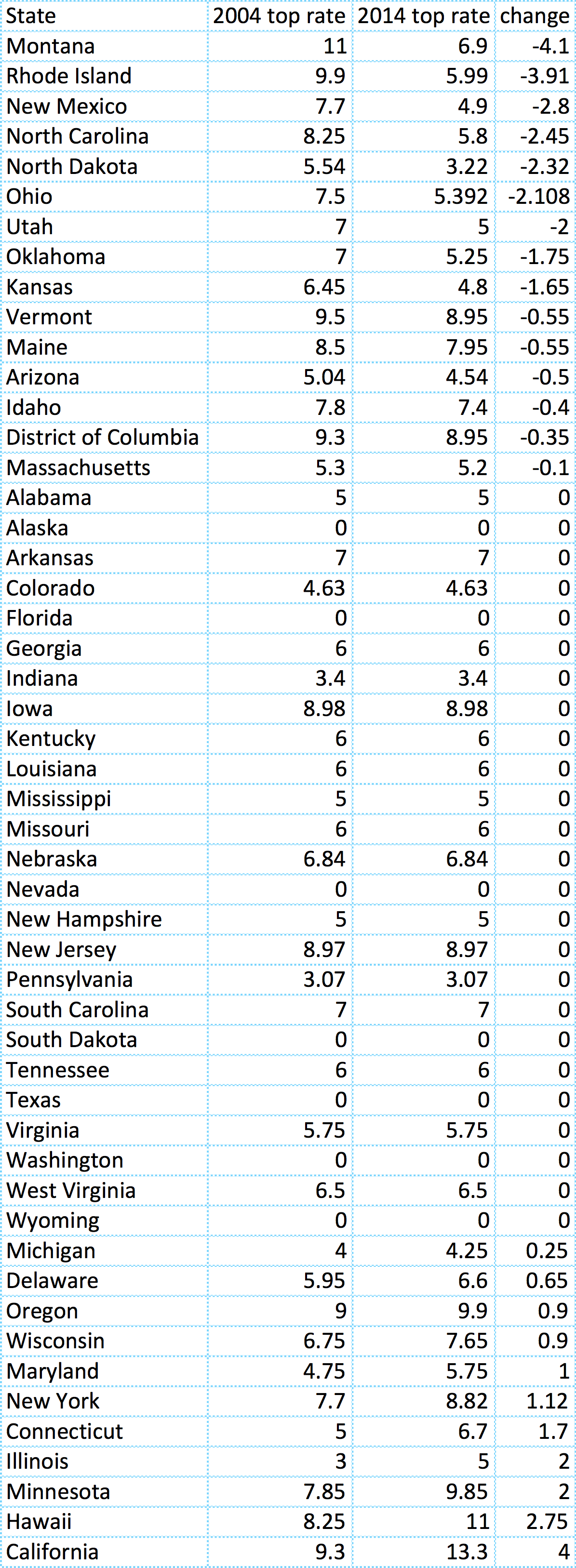

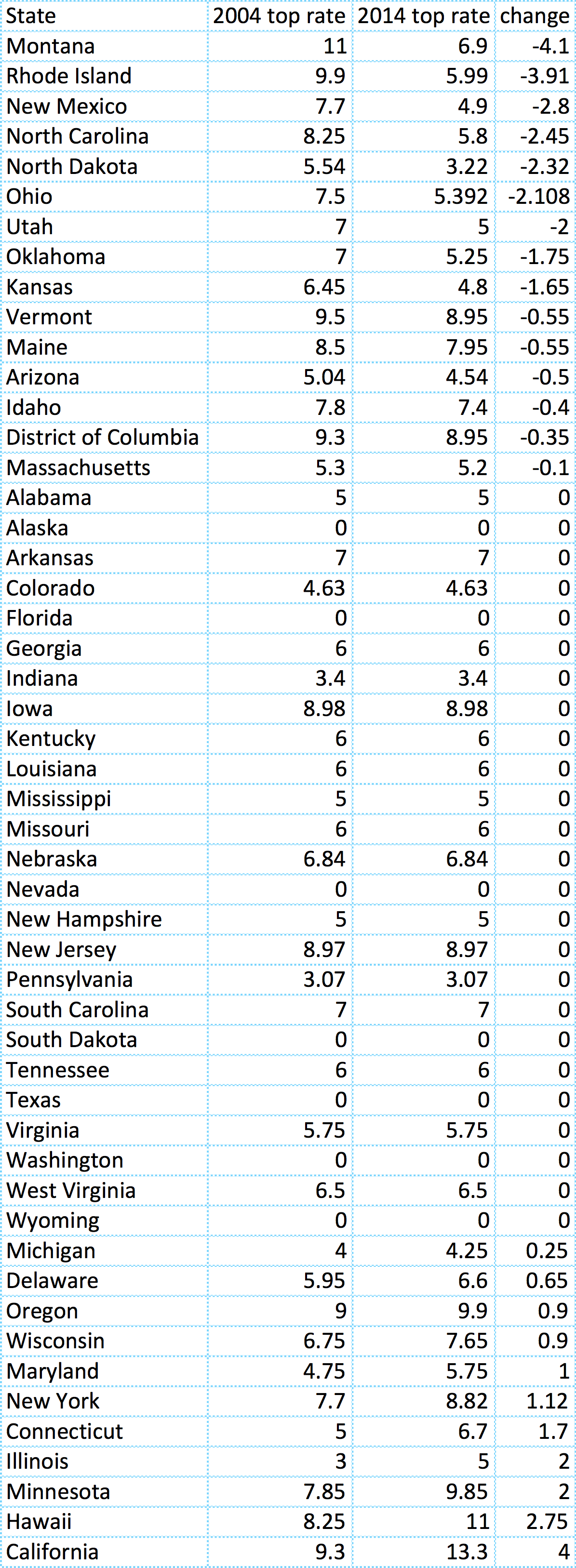

Republican Representatives Patricia Morgan and Dan Reilly have been making a major push to stop the truck tolls in the RhodeWorks proposal. With great vigor, they have branded their efforts as anti-toll, specifically making the argument that the truck tolls are a step on the way to car tolls. Yet despite their stated opposition to tolls, Morgan and Reilly have signed onto

Republican Representatives Patricia Morgan and Dan Reilly have been making a major push to stop the truck tolls in the RhodeWorks proposal. With great vigor, they have branded their efforts as anti-toll, specifically making the argument that the truck tolls are a step on the way to car tolls. Yet despite their stated opposition to tolls, Morgan and Reilly have signed onto

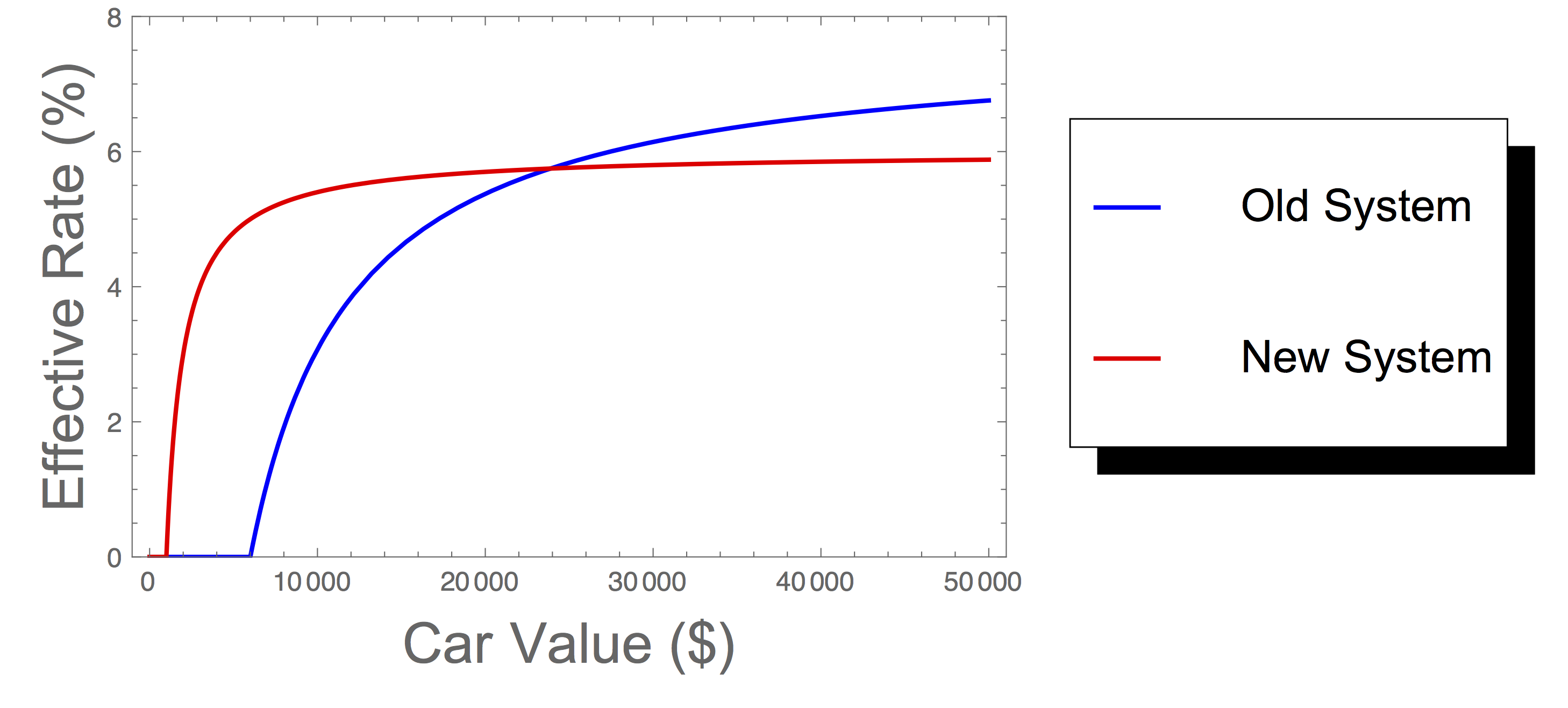

Property taxes are very high in Providence. Each year, homeowners must pay

Property taxes are very high in Providence. Each year, homeowners must pay