Gina Raimondo should be investigated, according to AFSCME’s much-awaited Ted Seidle report for the “sinister pall of secrecy regarding fundamental investment information … orchestrated by state officials and aided by key investment services providers, punctuated by periodic self-serving misrepresentations regarding such investment matters to the general public.”

It says: “In our opinion, based upon our knowledge of pension investment operations, an investigation by state or federal securities regulators would reveal intentional withholding of material information and misrepresentations regarding state pension costs, as opposed to a lack of knowledge about the exponential growth and magnitude of the fees.”

READ THE ENTIRE REPORT HERE

or the Providence Journal coverage here.

It also unearths new evidence that shows why the over-arching non-disclose agreements Rhode Island entered into with its hedge fund advisers is inherently risky for public sector funds.

The absolute discretion ERSRI has granted to certain managers amounts to a license to steal from the state pension.

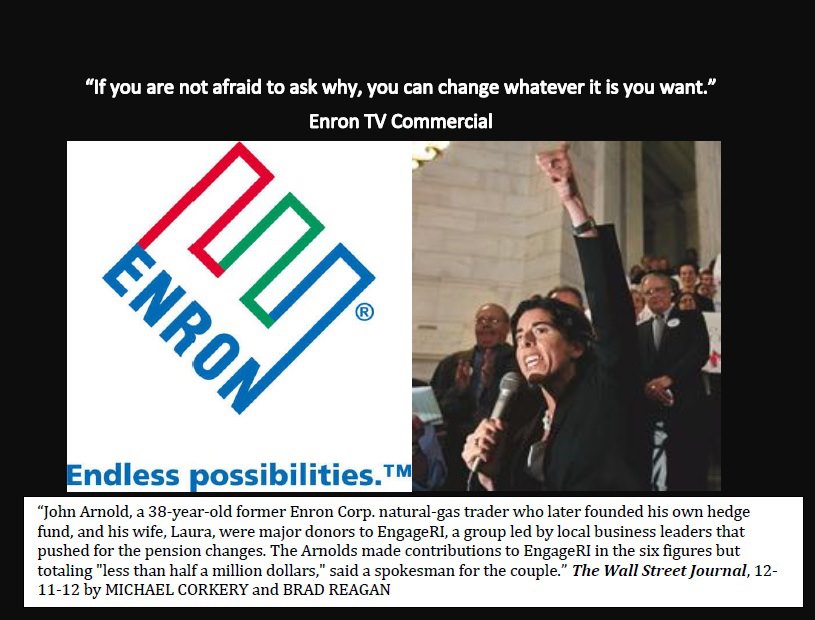

Since the managers may completely change their investment strategies at any time, there is no way ERSRI can ensure that the hedge funds are providing any diversification whatsoever—contrary to representations by the Treasurer. For example, all the hedge fund managers could invest in a single asset class, say cash, or a single stock, say Enron, at an inopportune time.

The above outrageous nondisclosure policies detailed in the hedge fund offering documents cause these investments to be, at a minimum, inherently impermissible for a public pension, such as ERSRI, if not illegal.

However, given that public pension investments in alternative investments have doubled in recent years (now amounting to 24 percent of portfolios) and billions in public pension assets across the country are currently at risk from such hedge fund schemes, the need for an immediate, focused response by securities regulators and law enforcement is compelling.

And it casts doubt that the suspended COLA will ever be reconstituted.

In summary, the likelihood that any meaningful COLA will ever be paid in the future under the new statutory scheme is remote—a fact which has not been shared with workers and retirees.

In conclusion, ERSRI’s total investment expenses may already, or in the near future, amount to a staggering almost $100 million annually— an amount far in excess of the $5 million cost of conservatively indexing or passively managing the Fund’s assets.

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387

Deprecated: Function get_magic_quotes_gpc() is deprecated in /hermes/bosnacweb08/bosnacweb08bf/b1577/ipg.rifuturecom/RIFutureNew/wp-includes/formatting.php on line 4387